Welcome to this week’s edition of TOPICAL WEDNESDAY! Today, we’re diving into Viceroy Research’s blunt takedown of Vedanta, accusing the group of bleeding its own businesses to keep a debt-heavy parent company alive.

In a scathing 95-page report, the short-seller compared Vedanta Resources to a parasite, accused it of looting its own subsidiaries, and suggested the entire group is one liquidity shock away from collapse. The language was as bold as the numbers were alarming.

Vedanta hit back with a denial, of course. But the questions raised around debt, governance, and group structure aren’t going away anytime soon.

In this edition, we break down the full story: how Vedanta’s financial maze is structured, what Viceroy alleges, what the data actually shows, and what it all means for shareholders, lenders, and the system.

Before we deep-dive into the specifics, let’s first get a handle on what Vedanta actually does.

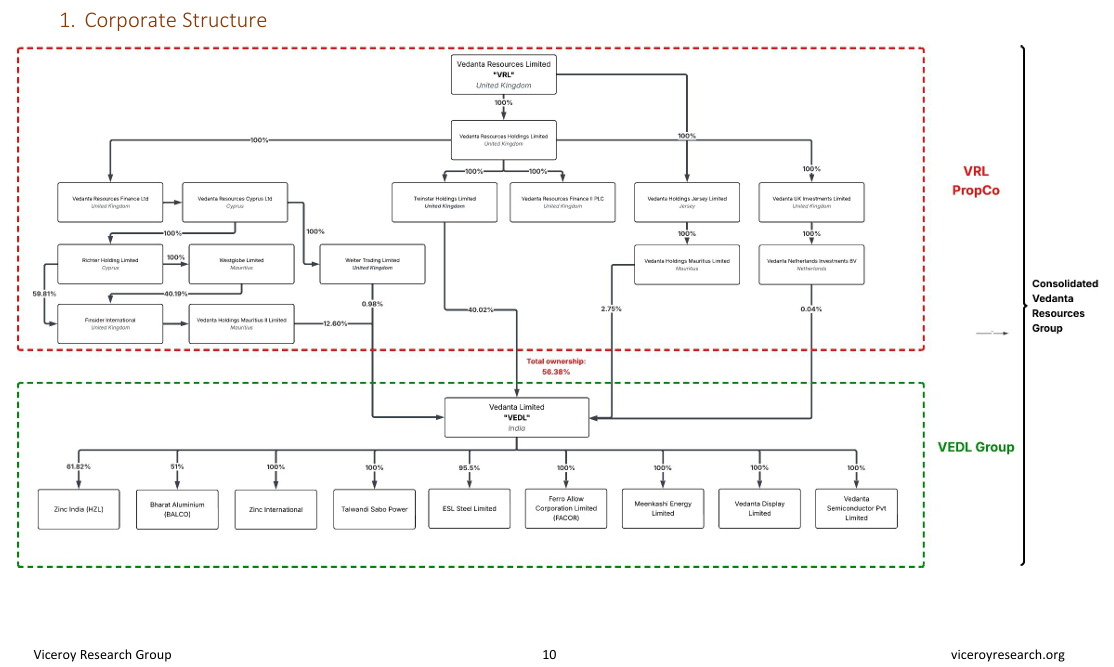

At its core, Vedanta is a giant natural-resources business—think zinc, aluminium, copper, iron ore, and even oil & gas—extracted from the ground and then refined or smelted for everyday use. Most of these operations sit within Vedanta Ltd (VEDL), the listed entity that generates cash. But there’s also a private holding company, Vedanta Resources Ltd (VRL), that sits on top, collecting dividends and fees. In short: a sprawling metals-and-minerals powerhouse with a complicated corporate roof overhead.

The Parasite and the Host

Viceroy boils Vedanta’s two-tier structure down to a blunt image: Vedanta Resources Ltd (VRL) is the parasite, Vedanta Ltd (VEDL) the host.

VRL, the private holding company we just met, carries almost $5 billion of debt yet owns no operating assets. Its lifeline? Supersized dividends, “brand” fees and inter-company loans funneled up from VEDL, the listed entity that actually runs Hindustan Zinc, Cairn, BALCO and the rest. With a five-way demerger racing toward a September 2025 finish line, that structure is only getting more complicated.

