This is the 5th part of our Semiconductor Series. Today, we will cover how TSMC dominated the entire semiconductor market and became the PLAYER that manufacture the majority of semiconductor chips globally.

But first, a quick recap of our journey so far:

Semiconductor Series Letter 1: History of the Semiconductor Industry

Semiconductor Series Letter 2: The Semiconductor Value Chain

Semiconductor Series Letter 3: Key Players Across the Value Chain

Semiconductor Series Letter 4: The Rise and Fall of Intel

Now, let’s go through the dynamic story of Morris Chang, the founder of TSMC and how this company on a small island of Taiwan became one of the most important company of the 21st century (this is not an exaggeration).

In 1987, a 56-year-old engineer who most of Silicon Valley had written off, quietly launched a company in Taiwan with no products, no legacy, and no blueprint to follow. That company, TSMC, didn’t design chips, didn’t compete with clients, and didn’t look anything like the semiconductor giants of the day. And yet, by flipping the industry’s business model on its head, it unlocked a wave of innovation that powered the rise of Apple, Nvidia, and every major fabless firm since. Today, TSMC manufactures over 90% of the world’s most advanced chips, making it arguably the most important tech company you’ve never heard of. This is the story of how it got there.

The Beginning: It’s Not Over Until It’s Over

Born in war-torn China in 1931, Morris Chang spent his early years moving from city to city as conflict and political upheaval swept the country. At 18, he left for the United States, beginning at Harvard before transferring to MIT, drawn by a deeper interest in engineering. That curiosity took him to Stanford, and eventually to Texas Instruments (TI), where he would spend the next 25 years building the company’s semiconductor manufacturing muscle.

Yes, he wasn’t just managing operation, he built them:

- Oversaw TI’s early entry into mass production of silicon transistors.

- Played a key role in setting up TI’s first semiconductor fab in Asia.

- Pioneered the concept of cost-effective high-volume chip manufacturing, which would later become the backbone of TSMC’s model.

But despite his achievements over 25 years, he was not selected as a CEO of TI. Chang was passed over, more than once. At age 52, after decades of loyalty, he left TI. A brilliant career, but not the fairytale ending most would expect.

Return to Asia: Founding of TSMC

In 1985, the government of Taiwan had a bold ambition: transform the island from a low-cost electronics assembly hub into a high-tech manufacturing powerhouse. But building a semiconductor industry from scratch required more than just political will, it needed leadership, credibility, and someone who had already walked the path.

So they reached out to Morris Chang, then a semi-retired executive teaching at Stanford, with no personal or professional ties to Taiwan. He was 54. Most would’ve seen it as a quiet end to a decorated corporate career. He saw it as the beginning of something bigger.

Taiwan’s Industrial Technology Research Institute (ITRI) offered him the platform to create something of his own. Two years later, in 1987, Morris proposed a radical idea:

- A semiconductor company that would manufacture chips but never design them.

- A company that would serve any client, large or small.

- One that would never compete with the companies it served.

At the time, it was unheard of. All major chip companies like Intel, TI, Motorola, were vertically integrated. They designed chips, built fabs, and tightly guarded their IP. Outsourcing manufacturing was almost laughable.

But ideas alone don’t build factories. Morris needed funding and access to cutting-edge semiconductor technology. The Taiwanese government agreed to fund 50% of the proposed venture. The rest? He had to find it himself.

So he called on old contacts. One of them was Philips Electronics, yes, the same Philips you know from your home appliances. Philips not only invested but also contributed patents, equipment, and technical know-how, giving the project a crucial technological head start.

So with $220 Mn in initial capital, backed by a public-private partnership, borrowed IP, and a business model no one had dared to try, TSMC was born.

