Welcome to this week’s edition of TOPICAL WEDNESDAY! This week, we will discuss Ultratech Cement’s (Birla Group Company) bold move to diversify into the wires and cables (W&C) business. UltraTech Cement, a flagship company of the Aditya Birla Group, has made a bold leap into the wires and cables sector, signaling a strategic diversification beyond its cement core. This move has sent ripples across the market, with major players like KEI Industries, Polycab India, and Havells India witnessing sharp stock price declines, some plunging as much as 17% the next day. This kind of market’s reaction has sparked widespread debate and commentary, including:

“This was inevitable as W&C stocks were overvalued.”

“These are commodity-converting companies; why were they commanding such high valuation multiples?”

“This will mirror the disruption seen in the paint industry.”

“These companies may never regain their past valuation multiples.”

The parallels drawn between UltraTech’s W&C entry and Grasim Industries’ foray into paints with Birla Opus have fueled speculation about whether this move will have similar impliactions for the W&C sector.

Ultratech’s Wires & Cables Foray – The Plan

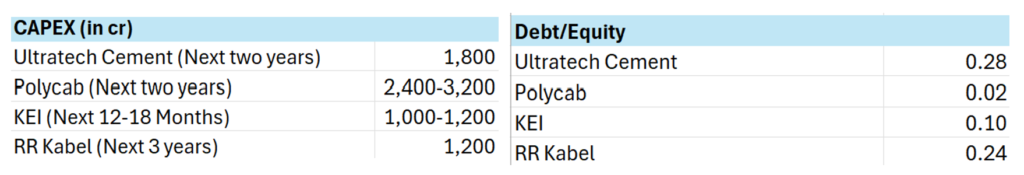

With a planned investment of Rs. 1,800 cr, the company aims to establish manufacturing facilities in Jhagadia, Gujarat, slated for production by December 2026. This strategic move aligns with UltraTech’s vision of becoming a comprehensive building solutions provider, leveraging its robust customer network through UltraTech Building Solutions (UBS).

(Source: Ultratech Cement, Investor Presentation)

As investors respond to this diversification, it’s essential to take a step back and assess the bigger picture. Is the market’s reaction warranted, or are we witnessing an overreaction? The answer is not as clear as one desires. However, here are the FIVE key points to consider before concluding the direction in which this may be headed:

1. What will be the demand and capacity scenario after two years?

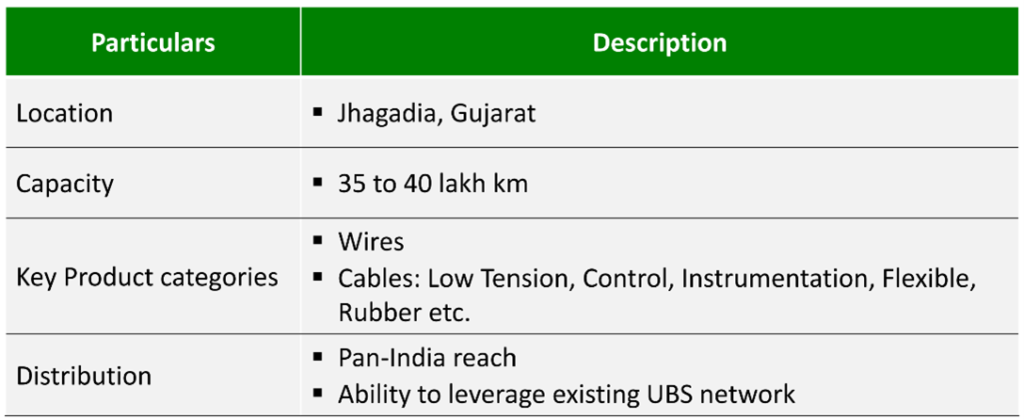

(Source: Companies, Investor Presentations & Con Calls)

UltraTech’s manufacturing capacity is set to go live by December 2026, nearly two years from now. The critical question is: what will the industry’s capacity versus demand landscape look like at that point? With major players already ramping up their expansion plans, the competitive dynamics could shift significantly. Here’s a closer look at the details shaping this scenario.

Additionally, as of H1 FY25, all the existing players boast a balance sheet that is as strong or stronger than Ultratech. In a potential overcapacity scenario, these established players could be better equipped to manage excessive overheads due to their entrenched market positions. Unlike past crises in sectors like real estate, power, or telecom, this overcapacity is less likely to result in a shakeout of players.

