Navigating a New Era of Fixed Income

Welcome to this week’s edition of TOPICAL WEDNESDAY! Today, we will try to make sense of what is happening in the global bond market.

Forget the flashing lights of the stock market for a moment. The usually predictable, some might even say staid, world of bonds is currently undergoing a seismic shift. For decades, the global economy sailed on relatively calm waters of declining interest rates and central bank support. However, the global bond markets, often called the backbone of the financial system, are now going through significant upheaval. Inflation’s resurgence, aggressive central bank responses, and evolving geopolitical landscapes are redrawing the map for fixed income. From the United States grappling with historic debt and political gridlock, to Japan’s decades-long low-yield environment finally showing signs of change, the global bond market is undergoing significant changes and the ripple effects are already reaching emerging markets like India.

This isn’t just a technical adjustment; it might be fundamental reset redefining risk, reward, and the very role bonds play. Whether you invest in the government bonds or not, it is essential to know what is happening right now and its implication.

With that said, let’s dive in.

Understanding Bond Market Jargon — Simplified

Before we go deeper, here are key bond market terms you’ll see frequently:

Bond: It is an IOU (I owe you) issued by governments or companies to borrow money. Investors buy bonds and receive interest (known as coupon) until maturity, when the principal is repaid.

Bond Price and Yield: Bond prices and yields move in opposite directions. If, bond prices fall, yields rise meaning new investors demand more return for lending money.

Government Debt: The total money a government owes, often measured as a percentage of GDP to show how big it is relative to the economy. A government borrows money when spending exceeds tax and other revenue collections, financing infrastructure, social programs, defence, and other budget deficits. These borrowings are made by issuing as bonds traded in the market.

Credit Rating: A score given by agencies (like Moody’s) indicating how risky it is to lend to a government or company.

Auction: Governments regularly sell new bonds to raise money. Auction demand reflects investor confidence.

Inverse Relationship: Interest Rates vs Bond Prices & Yields

To understand what’s happening now, it’s crucial to grasp the relationship between bond price and bond yield.

- Bond price = What investors pay to buy a bond.

- Bond yield = The return investors earn on a bond, expressed as a percentage.

Prices and yields move in opposite directions:

- If bond prices fall → yields rise.

- If bond prices rise → yields fall.

(Source: Bastion Research)

Imagine a bond paying Rs. 5 interest per year with an original price of Rs. 100 (a 5% yield). If negative news causes investors to sell, the bond price might drop to Rs. 90. Now, buying at Rs. 90, but it still yields Rs. 5 annually, therefore, the effective return is about 5.5%. Thus, yield rises as price falls.

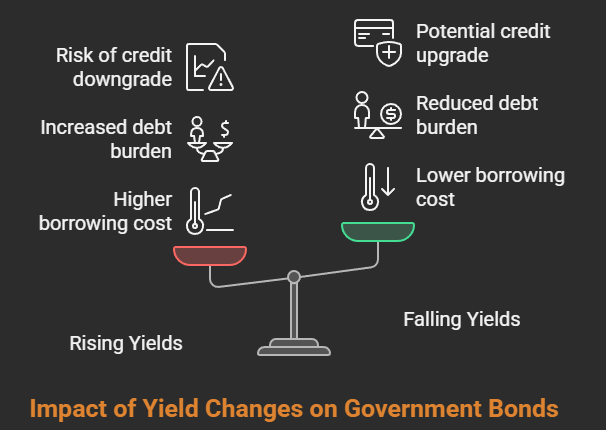

Government Bonds and Effect on Yield

The same principle applies to government or corporate bonds. When yields rise (prices fall), governments face higher borrowing costs on new debt:

- New bonds must offer higher yields to attract buyers.

- This raises debt servicing costs, potentially straining budgets.

- Credit rating agencies may worry about fiscal sustainability, risking downgrades.

- Downgrades often push yields even higher, creating a negative cycle.

In short, falling yields are good for bonds (lower borrowing costs), while rising yields increase borrowing costs and debt burdens.

(Source: Bastion Research)

Inflation’s Shadow

It is one of the fundamental aspect of bonds. Inflation means rising prices, which reduce the buying power of fixed bond payments. When inflation rises, investors demand higher yields to compensate for this loss.

Example: If a bond pays 5% interest but inflation rises from 2% to 5%, the real return falls from 3% to zero. To stay attractive, the bond’s price falls, pushing the effective yield above 5%. New buyers pay less but earn higher yields reflecting inflation risk.

In short, rising inflation causes bond prices to fall and yields to rise, increasing borrowing costs for governments.

With this basic in mind, let’s understand what is happening around the world today.

The US Bond Market: A Rollercoaster Ride After Decades of Calm

The U.S. bond market is the world’s largest, valued over $51 Tn, about 40% of the global market. U.S. government debt alone exceeds $36 Tn.

For much of the past 2 decades, this market was characterized by falling, then persistently low, interest rates. The Federal Reserve (the “Fed”) kept its benchmark Federal Funds Rate near zero for extended periods, especially post-2008 financial crisis and during the COVID-19 pandemic.