The Execution Years: TSMC in the 1990s and 2000s

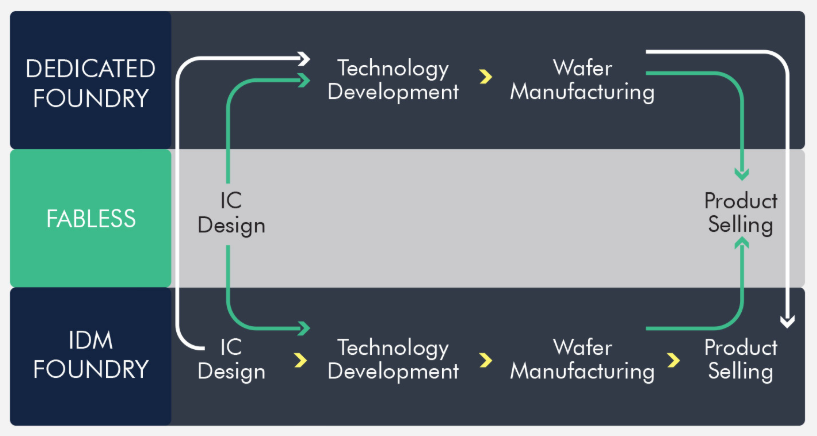

In 1987, TSMC introduced the first “pure-play” foundry, meaning it focused solely on manufacturing chips for other companies, rather than designing and selling its own products.

(Source: TSMC Website)

In the early 1990s, TSMC’s edge wasn’t innovation, it was execution. While companies like Intel and Texas Instruments raced to invent the future, TSMC focused on reliability, yield, and trust. That made it the go-to partner for a new generation of fabless chip companies, starting with Weitek, its first customer, and later LSI Logic.

At the helm was Morris Chang, still CEO, who made it clear: TSMC would succeed not by designing chips, but by becoming the most reliable and neutral manufacturer in the industry.

It didn’t take long for that bet to pay off.

By 1994 itself, TSMC grew like wildfire became the first Taiwanese semiconductor company to list on the NYSE (as an ADR), cementing its global credibility. Over the rest of the decade, it mastered one process node after another: from 1μm to 0.6μm, then 0.35μm, 0.25μm, and 0.18μm, a pace that matched the best in the world.

Rather than trying to lead R&D, TSMC poured resources into manufacturing infrastructure: fully automated fabs, cleanroom upgrades, and statistical process control. These gave it precision on par with global IDMs, and the flexibility to handle a growing mix of customers and chip designs.

In the early 2000s, it made two key technical leaps:

- 0.13μm copper interconnects, which enabled faster, lower-power chips.

- Preparing for FinFET transistor architectures, laying the groundwork for its future 16nm node.

At the same time, its pure-play foundry model gained traction. With no competing products of its own, TSMC became the “Switzerland of semiconductors”, a safe, high-quality partner for everyone. Fabless giants like Qualcomm, Broadcom, MediaTek, and Nvidia, which started working with TSMC in the late 1990s, turned to the company to bring their designs to life.

By the late 2000s, It had grown from a single fab into the world’s largest dedicated semiconductor foundry, outpacing rivals like UMC, SMIC, and Chartered Semiconductor. Its customer base expanded from niche designers to some of the most powerful chipmakers in the world. And while Intel still led in cutting-edge process nodes, TSMC was catching up fast.

Before we move ahead, lets understand some technical terms that would help us understand what was actually happening in the semiconductor chips and how TSMC changed the game through technical breakthroughs:

