Welcome to this week’s edition of TOPICAL WEDNESDAY. This week, we look at the cashless stand-off between AHPI and Bajaj Allianz, why it happened, and what it tells us about the hospital and insurer trust gap in India.

On 22 August 2025, India’s largest hospital collective told its members to stop cashless treatment for one of the country’s biggest insurers. A week later, the same body rolled the decision back. In between, thousands of families asked the same question: “If I paid my premium, why do I still need to swipe my card at the hospital desk?”

And this is not a one-off scuffle. It is a symptom of a long, uneasy relationship between hospitals and insurers. Let us walk through what happened, why it happened, who stepped in, and why you should expect more flare-ups like this.

What Actually Happened?

- 22 Aug 2025: The Association of Healthcare Providers India, or AHPI, advised member hospitals across North India to suspend cashless for Bajaj Allianz General Insurance and also warned Care Health Insurance, effective 1 Sep. AHPI cited long-running issues like outdated package rates, claim denials and slow pre-auth and discharge approvals.

- 27 Aug 2025: The General Insurance Council, or GIC, the industry body for non-life insurers, publicly urged AHPI to withdraw the advisory in the interest of patients and to keep cashless running while talks continued.

- 29 Aug 2025: After meetings, AHPI revoked the suspension for Bajaj Allianz policyholders. Cashless was restored at AHPI member hospitals, and both sides committed to follow-ups on rates and processes.

Quick primer: AHPI & GIC

- AHPI: A not-for-profit umbrella of private healthcare providers. It represents hospitals, nursing homes, and diagnostics on policy and operations, and coordinates collective actions when talks stall.

- GIC: The statutory industry body for non-life insurers under Section 64C of the Insurance Act. It links insurers with IRDAI, sets common positions, and mediates during disputes.

In this episode, AHPI issued the advisory; GIC urged withdrawal and brokered talks so cashless could continue while issues were negotiated.

Why It Happened?

Hospitals argue that insurer contracts haven’t kept pace with medical inflation and point to unilateral deductions, delays, and slow authorisations that clog beds and disrupt care. Insurers counter that some providers inflate bills when a policy covers the cost, pushing them to demand tighter packages and stricter controls. The friction is structural, not episodic.

The Hospital Perspective: Recurring Pain Points

- Stagnant tariffs vs inflation: Package rates locked for years while staff, consumables and tech costs rise 6–10% annually.

- Payment timelines: Even approved claims can take 30–90 days to settle, locking up working capital.

- Pre-auth & discharge delays: Beds blocked while approvals crawl, frustrating patients and staff alike.

- Unilateral deductions: Consumables or implants approved upfront often get cut at final settlement.

- Documentation load: Hospitals must maintain detailed coding and insurance desks to meet insurer audits.

The Insurer Perspective: Why They Push Back

Insurers argue hospitals inflate bills when a third party (insurers) is paying, and highlight fraudulent claims in some cases. They want stricter packages, better coding, and more control on utilisation.

And The Patient Gets Caught In Between

When a network turns cashless off, care does not stop, liquidity does. Patients are asked to pay upfront and then claim reimbursement, which is hard during a surgery or an ICU admission. GIC’s intervention focused exactly on this patient impact, which is why the advisory was rolled back.

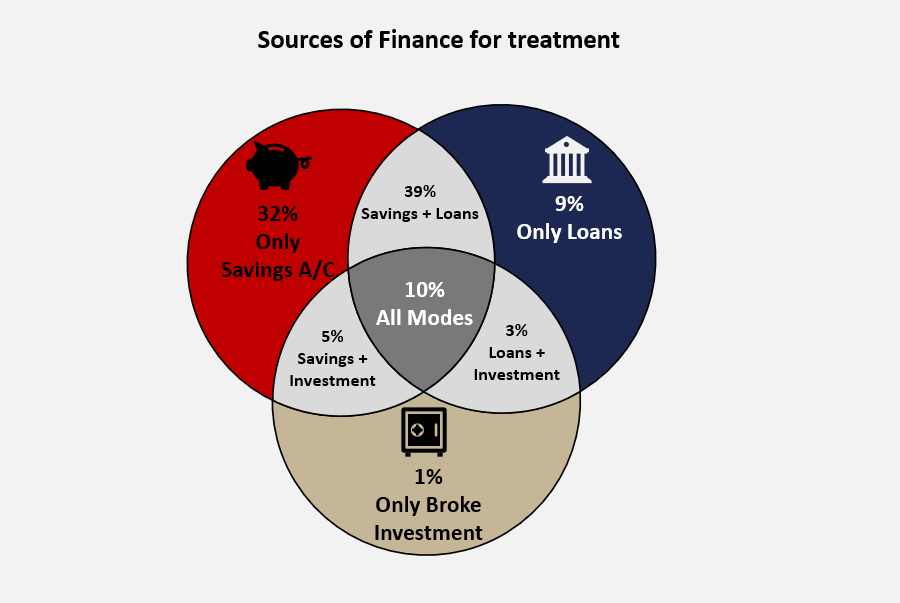

(Source: Policybazaar)

Not The First Time, And Not The Last

The pattern has shown up repeatedly in recent years.

