A Global Wake-Up Call and India’s Path Forward

Welcome to this week’s edition of TOPICAL WEDNESDAY! Today, we dive into one of the most critical, and underappreciated geopolitical choke points: Rare Earth Metals. We’ll explore how China came to dominate this strategic sector, why the world is finally waking up, and what it means for India’s ambitions to build its own resilient supply chain.

Recently, China sent shockwaves across the globe when it decided to ban rare earth metal exports, primarily targeting the USA, as the trade war escalated between the world’s two largest economies. This period of heightened trade tensions saw both nations figuratively firing shots through tariffs, restrictions on tourism, and changes to immigration policies.

Recall our earlier article where we discussed trade tariff wars between the US and the rest of the world. Well, China isn’t the type of country to simply accept terms dictated by the US. Instead, it banned, or rather restricted, the export of seven Rare Earth Elements (REEs) and magnets worldwide. This move triggered a rapid exchange of retaliatory tariffs and restrictions, with the US at one point imposing a 145% charge on China, and China responding with 125% retaliatory tariffs.

Soon, both countries, realizing it was a lose-lose situation, decided to de-escalate. The US and China held multiple meetings in London and Geneva, which led to a truce. This agreement lowered tariffs, with the US charging 55% tariffs and China 10%, alongside China lifting the ban on the majority of REEs and magnets.

Even after the truce between the two nations, the ripple effects of this trade war and China’s actions, particularly the global ban on rare earth metal exports, were felt worldwide.

India was not spared. Auto manufacturers here faced major disruptions, especially those in the electric vehicle (EV) segment, where rare earth magnets are a critical component.

Before dive into discussion, let’s take a step back and understand what exactly are Rare Earth Elements and Magnets?

Rare Earth Elements and Magnets, are they really rare?

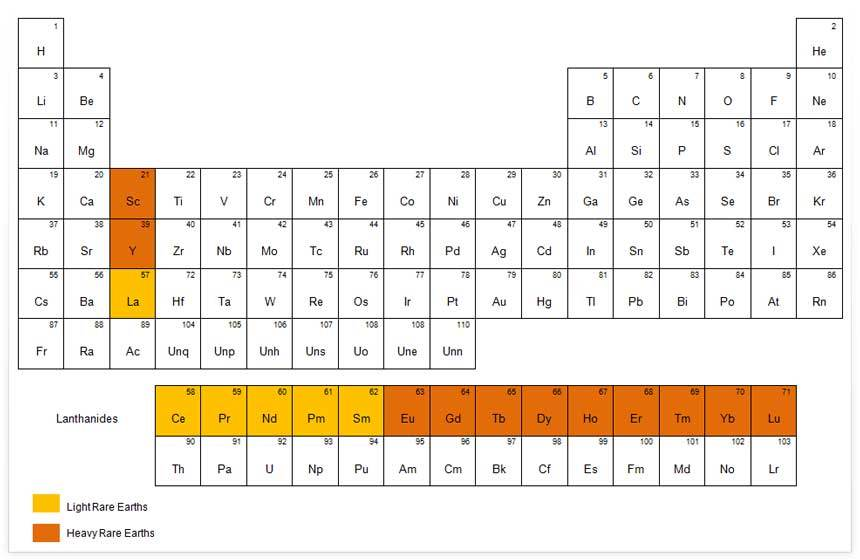

Ironically, rare earth elements aren’t actually that rare. They consist of 17 elements from the periodic table, including neodymium, dysprosium, and praseodymium, which are found abundantly across the Earth.

(Source: geologypage.com)

The table below illustrates which Rare Earth Element is primarily used in which product and the corresponding sector.

(Source: www.usgs.gov)

Notably, Neodymium (Nd) is an extremely crucial component in the manufacturing of permanent magnets used in modern EV motors, primarily due to their lightweight nature and high performance compared to regular magnets. Scandium is another important element used in aerospace and military aircraft, which is why China has yet to remove restrictions on its export.

This leads us to the question: if these metals aren’t rare and are so important, why is China calling all the shots or able to use this as leverage in diplomatic negotiations?

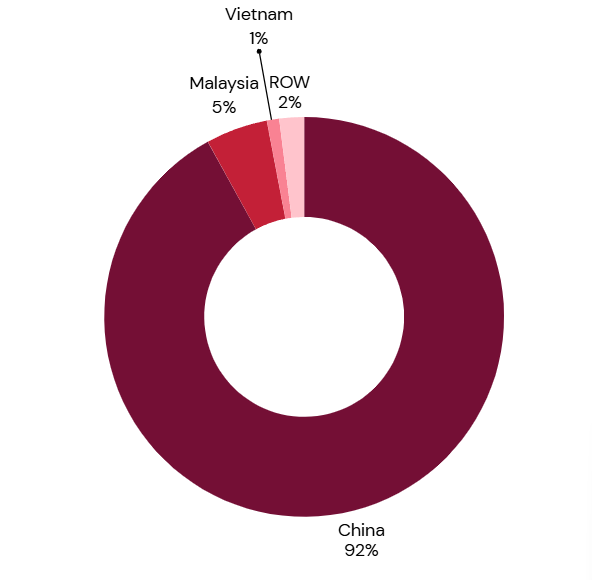

Rare Earth Elements: China’s Oil

China possesses ~75% of the world’s rare earth element mining capacity and refines over 90% of the global supply. This all began in the 1980s when China strategically identified rare earth metals as a key investment. Then, the government treated REE refining plants as national infrastructure, absorbing all early losses. It heavily funded the industry with direct subsidies, tax breaks, and R&D funding, driven by a long-term vision of becoming a global powerhouse. This foresight allowed the country to corner these commodities and establish a near-monopoly, enabling them to significantly undercut US refineries and eventually bankrupting many global players, most notably the Mountain Pass Mines in California, which was the world’s largest rare earth mine in 2002.

