A simple but very crucial question that we often fail to ask, and get trapped

Welcome to today’s edition of learning of the week. Firstly, a very Happy Diwali and a Prosperous New Year to you and your loved ones. Since this is the first LEARNING OF THE WEEK newsletter of Vikram Samvat 2082, we thought of talking about something basic, but worth its weight in gold. Also, it’s funny to witness that, despite such significant importance, it doesn’t get the thinking bandwidth it deserves. In this newsletter, we are going to talk about the “basis of valuation” and the process you must follow before making an investment decision. So, let’s dive in…

Important side note: If you’re someone who loves to listen and learn, we’ve also added an audio version of this newsletter. Prefer reading instead? Go right ahead.

Valuation – a central piece of every Investment conversation

No matter where and between whom the conversation is taking place, if it is an investment conversation, in all probability, valuation is the beating heart of that conversation. We love to cite examples of how not paying attention to valuation ended up in wealth destruction or opportunity loss. Despite all this wisdom, many times we skip to ask a very basic question: “What’s the basis of this valuation?”

We’ll debate endlessly about whether something is “cheap” or “expensive”, “value” or “growth”, but rarely stop to ask cheap or expensive based on what?

This single question, when ignored, quietly gives birth to two classic mistakes we (investors) often make:

a) Buying into the frenzy because everyone’s excited.

b) Missing out on value because everyone’s skeptical.

And here’s the strange part: we conveniently ignore this question exactly when we need it the most. When we hear a business story wrapped in blazing growth or recent collapse, our brain takes a shortcut. We assume that because the company is growing fast or because it has struggled recently, the valuation somehow justifies itself. In both cases, the basis of valuation quietly slips out of the discussion. Now, before getting into details, let’s first simply define this term:

The Basis of Value

Very simply, think of the basis of value as the lens through which we decide what a business is worth. Are we paying for what it owns, what it earns/could earn in the future or for the cash flows it generates? This lens and its clarity are aspects that determine whether we’re investing or just guessing. In other words, the basis of value is the anchor of any investment.

THREE bases of Value – Cutting away the noise

When we dive into the investing core, the value of any business rests on just three bases. No matter where we think a company’s value comes from, its people, R&D, brand, scale, or anything else, these strengths eventually show up in one of three measurable levers. Therefore, we can generally assign value to a business based on the following:

1. Assets: What are the company’s assets worth if we had to sell everything today? This is the foundation of traditional Graham-style investing, value anchored in the balance sheet.

2. Earnings: How much can this business consistently earn? Here, the focus is on profits. Stability, margins, and repeatability of earnings.

3. Cash flow: How much real cash does the business generate over time? Because at the end of the day, cash is a reality.

Everything we see as “value” innovation, execution, leadership, or resilience ultimately influences one or more of these three variables. The essence of valuation is in knowing which lever we’re betting on and why.

The Balancing Act

We love labels. “I’m a value investor,” or “I am a growth investor.”

However, in reality, for a successful investment outcome, both are required. No one wants a slow-growing business, no matter how cheap. And no one should want a fast-growing business at a ridiculous price. Every sensible investment lies in the balance between the two. Here is how the great Warren Buffett puts it:

The art of investing is not about choosing sides; it’s about understanding the business, knowing what we’re in it for, and following a disciplined approach. It’s about efficiently undertaking the following THREE steps:

1. Defining the basis of value – Once we have built a satisfactory level of business understanding and are pondering whether to dive into the investment or not, the first and most crucial question we need to ask ourselves is: “What am I in this for?”

Are we investing because we believe the market is underestimating the true value of its assets? Or is it about the company’s ability to generate and grow earnings consistently over time? Perhaps we’re in it for the cash flow potential, either the cash it’s making now or the cash it could make in the future?

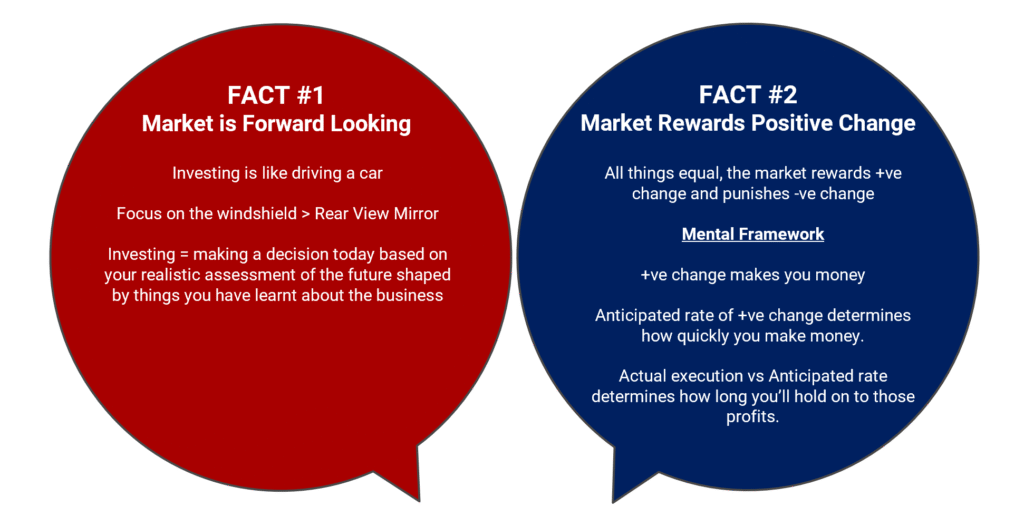

This step is all about clarity. We need to define our anchor. What’s our reason for being in the investment? If we can answer this question with confidence, we’ve already set the foundation for our investment decision. But before we move to the next step, let’s quickly review two key facts about how the market works:

These two facts serve as the backdrop for the next steps in the process.

