Welcome to this week’s edition of TOPICAL WEDNESDAY! Today, we will cover a topic that’s been at the center of market chatter lately, SEBI’s crackdown on Jane Street.

The recent SEBI action against Jane Street has stirred debates not just about derivative markets, but about how far smart money can stretch the rules before it snaps them. For many retail investors, this has raised a bigger question: Has SEBI been too slow to act?

Whatever the view maybe, one thing’s clear, this case is setting a powerful precedent that could reshape how the trading giants are policed going forward.

In this edition, we unpack the complete story of Jane Street’s entry into India, from its trading strategies and tax structures to regulatory loopholes, and explore the implications for exchanges, retail traders, and the future of India’s derivatives market.

The Specifics Behind the SEBI Order

Last Friday, SEBI issued one of its most serious actions in our recent memory. In a 105-page interim directive, the regulator accused U.S.-based proprietary trading firm Jane Street of using high-frequency trading tactics to manipulate key Indian indices, particularly the Nifty 50 and Bank Nifty. According to SEBI, this wasn’t just aggressive trading, it was a case of deliberate market manipulation, with Jane Street allegedly tilting the scales to its advantage.

Before diving into the specifics, lets understand a bit about Jane Street, its operations and history.

Who Is Jane Street?

At the center of this storm is Jane Street Group LLC, a low-profile yet highly influential trading firm based in the U.S.

Founded in 2000’s in New York, Jane Street has grown into a global powerhouse with offices in London, Hong Kong, Amsterdam, and more. The firm operates in over 100 financial markets worldwide, quietly executing billions of dollars in trades each day without much public attention.

Like many modern trading firms, Jane Street doesn’t try to guess where the market is heading. Instead, it uses sophisticated algorithms and high-frequency strategies to buy and sell financial products like stocks, bonds, derivatives, ETFs, even crypto.

The India Chapter

Jane Street’s India story began around 2020, as the firm looked to tap into one of the world’s fastest-growing derivatives markets. India was witnessing a surge in retail participation in index options, particularly Bank Nifty weekly expiries. At the same time, regulators were slowly opening the door to foreign proprietary trading desks. For Jane Street, which thrives on high liquidity and fast-moving markets, India was a strategic fit.

When Jane Street entered in 2020–21, Jane Street quietly set up shop, registering with SEBI, establishing Indian entities, and beginning to trade index options and futures on NSE and BSE. But by 2022, it had gone from low-profile entrant to dominant player, frequently ranking among the top traders in Bank Nifty expiry-day volumes.

The scale ramped up fast – and so did the scrutiny as Jane Street started making huge profits after its entry.

How Did SEBI Catch On?

In early 2024, Jane Street filed a lawsuit in a U.S. court against rival hedge fund Millennium Management, accusing two of its former traders of stealing a proprietary trading strategy and using it at their new firm. What caught everyone’s attention, especially SEBI’s, was Jane Street’s own admission in the court filing: the firm claimed that this particular strategy had generated nearly $1billion in profits from India’s derivatives market in 2023 alone.

That revelation set off alarm bells.

SEBI picked up the trail and began investigating Jane Street’s trading patterns in the Indian market, particularly around index derivatives on expiry days. What followed was months of data analysis, surveillance, and order flow audits, eventually culminating in the explosive 105-page interim order.

What SEBI Found

Once the investigation was underway, SEBI turned its attention to Jane Street’s trades between January 2023 and May 2025, and the findings were serious.

According to SEBI’s interim order, Jane Street allegedly generated over Rs. 43,000 Cr in gross profits through index options trading. How? By placing massive, coordinated trades in both the cash market and the F&O segment at the same time.

The result? A net profit of Rs. 36,671 Cr during the period, after accounting for losses in equities and futures that was also a part of their strategy.

