8 Learnings from the latest memo by Howard Marks

Exploring key insights from Howard Marks’ latest memo.

Marks, a renowned investor, is known for his highly insightful memos that attract significant attention. Warren Buffett himself once remarked, “When I receive memos from Howard Marks, they’re the first thing I read.”

If you’re unfamiliar, Howard Marks is a co-founder Oak Tree Capital Management, a prominent Alternate Investment Manager, managing assets exceeding $192 billion. This should underscore his significant influence in the investment realm.

On 17th April 2024, Howard Marks published his latest memo titled “The Indispensability of Risk” here are our Top 8 learnings from the same.

The memo starts with an analogy, where he explains how a game of chess involves deliberately giving away (sacrificing) a piece as a part of one’s game plan. This is true for investing as well.

1. Investments involve real sacrifices

Similar to a chess player, an investor assumes the risk of potential losses in exchange for gains that often do not materialize immediately. Simply put, in the quest for investment success, not taking risks poses a significant risk itself.

2. Investors always have three investment choices

a. Avoiding Risk – This results in low return (Think of a Bank FD)

b. Taking Moderate Risk – This mostly results in a commensurately moderate return (Think of investing in an Index Fund)

c. Taking High Uncertainty – This could result in a substantial permanent loss of capital and is the path to finding multi-baggers.

Since option “C” is something most of us are interested in, let’s understand it in a bit more detail.

To understand this, imagine the Execution Risk that investors took with Angel One Ltd. when the company transitioned from a traditional broking model to a modern discount broking model. This resulted in significant wealth creation. On the contrary, you must have also heard stories about how Sulzon Ltd. failed to create the kind of wealth investors envisaged initially, resulting in significant wealth destruction. Exposing investors to the risk of Operating at High Debt.

3. Imperatives to earn a high absolute/relative return

If you are hunting for a high absolute return, You must accept the possibility of a loss in the pursuit of a high profit. Similarly, If you are looking to outperform a benchmark, you must accept the possibility of underperformance in the pursuit of a higher performance. In short, Risk and Reward are inseparable.

Warrants are instruments that confer the right, but not the obligation, to buy a company’s stock at a specified price. But wait. It has some regulations and compliance around it that are important to understand.

4. Successful investing requires living with some losses

it is very important to appreciate the fact that having winners and losers in one’s portfolio is part of the game. We should not aim to have a “Loser free Portfolio”. Because the only sure way to achieve a “Loser free Portfolio” is to take no risk at all, which will eventually deprive us of great investment outcomes.

5. Taking risks is necessary, but it doesn’t guarantee success.

Yes, risk-taking is necessary, but it is foolish to believe that taking risks alone is enough to be successful in investing. It is important to understand that approaching investing this way will be nothing but, speculation.

6. Successful investing involves following a method that can be replicated over the long haul. It involves the following:

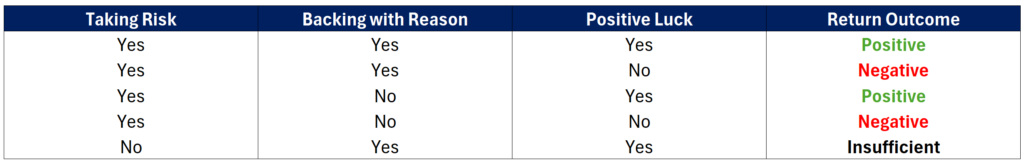

a. Taking Risk

b. Making Reason-Backed Investments

c. Luck Playing Out Positively

The investing method becomes irreplicable if one of the above three elements doesn’t work in tandem. Here is a useful grid.

7. Ingredients of a Great Investment Performance

a. Many Decently Made Investments

b. Small Number of Big Winners (Backed by Allocation and a Long Holding Horizon.)

c. Relatively Few Big Losers

8. It is IMPORTANT to take a shot

To be successful in investing, one must accept that success will stem from making many investments, all of which one expects to succeed but only a portion of which one doesn’t know.

Conclusion

a. Don’t expect to make money without taking risks.

b. Taking risks alone doesn’t guarantee superior investment performance.

c. Successful investing outcome requires sacrificing CERTAINTY.

d. But that has to be done wisely and intelligently with emotions under control.

Lastly, a useful paragraph reproduced from the memo itself.

“Taking a chance doesn’t mean there will be a successful outcome, nor does it require it. If the reasons are sound, the risk should be taken almost reflexively. The more often we trust our judgment, the more confidence we gain in our decision-making capacity. The courage to take risks becomes a worthwhile end in itself.”

Fin Meme of the Week

Me Protecting my Portfolio from Losses