Side Note: The Technical Know-How

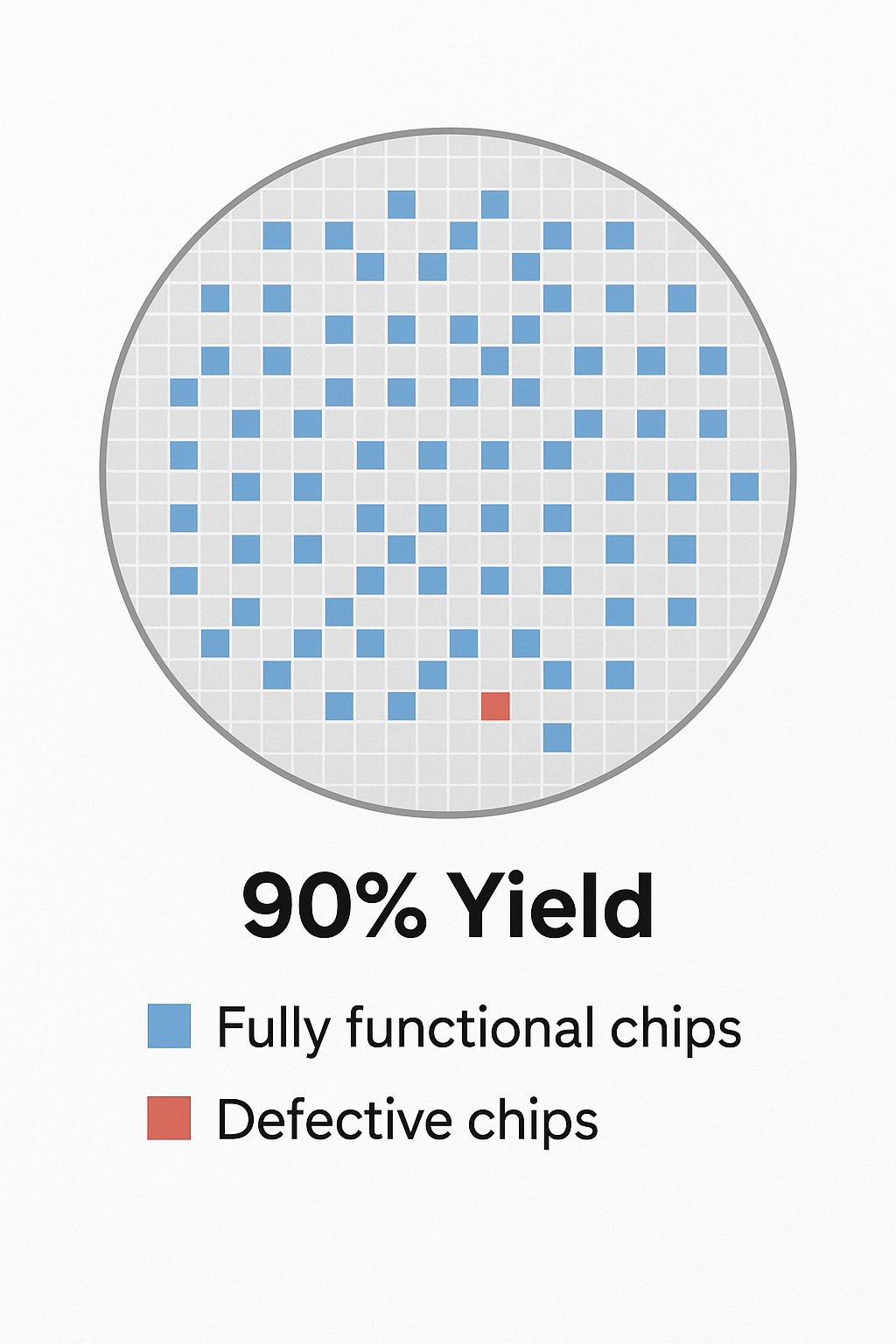

Yield – To understand how chips are made, picture a wafer, a thin, round slice of pure silicon. On each wafer, hundreds (sometimes thousands) of individual chips are printed. But not all of them come out perfectly. That’s where yield comes in. Yield is the percentage of usable, functional chips produced on a single wafer.

Let’s assume if 500 chips are printed and 450 work as intended, that’s a 90% yield. High yield means lower cost, better efficiency, and reliable delivery, especially critical when you’re producing millions of chips on tight launch timelines. TSMC’s reputation was built on its ability to deliver high yields even at cutting-edge nodes, and that consistency is one of the biggest reasons it became the go-to manufacturer for clients like Apple, Nvidia, and Qualcomm (more on this later).

(The circular shape is a silicon wafer, with each square representing a chip. Blue squares are functional dies; red ones are defective.)

