In this week’s TOPICAL UPDATE,Today, we’re uncorking some fascinating insights into the Indian alcoholic beverage market and spotlighting game-changing updates from some truly unexpected players.

Ready to dive in? Let’s get started!

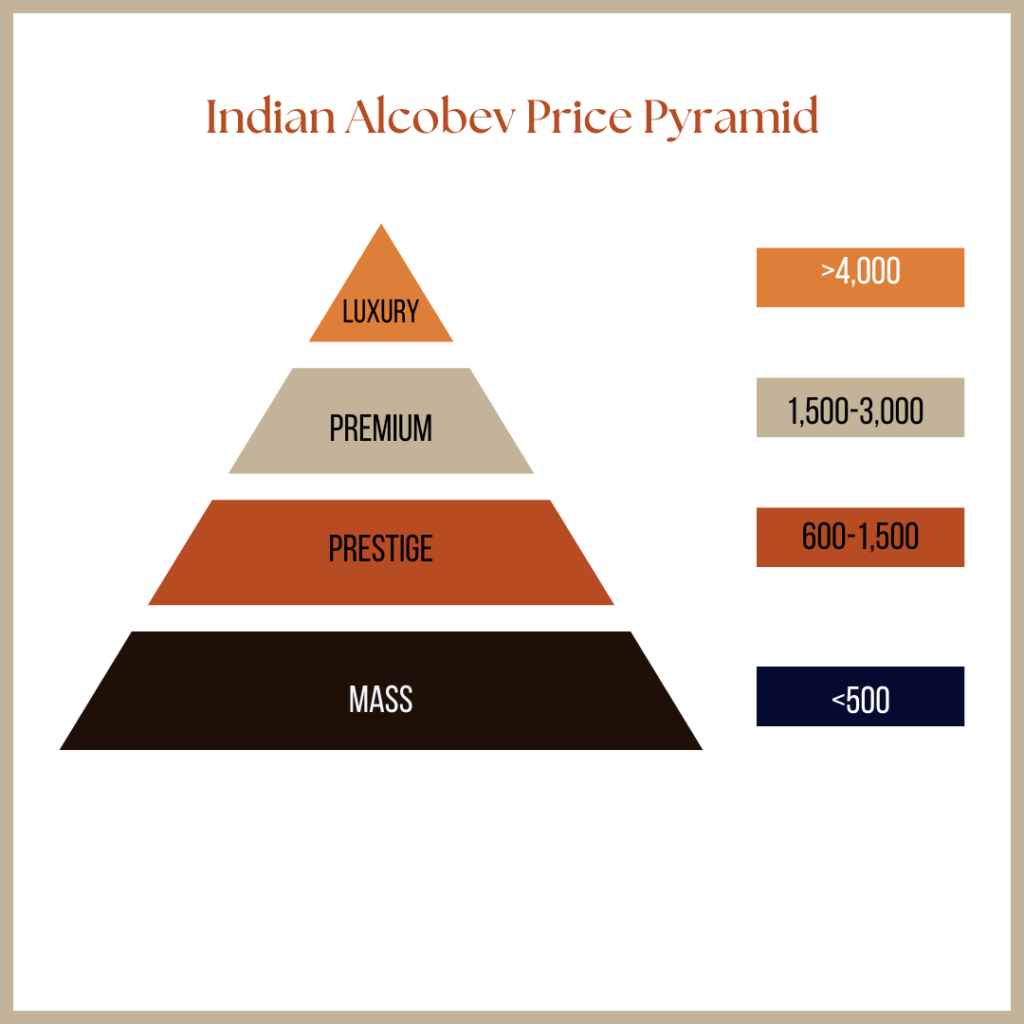

Before we get to the meat of the matter, let’s refresh the basics by looking at the market structure, which is divided in the following four categories:

The industry has been buzzing with activity lately, and while we’ve previously explored its evolving structure and the sweeping shift towards premiumization, today we’re taking it a step further.

We’ll break down this premiumization wave into the following TWO exciting sub-trends that reveal what’s really shaking up the market.

1) The expansion of OGs

2) The upgradation of smaller players

The expansion of OGs

The Indian alcoholic beverage market is buzzing with headlines like “Diageo expands into white spirits with new X series” – Storyboard, “Radico Khaitan Grows with Premiumisation Focus” – Business World, and “Bacardi doubles down on premiumization and experiential luxury to capture evolving Indian spirits market” – Business Today. These stories underscore the relentless push toward premiumization in the industry. But amidst all this, one trend stands out: India’s growing obsession with Indian whiskey.

Here’s how the industry giants are riding this wave:

Diageo-owned United Spirits Ltd (USL) has made significant strides by launching Indian single-malt whiskies like Epitome Reserve and Godawan, each priced in the luxury segment.