2. Judging the Improvement or Deterioration in “Basis of Value” – Once we’ve defined our anchor, the next step is to assess, based on our understanding of the business prospects, whether the basis of value will improve or deteriorate. This is where we start thinking through scenarios based on our judgment of the business and market outlook. It’s a subjective exercise. But it’s essential. The more realistic and grounded our scenarios are, the better prepared we’ll be to navigate the market.

However, sometimes, the market presents us with rare opportunities where valuations become so attractive that we can almost skip this step entirely. In those cases, the company’s price is so out of line with its “basis of value” that it becomes an easy call. The investment is almost too obvious to miss. Think of KRBL Ltd. in Feb-Mar’25, for example.

The market cap (price of the entire business) ranged from ~Rs. 5,800 cr to Rs. 6,300 cr. Further, if you had referred to its balance sheet as of Q2 FY25 and its Q3 FY25 investor presentation, you will find that the total value of its tangible assets (Market Value of Inventory + Net Block – Net Debt) amounted to ~Rs. 6,000 cr. This means the entire business of India’s largest basmati rice brand (India Gate) was selling for 1x its tangible asset value. This kind of pricing stayed for ~45 days (14th Feb to 28th Mar), and since then the company has given 40-50% return in a matter of 7-8 months. The idea here is not to showcase return but to give an understanding that one can find occasions where the entire growth and positivity in a business comes completely free.

3. Determining the Right Price – This is the last and most tangible part of the process. If, based on the above developed scenarios, we believe that there is a higher probability of improvement in our “basis of value” (whether that’s profit growth, strengthening assets, or stronger cash flows), we need to figure out how much we’re willing to pay for that future growth. In simple terms, this step is all about identifying the price we’re willing to pay today for what we expect to earn tomorrow.

How do we apply the above process at Bastion Research?

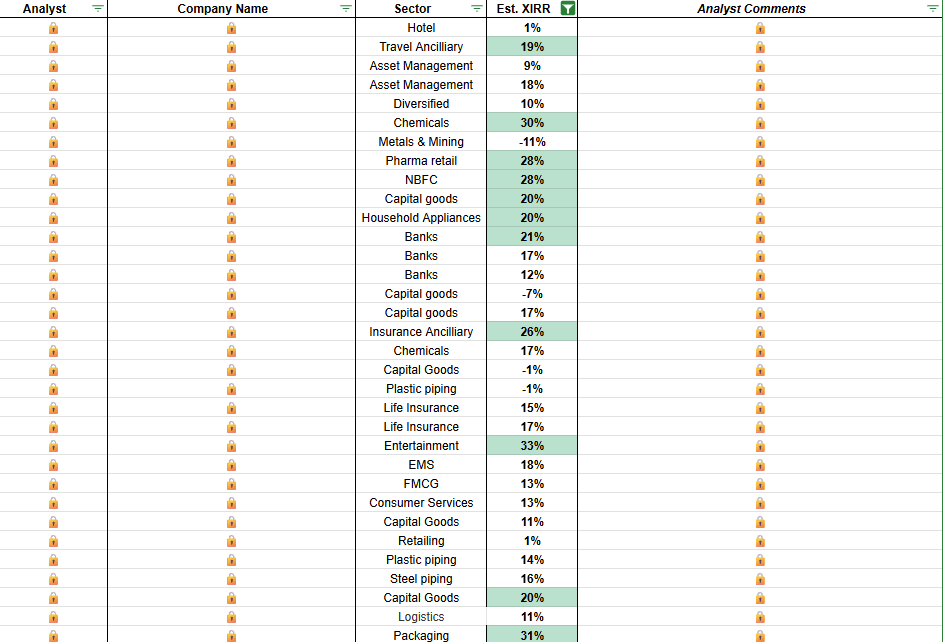

We actively apply the above process and conduct proceedings internally. Here is what we do: We have a ready watchlist of businesses we, are interested in and are actively looking into. The team has clearly defined the “basis of valuation” for each business and has determined the price we are comfortable paying for each business based on the scenarios we have internally created. As the market presents us with an opportunity, we are quickly able to act on that idea (in most cases) and add value to our clients and subscribers.

Below is a snippet for your reference if you wish to systematically apply the above learnings, just like we do.

Conclusion – Beware of the Mirage of “Storification”

In the equity markets, particularly during bull runs, stories often move faster than numbers. Phrases like “great brand,” “legendary management,” or “market leadership” sound reassuring, but when the stock corrects 40%, we realise that we weren’t investing in fundamentals but were just buying into a narrative. This is the moment when we recognise that we haven’t thought enough about the basis of value, nor followed the disciplined process that should have guided our decision.

Think of the basis of value as the foundation of a house. Sure, we can adorn it with appealing stories, shiny brand names, and charismatic management, but without a solid foundation, it’s only a matter of time before it all crumbles in a storm.

If you enjoyed reading this newsletter, please feel free to share it with others who might find it insightful. We’d also love to hear your thoughts and feedback on X. Connect with us there at @bastionresearch.

Happy Investing!!!

😂Meme of the Week🤣