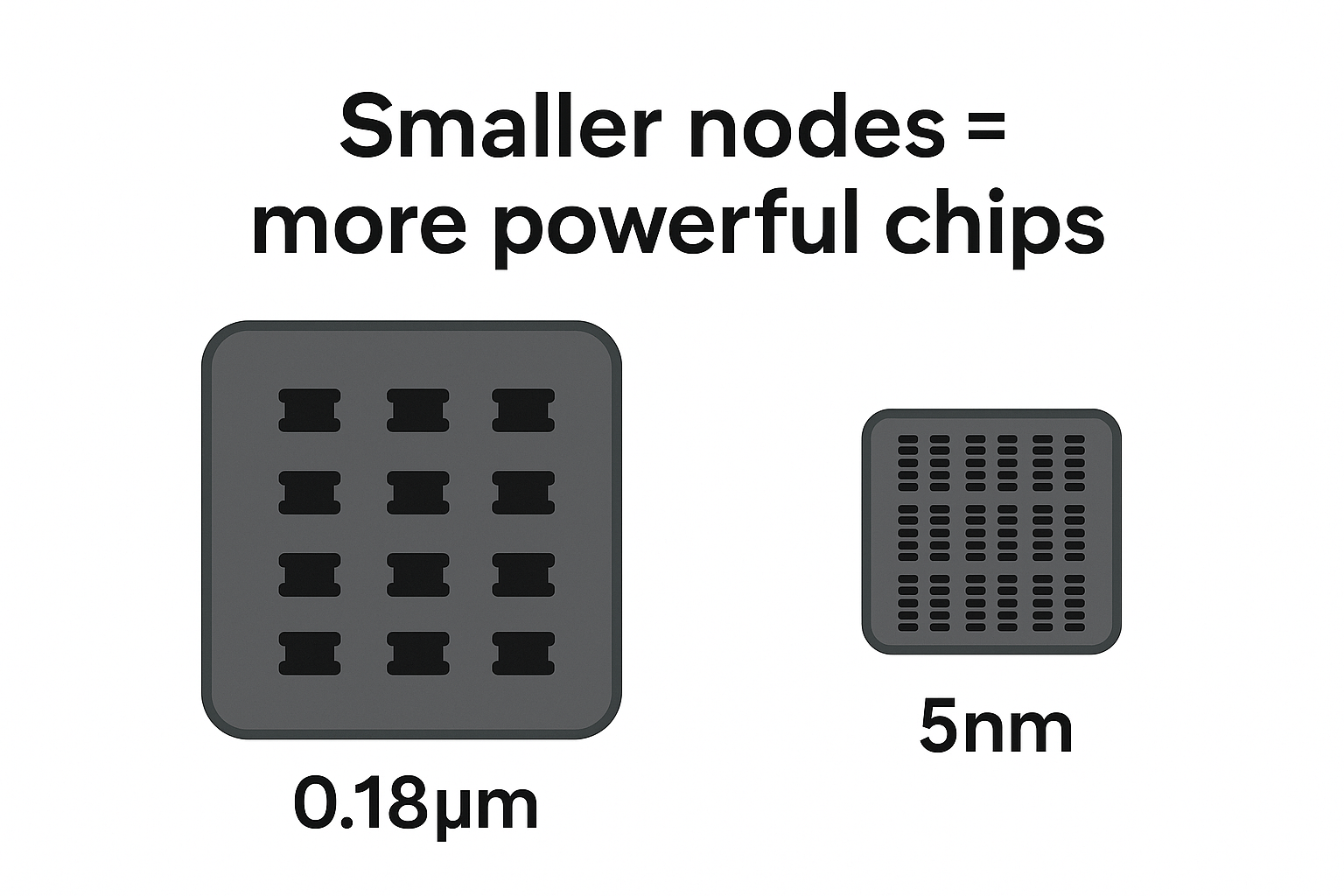

Nodes Size – In the semiconductor world, you’ll often hear terms like “5nm” or “0.18μm”. These refer to the process node, or the scale of the smallest features that can be etched onto a chip. The units are micrometers (μm) and nanometers (nm). For context, 1μm is one-millionth of a meter, and 1nm is one-billionth. The smaller the node, the more transistors you can fit on a chip, which typically means better performance, lower power consumption, and more efficient use of space. So when TSMC advanced from 0.35μm to 0.18μm, and eventually to 5nm and below, it wasn’t just an engineering flex, it enabled everything from longer-lasting phone batteries to faster AI chips.

Now, let’s continue on the rise of TSMC and how the next decade of 2010s, where it didn’t just close the gap, it sprinted ahead.

