Welcome to this week’s edition of TOPICAL WEDNESDAY! Today, we explore how Ather Energy is charging up India’s EV market ahead of its much-anticipated IPO.

India’s electric vehicle revolution didn’t spark to life overnight-it took a pair of IIT graduates, a garage, and a relentless drive to reimagine mobility. Ather Energy, founded in 2013 by Tarun Mehta and Swapnil Jain, lit the fuse for India’s EV two-wheeler market with its tech-packed, homegrown scooters. While the government now pours billions into charging networks and manufacturing incentives, and automakers rush to launch18 new EV models in 2025 alone, Ather was the first to prove electric scooters could rival petrol bikes in performance, design, and sheer desirability.

Today, as India’s EV market hurtles toward a projected 40%+ annual growth, Ather’s story stands as a testament to how bold innovation can reshape an entire industry. But here’s the twist: While Ather gears up for its IPO, rival Ola Electric-which went public last year-continues to bleed cash despite its market dominance. The question now: Will Ather follow Ola’s loss-heavy footsteps, or can its premium-first strategy and homegrown tech shield it from the cash-burn trap plaguing India’s EV upstarts?

Against the backdrop of cutthroat competition and cash-burn woes plaguing India’s EV sector, Ather energy is making headlines with ~Rs. 3,000 Cr IPO.

Firstly, let’s talk about the IPO size.

IPO Size & Structure

(Source: Company, Bastion Research)

Reduction in the amount of OFS

Ather slashed its Offer For Sale (OFS) component by 50% – from 2.2 crore shares to 1.1 crore shares – reflecting a strategic retreat by early investors amid market turbulence. Here’s the breakdown:

- Early Exit Caution: Investors like Tiger Global, Caladium, and NIIF II reduced their exit plans, signaling less urgency to cash out amid volatile markets. For instance, Tiger Global originally planned a larger exit but scaled back, likely to avoid oversupply and price pressure.

- Founders’ Skin in the Game: Promoters Tarun Mehta and Swapnil Jain trimmed their OFS contributions marginally (to 9.8 lakh shares each), preserving their stake and signaling confidence in long-term growth.

- Hero MotoCorp’s Hold: The largest shareholder (40% stake) opted out of the OFS entirely, reinforcing its commitment to Ather’s EV ambitions.

Valuation Reset

Ather has dialed back its valuation ambitions from the original $1.6–2.4 Bn range to around $1.4 Bn, aiming to make the IPO more attractive to a broader set of institutional investors

The trimmed OFS and valuation reset signal a strategic balancing act – Ather is prioritizing long-term stability over short-term gains. By reducing share supply (via the OFS cut) and realigning its valuation, the company aims to avoid post-listing price volatility while keeping institutional investors engaged. Hero MotoCorp’s hold and the founders’ reduced exits further reinforce confidence in Ather’s EV roadmap.

Where will the money be used?

(Source: Company, Bastion Research)

The new facility will expand the Company’s manufacturing footprint and position it for further growth.

Let’s start with a little memory down the lane.

From IIT Garage to EV Pioneer: The Ather Energy Story

Ather Energy’s story is a classic tale of bold ambition, relentless innovation, and a willingness to challenge the status quo. It all began in 2013, when two IIT Madras graduates, Tarun Mehta and Swapnil Jain, set out to solve what they saw as the biggest pain point in India’s electric vehicle market: uninspiring, underperforming scooters. What started as a project to build better batteries quickly evolved into something far more audacious-the dream to create India’s first truly smart electric scooter.

Early on, their vision caught the attention of the Flipkart founders, Sachin and Binny Bansal, who backed Ather with $1 million in seed capital. Inspired by global pioneers like Tesla, Mehta and Jain wanted to prove that an electric scooter could outshine petrol vehicles in both performance and design. Their breakthrough came in 2016 with the unveiling of the S340, a scooter packed with features like a touchscreen dashboard and cloud connectivity-years ahead of anything else on Indian roads.

But building a high-quality EV in India wasn’t easy. The founders faced constant challenges sourcing reliable components and convincing local vendors to meet their exacting standards, leading to production delays. The real turning point arrived when Hero MotoCorp invested, giving Ather not just capital but also the industry connections needed to scale up.

By 2018, Ather launched the 450-thefastest electric scooter in India at the time. From a college project to a unicorn reshaping urban mobility, Ather’s journey is a testament to the possibilities when vision meets execution-and when founders dare to build not just a product, but an entirely new category.

Innovation First:

When it comes to electric two-wheeler(E2W) startups, two names stand out: Ola Electric and Ather Energy. Most other big players are part of traditional auto groups. Ola and Ather made a mark with their focus on performance, design, and software. However, Ola’s scooter wasn’t built from scratch. After raising ~$300 Mn in 2019, Ola acquired Amsterdam-based Etergo in 2020 for its design, set up the Ola Future factory, and spent heavily on marketing before launching its scooter in late 2021—just 2 to 2.5 years after founding.

