Welcome to this week’s edition of TOPICAL WEDNESDAY! Today, we’re unpacking WeWork India’s IPO, a surprising twist for a brand whose global parent flamed out in spectacular fashion.

Once valued at $49 billion, WeWork became the poster child of unchecked ambition, lavish spending, and corporate chaos. After its failed IPO in 2019 and eventual bankruptcy in 2023, most thought the story was over.

But the Indian entity took a different path. Backed by Embassy Group, it sidestepped the fallout and is now headed for a public listing of its own. In this edition, we break down the coworking model, the rise and fall of the global brand, and why WeWork India believes it deserves a second shot, this time on Indian bourses.

Before we delve into WeWork India’s story, let’s understand the coworking space and the industry itself.

The Idea Behind Coworking Spaces

Coworking, at its core, is just a smarter way of using office space. The easiest way to understand it is to think about how hotels work. A hotel either owns a building or signs a long lease for it. They cover all the fixed costs like mortgage payments, maintenance, and staff salaries. Then, instead of renting the whole building to a single person or company, they break it down into smaller units such as individual rooms and rent them out for short stays. The profit comes from what is called the rental spread, which is the difference between what they pay for the entire property and what they collect from all those smaller rentals combined.

Coworking spaces follow this same basic principle, but in the office world. Instead of hotel rooms for a night or two, they rent desks, cabins, or entire office floors for a month, a quarter, or sometimes even just a few days. Here is how it usually works: the operator leases a large commercial space, often for 5 to 10 years, which locks in their cost of the property. They then invest in transforming that empty shell into a fully functional office. This means furniture, high-speed internet, conference rooms, coffee machines, printers, and everything a business needs to simply move in and start working.

Once the space is ready, it is divided and rented out to multiple clients. These could be freelancers who just need one desk, startups that require a small cluster of seats, or big corporates that might take an entire floor. By slicing the space into smaller, more flexible units and charging a premium for the convenience, the operator turns one long-term lease into many short-term rentals, each contributing to the overall profit. For the client, the appeal is obvious: no huge upfront costs, no multi-year commitments, and the flexibility to scale up, scale down, or move as needed.

Operators typically engage in three main leasing models:

- Managed Office Model : In this model, the operator neither leases nor owns the space. Instead, it partners with landlords or corporate clients to design, build, operate, and manage a custom workspace for a fixed fee, typically under long-term contracts.

- Profit-Sharing Model: This involves a profit split with the landlord (typically 70:30 with landlord making the 70). While it significantly reduces the lease burden, it also limits the benefits derived from scaling operations.

- Direct Lease Model: In this model, the operator leases the property directly from the landlord, bearing all leasehold expenses. In return, the operator retains all generated profits.

(Source: Bastion Research)

For customers, the appeal is clear: they avoid the complexities of long-term commitments and substantial upfront investments in office interiors. Most coworking plans are monthly, offering the flexibility to scale up, down, or relocate as business needs evolve.

Landlords also benefit from this arrangement. Instead of constantly searching for new tenants and managing vacant properties, they secure stable, predictable income through 5-to-10-year leases with coworking operators, reducing their day-to-day management concerns.

The Booming Coworking Industry in India

India’s office space is growing at ~6.3% CAGR from FY22 to FY26. The demand for Flexible Workspace Stock is expected to grow at CAGR of 18-20% in Tier 1 Cities and CAGR of 27-28% in Tier 2 Cities.

This growth is fueled by a clear demand-supply gap in commercial real estate. The rising number of companies seeking flexible office setups is outstripping the availability of traditional office space. Furthermore, as more businesses adopt hybrid and remote work models, the demand for individual desks and flexible environments has surged. Many companies are also establishing satellite offices, and coworking spaces provide the agility to scale operations without the burden of heavy capital expenditure or long-term maintenance.

Let’s talk about WeWork Inc.

WeWork Inc. was founded in New York in 2010 with a straightforward premise: to provide flexible coworking spaces for freelancers, startups, entrepreneurs, and large corporations alike. The concept rapidly gained traction, quickly establishing WeWork as one of the most recognizable names in the coworking world. At its peak, the Company employed thousands of employees and with over 800 locations across 40 cities in the United States and 32 other countries, including Brazil, Germany, and Thailand.

Unlike some competitors, WeWork operated exclusively on a leasing model, foregoing revenue-sharing agreements with landlords. It secured long-term leases in premium buildings situated in prime urban areas. Crucially, it invested significant capital in high-end interiors and advanced technology, transforming its spaces into sleek, design-driven offices targeting a premium clientele.

Flexibility was central to its offering. Clients no longer needed to commit to rigid, multi-year leases. WeWork provided six membership tiers, including All Access, On Demand, dedicated desks, small private offices, office suites, and even full-floor custom spaces. The All Access plan enabled individuals to utilise open seating in shared spaces at any WeWork location worldwide. The On Demand plan, conversely, enabled users to pay only when they needed a desk or meeting room, making it ideal for sporadic workers or frequent travellers.