2. Initially, Ultratech will be a minor player in the industry

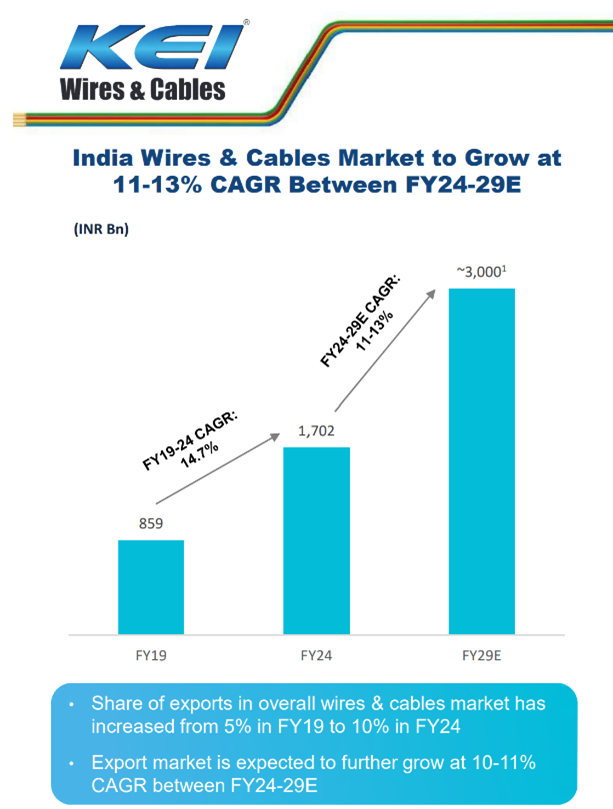

Given the CAPEX plan of Rs. 1,800 cr and an expected asset turn of ~4x, Ultratech, at peak, should be able to clock revenue of Rs. 7,200 cr. Additionally, the industry data provided by KEI Industries in its latest presentation suggests that the wires & cables industry is slated to reach a size of 3 lakh cr by FY29.

(Source: KEI Industries, Investor Presentation)

Even if UltraTech achieves peak capacity and generates Rs. 7,200 cr in revenue by FY29, it would secure only about 2.5% of the wires and cables market, a modest share compared to Birla Opus’s ambitious 6-9% target in the paint industry by FY25. This indirectly indicates towards a contrast in intensity; the Aditya Birla Group’s foray into paints looks far more aggressive than UltraTech’s entry into wires and cables.

3. Limited contribution to Ultratech’s topline

Whenever any company plans to foray into another business, it is fundamental to understand the kind of contribution the new business is expected to make. Let’s break it down for UltraTech: in FY24, the company reported revenues of ~Rs. 71,000 cr. Assuming a modest 5% annual growth, its cement business topline could reach ~Rs. 90,500 cr by FY29. Even if the wires and cables segment achieves Rs. 7,200 cr in revenue, it would contribute just ~7.5% to UltraTech’s consolidated topline.

To put this into perspective, this level of contribution mirrors the Fast Moving Electrical Goods (FMEG) segment’s share in Polycab’s total revenues which is noteworthy but doesn’t look like a game-changing addition.

4. How will Ultratech think about its margins?

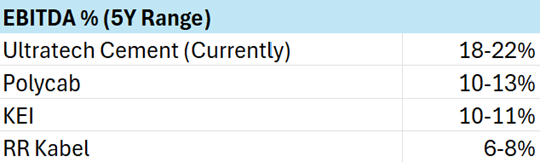

When a company ventures into a new business, one critical consideration is its impact on existing margins. In investment terms, the key question is: will the new business be margin accretive or margin dilutive? Let’s analyze UltraTech’s case with the following data to uncover the potential implications.

UltraTech’s existing business operates at a robust EBITDA margin of 18-22%. In contrast, leading wires and cables players, like Polycab, achieve peak margins of 10-13%, driven by strong contributions from house wires and exports—built over years of effort.

Even in the best-case scenario where UltraTech matches Polycab’s margins, it would dilute the company’s overall profitability. The higher the share of the wires and cables business in UltraTech’s revenue mix, the greater this dilution becomes.

How Ultratech thinks about this aspect is something that remains unclear, but this is a critical factor that demands careful consideration.

5. How ready is Ultratech in terms ofproduct distribution?

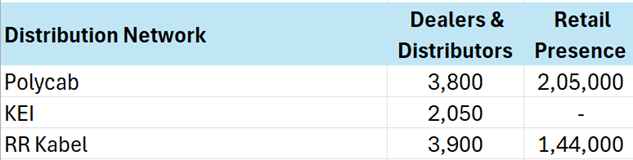

Birla Opus’s righ to win in the paint industry was largely driven by its ability to leverage a strong distribution network built for Birla Putty, which shares a common sales channel with paints. In contrast, UltraTech faces a tougher challenge as wires and cables operate on entirely separate distribution networks from cement.

Building a robust network from scratch will be critical to achieving its goals, a task that is anything but easy in this fragmented and competitive market.

We’ve explored FIVE critical questions surrounding UltraTech’s entry into the wires and cables business, but the truth is, the future remains uncertain. How this venture will unfold once operations begin is something only time can reveal.

What we do know for sure is the value of stepping back, analyzing the situation holistically, and grounding decisions in data rather than speculation. Knee-jerk reactions rarely lead to sound outcomes whereas, thoughtful and well-informed actions do. If you’ve stayed with us till now, we urge you to take a measured approach and think deeply in such situations before forming conclusions or making moves.

Lastly, if there are questions we haven’t addressed, we’d love to hear from you! Feel free to email us your thoughts or queries. Until then, happy investing!

Disclaimer: This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

😂Meme of the Week🤣

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.