The Global Accent of Indian Single Malts

In this newsletter, we will talk about the whiskey market in India and what are the current trends that are shaping up the industry for future growth..

If there’s one thing we can all agree on, it’s that Indians have a deep love for whiskey. Whether it’s unwinding after work, celebrating at a wedding, attending a weekend function, or socializing at a gathering, whiskey is a staple that brings people together in India. This passion is so profound that India has become the largest whiskey market in the world by volume (no. of cases where each case is typically 12 bottles) and ranks second only to the USA in terms of value. Remarkably, for a whiskey like Scotch, which is traditionally made in Scotland, India has surpassed France to become the largest market by volume and the fifth largest by value, making it a crucial market for Scottish distilleries.

What’s unique is that India is likely the only tropical country where whiskey consumption rivals or exceeds that of beer. In other countries with similar climates, beer is typically the preferred choice. Let’s delve into this exceptional market and explore why Indian whiskey stands out.

Indian Whiskey Market Overview:

In 2023, the Indian whiskey market was valued at $21.13 billion, with sales reaching 260.07 million cases.

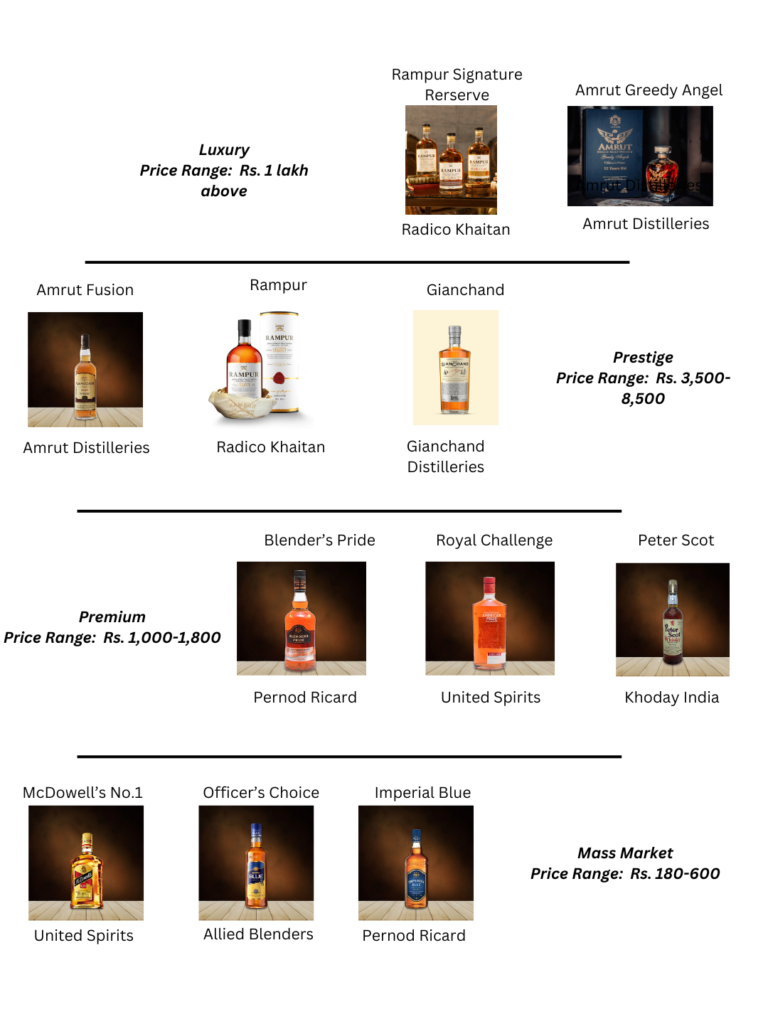

The market is categorized into economy, premium, prestige, and luxury segments, with economy whiskies making up nearly 70% of the total volume.

(Examples of whiskeys at different price points)

South India leads in whiskey consumption due to cultural preferences and strong local production, particularly in states like Kerala, Karnataka, Telangana, and Tamil Nadu.