- Ahmedabad, 2025: The city’s hospitals association, AHNA, suspended cashless for Tata AIG, Star Health and Care Health in April, citing delisting, old tariffs and settlement delays. By mid-May, Star Health and Care resumed after talks, Tata AIG stayed unresolved longer. Same playbook, same outcome.

- Other 2025 coverage across metros captured the same push and pull, with hospitals demanding tariff updates and insurers warning about misuse.

Expect more such city-level flashpoints whenever inflation outpaces rate cards or service levels slip. The headlines change. The script doesn’t.

Why Hospitals And Insurers Still Need Each Other

Insurance is a promise plus a network. A policy is more attractive when it unlocks cashless at many and credible hospitals. Hospitals, in turn, do better volumes when many insurers offer cashless at their counters. Each side drives the other’s demand, which is why standoffs usually end in negotiated peace rather than permanent divorce.

What Might Change Post Renegotiation

- Faster decisions and discharges: 1-hour target for initial authorisation, 3-hour window for final cashless settlement at discharge. If insurers miss, they bear the overstay cost. This is meant to de-jam counters and protect patients.

- Towards near-100% cashless: IRDAI and GIC are pushing to minimise reimbursements so families don’t fund hospital bills and chase money later. Execution will hinge on hospital desks being process-ready and on insurers honouring the timelines.

- Cashless beyond the network: Cashless Everywhere allows cashless at any hospital, subject to intimation and admissibility. This improves choice but requires SOPs on pricing and documentation to avoid fresh disputes.

What The Reversal Really Signals

AHPI did not suddenly decide that old rates are fine. GIC did not suddenly accept across-the-board tariff hikes. The rollback tells you both sides recognised the patient-experience risk of a hard suspension and chose to talk with cashless switched on. That is the pragmatic equilibrium the system gravitates to, until the next renewal cycle or inflation spike forces the issue again.

What This Means For You As An Investor

From an investor lens, this episode tests two levers that drive earnings: pricing power and process discipline. Pricing power is the ability to revise packages and sustain ARPOB. Process discipline is how fast and cleanly claims move through authorisations, discharge, settlement and documentation. Use the indicators below to see who is executing on both.

Hospitals: indicators to watch

ARPOB vs inflation growth: ARPOB lagging medical inflation for multiple quarters imply margin pressure.

ARPOB vs peers: Much higher than peers with a similar case mix may indicate aggressive pricing or richer packages; too low may indicate stale tariffs or weak bargaining.

ALOS trend: Lower is generally better; a rising ALOS without a shift toward more complex cases can indicate discharge delays or slow insurer approvals.

Receivable days from insurers/TPAs: Rising days can signal settlement friction or tighter deductions; monitor cash flow from operations relative to EBITDA.

Watch: How to analyse the hospital sector

Insurers: Indicators to watch

- Health loss ratio (HLR) / incurred claims ratio: A lower HLR can reflect efficiency or simply stale hospital contracts; look for context on tariff renewals and anti-fraud controls.

- Claim settlement ratio and turnaround times: Weak settlement percentages or long pre-auth and discharge TATs indicate service risk and potential provider friction.

- Average claim size vs medical inflation: Growth far above inflation without a mix change may indicate leakage or package slippage.

The Bigger Picture

India needs a repeatable way to refresh hospital packages without brinkmanship. Two things would help. First, time-bound, inflation-linked revisions for standard procedures that reflect changes in staff costs, consumables and technology. Second, clean service-level norms for pre-auth, discharge and settlement, with transparent reconciliation to reduce disputes.

GIC and AHPI already sit at the table, the law already recognises the council’s role, and the providers already have a collective forum. The ingredients are in place, the habit of using them before a standoff is still forming.

Closing Thought

India’s health insurance market runs on trust: that an insurer will pay on time and that a hospital will bill fairly. Every public standoff is a stress test of that trust. Each time a network blinks, confidence takes a hit, not because care is unavailable, but because predictability disappears at the moment families need it most.

The system will mature when two habits stick: inflation-linked package revisions on a timetable, and service-level discipline that holds under pressure. Until then, cashless will work most days and then suddenly not, only to resume after a noisy pause because neither side can grow without the other. The patient should not be the circuit breaker.es activity offshore. Either way, the decisions made in the coming months will shape the digital economy’s direction for years to come.

We’d also love to hear your thoughts and feedback on X. Connect with us there at @bastionresearch.

Happy Investing!!!

Disclaimer: This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

😂Meme of the Week🤣

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.