Welcome to this edition of learning of the week, where we talk about an idea that’s quietly shaping conversations. Imagine if companies could buy time; not for themselves, but for the planet. Let’s understand the scenario:

A cement plant in Gujarat emits carbon every time its kiln fires up. Halfway across the world, a mangrove restoration project in Indonesia captures carbon every time a new sapling grows. Now imagine both being part of the same transaction; one paying for the right to emit, the other getting paid for the right to absorb. That’s not a fiction, that’s the business of carbon credits. The world’s attempt to put a price on pollution.

It’s a fascinating experiment in global economics: where forests become assets, emissions turn into liabilities and sustainability is no longer just a moral stance but a tradable commodity. As nations race to decarbonize, carbon credits have become the new currency of climate. Today we cover:

- what are carbon credits?

- Who are involved within the ecosystem?

- What is the cost of credits?

- Case study: The Vantara Story

Let’s dive in…

What are Carbon Credits?

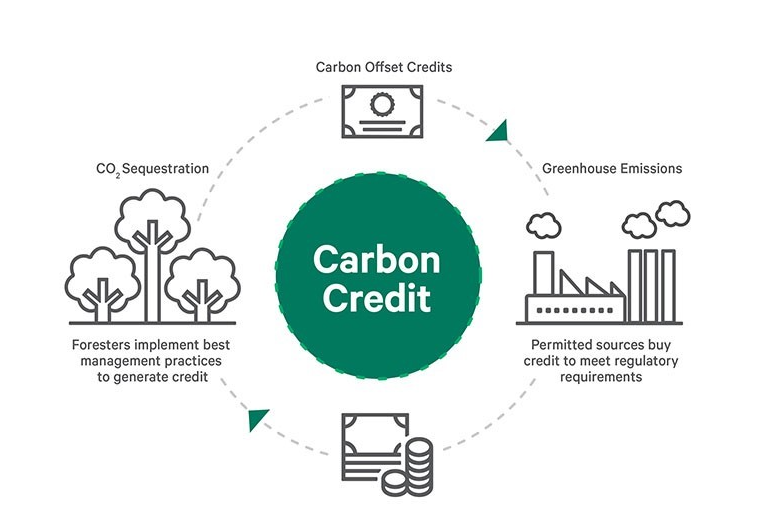

At its core, a carbon credit is a certificate that represents one ton of carbon dioxide reduced, removed or avoided from entering the atmosphere. Think of it like a receipt for doing something good for the planet. Let’s understand through an example:

A renewable energy project in Rajasthan replaces coal power and cuts emissions. Those saved tons of carbon are measured & verified by an independent agency and then converted into tradeable credits. A corporation in Europe or the US can then buy these credits to offset its own emissions and claim progress toward its “net-zero” goal.

So, in a sense, it’s a balancing act. Polluters on one side, mitigators on the other side connected through a carbon marketplace. The entire process from project creation to trading follows a defined chain. Each step adds credibility and traceability to ensure that every credit sold truly represents a real climate impact.

(Source : LinkedIn, Tanveer Arif)

There are two main types of carbon credit systems:

- Compliance Markets – These are government-regulated systems that cap how much carbon companies can emit. Firms that emit less than their allowance can sell the leftover credits to others. For instance, EU Emissions Trading System (EU-ETS) & the Carbon Credit Trading Scheme (CCTS) by Bureau of Energy Efficiency (BEE) & Ministry of Power, India.

- Voluntary Markets – These operate outside regulation. Companies buy credits voluntarily to signal environmental responsibility or meet internal sustainability goals. Example, verified credits under Non-profit Organizations such as Verra, Gold Standard or Climate Action Reserve.

Even within these markets, credits come in two variants:

- Avoidance credits – This are earned by preventing emissions (like replacing diesel with solar).

- Removal credits – Those credits which are earned by capturing or absorbing carbon (like reforestation or carbon-capture projects).

Important question – But how do we ensure these credits aren’t manipulated?

Every credible program has an audit trail. Independent third-party verifiers conduct field assessments, satellite-based monitoring, and data audits before credits are issued. Registries like Verra and Gold Standard require periodic re-verification to prevent overstatement or double-counting of carbon savings.

In India’s upcoming CCTS (Carbon Credit Trading Scheme), the Bureau of Energy Efficiency and accredited third-party agencies will play that verification role. They will be ensuring that every ton of carbon reduction claimed is backed by measurable and auditable evidence.

Carbon credits credibility – Lesson from past

Carbon credits have seen their share of controversy. In the early 2000s, when global carbon trading first took off under the Clean Development Mechanism (CDM), the idea was simple developing countries could earn credits by running cleaner projects, which developed nations would buy to offset their own emissions. But as billions of dollars started flowing in, the cracks began to show.