The rise of Indian whiskey has also benefited homegrown players like Radico Khaitan, which has seen its net sales grow at an impressive ~20% CAGR over the past three years, outpacing USL’s 12%.

Even global players are taking note. Pernod Ricard (PR), which recently dethroned USL from the leadership position in FY24, is betting big on Indian whiskey. In a recent interview with The Economic Times, CEO Alexandre Ricard highlighted how Indian whiskey is carving out its own identity globally, akin to Scotch or Japanese whiskey. He revealed that Indian whiskies now have dedicated sections in Parisian whiskey shops—a testament to their growing international appeal.

Last year, PR launched Longiture 77, its first Indian single-malt whisky. To capitalize on this momentum, domestic companies like Piccadilly are ramping up their operations. This brings us to our second major trend…

The Rise of Emerging Players

Smaller players are stepping up to meet the growing demand and position themselves on the global stage:

Piccadilly Distilleries is scaling its operations by expanding its Chhattisgarh and Haryana facilities to 460 KLPD and increasing malt production to 30 KLPD. Boldly venturing into international markets, Piccadilly is setting up India’s first homegrown distillery in Scotland—a groundbreaking move for the industry.

Amrut Distilleries, another key player, plans to boost its capacity by 30% by the end of 2024, reaching 3.56 KLPD.

To overcome challenges like inter-state taxation, Amrut has entered a licensing agreement with India Glycols Limited to manufacture its flagship brands—such as MaQintosh Whisky and Old Port Rum—in northern markets.

Meanwhile, Tilaknagar Industries is making its debut in the luxury brandy segment with the launch of Monarch Legacy Edition, signaling its intent to tap into premiumization trends. These developments highlight how both established giants and emerging players are reshaping India’s alco-bev landscape. With innovation and expansion at the forefront, the industry is poised for an exciting future!

Conclusion

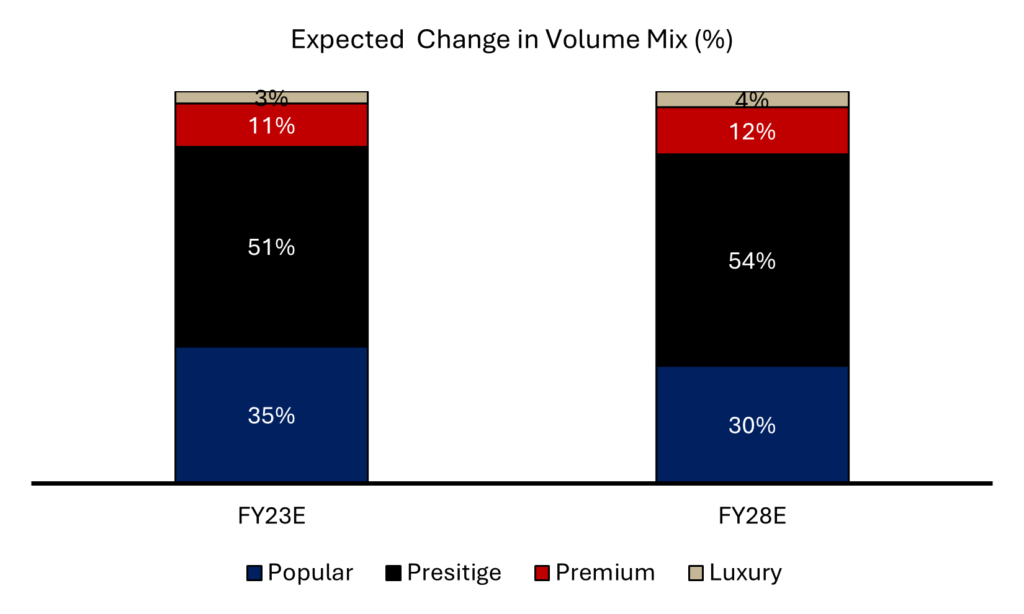

Indian-style whiskies and the broader trend of premiumization are thriving like never before. What’s exciting this time is that it’s not just the industry giants but also smaller, ambitious players making bold moves into the Premium and Luxury segments. The driving force behind this shift lies in a megatrend of up-trading—a progression from popular to prestige, premium, and luxury categories—fueled by rising disposable incomes.

This trend isn’t just transforming the alco-bev industry but is also reshaping sectors like consumer discretionary, real estate, automotive, and hospitality.

(Source: DRHP of Allied Blenders)

Looking ahead, as per Technopak Analysis, Prestige is expected to grow at 9%, Premium at 10%, and Luxury at an impressive 14% until FY28.

That wraps up today’s deep dive—served neat and insightful.

Cheers!

Author: Shailja Drangal (Linkedin)

Disclaimer: These insights are based on our observations and interpretations, which might not be complete or accurate. Bastion Research and its associates do not have any stake in any of the companies mentioned above. This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

Meme of the Week

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.