For businesses requiring more permanence, WeWork offered dedicated desks and enclosed office spaces leased to a single client. This tiered structure empowered users to start small and expand as needed, all without needing to switch providers.

At its peak in 2019, WeWork achieved a staggering valuation of ~$49 billion, primarily backed by SoftBank. It became the quintessential example of what aggressive venture capital and ambitious vision could build in the real estate sector.

However, the situation quickly unravelled. In 2019, under the leadership of co-founder Adam Neumann, the Company faced widespread criticism for poor governance, erratic decision-making, and unchecked spending. Its highly anticipated IPO collapsed, and the Company’s valuation plummeted by ~80-90%.

What led to downfall of the Global Entity?

WeWork’s expenditure on design and amenities far exceeded that of most competitors. Its workspaces featured high-end interiors, floor-to-ceiling glass walls, art installations, custom-made furniture, and regular community events. The objective was to offer a premium, lifestyle-focused experience rather than merely a functional office. However, this strategy rendered the business incredibly capital-intensive and challenging to scale profitably.

To fuel its aggressive global expansion, WeWork frequently paid landlords substantial sums upfront, sometimes even borrowing to do so. It prioritized acquiring properties in prime locations across major global cities, further escalating costs. Moreover, the extensive fit-outs and technology investments came with a hefty price tag. These premium interiors locked in even more capital but failed to translate into significant pricing power. Most customers simply desired flexible workspaces at reasonable rates and were unwilling to pay a premium solely for lavish design.

In addition to its unsustainable cost structure, WeWork’s IPO filings exposed serious corporate governance issues, including:

- Trademark Self-Dealing: CEO Adam Neumann personally trademarked the word “We” through a private LLC and subsequently sold it to the Company for $5.9 million.

- Real Estate Conflicts: He purchased properties in his own name and then leased them to WeWork, collecting rent from the Company.

- Excessive Control: Neumann held super-voting shares that granted him 20 times the voting power of regular shareholders.

- Lack of Accountability: He structured governance in a way that only he could appoint his successor.

This cash-burning model, backed by a power-trip CEO, turned out to be a perfect recipe for a disaster.

The Aftermath

Following its IPO filing, WeWork came under intense scrutiny from both investors and potential shareholders. The Company’s financials and corporate governance practices, particularly those involving then-CEO Adam Neumann, drew widespread criticism. Within just two weeks, these negative revelations severely eroded investor confidence, casting a deep shadow over the IPO and jeopardizing SoftBank’s $10 billion investment.

On 17th September 2019, the Company withdrew their IPO filings and then one week later under mounting pressure, Neumann stepped down as CEO and Chairman of the Company on 24th September 2019. The damage, however, was irreversible. WeWork’s valuation plummeted from $49 Bn to ~$8 Bn.

After appointment of New CEO and restructuring, WeWork eventually did get listed in October 2021 but its troubles were far from over and Covid-19 made sure to add further salt into their wounds.

Years later, in an effort to remain listed on the New York Stock Exchange, the Company announced a 1-for-40 reverse stock split in August 2023. This move aimed to boost its share price above $1, the minimum requirement to avoid delisting. At the time, WeWork still leased millions of square feet across 777 locations globally, according to its filings.

Ultimately, on November 6, 2023, WeWork filed for Chapter 11 bankruptcy protection in the United States. This bankruptcy primarily affected the Company’s operations in the US and Canada, while its international locations continued to function, depending on the structure of local subsidiaries and joint ventures.

The Indian Entity:

Unlike its global counterpart, WeWork India was never a wholly owned subsidiary of WeWork Inc. It started as a joint venture between WeWork Global and Embassy Group, a leading Indian real estate developer backed by Blackstone. Embassy held a 73% stake, while WeWork Inc. owned the remaining ~27% through its Special Purpose Vehicle(SPV), Ariel Way Tenant Ltd.

In 2022, facing rising financial pressure, WeWork Inc. explored selling its 27% stake to investors reportedly linked to Embassy Group. The deal, valued at around Rs 700 Cr, implied a valuation of Rs 2,600 Cr for the Indian business. However, the transaction fell through due to a valuation mismatch.

Despite WeWork Inc.’s bankruptcy filing in 2023, WeWork India retained rights to the brand through a licensing agreement and continued operating as a separate entity.

