Welcome to this week’s edition of TOPICAL WEDNESDAY! Today, we will discuss the ongoing troubles of Gensol Engineering.

Today’s newsletter needs no introduction, right?

The meltdown of Gensol Engineering—a company once considered the poster child of the “sunrise” industry and hailed as “one of the biggest wealth creators”—has shocked the market. Last week, SEBI released a scathing report exposing the tactics used by the promoters to enrich themselves. After all, DLF Camellias isn’t going to buy itself.

This scam, like many before it, isn’t new. During a bull run, a promoter paints a rosy picture, borrows large sums for an “exciting” venture, uses creative accounting to mask the true financials, and treats the company as a personal piggy bank. Investors, mesmerized by the story, often defend such companies vigorously (why this tolerance isn’t shown for genuinely good businesses, I’ll never understand).

But when the music stops—as it just did for Gensol—there’s only one result: wealth destruction.

While it’s easy to blame the promoters alone, investors must also acknowledge some responsibility. Certain red flags were visible in the numbers over the years—signals that the company wasn’t in as great shape as its skyrocketing price suggested.

Let’s break down the signs—both obvious and hidden—and explore how investors can protect themselves.

Obvious Signs

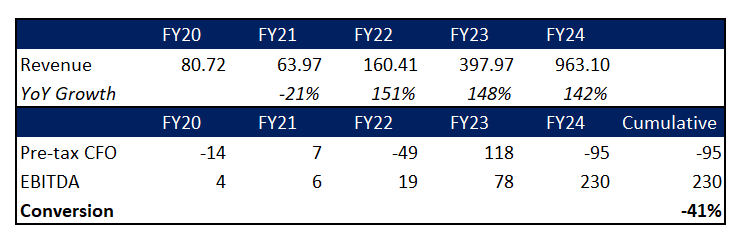

1. Revenue vs. Cash Flow

(Source: Company, Bastion Research)

Gensol’s revenue and EBITDA grew rapidly in recent years. However, its pre-tax operating cash flow remained negative (–Rs. 95 crore), resulting in a poor cash conversion ratio of –41%. Profits that don’t translate into cash are always a red flag.

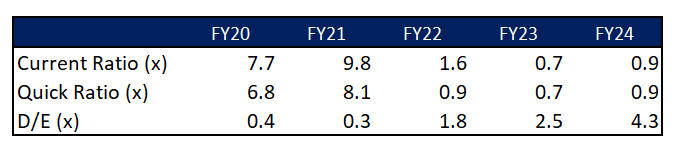

2. Liquidity Stress

(Source: Company, Bastion Research)

From FY20 to FY24, the company’s current and quick ratios plummeted—from strong levels of 7.7 and 6.8 to dangerous lows of 0.7 and 0.9. Meanwhile, the debt-to-equity ratio jumped from 0.4 to 4.3. These shifts clearly indicate worsening liquidity and mounting financial stress.

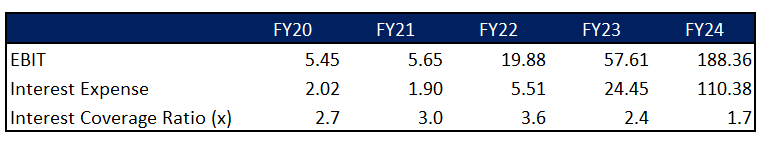

3. Operating Profit vs. Interest Expense

(Source: Company, Bastion Research)

Despite rising operating profits, interest costs exploded—from Rs. 2.02 crore in FY20 to ~Rs.110 crore in FY24. The interest coverage ratio fell from 2.7x to 1.7x, indicating the company’s weakening ability to service debt.

4. Promoter Share Pledging and Falling Holding

More than 80% of promoter shares were pledged, leaving the company vulnerable if the stock price dropped. Promoter ownership halved from 70% to 35% in five years—hardly a sign of long-term commitment.

5. Plant Visit (or Lack Thereof)

Admittedly, this isn’t easy for every investor to do. But for such a hot stock, a plant visit might have been insightful. In Gensol’s case, when an NSE representative visited its Pune factory, they found no manufacturing activity and only 2–3 workers. The highest electricity bill? Just Rs. 1.57 lakh (December 2024). That’s hardly what you’d expect from a manufacturing hub.

These were all red flags visible in public data—enough to raise concerns for any investor focused on fundamentals.

The Hidden Tricks – What SEBI Uncovered

Not everything could have been spotted from the outside. Some details only came to light after SEBI’s deep investigation.

1. Fake Pre-Orders & Misleading Announcements – Gensol claimed 30,000 EV pre-orders—but these were just non-binding MoUs with no pricing or delivery details. It created an illusion of demand that simply didn’t exist.