Ather Energy, on the other hand, took a very different route. It was started in 2013 and launched its first product in 2018. So, it spent nearly five years building everything (except the battery) from scratch—design, technology, software, and charging network. This longer timeline paid off, as Ather’s scooter introduced several first-of-its-kind features in India and changed how two-wheelers are perceived.

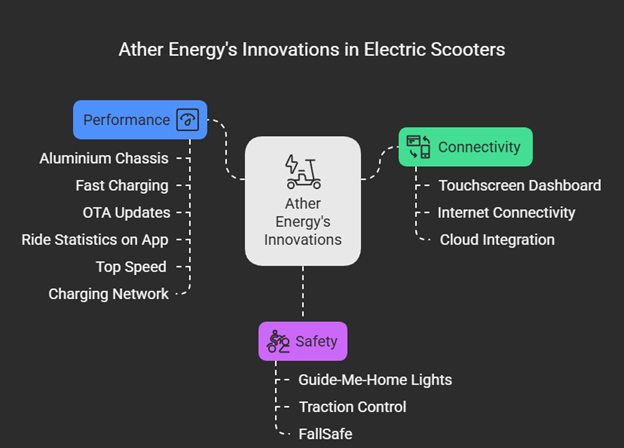

New features introduced by Ather Energy:

(Source: Bastion Research)

Regardless of what’s considered right or wrong, Ather remains one of the few companies in India to deliver truly innovative, industry-first products.

About the Company’s operations

Ather Energy stands out as a true “pure play” EV company, designing every product from the ground up in India with a focus on quality, technology, and user experience.

At its core, Ather’s business revolves around selling electric two-wheelers-most notably, the Ather 450 and the recently launched Rizta series.

(Source: Company, Bastion Research)

Software Edge – Ather’s proprietary software platform, Atherstack, is at the heart of its smart features—powering everything from onboard navigation and ride analytics to advanced safety tools. For those looking for more, the Pro Pack unlocks premium features along with three years of connected services. After that, users can continue with a subscription. Interestingly, software is no longer just an add-on; it contributed 6% of Ather’s operational revenue in FY24,marking a growing revenue stream.

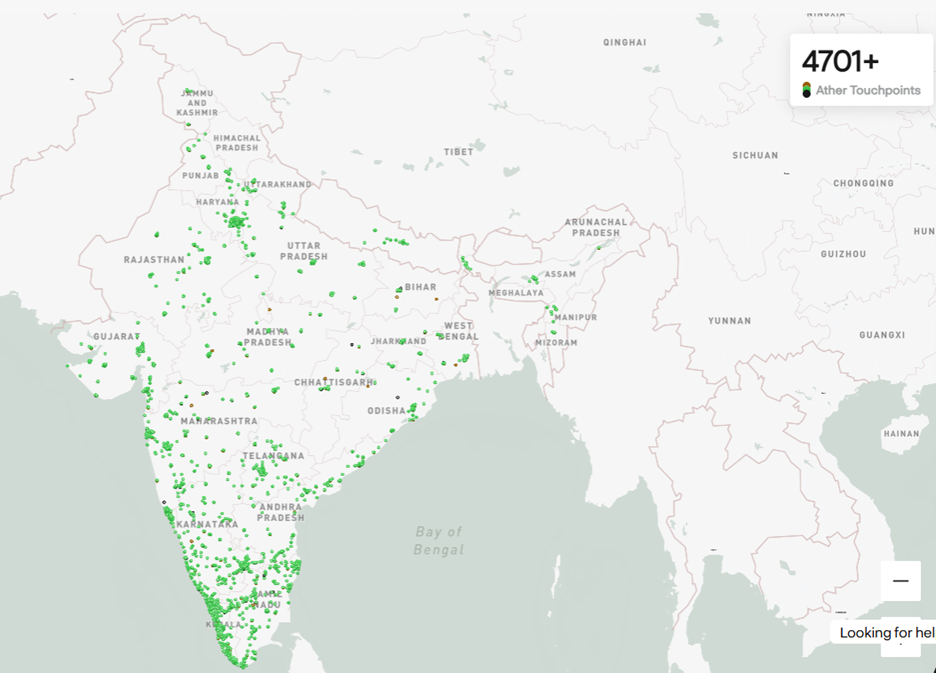

Charging Infrastructure – On the charging front, Ather has made serious progress. To ease charging anxiety, it has built Ather Grid—a rapidly expanding fast-charging network. As of December 2024, it includes over 2,600 fast chargers and 666neighborhood chargers across India. Every Ather scooter now comes with a portable charger, and select locations even offer free charging, giving users more flexibility on the go.

