The IPO boom that Indian markets witnessed in the year gone by

Welcome to this week’s edition of TOPICAL WEDNESDAY! Today we are saying goodbye to 2024.

First of all, Happy New Year! The record-breaking year of 2024, filled with twists and turns, has finally come to an end. As always, the stock market proved to be one of the most unpredictable and exciting places to be. Many of you would agree that 2024 was one of the craziest years for the stock market. We witnessed unprecedented levels of investor participation, fundraising, returns, and some of the most controversial corporate dealings in recent history.

As we close out the year, it’s important to reflect on how the market performed in 2024. While analyzing a single year’s performance may seem short-sighted, the insights from last year’s activity are vast—far too much to cover in one newsletter. So, we’ve narrowed it down to two key topics. Today, we’ll discuss the a) broader performance of the stock market over the past year and b) the record-breaking fundraising through IPOs and their performances in 2024.

Let’s dive into the broader market!

Market Performance – Sensex

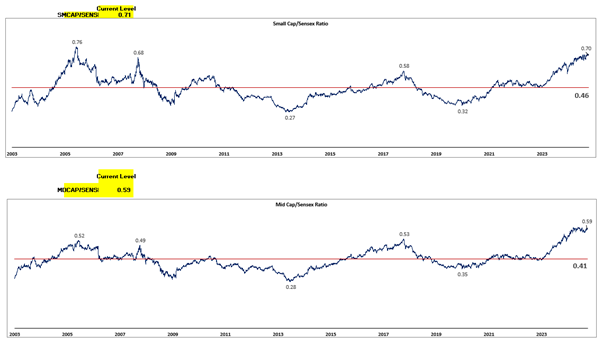

This year, the Sensex delivered an 8% return. A closer look at the performance reveals that this growth was primarily driven by the mid-cap and small-cap indices. The BSE Midcap returned 26.1%, while the BSE Small Cap delivered an impressive 29.3%. In contrast, large-cap stocks underperformed over the past year. Notably, the mid-cap and small-cap indices have been on a strong upward trajectory for the past two years, reflecting investors’ growing risk appetite.

To put things into perspective, the small-cap index, relative to the Sensex, has already surpassed its 2008 levels and is nearing the all-time high of 2005-06. Meanwhile, the mid-cap index, also in relation to the Sensex, is trading at an all-time high. This reflects the market’s growing enthusiasm for smaller companies.

Looking at sector performance, healthcare emerged as the best-performing sector in 2024, delivering an impressive annual return of 43%. On the other hand, the 3 worst-performing sectors were BSE Metal (7% growth), BSE Bankex (6% growth), and BSE FMCG (1% growth), all underperforming even the SENSEX. While Metal’s underperformance is not surprising due to its cyclical nature, the weak performance of FMCG and Bankex was unusual. Historically, FMCG has ranked among the top five performing indices in 10 out of the last 25 years but has been in the bottom five only 3 times, including this year. Similarly, Bankex, in its 23-year history, has been a top-five performer for 10 years but has been in the bottom five just 5 times, including 2024. This indicates that these historically favored indices saw limited investor interest this year.

Now, let’s turn to a topic we all either love or hate, depending on the allotment we have been getting—IPOs in 2024!

Record-Breaking IPOs in 2024

India’s IPO market experienced unprecedented growth in 2024, setting new benchmarks in the capital markets. A total of Rs. 1.62 lakh crore was raised through 92 mainboard IPOs, including one REIT, marking a staggering 3x increase from Rs. 49,440 crore in 2023. This surge highlighted growing investor confidence and increased participation in the primary market. Interestingly, despite Foreign Portfolio Investors (FPIs) being net sellers in secondary markets, their participation in IPOs remained strong throughout the year. Here’s an overview of IPOs in India in 2024.

Key Highlights of the IPO Market in 2024:

Sectoral Fundraising: The Automotive sector led IPO fundraising in 2024, raising Rs. 36,367 crore, followed by Renewable Energy with Rs. 20,052 crore. The E-commerce/Q-commerce sector raised Rs. 15,797 crore, while Construction and Pharma raised Rs. 9,837 crore and Rs. 9,164 crore, respectively. Together, these sectors accounted for Rs. 91,217 crore, reflecting robust investor interest and sectoral growth.

Positive Returns:~72% of IPOs delivered positive returns during the year, showcasing strong market sentiment and consistent demand for new listings.

Low Risk of Losses: Only 27% of IPOs listed at a loss, indicating relatively low risk for investors in 2024.