Major players like United Spirits and Pernod Ricard offer whiskeys across all price ranges, while brands like Amrut and Gianchand have carved out a niche for themselves. Looking ahead, the market is projected to grow at a compound annual growth rate (CAGR) of 7.6% from 2024 to 2032, with the volume expected to reach 502.80 million cases during this period.

The Indian whiskey industry is undergoing significant changes, driven by emerging trends and shifting consumer preferences:

Growing Premiumization

Upgrading Preferences: More Indians are opting for premium alcohol. Customers in the upper end of the popular segment are upgrading to prestige brands, while those already consuming prestige whiskey are moving towards premium and luxury brands.

Market Share: Premium, high-end premium, and super premium segments now hold the largest share in the Indian whiskey market, indicating a clear shift towards higher-quality products.

Declining Mass Market

As more consumers gravitate towards premium options, the mass market segment is experiencing a decline.

Local Production

Rising Demand for Indian Whiskeys: There’s a growing preference for Indian whiskeys with local roots. Brands like Amrut, Paul John, Rampur, and GianChand have gained international acclaim, particularly in the single malt category.

Market Share: Indian malt whiskies now make up almost half of all premium single malt whiskies consumed in India.

These trends are prompting Indian whiskey makers to adapt and innovate, ensuring they position themselves in line with the evolving demands of the market.

Companies are pivoting and innovating:

1. United Spirits Ltd:

Strategic Shift: USL sold 32 mass-market brands to Inbrew Beverages for Rs. 820 crore at a loss of Rs. 760 crore. They also franchised 11 brands for Rs. 133.1 crore over five years.

Focus on Premium: This move allows USL to concentrate on becoming a premium player by shedding less profitable popular brands.

2. Radico Khaitan:

Premium Expansion: Radico Khaitan is expanding its premium and super-premium offerings, including the Spirit of Victory 1999 as well as Rampur Signature Reserve, which sells for Rs. 5 lakh per bottle.

(Radico Khaitan’s Spirit of Victory 1999)

Exclusivity: Limited editions like Rampur Signature Reserve, with only 400 bottles, add prestige and exclusivity to their brand.

3. Pernod Ricard:

Local Premium Malts: Committed to the ‘Make in India’ initiative, Pernod Ricard introduced premium Indian single malts like Longitude77.

Global Launch: Longitude77 was launched internationally, aiming to put Indian whiskey on the global map of quality and premium spirits.

(Pernod Ricard’s Longitude 77)

This brings us to a particular trend that is gaining momentum in India. There is rise of premium whiskey consumption, especially among the top-tier consumers who are willing to pay a premium for exclusivity and quality.

Here’s a closer look:

Single Malt Whiskey Collections

Exclusive collector’s editions of rare Indian single malts, once targeted mainly at international markets, are now increasingly popular in India:

Diageo India’s The Godawan 100: Despite a price tag of nearly Rs. 1 lakh, all 48 bottles available in India sold out quickly.

Amrut Distilleries’ The Bagheera: Launched in March and available only in Gurgaon, it sold nearly 600 bottles in less than a month, priced between Rs. 25,000 and Rs. 40,000.

Rampur Signature Reserve: Priced at Rs. 5 lakhs, this limited edition was initially available only at duty-free outlets, prompting Indians to purchase it abroad.

Amrut Fusion X: Initially allocated 60 bottles for Bengaluru, demand led to an increase to 72 bottles, reducing the quota for another country.

(Luxury Whiskeys)

Pride and Prestige

This exceptional demand demonstrates that Indian single malts are now seen as collectible items, akin to fine art or rare wines. They are produced in small batches and sold at high prices, attracting keen interest from buyers.

For ultra-wealthy individuals, owning these premium single malts is a matter of pride. The success of Indian single malts, which have won multiple awards and global accolades, further boosts their appeal. Last year, Indian whiskies accounted for more than half of the category sales, highlighting their growing dominance.

So, cheers to the rise of Indian single malts and their journey to becoming a symbol of luxury and craftsmanship!

Meme of the Week

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.