- Inflated baselines: Many projects exaggerated how much carbon they would have emitted without the intervention. For example, a cement plant might claim it would have used an older, dirtier kiln even though it had already planned to upgrade, just to show higher “savings” and earn extra credits.

- Double counting: In some cases, the same reduction was claimed twice; once by the project developer in India and again by the overseas buyer. With weak digital tracking, there was no unified registry to catch overlaps.

- Ghost projects: A few renewable or biomass projects claimed emission reductions that never actually happened, either because they never ran at full capacity or had shut down long before credits were issued. Yet the credits kept trading.

India, being one of the biggest suppliers of carbon credits under the UN’s Clean Development Mechanism (CDM), also saw its share of problems. Several hydropower and wind projects registered between 2006 and 2012 claimed they were built only because of carbon credit income but in reality, many of them would have been built anyway. This meant the emission savings they reported weren’t truly “extra” which defeated the whole purpose of the system.

When these issues came to light, international bodies started reviewing projects more strictly. By 2013, hundreds of Indian projects had their credits questioned or rejected and global trust in the market began to fade. Carbon markets lost credibility, buyers became cautious. Prices for CDM credits (primarily traded under EU-ETS), once trading above €20/ton crashed below €1/ton by 2014.

Carbon Credits Ecosystem

The world has learned to monetize responsibility. Every ton of carbon saved, captured or prevented can be turned into a tradeable credit which has a value in markets where companies are desperate to offset what they can’t yet reduce.

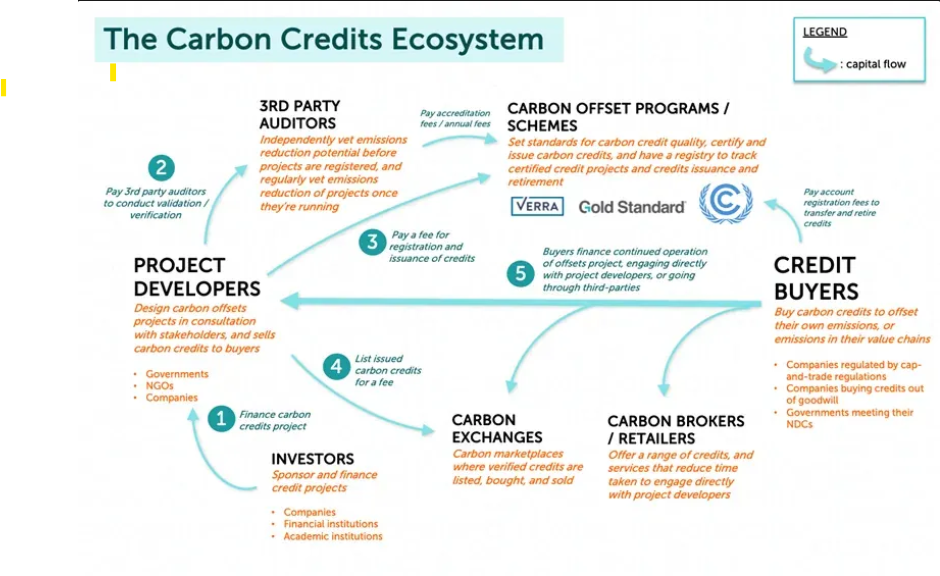

Behind every credit lies an entire ecosystem of players:

Buyers – From big global corporations such as Microsoft to Indian players like JSW Steel, Reliance Industries and many more companies buy these credits to balance their emission books and maintain their ESG scores. Airlines, cement companies and oil refiners are among the biggest buyers.

Project Developers – They’re the creators. Think of Adani Green Energy Ltd expanding solar capacity. Each unit of clean energy displaces fossil fuel usage and earns credits. Similarly, forestry, waste management and biofuel projects do the same.

Verifiers & Certifiers – These are the auditors who ensure that credits are real, measurable and additional. They check if the project genuinely reduced emissions. Names like Verra and Gold Standard dominate here.

Registries & Exchanges – Once verified, the credits are recorded on a digital ledger (registry) and made available for trade. Global platforms like Air Carbon Exchange, CIX Singapore and India’s carbon credit trading platforms such as Indian Carbon Exchange (owned by IEX) & Power Exchange India Ltd (owned by PXIL) handle these transactions.

(Source: WFM Media)

Unit Economics of Carbon Credits

Not all carbon credits are the same. Prices swing widely depending on what kind of project created them, how credible they are, and how long the captured carbon will stay out of the atmosphere. Each carbon credit broadly falls into the following three buckets:

Low-Cost Avoidance Credits (~$2-10/tCO₂e):

These come from large renewable or efficiency projects that replace fossil-fuel power. They’re cheap to generate because the technology is mature and the volume of credits is massive. Such projects focuses on carbon avoidance rather than carbon removal. India’s voluntary market is full of such projects. The average price stood at just $2.35/ton in 2024.