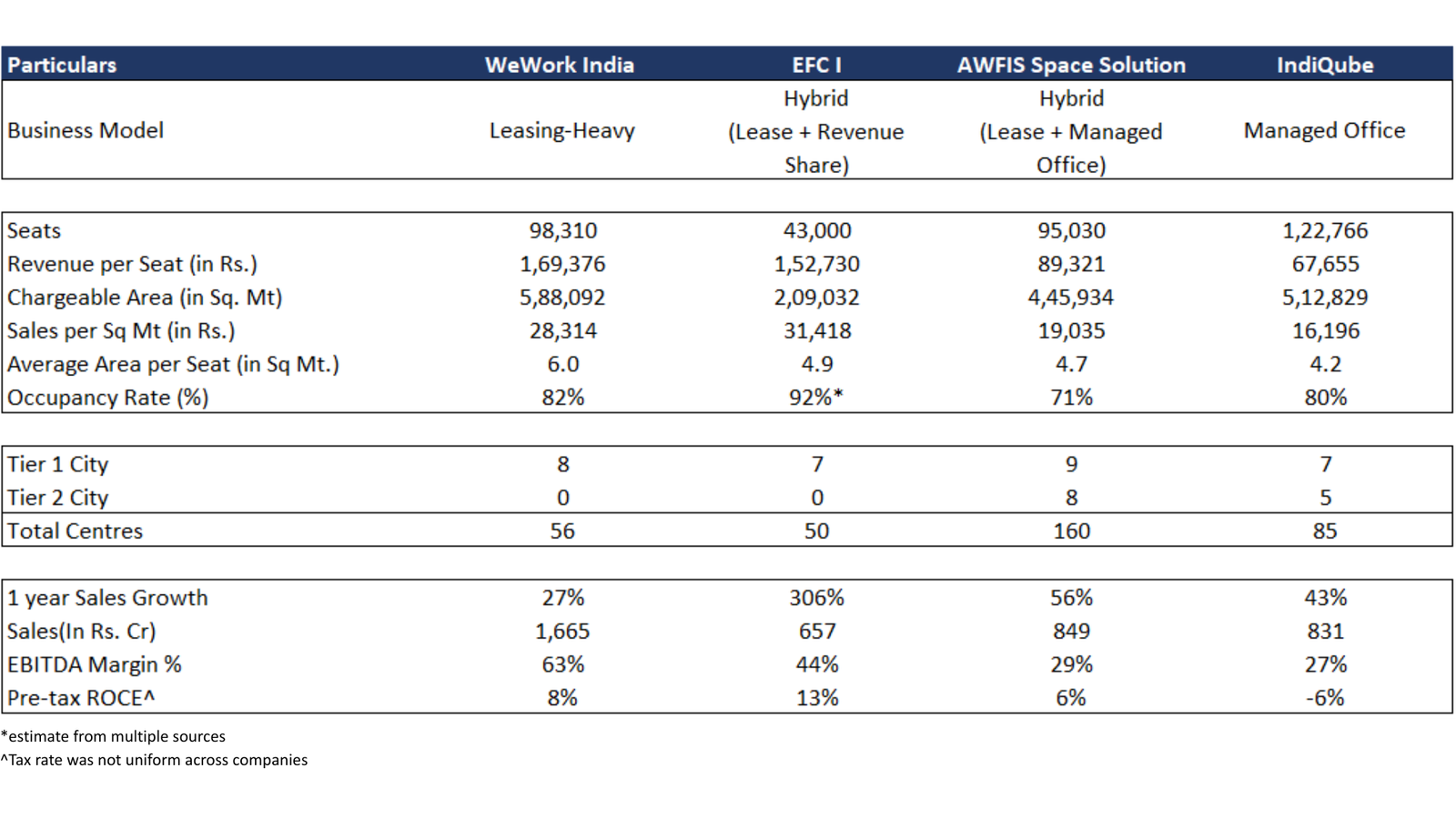

Business Model and How the Peers Operate:

(Source : WeWork India RHP, EFC I, AWFIS Space Solutions, IndiQube, Bastion Research)

The IPO

Now preparing for its public debut, WeWork India’s IPO will be a pure Offer for Sale (OFS). There is no fresh issue, which means the Company isn’t raising new capital but simply providing an exit route for existing shareholders.

Pre-IPO, Embassy Group holds ~76%, while Ariel Way Tenant Ltd, the SPV linked to WeWork Global, owns ~23% of WeWork India.

- Embassy Buildcon LLP is offloading ~25% of its stake.

- Ariel Way Tenant Ltd is selling ~7.7%. After the failed deal in 2024, this IPO marks WeWork Global’s renewed attempt to partially exit the Indian business through its SPV.

- SEBI has already cleared the proposal, giving investors a chance to own a stake in one of India’s most recognisable coworking brands.

Closing thoughts

We believe WeWork India positions itself as a more premium offering compared to its counterparts, offering larger desk spaces with lavish facilities. It does follow in the footsteps of its now-bankrupt global parent. However, the Company’s losses have reduced by ~80% from FY22 to FY24, indicating improving cost control and operational focus. Although there are still unanswered questions and it’s unclear how this will ultimately pan out, the absence of corporate governance issues and the strong backing of Embassy Group, who is a prominent player in Indian real estate, will provide some comfort.

We’d also love to hear your thoughts and feedback on X. Connect with us there at @bastionresearch.

Happy Investing!!!

Disclaimer: This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

😂Meme of the Week🤣

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.