Derivative Basics

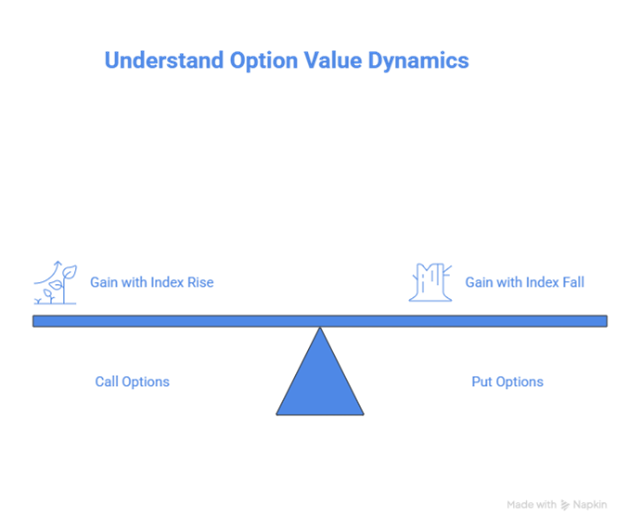

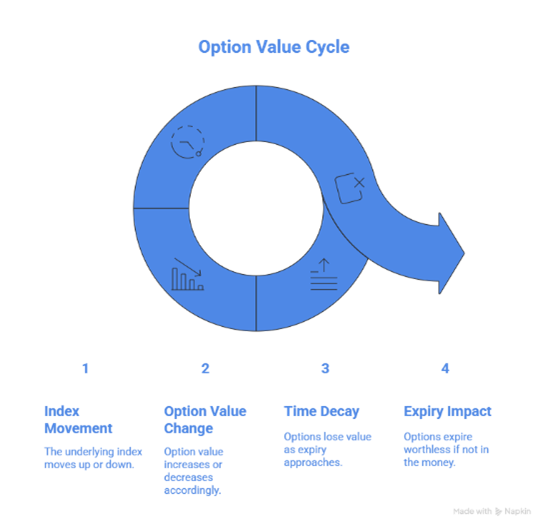

Before we get into the specific strategies Jane Street allegedly used, here’s a quick refresher on how call and put option prices typically move with changes in the underlying index. It’ll help make sense of what comes next.

(Source: Bastion Research)

The Alleged Playbook: How Jane Street Tilted the Game

SEBI says Jane Street used two core tactics to tilt the expiry-day game in their favor. Let’s take a simplified look at both:

1. Marking the Close: Playing the Clock

India calculates the closing value of Nifty and Bank Nifty based on the average price in the last 30 minutes of trading.

Jane Street allegedly took advantage of this:

- Just before 3 PM, they’d load up on dirt-cheap options that only made money if the index moved a little up or down.

- Then in the last half hour, they’d aggressively buy or sell big index stocks like HDFC Bank or Reliance, not to invest, but to nudge the index slightly in their favor.

- Even a small shift could turn those near-worthless options into jackpots.

It wasn’t random. Algorithms told them exactly how much to buy, when, and at what price, all in time to influence the official expiry rate.

2. The Expiry-Day Flip Trade

- Morning: Jane Street buys big in index stocks and futures. This pushes the index up and with it, call option prices.

- Midday: They quietly flip their stance, betting against the index by loading up on puts or selling calls.

- Afternoon: They dump the stocks and futures, pulling the index back down.

Yes, they lost some money on the stocks. But the real win came from the options, which exploded in value once the index dropped..

What Action Did SEBI Take and What Happened Next?

SEBI’s order targeted four entities linked to the Jane Street Group: JSI Investments andJSI2 Investments (Indian entities), Jane Street Singapore, and Jane Street Asia Trading (Hong Kong). These entities have been barred from accessing the Indian securities market, directly or indirectly, until further notice.

The regulator also froze Rs. 4,843 Cr, calling it “unlawful gains” stemming from the alleged expiry-day manipulation. Notably, SEBI has extended its probe to other indices and exchanges, indicating that this may be just the beginning of a broader crackdown.

The immediate market reaction was sharp. Shares of several brokerages and exchange-related firms took a hit: Angel One (‑6%), BSE (‑6.4%), Nuvama (-9%) and Central Depository Services (‑3.5%)

Jane Street, for its part, has refuted the allegations, stating it will engage with SEBI and contest the interim order. The firm has 21 days to formally respond and retains the right to challenge the ban legally.