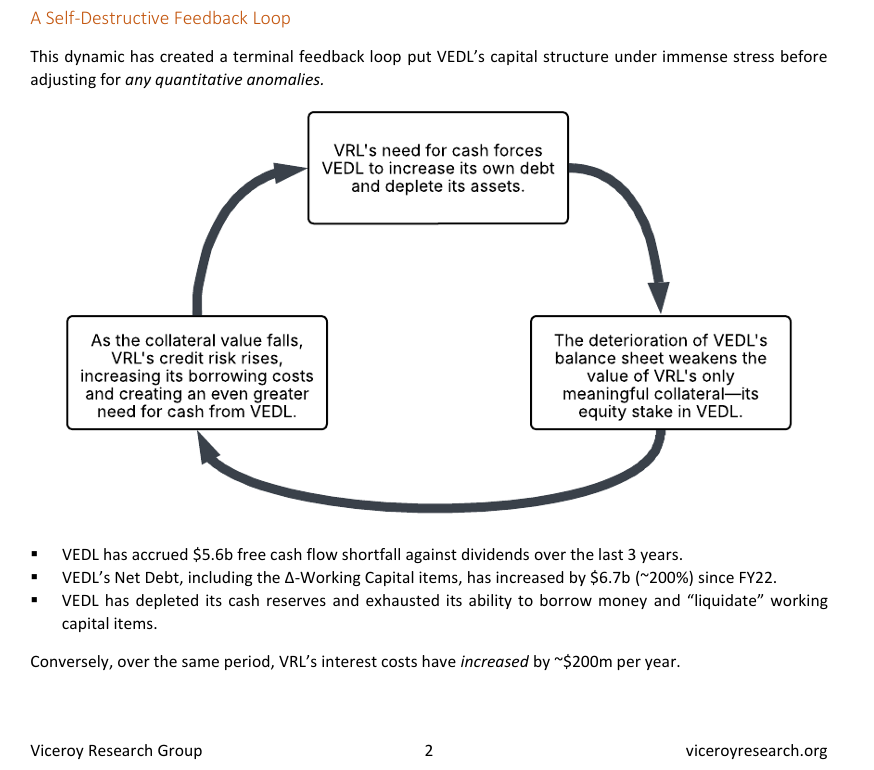

This setup, Viceroy argues, is structurally self-destructive. To survive, VRL keeps extracting cash from VEDL, even if it means piling debt onto VEDL, draining its reserves, and impairing its ability to function. Since VRL’s debt is secured against its stake in VEDL, this amounts to slowly eating your own collateral.

The result? What Viceroy calls “a Ponzi-like scheme” dressed up as a conglomerate.

The Mechanics of the Alleged Looting

Here’s how the alleged playbook works:

- Unsustainable Dividends: In the past three years, VEDL paid out ~$8 billion in dividends, despite generating only ~$2.4 billion in free cash flow. The rest was funded through more debt.Viceroy estimates VEDL’s free cash flow shortfall at $5.6B.

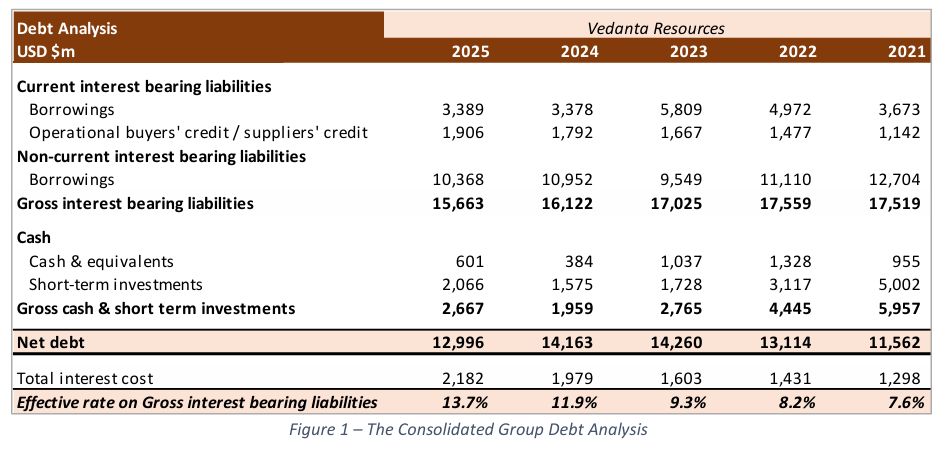

- Skyrocketing Leverage: VEDL’s net debt has jumped ~200% since FY22. Working capital ratios have fallen below 1.0, indicating persistent liquidity pressure.