From Steady Hand to Global Powerhouse

By the early 2000s, TSMC was hitting its stride. It had proven the viability of the pure-play foundry model. Fabless chip companies were growing rapidly, and TSMC was becoming their most trusted manufacturing partner. It had mastered the sub-micron era, rolled out copper interconnects at 0.13μm, and was preparing to enter the deep-submicron world with 90nm and 65nm nodes.

Morris Chang, then in his early 70s, had spent nearly two decades building the company from scratch. Confident in the leadership bench he’d developed, he stepped down as CEO in 2005, staying on as chairman. The company’s growth continued under new management, and Chang fully retired from day-to-day operations in June 2009.

But just as the next phase of the semiconductor boom was picking up, TSMC began to stumble.

The 40nm Setback and Nvidia’s Warning

Around 2009, TSMC was ramping its 40nm node, but ran into yield issues. These issues hit Nvidia particularly hard. The company’s GPUs, produced on TSMC’s 40nm process, faced delays and performance problems, leading to a public fallout. Nvidia even threatened to shift its orders to GlobalFoundries. For a foundry whose business depended entirely on customer trust, this was a red flag. The once-smooth execution engine had misfired at a critical juncture.

In response, the board turned back to the one person who had built the company’s foundation, Morris Chang. And so, on June 12, 2009, the same day TSMC had planned to announce his departure, it instead announced his return as CEO, with Chang resuming day-to-day leadership while continuing as Chairman.

He immediately steered the company back to its strengths: process discipline, customer alignment, and long-term technological bets. He increased capital spending, strengthened R&D, and made bold moves toward the next frontier in chipmaking: FinFET transistors and EUV lithography.

Enter Smartphones and Apple

As TSMC got back on track, the world was undergoing a major technological shift. The smartphone era was taking off since Apple’s first iPhone. These new age devices needed chips that were smaller, faster, and dramatically more power-efficient than traditional PC processors.

This trend played directly into TSMC’s hands. It had no legacy desktop business to protect. It simply became the best at making small, efficient chips for mobile computing.

Then came the inflection point: Apple.

In 2013, Apple dropped Samsung as its chip supplier and handed exclusive manufacturing of its A-series mobile chips (used in iPhone) to TSMC. That relationship grew into one of the most strategically important deals in modern tech.

TSMC gave Apple:

- First access to new nodes like 16nm, 10nm, 7nm, and later 5nm.

- A customized production roadmap tailored to Apple’s high-performance, low-power needs.

- Reportedly, a per-chip pricing model, unlike the per-wafer standard applied to other clients.

Apple, in turn, became TSMC’s largest customer, accounting for ~25% of revenue in later years. This massive, predictable demand helped TSMC scale its most advanced nodes faster than anyone else.

It wasn’t just Apple, other major chipmakers like Qualcomm, MediaTek, and Nvidia also began relying on TSMC to manufacture their chips. They were drawn by TSMC’s cutting-edge technology, reliable output, and promise not to compete with customers. As smartphones became the main computing device for billions of people, these partnerships helped TSMC scale up like never before, placing it at the center of the mobile tech boom. To keep up with growing demand, TSMC rapidly expanded its manufacturing capacity, building new factories and investing heavily in R&D.

And while TSMC was scaling new heights, Intel, the former champion of semiconductor manufacturing, was falling behind, plagued by delays and missed node transitions.

(TSMC’s first chip for Apple was the A8—a 20nm processor and the first 20nm chip to be mass-produced at scale.)

The Node Race and Intel Falls Behind

From 2015 onward, TSMC began to pull away from the competition.

- It launched its 16nm FinFET process in 2015.

- Followed by 10nm in 2017, and 7nm EUV in 2018.

- By 2020, it had begun volume production of 5nm chips, with 3nm close behind.

Meanwhile, Intel, once the undisputed leader in process technology, was falling behind.

- Its 10nm node was delayed by nearly 4 years.

- It struggled with yield and complexity.

- And its vertically integrated structure made it harder to adapt quickly to changing markets.

TSMC, in contrast, had a laser-focused mission: manufacture chips for others, no product lines, no design ambitions, just execution at scale.

