Welcome to this week’s edition of TOPICAL WEDNESDAY! Today, we will try to understand the new US tariff that are expected to be imposed tomorrow.

Unless you’ve been living under a rock, you’ve probably heard about the new tariffs announced by President Trump on April 2, 2025. These measures unveiled a list of countries now facing reciprocal tariffs from the U.S. Of course, if you’re an investor, you’ve likely already felt the pain in your portfolio. So, let’s understand what is actually happening with tariffs and what it means for India?

But before we dive in, let’s familiarize ourselves with some key financial terms:

Trade Deficit/Surplus – A trade deficit occurs when a country imports more than it exports. A trade surplus is the opposite—when exports exceed imports.

Tariff – A tariff is a tax imposed on imported goods to make foreign products more expensive and protect domestic industries.

Reciprocal Tariff – A reciprocal tariff is designed to balance trade between two nations by matching or offsetting tariffs when there’s a deficit. This is what the U.S. is now imposing on other countries.

Counter-Tariff – A counter-tariff is a retaliatory measure, usually imposed in response to another country’s tariffs, often seen during trade wars.

Why These Tariffs?

Trump’s reasoning is straightforward: The US has charged minimal import tariffs in the past while its trade allies have levied heavy import tariffs on US-based products. He claims this has allowed these nations to “loot” America. With these new measures, he aims to restore trade balance, boost local manufacturing, create more jobs, and gain negotiating leverage with trading partners.

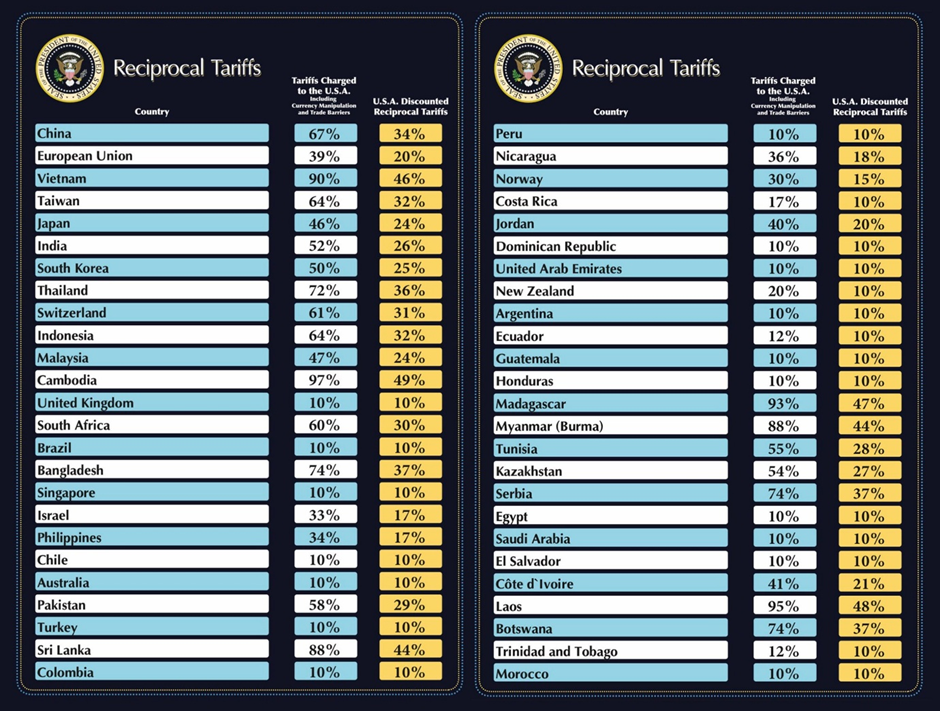

The Image That Shook the World

(Source: The White House)

On April 2, 2025, President Trump announced tariffs on all U.S. trading partners and released a list detailing the specific rates to be imposed on each country. At first glance, the numbers don’t seem to add up. How did the US government calculate specific percentages for over 100 industries operating in various countries?

For example, India charges 60% import duties on automobiles but 0% on crude oil from the US. So how did the US arrive at a blanket 52% tariff that India supposedly charges on imports from the USA? Or 67% for China and 90% for Vietnam?