- Interest Expense Doesn’t Add Up: VRL reported ~$835M in interest expense in FY25, which implies a 15.8% rate on its debt, far higher than the rates on its publicly listed bonds (9–11%)Viceroy says this could indicate hidden debt, intra-period loans, or misreported costs, all serious red flags.

- Brand Fees as Disguised Cash Transfer: VEDL and subsidiaries paid $338M in “brand fees” to VRL in FY24. These fees were levied even by companies that don’t use the Vedanta brand and often prepaid, with no clear service provided.

The Subsidiaries: What’s Under the Hood?

The report also dissects several of VEDL’s operating subsidiaries. A pattern of weak assets, inflated values, and hidden liabilities emerges:

- Fujairah Gold (Dubai): Allegedly buys gold-rich feedstock at inflated prices. Viceroy links this to possible money laundering and criminal supply chains.

- Hindustan Zinc Ltd (HZL): The crown jewel may also be the biggest risk. If a GoI-triggered option clause is exercised, VEDL could face a $10.6B outflow or be forced to sell its stake at half the market value.

- Konkola Copper Mines (Zambia): Non-operational and insolvent, but carried at a $1.6B valuation on books. VRL has promised $1B+ to revive it, a promise it can’t afford to keep.

- ESL Steel: Routinely capitalizes expenses to inflate assets and mask losses. Roughly 40% of capex since acquisition went to environmental penalties.

- Talwandi Sabo Power Ltd (TSPL): Booked unpaid power dues as revenue, concealed a $150M liability during its demerger filing, and was flagged by the NCLT.

The Governance Mess

The accusations don’t stop at numbers. Viceroy paints a picture of a group held together by opacity, not oversight:

- Auditor Arbitrage: VRL’s UK auditor (MHA MacIntyre Hudson) and several Indian auditors have been fined or banned by regulators. One offshore auditor operates from a Bhiwandi apartment, using a Hotmail address.

- High-Level Attrition: Since announcing the demerger in Sept 2023, the group lost its aluminium CEO (3 months in), Cairn CEO (7 months), Deputy CEO of HZL, and VRL’s own CFO.

- Legal Entanglements: Vedanta disclosed 107 liability-related announcements between Feb 2022–25. Tata Steel and JSW? Just 8 and 3, respectively.

The Deteriorating Math

Group-wide net debt: ~$13B

Effective interest rate: 13%+

Working capital stress: VEDL’s current liabilities exceed current assets by >$2.5B

Encumbered equity: 99.8% of VRL’s stake in VEDL is pledged to creditors

And yet, the group continues to announce flashy multi-billion-dollar projects, from semiconductors to glass manufacturing, most of which are underfunded, delayed, or quietly shelved. Viceroy calls this a bait-and-switch model to justify debt raises. In its view, the planned demerger won’t solve the group’s problems, it may simply spread the financial strain across more entities, each left to navigate legacy debt with limited cash generation.

So What Does Vedanta Say?

Vedanta issued a short rebuttal. It denied all allegations, called Viceroy’s report “malicious,” and reaffirmed its commitment to capital discipline and transparency. But it did not address specific claims in detail.

The stock initially fell nearly 8% after the report but recovered partially after the company’s statement.

Why This Matters?

Regardless of how this unfolds, the report raises broader questions for India Inc. Should parent companies be allowed to bleed listed subsidiaries to meet private obligations? Where’s the line between financial strategy and shareholder abuse? And what protections do minority investors (including the government) really have in such setups?

These aren’t just Vedanta’s problems. They tap into deeper concerns around governance standards, market integrity, and whether corporate structures are evolving faster than the rules that oversee them.

Closing Thoughts

Is Vedanta a ticking time bomb or a misunderstood restructuring story?

Time will tell. But if even part of Viceroy’s claims are validated, this episode may serve as a cautionary tale, not necessarily India’s biggest scandal, but a timely reminder that corporate opacity, when left unchecked, can quietly become a systemic risk. While it may not shake Indian markets, the story has shades of deja vu. This isn’t a Hindenburg-style saga, but the script feels oddly familiar, family control, rising debt, and vanishing oversight.

Disclaimer: This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

😂Meme of the Week🤣

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.