If SEBI’s findings hold up, this could become the largest enforcement action in its history, not just in terms of the money involved, but also in its implications for foreign proprietary trading in India.

Now, the Income Tax Angle

SEBI’s crackdown hasn’t just rattled the markets; it’s also put Jane Street on the radar of the Income Tax Department.

What’s raising eyebrows is how the profits were split between Jane Street’s Indian and offshore arms. Remember, Jane Street’s 4 entities were involved across multiple transactions, two were in India and two were foreign entities. So, most of the lucrative expiry-day options trades, the ones that actually made money, were routed through the Singapore entity and because of the India-Singapore tax treaty, these profits were largely tax-exempt.

Meanwhile, the Indian entities, which are taxed at 30–40%, mostly handled the cash equity and futures trades. These were often loss-making due to the nature of the strategy. As a result, taxable profits in India were minimal or even negative, despite the group as a whole walking away with massive net gains.

In short, profits landed where the tax rate was near zero, and losses stayed where the tax rate was high, a structure that’s technically legal but now under the scanner for being tax avoidant.

Under Indian tax law, this kind of structure could potentially be flagged as an “impermissible avoidance arrangement.” And that means Jane Street might soon be facing questions not just about market manipulation, but also about tax avoidance.

And What About the Exchanges?

As the spotlight intensifies on Jane Street, a new question is starting to make the rounds: how did this go unnoticed for so long and what were the stock exchanges doing?

SEBI’s order reveals that stock exchanges had, in fact, issued caution letters to Jane Street in the past. But what’s unclear is whether any meaningful action followed, especially given the scale and frequency of the trades involved. That gap has sparked a broader debate around the role of exchanges in upholding market integrity, particularly when it comes to sophisticated strategies and high-volume players.

Critics argue that since exchanges earn revenue from trading volume, they may be less incentivized to raise red flags against their most active participants. Whether this is a case of oversight, structural limitation, or conflict of interest, it’s a conversation that regulators and market participants alike can no longer ignore.

Market Perceptions

At the same time, there are questions about how Jane Street’s exit might impact overall market volumes. On many days, the firm alone accounted for 20–25% of options turnover. Understandably, concerns have emerged about the potential dent in F&O liquidity.

Dinesh Thakkar, Chairman and Managing Director of Angel One, offered a more optimistic perspective, and said “When one player exits, others step in and often, very fast.”

On the other hand, Nithin Kamath, Founder & CEO of Zerodha, struck a more cautious note. “Proprietary firms like Jane Street account for nearly 50% of the options trading volumes and any kind of pull back might impact retail activity whose share is around 35%. This could be bad news for both exchanges and brokers. The next few days will be telling. F&O volumes might reveal just how reliant we are on these prop giants“.

Together, these perspectives reflect the uncertainty and nuance surrounding the short-term impact of SEBI’s move and its long-term implications for India’s derivatives ecosystem.

The Story, In Other Words, May Have Just Begun

But beyond the regulators, the tax department, and the trading floors, there’s another group this saga affects, retail investors.

India accounts for nearly 60% of global trades, as per April 2025 data from the Futures Industry Association. While retail participation in index options has eased a bit in recent months, SEBI officials say that 91% of traders still ended up in the red in FY25. Retail F&O traders’ total net losses surged from Rs 75,000 crore in FY24 to an alarming Rs. 1.05 lakh crore in FY25. This is what happens when the playing field isn’t level, expiry-day strategies start working for the big players, while small investors end up taking the hit.

Closing Thoughts

Was this outright manipulation or just a sophisticated firm capitalizing on market inefficiencies? That’s still up for debate. What’s clear is that SEBI considers Jane Street’s actions illegal and has responded with one of its strongest crackdowns yet. This episode has peeled back several layers of how India’s markets operate. How it unfolds remains to be seen.

But one thing is clear: in derivatives, the edge lies with those who have better tech, sharper strategies, and deeper capital. Retail traders, while having access, are rarely on equal footing. And in a market where 91% are losing money, this isn’t a bug — it’s the system.

Access may be equal. The playing field isn’t.

Disclaimer: This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

😂Meme of the Week🤣

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.