Even more puzzling, many countries have been slapped with flat 10% reciprocal tariffs, including the McDonald Islands near Australia, which is inhabited only by penguins and seals! Countries such as the UK and Singapore, which have trade surpluses with the USA, were also imposed these same 10% tariffs.

So, what’s actually behind these numbers? Surely, there isn’t a magical formula that simplifies it all this neatly—right?

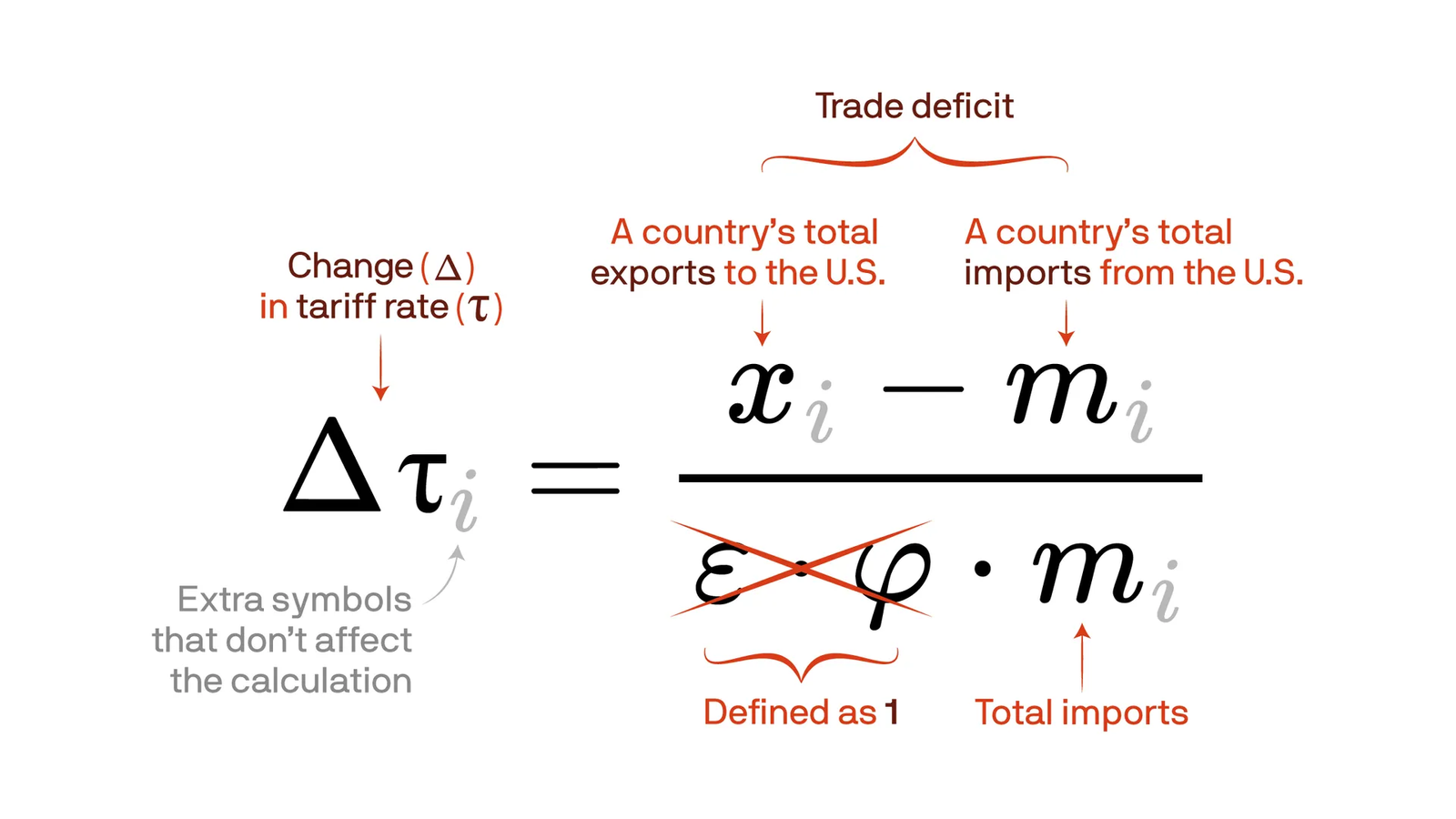

The “Magic Formula”

Surprisingly, the Trump administration has developed a formula.