By the late 2010s, TSMC had overtaken Intel in process leadership, and even Intel began outsourcing parts of its chip production to TSMC, a symbolic shift in industry power.

Becoming the World’s Foundry

By the early 2020s, TSMC had become the backbone of the global electronics industry. It was producing over 90% of the world’s advanced chips (under 7nm), with a client list that included Apple, Nvidia, AMD, Qualcomm, Broadcom, MediaTek, and even Intel. Its 3nm EUV node had entered production, and 2nm with gate-all-around (GAA) transistors was already in development.

It wasn’t just making chips, was enabling entire industries:

- AI (through Nvidia)

- iPhones and Macs (through Apple)

- Data centers and gaming (through AMD)

- 5G and connectivity (through Qualcomm and MediaTek)

Even Samsung, a direct competitor that traditionally both designed and manufactured its own Exynos chips, made a major shift: for its 2023 flagship Galaxy S23 and all flagship model after that, it abandoned Exynos globally and adopted Qualcomm’s Snapdragon 8 Gen 2, a chip designed by Qualcomm and manufactured by TSMC on its 4nm node. This move helped Qualcomm capture nearly 40% of the global smartphone SoC market, most of it riding on TSMC’s manufacturing leadership.

(Source: GizChina, a 3nm chip by TSMC)

TSMC Today and the Road Ahead

As of 2024, TSMC isn’t just the world’s most important chip manufacturer, it’s the foundation layer of the modern digital economy. The company controls an estimated 60–65% of the global foundry market, and an even more astonishing 90%+ of all advanced chip manufacturing (below 7nm). From your iPhone and MacBook to the chips training the latest AI models and powering data centers, TSMC is the invisible engine behind it all.

Technologically, TSMC is miles ahead of its competitors. It is the only company in high-volume production at the 3nm EUV node, and already deep into 2nm development using Gate-All-Around (GAA) transistor architecture, which promises even greater performance and power efficiency. No other foundry, not even Samsung or Intel has reached this level of scale or consistency at these advanced nodes. Intel, for example, is still working toward catching up with its Intel 3 and 20A process nodes, while Samsung struggles with yield and client retention.

TSMC’s client list reads like a who’s who of the global tech economy:

- Apple (its largest customer, exclusive for 3nm)

- Nvidia (AI and GPU chips)

- AMD (CPUs and GPUs)

- Qualcomm (Snapdragon mobile SoCs)

- MediaTek, Broadcom, and even Intel (for outsourced manufacturing of select designs)

(And this is just the tip of the ice berg) This dominance has raised a natural question: If TSMC is already this powerful, where does it go from here? And perhaps more importantly: Can anyone else catch up?

The answer lies in how TSMC is future-proofing itself, not just through better chips, but through better foresight.

It is:

- Scaling globally, with advanced fabs under construction in Arizona, Japan, and Germany, to reduce geopolitical risk and serve key markets locally.

- Investing in next-generation packaging technologies like CoWoS, SoIC, and InFO, which allow chips to be stacked and integrated for even higher performance without always needing smaller nodes.

- Doubling down on AI, becoming the sole foundry partner for Nvidia’s H100 and upcoming B100 chips, vital for generative AI workloads.

- Preparing for 2nm and beyond, with early-stage R&D on new materials and transistor structures like nanosheets and possibly 2D materials down the road.

The reality is: as long as the world runs on silicon and we still do, no other company is structurally positioned to catch TSMC. The capital intensity, execution discipline, ecosystem partnerships, and decades of node leadership are not something a competitor can simply “build” overnight. The moat is wide, and it’s deep.

TSMC doesn’t sell devices. It doesn’t chase headlines. But it may be the most quietly indispensable company of the 21st century, powering everything, from smartphones to supercomputers, and now, the future of AI.

If you enjoyed reading about TSMC’s rise to dominance, feel free to share it with others who might find it insightful. We’d also love to hear your thoughts and feedback on X. Connect with us there at @bastionresearch.

Happy Investing!!!

Remembering Rakesh Jhunjhunwala—The Investor Who Inspired a Generation