(Source: IEA(2024))

Although these rare earth metals aren’t rare, they are typically found in grouped chunks, not separately. The true cost lies in separating and then refining them, a process that was simply not economically feasible for many countries until recently.

Well, it wasn’t feasible back then, but surely it is feasible now with the EV boom… right?

Difficulties in Setting Up an End-to-End REE Value Chain

You might be wondering why other nations can’t simply develop their own plants, especially since these elements are abundantly available in their own soil. There are multiple reasons:

- Complex Chemistry: Yes, recall the periodic table! These rare earth metals are chemically extremely similar, making their separation notoriously difficult. It requires multiple processes, the use of corrosive chemicals, and precise controls. Consequently, highly skilled employees who cannot be trained immediately are essential.

- Environmental & Regulatory Barriers: The separation process releases radioactive waste, which can be harmful to the environment and therefore attracts a lot of stringent regulations. Western nations, in particular, are much stricter about these norms than China was in the 1980s or even now.

- Requires Large Initial CAPEX: To fully set up a complete spectrum from collection to separation to refining, plants can require $500 Mn to $1 Bn+ depending on scale, not to mention the working capital and waste management costs.

- Long Construction Duration: Related to our previous point, after locking up the capital, it can take years to complete an end-to-end value chain. Even a single separation plant can take up to 3-5 years, and if a country doesn’t have approved mines ready, it would add 7-10 more years just for exploration, approval, and construction of the mine. Moreover, to reach China’s scale, it could take 10+ years.

- Supply Chain Coordination: If you don’t want to build all pieces of the value chain, most countries will only have 1-2 pieces of the value chain, making it extremely difficult to coordinate with each other.

- Uncertain Returns: Every business faces uncertainty, but for rare earth metals, where you are locking up capital for half or even an entire decade, you’d expect a higher return for the risk taken. However, the rare earth element refining market is extremely volatile. Furthermore, if China senses another competitor, its first-mover advantage allows it to flood the market with its supply, driving down prices and making years of investment worth almost nothing.

All these hurdles have led the world to outsource their rare earth metals and magnets from China, making them dependent on it. The Indian Automotive Industry is a prime example of this dependence.

Effect of This Global Dispute on India

India was not immune to the rare earth element and magnet restrictions imposed by China, which mandated that every importer of these commodities obtain an end-user certificate approved by China. This process requires Indian buyers to complete a lengthy form, state the precise purpose of requiring the REEs and magnets, and provide multiple confirmations that the materials will not be used for defense purposes or re-exported to the USA. This entire approval process could take 45 days, and in case of rejection, the importer would have to restart the entire process, taking another 45 days. So far, 30 applications have been submitted from Indian importers, and not a single one has been approved. Globally, only 25% of applications have received approval.

Even though many industries have been disrupted, the Indian automotive industry, in particular, has been one of the most affected by these restrictions. Indian OEMs were ramping up production to prepare for festive season sales in H2FY26, so these trade restrictions couldn’t have come at a worse time. Maruti Suzuki, India’s largest carmaker, which was poised to enter the EV space this year, has had to cut its production of its first EV, “E-Vistara,” by 66% from 26,500 units to 8,200 units due to the shortage of rare earth magnets used in their vehicles.

There is also concern regarding targeted rejections from Chinese authorities; while the same company’s subsidiaries in the US and Germany had their import orders approved, their Indian unit’s request was rejected.

India’s supply crunch and the way forward

Initially, representatives of the Indian auto sector held talks with Chinese counterparts. Even after the truce between the US and China, the situation remains dire for Indian importers; in fact, it has become even worse as US and EU importers are being prioritized, with 21 pending certificates from Indian Companies currently awaiting approval. The Indian Embassy in China has also been initiating negotiations.

The past few months have unequivocally taught India the lesson that it needs to find a way around China’s monopoly. The short-term solution suggested by the government is to change the technology used in motors, which might be less efficient and more costly, but crucially, not dependent on REEs. Additionally, India aims to diversify its supply sources for REEs, importing from countries like Vietnam and Malaysia. While this might come at a higher cost, it can help the industry in future crises where China cannot bully India or any other nation due to its upper hand.

Moreover, the long-term, sustainable approach for India is to build its entire end-to-end rare earth element and magnet value chain. With government support, India can become a self-dependent REE producer and help reduce China’s global monopoly.

Conclusion

While China may have demonstrated its dominance to the world with its monopoly in the REE space, it has also triggered a chain reaction of events, alerting nations that were overly dependent on China, assuming free trade. This has prompted countries like the US to take action, with companies such as MP Materials accelerating the commissioning of their plant and Ucore being granted $18.4 Mn for their Phase 1 expansion.

India on its part, plans to incentivize its downstream NdFeB (powerful magnets used in EVs) supply through its PLI scheme. These capital expenditures are focused on crucial choke points within the middle of the value chain. Although these projects will not erode China’s dominance in a day or even in a few years, they represent a significant step in the right direction for these nations and for the global economy.ounders today have far more viable, India-based pathways to scale. India is evolving from a startup exporter to a startup builder and keeper.

Happy Investing !!!

If you liked this newsletter, feel free to share it. Also, feel free to share your thoughts on X, where you can find us as @bastionresearch.

Disclaimer: This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

😂Meme of the Week🤣

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.