(Source: Axios)

It might look complex, but it’s actually quite simple. Here’s how it works:

- Take total imports from a country

- Minus total exports to that country = Trade deficit

- Divide the deficit by imports to get a percentage

- Then halve it as a “discount (kindness),” and round off the number

Let’s take India as an example:

- US imports from India: $87.4 billion

- US exports to India: $41.7 billion

- Trade deficit: $45.7 billion

Applying the formula:

$45.7 billion ÷ $87.4 billion = 0.523 or 52.3%

52.3% ÷ 2 = 26.15%, rounded to 26%

This simplified approach saved the government from complex calculations for every individual industry across every country. This formula hasn’t been well-received by economists and trade experts worldwide.

Criticism from Experts

Economists and trade analysts have been quick to criticize. They argue the tariffs aren’t truly “reciprocal” and don’t reflect real-world trade practices.

- Julia Spies (International Trade Centre): Called the math “not standard economics.” She said the U.S. overestimated foreign tariffs by more than 95%, citing EU rates of 3.5%—not the 39% claimed.

- Alberto Cavallo (Harvard): “If the correct figure were used, the resulting tariffs would be about four times smaller.”

- Emily Kilcrease (Former U.S. Trade Official): Said the administration picked an “approximation consistent with their policy goals,” not sound economics.

But What About Those Penguins?

Yes, the McDonald Islands—home to penguins and seals—got a 10% tariff too. Why?

Commerce Secretary Howard Lutnick explained it was to close potential loopholes—preventing companies from routing goods through uninhabited territories or surplus nations to avoid tariffs.

Strangely, there might be something to this. In 2022, the U.S. imported $1.4 million worth of goods from these islands, labeled “machinery and electrical.” This has raised suspicions about mislabeling in shipping records.

Now, let’s understand the global implication.

Impact on Global Economy

The global economy is projected to experience a substantial contraction due to the tariff war. Overall global GDP is forecasted to decline by ~ $500 Bn (0.43%), reinforcing the established economic principle that trade wars shrink the global economy. The IMF is expected to make a downward “correction” to its 2025 forecast of 3.3% global growth. JP Morgan has already revised their estimates for global recession from 40% to 60%.

(Source: The Conversation)

Southeast Asian countries have been severely impacted by these tariffs because a significant part of their business comes from exports to the USA. They have been handed tariffs ranging from 10% to 49%. Cambodia has been charged the highest tariffs at 49%, followed by Vietnam (46%), Thailand (36%), and Indonesia (32%). These countries’ export-driven development models now face an existential threat.

How Countries Responded

Global responses have been mixed—some retaliate, others renegotiate.

Retaliation:

- China has imposed counter-tariffs of 34% on all US imported goods.

- Canada had already implemented 25% tariffs in March 2025 and has warned the US of more counter-tariffs if these “unjustified” tariffs continue.

- The European Commission proposed counter-tariffs of 25% on a range of US goods.

Open to Renegotiation:

- Vietnam has pledged to reduce their import duties to almost 0%.

- Cambodia has reduced their tariffs from 35% to 5% to renegotiate the reciprocal tariffs with the US.

- Some countries, like Singapore, have accepted the tariffs from the US and are in ongoing discussions to further reduce the imposed tariffs.

- India hasn’t taken any immediate steps but there have been discussions regarding reduction in tariffs.