However, the landscape shifted dramatically post-COVID. Massive government stimulus to counter pandemic-induced economic slowdowns contributed to a surge in inflation. Initially dismissed as “transitory,” inflation peaked at over 9% in mid-2022, a multi-decade high. In response, the Fed embarked on one of its most aggressive rate-hiking cycles, pushing the Federal Funds Rate to a range of 5.25%-5.50% by mid-2023, its highest level in over 20 years. While inflation has since shown signs of cooling, leading to expectations of eventual rate cuts, the immense government debt remains a central concern.

(Source: Al Jazeera)

Soaring Government Debt – The U.S. government’s debt has climbed to over $36 Tn, exceeding 120% of its GDP.

Credit Rating Scrutiny: In August 2023, Fitch Ratings downgraded the U.S. long-term credit rating from AAA to AA+, citing expected fiscal deterioration and a high government debt burden. More recently, in May 2025, Moody’s downgraded the U.S. credit rating from AAA to AA1, reflecting ongoing concerns about rising debt levels and fiscal challenges.

Yield Fluctuations: The 30-year Treasury yield, for instance, touched 5% in late 2023, its highest level in over a decade, pushing existing bond prices down. Concerns over fiscal deficits and future borrowing needs contribute to this volatility.

Investor Appetite: There are signs of weakening investor appetite for long-term U.S. debt. For example, a U.S. Treasury auction in May 2025 for 20-year bonds saw a coupon rate of ~5% (yields fluctuate around coupon rates based on auction demand). Reports noted that primary dealers (banks obliged to buy unsold bonds) took up a larger-than-average share, indicating softer demand from other investors.

What this means for Americans?: Rising borrowing costs for the U.S. government can translate into higher loan and mortgage rates for citizens, potentially slowing economic growth. Increased spending on debt interest repayments can also strain the federal budget, possibly leading to reduced public spending or considerations for tax increases.

The ripples from the US bond market are felt globally, and one nation navigating a particularly unique transition is Japan which is going through its own challenges.

Japan: The Quiet Bond Market Shift

Japan maintained ultra-low bond yields for years, with the BoJ keeping rates near zero and buying bonds aggressively to fight deflation. The policy led Japanese investors to invest heavily abroad, especially in U.S. Treasuries, making Japan the largest foreign holder of U.S. debt (~$1.13 Tn).

However, the landscape is now shifting. Inflation in Japan finally started to pick up, consistently exceeding the BoJ’s 2% target for several months. This, coupled with pressure from rising global yields and a weakening yen, prompted the BoJ to pivot.

- In March 2024, the BoJ ended its negative interest rate policy, raising its benchmark rate to a range of 0% to 0.1% – its first rate hike in 17 years.

- It also formally scrapped its Yield Curve Control (YCC) framework for 10-year JGBs, which allowed to keep the interest rate near zero. Though BOJ pledged to continue bond purchases if needed.

- The 10-year Japan Govt. Bond (JGB) yield, long capped, has been allowed to drift higher, recently trading around 0.9-1.0%.

(Source: Trading Economics)

- Longer-term yields have seen more significant increases; for instance, the 30-year JGB yield touched levels above 2% in May 2024, a multi-year high.

Implication for Japan:

For Japanese Citizens – Higher yields could mean better returns on savings but also potentially higher borrowing costs.

Repatriation Risk – If JGB yields become sufficiently attractive, Japanese institutional investors might repatriate some of their vast overseas investments, mainly US bonds.

Government Finances – With Japan’s government debt already exceeding 250% of GDP, higher borrowing costs will further strain public finances, necessitating prudent fiscal management.

(For more on recent Japanese inflation and yen dynamics, you might refer to our previous newsletter.)

These shifts in the world’s largest bond markets inevitably influence emerging economies like India.

What does this mean for India?

India’s bond market has been relatively stable compared to the U.S. and Japan, thanks to its strong economic growth and fiscal management. India’s 10-year government bond yield has stayed near 6.25%, with expectations of rate cuts by the Reserve Bank of India (RBI).

However, rising global yields and political uncertainties abroad have led to recent foreign investor outflows from Indian stocks and bonds. For example, in May 2025, foreign investors sold shares worth Rs. 10,000 crore, reversing earlier buying trends.

Therefore, experts caution that India isn’t immune to shocks in global bond markets, especially if yields continue to rise sharply worldwide.

A major positive is India’s inclusion in prestigious global bond indices, such as JPMorgan’s GBI-EM index starting in June 2024. This is expected to attract significant passive inflows (estimated at $20-25 Bn over the subsequent year), which can support demand for Indian government bonds and help stabilize or even lower yields.

Conclusion:

The era of ultra-low interest rates is over. Global bond markets are recalibrating to higher inflation, fiscal stress, and shifting monetary policies. The U.S. bond market signals caution with rising yields and political challenges. Japan’s policy shift adds uncertainty. India, while resilient, faces external pressures and cannot fully insulate itself. Therefore, investors should expect volatility, rising borrowing costs, and changing capital flows, requiring vigilance and prudent portfolio management.

Happy Investing !!!

If you liked this newsletter, feel free to share it. Also, feel free to share your thoughts on X, where you can find us as @bastionresearch.

Disclaimer: This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

😂Meme of the Week🤣

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.