Mid-Market Nature & Improved Integrity Credits (~$7-25+/tCO₂e):

These include higher-quality forestry, land-use, and agri-methane projects, backed by stronger monitoring and verification systems. With the Integrity Council for the Voluntary Carbon Market (ICVCM) introducing stricter “Core Carbon Principles,” buyers are paying up for cleaner & verified supply.

Premium Removal Credits (~$150-400+/tCO₂e):

These are the rarest and most expensive credits. It is built through technologies like Direct Air Capture (DAC), bio-oil sequestration or mineralization that permanently remove carbon from the air. As per Ecosystem Marketplace, global removal deals are routinely priced in the hundreds of dollars per ton due to high capital intensity and long-term durability.

To understand the economics from the generation side perspective – let’s connect with a familiar benchmark.

A 1 GW solar power plant operating in India produces around 1,600-1,700 GWh of clean energy annually, displacing roughly 1.5-1.8 Mn tons of CO₂ that would otherwise come from coal. At India’s voluntary market price of ~$2.35/ton, that’s ~$3.5-4.2 Mn (Rs. 29-35 Cr) worth of potential carbon credit revenue each year.

Scaling this up: India is expected to add 50 GW of solar capacity every year through 2030 under its renewable roadmap. If even half of that capacity were to participate in verified credit generation, the annual offset potential could exceed 40-45 Mn tons of CO₂, translating to over ~$100 Mn in credit value even at current low voluntary prices.

Of course, this isn’t pure profit. Developers still bear verification, monitoring and registry costs that can consume 20-30% of gross value. Yet it highlights an important split in the carbon market:

- Large-scale renewables earn low-margin, high-volume credits.

- Small, high-integrity removal projects (like biochar or DAC) earn fewer credits but command higher prices.

How These Costs Are Built?

The cost to create a carbon credit isn’t just planting a tree or setting up solar panels. It’s a chain of activities. Typical components include:

- Project development & operations: Building or maintaining the project (wind, solar, or forestry).

- MRV (Monitoring, Reporting, Verification): Sensors, audits, and third-party validation.

- Registry & certification fees: Platforms like Verra, Gold Standard, or India’s Carbon Registry charge project registration, verification and per-credit issuance fees. Think of this as the project’s climate creditworthiness check ensuring it meets global standards.

- Risk & insurance buffers: For reversal or underperformance protection.

The Vantara Story

In 2024, Reliance Industries quietly unveiled something unusual. Not another refinery, not another Gigafactory but a 3,000-acre rewilding and animal rescue initiative in Jamnagar, Gujarat, called Vantara.

(Source: Vantara)

At first glance, it looked like a pure philanthropy project. A blend of wildlife rehabilitation, veterinary research, and forest restoration. But scratch a little deeper, and Vantara starts to resemble something else entirely: a blueprint for India’s future in nature-based carbon projects.

If structured under approved methodologies say, Afforestation, Reforestation and Revegetation (ARR) or Improved Forest Management (IFM) a project like Vantara could generate high-integrity carbon credits tied to measurable ecological restoration. Such credits trade at a premium because they go beyond just offsetting carbon. They create co-benefits: restoring biodiversity, improving soil health, recharging groundwater, and uplifting local communities. In carbon markets, that combination of durability and co-benefit is gold. In a market shifting from “volume-first” to “quality-first”, projects like Vantara could shape the very definition of what high-quality Indian carbon credits.

What makes Vantara special is not its scale, but its intent. It signals a shift from Corporate Social Responsibility (CSR) to Carbon Return on Investment (ROI) where environmental spending is not a cost center, but a value-creating asset.

Reliance Industries, like many Indian conglomerates, is positioning itself at the intersection of ESG credibility, sustainability branding, and long-term carbon economics. With the Indian Carbon Credit Trading Scheme (CCTS) on the horizon, these early moves can help corporates generate or even trade credits turning conservation into a balance-sheet advantage.

Conclusion

Carbon credits have evolved into a complex economic instrument that sits at the intersection of policy, profit, and planetary responsibility. For some, it’s a compliance tool, for others, a market opportunity.

India now stands at a critical inflection point. With its vast renewable capacity and emerging nature based projects like Vantara, the country could redefine what credible carbon markets from the global south looks like.

The next phase of this story won’t just be about trading tons of carbon. It will be about trust; how credits are created, verified, and retired. Because as the market matures, credibility will decide who profits and who fades.

If you enjoyed reading this newsletter, please feel free to share it with others who might find it insightful. We’d also love to hear your thoughts and feedback on X. Connect with us there at @bastionresearch.

Happy Investing!!!

😂Meme of the Week🤣