Record-Breaking IPO Applications: Waaree Energies set a new benchmark in October 2024 by receiving 97.34 lakh applications for its IPO, surpassing the previous record made by Bajaj Housing Finance just 2 months ago in September 2024. Tata Technologies had previously held the record in 2023.

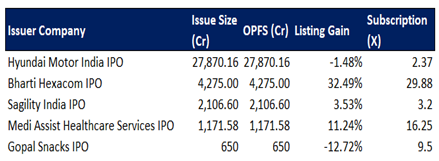

Largest IPO/ OFS in Indian history: Hyundai Motor India launched the largest IPO in Indian history, raising Rs. 27,870 crore, entirely an Offer for Sale (OFS) by its parent company.

Yeah, pretty crazy!

Now, as mentioned earlier, 2024 was a landmark year for the IPO market, marked by several unprecedented events. One defining trend was the record-breaking surge in promoters and early investors cashing out. This year saw the highest-ever amount raised through OFS.

High on OFS

Out of the total record raise of Rs. 1,62,390 crore through the primary markets, 61% (Rs 99,425 crore) come from OFS, reflecting promoters and early investors monetizing stakes amid favorable conditions. The remaining 39% (Rs 62,965 crore) came from fresh issues. On the other hand, 17 companies opted for 100% OFS, raising Rs. 55,412 crore, showcasing a trend of promoters and early investors monetizing their stakes while ensuring wider public participation in these businesses.

Top 5 IPOs with 100% OFS

This doesn’t mean the year was only about promoters selling their stakes. 2024 also set records for fresh issues.

Fresh Issue

Fresh issues, which represent the capital raised by companies for expansion, debt reduction, and operational support, also saw significant growth in 2024. A total of 20 companies raised Rs. 24,186 crore exclusively through 100% fresh issues, emphasizing their focus on funding growth, expansion, and operational requirements.

Top 5 IPOs with 100% fresh issue

We all know that IPOs generated immense investor interest, but how did they perform after listing? The answer might surprise you.

Listing Gains & Performance in 2024

On average, IPOs in 2024 delivered 30% listing gains, significantly outperforming market indices. Further, the average return from IPOs reached an impressive 41%, indicating additional gains of ~10% beyond the initial listing performance. Notably, IPOs managed to outperform the yearly returns of major indices in just a single day of trading, underscoring the attractiveness of investing in new listings.

Investors’ Craze for IPOs in 2024

The year 2024 saw an unprecedented frenzy among investors for IPOs, with the Bajaj Housing Finance IPO standing out as a prime example. The Rs. 6,560 crore issue attracted a staggering demand of Rs. 3.2 lakh crore, receiving 89 lakh applications and being oversubscribed 67x (excluding anchor investors). This record-breaking response highlighted the immense enthusiasm for new listings.

In their pursuit of quick profits, many investors went to extraordinary lengths, including withdrawing funds from banks and even taking loans to apply for IPOs. Kotak Bank’s CFO, Mr. Devanga C. Gheewala, remarked during the Q1FY25 earnings call: “Challenges on low-cost deposits continued as savers turned into investors, deploying money in high-yielding capital market products, which impacted our cost of funds.”

This trend underscores the intense craze for IPOs in 2024, with investors leveraging every opportunity to capitalize on the booming primary market.

It looks like the IPO momentum is far from slowing down, as 2025 is set to bring another wave of well known companies raising massive funds through public offerings.

What to Expect in 2025?

The year 2025 could shape up to be another landmark year for IPOs, with several high-profile listings expected to dominate the market:

Reliance Jio: Mukesh Ambani’s telecom giant is targeting a $100 Bn valuation, potentially making it India’s largest-ever IPO and surpassing all previous records.

Flipkart: India’s leading e-commerce platform, valued at $36 Bn, is preparing for its much-anticipated IPO after relocating its domicile from Singapore to India.

LG Electronics India: The Indian arm of LG Electronics is expected to go public with a valuation of up to $15 billion.

Subsidiary IPOs: Major companies like HDFC Bank, Hero MotoCorp, Reliance Industries, and Canara Bank are planning to list their subsidiaries. Notable examples include HDB Financial Services (Rs. 12,500 crore IPO) and Hero FinCorp (Rs. 3,668 crore IPO), among others.

With over 34 companies already approved and many more in the pipeline, 2025 could be another record-breaking year for India’s capital markets. What do you think? Let us know by replying to this email.

Disclaimer: This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

This cost-efficient model allowed SpiceJet to offer affordable fares, attracting budget-conscious travelers and capturing a significant share of India’s expanding middle-class market. By 2008, SpiceJet had soared to become one of India’s top five carriers—a testament to its strategic focus and execution.

Wishing you a Prosperous New Year From Team Bastion

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.