How to Evaluate Acquisitions?

Do you end up confused when any of your portfolio company announces an acquisition or is getting acquired?

Here is your guide to evaluating acquisitions

When a company in your portfolio is either snapping up another business or getting acquired, it requires a bit of detective work to fully understand it. There are key factors that needs to be explored to get the full picture and determine your next move. So, let’s unravel the mystery of acquisitions!

To gain a better understanding, let’s examine a recent example.

Coforge Ltd Acquires Cigniti Technologies Ltd.

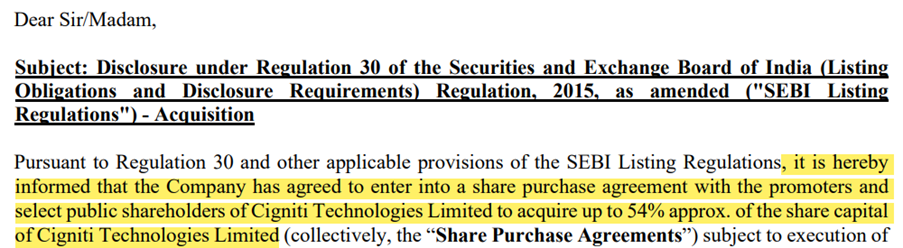

On May 2, 2024, Coforge Ltd. announced its intention to acquire Cigniti Technologies.

When a deal like this hits the headlines, there are four key pieces of the puzzle you need to piece together to really get a handle on what’s happening. Let’s break it down together:

- Who’s Who? – First things first, identify the players. Who’s the acquirer and who’s the target?

- Acquisition Percentage – How much of the target company is acquirer snapping up?

- Price & Swap Ratio – What’s the price tag? And what’s the swap ratio?

- Who’s Selling? – Find out who’s handing over their shares.

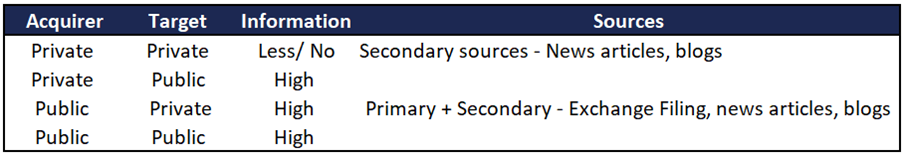

Depending on the companies involved, the amount of information available can be different.

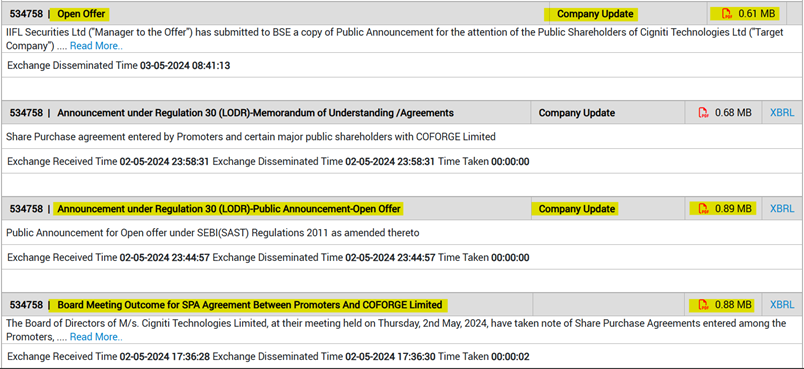

In our example, both Coforge (acquirer) and Cigniti (acquiree) are publicly traded. This means you can dive right into BSE or NSE websites anytime to snag up all the details from their corporate announcements.

Cigniti Corporate Announcements:

After that, let’s find out the four essential pieces of information mentioned above:

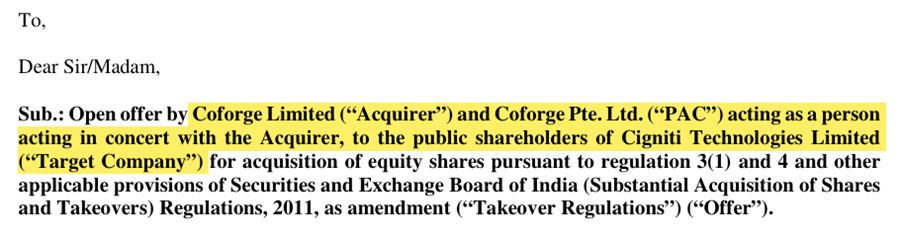

Who’s Who?

Coforge Ltd is the acquirer and Cigniti Technologies Ltd. is the acquiree or the target company.

Acquisition Percentage

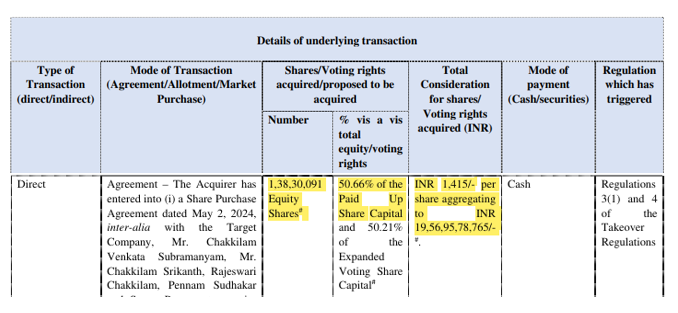

Coforge will acquire up to 54% of Cigniti Technologies in all cash deal.

Price and Swap Ratio

Coforge will purchase the above shares for Rs. 1,415 / Share or Rs. 2,086 cr.

Side Note 1 – Swap ratio

It is crucial when a company buys another using its own shares. But in our example, Coforge is acquiring Cigniti for cash—there are no shares involved. So, the swap ratio doesn’t come into play this time.

Who’s Selling?