(Source: Company, Bastion Research)

Manufacturing & Distribution

On the manufacturing side, Ather assembles its scooters and battery packs at two facilities near Hosur, Tamil Nadu, and is building a new mega-factory in Maharashtra to push annual capacity to 1.42 million units. The company’s approach blends in-house design and manufacturing with select external partnerships, especially for components like motors and chargers. Distribution is handled through a network of 154 retail partners and 4500+ touchpoints in India, plus outlets in Nepal and Sri Lanka. Their “Ather Space” experience centers offer sales, service, and test rides in a tech-forward environment.

Ather’s Grit in the EV Arena

Ather Energy has clawed out a 10–11% stronghold in India’s electric scooter wars-no easy feat against Ola Electric’s 34% dominance and legacy giants TVS and Bajaj snapping at its heels. While the company remains in the investment phase—with ongoing losses and negative EBITDA—it continues to focus heavily on R&D, expanding manufacturing capacity, and enhancing the customer experience, positioning itself for long-term growth.

(Source: Company, Bastion Research)

Ola vs Ather: The Ultimate Electric Scooter Face-Off

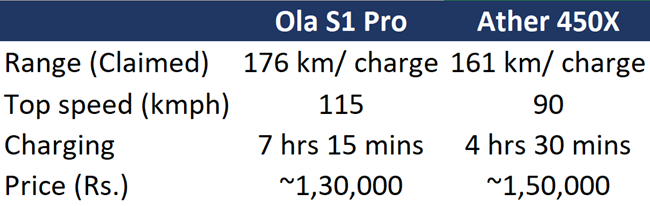

Ola and Ather have become the go-to choices in India’s electric scooter market, each building a strong following and making their mark on city streets. While both brands are widely used and spark plenty of debate among enthusiasts, their scooters offer distinct strengths. Here’s a head-to-head comparison on the metrics that matter most.

(Source: Company, Bastion Research)

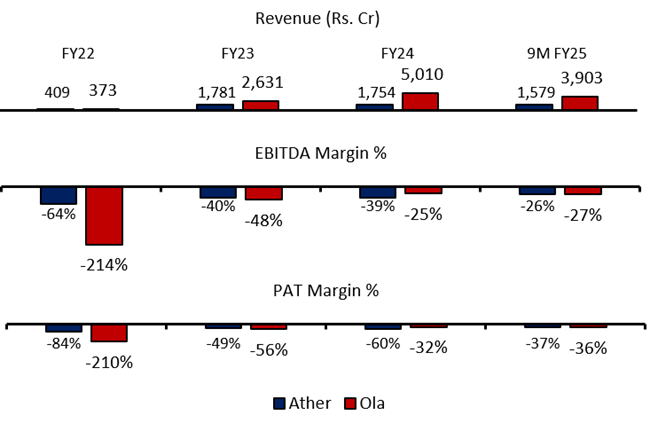

Financial performance

(Source: Company, Bastion Research)

Ola Electric has raced ahead in market share (35% vs Ather’s 10%) and revenue (₹5,000 Cr FY24vs Ather’s ₹1,750 Cr), powered by aggressive pricing, mass-market focus. But here’s the catch: both are bleeding cash – a red flag that underscores the high-stakes gamble of India’s EV race.

Besides the financial issues, there are other risks attached as well. Let’s review them!

What can trip up Ather’s story?

Battery Sourcing Jitters: Ather relies heavily on imported lithium-ion cells, so any global supply chain hiccup or geopolitical shock could squeeze margins and disrupt production.

Supplier Dependence: Other than batteries made in-house, almost every part comes from external suppliers-making Ather vulnerable to any issues in its vendor network.

Brand Watch: Past customer complaints and negative buzz can quickly dent Ather’s reputation

Regional Sales Bias: Most of Ather’s sales are packed into South India, so any slowdown in this region could hit overall numbers hard.

(Source: Company, Bastion Research)

Crowded Market: The EV two-wheeler space is heating up, with big names and new challengers fighting for share.

Valuation Stretch: The IPO is priced at 6–7xEV/Sales (FY24), which is on higher side given current financials.

Closing Thoughts

India’s electric two-wheeler market is on a turbocharged ride—expected to grow at a whopping 41% CAGR and double in size by 2027. What’s fueling this? Falling battery prices, policy push, and anew wave of EV-hungry consumers. Ather looks ready to ride this wave, thanks to its sharp focus on product quality and homegrown innovation. But investors should be cautious. Ola Electric—despite being the early mover and now a public company—has already hit a few speed bumps, with its stock down ~34% post-IPO due to internal hiccups and service woes. While Ather follows a different philosophy and operates in a more premium segment, its post-listing journey will be closely watched to see if it follows Ola’s footsteps or carve out its own path.

If you liked this newsletter, feel free to share it. Also, feel free to share your thoughts on X, where you can find us as @bastionresearch.

Disclaimer: This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

😂Meme of the Week🤣

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.