Effect of Tariffs on India

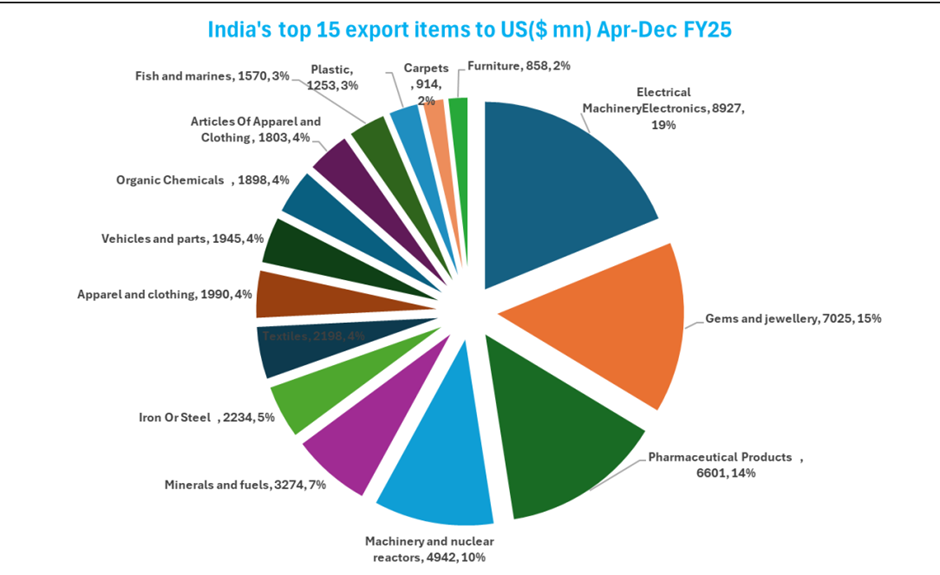

(Source: SBI)

Electrical Machinery: Contributes the highest share of India’s exports to the US at ~$9 Bn as of 9MFY25. Previously faced very low duties (average 0.4%) in the US market. Starting April 9, 2025, these products will face a 26% tariff. Experts predict a decline in exports by 12% after the new restrictions.

Pharmaceuticals: India is a leading hub for pharmaceuticals globally and in the USA, 47% of generic medicine comes from India. Historically, the US imposed less than 1% tariff on these products. Trump hasn’t imposed any tariffs on pharmaceuticals yet, giving companies a year to shift their manufacturing to the US. However, he has suggested future tariffs could be 25% or higher.

Gems & Jewelry: The sector will be heavily impacted by the 26% tariff, accounting for $7 Bn worth of exports in 9MFY25. Experts predict a 30-50% drop in US-bound shipments, with orders halting ahead of April 9, potentially creating a crisis worse than 2008 for Surat’s diamond industry. Currently, the Indian industry processes ~90% of global diamonds.

Textile: India’s textile industry operates on very slim margins and will be impacted once the tariffs take effect. However, Indian manufacturers are willing to absorb 5% of the tariff and pass the remainder on to U.S. customers if they source more business from India over countries like Bangladesh or Pakistan. This strategic move, not seen in other textile-exporting nations, could give India a competitive advantage. These textile companies have actually requested subsidies from the government or loans at lower interest rates to expand their capacity and stay competitive.

India as a Net Gainer

Despite heavy tariffs, India might see higher demand due to its relatively lower tariffs (26%) compared to other South Asian countries like Pakistan (30%), Bangladesh (37%), and China (34%). This could lead to a net benefit for India.

For example, Apple, which currently assembles its phones in China, Vietnam, and India, plans to shift 25% of its production to India from the current 15%. These new tariffs give Apple an higher incentive to accelerate this transition.

However, there’s a catch: While this incentivizes international businesses to shift from neighboring countries to India, it could also lead to business moving from India to nations with even lower tariffs. UAE and Saudi Arabia, with their special economic zones, are attracting more companies. Meanwhile, other emerging countries like the Philippines or Brazil now have the opportunity to capture more business deals with US firms.

Conclusion

The new tariffs take effect tomorrow and have already shaken markets and governments worldwide. Trump says he’s open to negotiations, but his cabinet insists the tariffs are here to stay. Mixed messaging has only fueled uncertainty.

The bigger worry? The escalating U.S.-China trade war. China’s counter-tariffs prompted Trump to threaten an additional 50% tariff if they aren’t removed within a day. China, meanwhile, remains firm, calling the ultimatum “blackmail.” An all-out trade war between the world’s two largest economies can potentially have devastating global consequences.

Before we say goodbye for today, it is important to remember that opportunities may exist in the chaos, but the road ahead will require careful navigation.

If you liked this newsletter, don’t forget to share it. Also, feel free to share your thoughts on X, where you can find us as @bastionresearch.

Disclaimer: This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

😂Meme of the Week🤣

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.