2. Inflated Order Book & Disclosures – The company repeatedly inflated its order book and misled investors, regulators, and even rating agencies. It painted a business picture far rosier than reality.

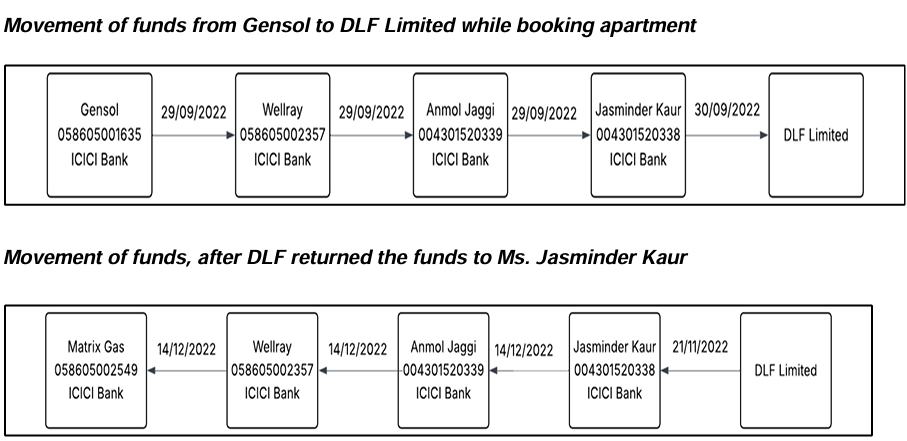

3. Diversion & Misuse of Funds – Gensol raised Rs. 978 crore in loans, supposedly for EV leasing. A significant portion was siphoned off. Over Rs. 200 crore went through a car dealer to promoter-linked entities. Rs. 42 crore was used to buy a luxury apartment in DLF”s Camellias.

(Source: SEBI)

4. Fake Loan Repayment Documents – The management submitted fake documents to show timely loan repayments, deceiving both lenders and credit rating agencies.

5. BluSmart Defaults & Lapses – BluSmart defaulted on bond payments and failed to raise new capital. Investors had little clarity on where the money went. Asset documentation was either missing or unclear.

And that’s just the tip of the iceberg.

Investors were blind-sided because:

Complex Company Structures: Gensol, BluSmart, and several related entities created an opaque network that made tracing fund flows nearly impossible.

False Disclosures: Even credit rating agencies and regulators were duped by misleading filings.

No Early Red Flags: Public filings showed no major issues until SEBI intervened.

Retail Investors Were Blindfolded: Investors had to rely on official disclosures, which were either manipulated or outright false.

The promoters built a web of deceit through fake documents, inflated figures, and complex entities. By the time the truth emerged, it was too late.

One More Thing…

A long-forgotten link has resurfaced—the Mahadev betting scam.

The Mahadev online betting scam, run from Dubai, generated thousands of crores through illegal gambling and laundered the money via cryptocurrencies and fake companies. A key player, Dubai-based Zenith Multi Trading DMCC (controlled by accused hawala operator Hari Shankar Tibrewal), funneled these illegal funds into Indian small-cap stocks like Gensol Engineering. In these investments, promoters of small-cap companies colluded with foreign investors like Zenith to manipulate stock prices, leaving retail investors stranded when the bubble burst. That’s the M.O.

Zenith acquired a 1.37% stake in Gensol through a preferential allotment in 2022. With the recent Gensol’s collapse, promoters are already facing multiple charges, and regulators found Rs. 262 crore of its EV loans diverted for personal expenses. On top of that, the ED has frozen assets worth Rs. 581 crore held by Zenith, including 5 lakh shares of Gensol.

Yesterday, ET reported that ED may summon the Jaggi brothers to investigate possible links to the Mahadev Scam. So, things aren’t looking that great for the brothers. ED has not yet written to the brothers. Previously, Mr. Anmol Jaggi stated on Twitter that they have no link to Zenith. But if this conversation reopens during the Rs. 200+ crore probe, who knows what’s in store.

Closing Thoughts

Perhaps the investor frenzy around Gensol, fueled by influencers and FOMO, was just another symptom of the bull market. If Gensol did it, surely others did too—companies with flashy order books and suspiciously high growth.

We don’t know how many of them are real. Or how many will be uncovered. What we do know is this: Don’t blindly chase hot stories.

As Peter Lynch said:

“Avoid hot stocks in hot industries.”

Until next time, happy investing.

If you liked this newsletter, don’t forget to share it. Also, feel free to share your thoughts on X, where you can find us as @bastionresearch.

Disclaimer: This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

😂Meme of the Week🤣

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.