Promoters and select public shareholders are selling their entire stake to the tune of 50.66%

Once we’ve gathered all the essential info, it’s time to roll up our sleeves and analyze how this acquisition makes sense.

Here are some crucial questions to keep in your toolkit. Let’s break it down and see what this deal really means.

Question 1 – Why is an acquirer buying a target company in particular?

There are mainly 3 reasons for an acquisition.

Growth, Diversification, or Acquiring specific capabilities or talent.

Coforge Ltd. (Acquirer) is an IT company that offers products such as an AI-based digital business assistant, deep learning, ML, NLP, and workflow automation.

Cigniti Technologies Ltd. (Target) – It provides services such as software testing and analysis for quality assurance, next-gen testing, digital assurance, IP & innovation, etc.

Coforge’s Acquisition Rationale:

- 3 New Verticals: Acquiring Cigniti Tech will create three new scaled-up verticals – Retail, Technology, and healthcare for Coforge.

- New Geographies: This will help Coforge realize its objective of expanding its presence across the Southwest, Midwest, and Western US markets.

- AI for Assurance: It will help the company address the significant opportunities that the proliferation of AI is creating for specialized Assurance Services.

Coforge Ltd. believes this acquisition will improve its operating margins by 150-200 bps and double its revenue to $2Bn by FY27.

In short, Coforge is acquiring Cigniti to diversify its products without overlap, enter new markets, and boost growth with AI-driven products.

Question 2 – How much is it buying for?

Whenever we’re eyeing a purchase, one question always pops up: “Is it worth the price?” This holds true even in the big leagues of corporate acquisitions. So, let’s dive into the nitty-gritty: How much is Cigniti really costing Coforge?

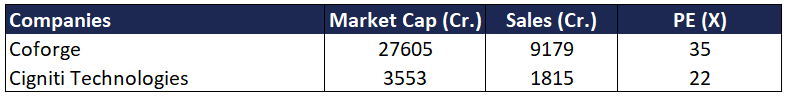

Current valuations of Acquirer & Acquiree:

Proposed Valuation for Acquisition

As per the acquisition, Coforge Ltd. plans to buy 54% of the company from promoters and select shareholders for Rs. 1,415/ share which will amount to Rs. 2,086 cr.

Implied Market Cap = Rs. 3,863 cr.

Cigniti’s PAT (FY24) = Rs. 166 cr.

Therefore, Implied P/E = 23

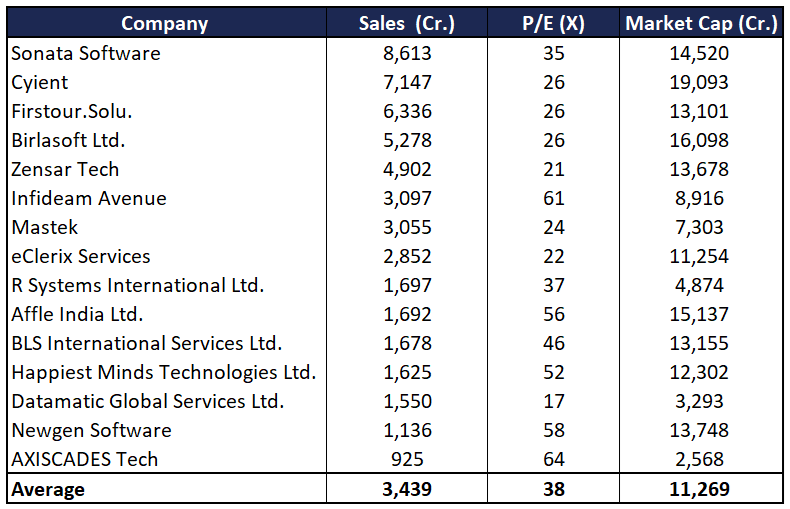

To know if Cigniti acquisition is expensive or not, we have to compare its value with its peers

As mentioned above, Cigniti Tech’s P/E ratio stands at 23 which is well below the industry average of 38. This little gem of a stat suggests that Coforge is snagging a deal at a pretty reasonable valuation.

Because Cigniti is cheaper than Coforge, it will be value accretive from day 1.

Side Note 2: Open Offer

When a company’s ownership shifts and someone acquires 25% or more of the voting rights, they must make an open offer to buy an additional 26% of the shares, allowing shareholders to cash out or adjust their stakes.

Deal Breakdown of Coforge & Cigniti

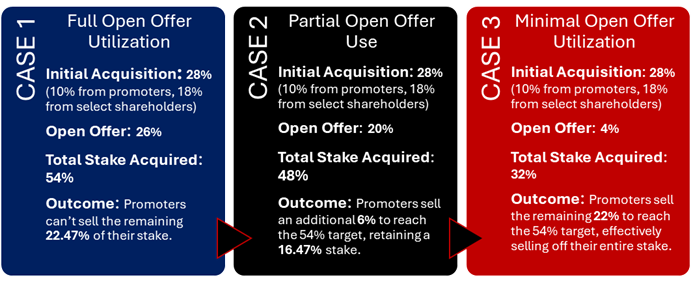

Coforge is strategically acquiring Cigniti by first purchasing 10% from promoters and 18% from select shareholders, triggering a mandatory open offer for an additional 26% to reach a 54% stake. If this target isn’t met, existing promoters of Cigniti will sell the necessary shares to Corforge for it to achieve its 54% acquisition target.

This is how it could play out:

It is highly likely that Case 1 will play out.

End Note: We’ve explored the strategic acquisition of Cigniti by Coforge, covering the reasons, financials, and potential impacts. As we conclude, remember the mergers and acquisitions world is full of learning opportunities. Stay curious and informed to navigate these waters successfully.

Until next time, Happy Investing

Fin Meme of the Week

Did you buy physical gold or SGB this Akshay Tritiya?