| Insights from the THREE Plant Visits and Management Interactions |

In this edition of LEARNING OF THE WEEK, we’ll discuss some interesting insights on the brass industry from our plant visits and management interactions with brass recycling companies in Jamnagar, India’s “Brass City.”

The importance of Jamnagar

To explore the brass industry, we visited Jamnagar, Gujarat, known as the “Brass City of India” and Asia’s brass hub. Jamnagar, a seemingly quiet city in the western state of Gujarat, is a hidden powerhouse in the global brass recycling industry. Jamnagar is where scrap brass from around the globe comes to be reborn into new life, serving the needs of countless industries. Renowned for its scale and quality to both domestic and international markets, Jamnagar contributes nearly 80% of India’s brass exports, reaching over 100 countries worldwide.

Interestingly, Jamnagar is India’s only competitor to China in brass recycling, with around 7,000 factories. While 80% are small, unorganized units with turnovers up to ₹30 crore, about 100 larger players generate ₹100-400 crore each.

Inside Brass Recycling – Insights into the Recycling Process

Brass recycling mainly involves the following four steps:

Step 1: Procurement of Metal Scrap

Majority of brass recyclers in Jamnagar source their primary raw material, BRASS SCRAP, from a diverse global supplier base, including the USA, UK, Europe, the Middle East, and some domestic markets.

Management insight – Approximately 30,000-40,000 tons of brass scrap are consumed daily, with recyclers importing containers of up to 27 tons each, costing around ₹1.5 crore. Additionally, recyclers prefer imports due to the unorganized domestic scrap market, risks of poor quality, and GST compliance issues, where suppliers often evade GST, passing the liability to buyers. Imported scrap is more cost-effective than domestic sourcing.

Step 2: Segregation of Scrap

The procured brass crap often contains unwanted materials like copper, iron, steel, plastic, and rubber. After procurement, brass scrap is segregated and sorted manually. Many of the recyclers do captive consumption of segregated scrap for manufacturing rods and components while many others sell segregated scrap to other processors.

Step 3: Processing Segregated brass Scrap in Ingots, Billets and Rods

The segregated brass scrap is melted into an electric furnace. The furnace is heated electrically to extremely high temperatures. The molten metal is poured in the mould for casting in form of Ingots or Billets of different kinds. Billets are then cut into the desired lengths and are then sent for extrusion in extrusion press machine for formation of brass rods and from here, rods go into wire process machines to make different variety of rods.

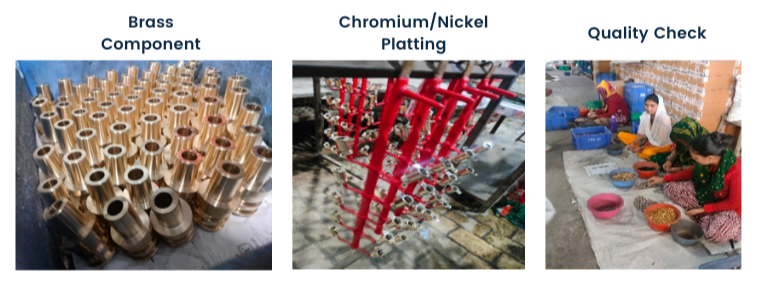

Step 4: Manufacturing Brass based Components

Forged rods undergo precision machining. Components are manufactured from rods using fully automated, semi-automated, or manual machines based on requirements. Machines used include CNC, lathe, tapping, drilling, threading, and grinding machines. Further, Polishing and chromium/nickel plating are performed as required, followed by quality checks and packing of the finished brass components.

Extended Producer Responsibility (EPR) – Will it transform Brass Recycling also?

When discussing the recycling industry, EPR policies often spark hope for a transformative push. To boost non-ferrous metal recycling, GoI has introduced an EPR policy notification on recyclability of non-ferrous metals on August 14, 2024. Mandating final manufacturers to meet recycling targets only through registered recyclers to ensure environmentally sound management of scrap of non-ferrous metals. Upon completion of recycling targets, CPCB shall generate an EPR certificate in favour of the registered recycler.

Management insights on EPR applicability for the Brass Recycling Industry: In brass recycling, there is minimal to no impact of EPR guidelines as the brass industry has thrived on RECYCLED SCRAP for decades. Manufacturing fresh brass costs ~₹580/kg, compared to the ₹515/kg average import rate for scrap used to recycled brass without compromising quality.

The reality is simple: there’s no mountain of unused brass waste piling up to be recycled. The industry has perfected its recycling game, leaving no room for non-ferrous EPR policies to play a meaningful role. When there’s no problem, there’s no need for a solution!

If not EPR, what factors are expected to drive industry growth?

After engaging with brass recyclers in Jamnagar, we’ve understood that the following forces are expected to propel this industry forward:

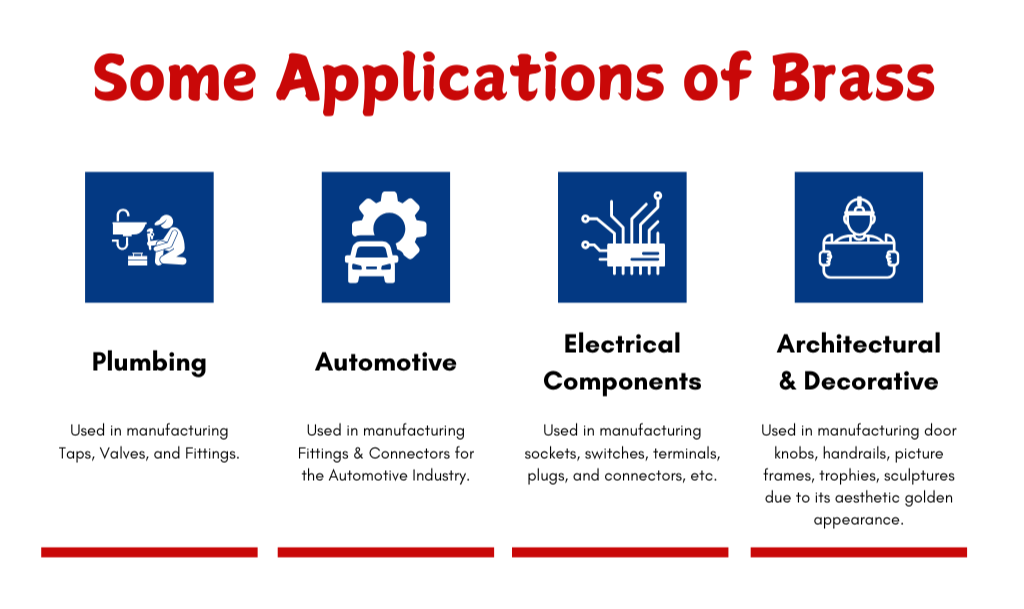

Increasing demand across key industries – Brass recycling in India is driven by its growing preference over steel and copper in plumbing, sanitary, and automotive industries due to its durability, corrosion resistance, conductivity, and aesthetic appeal. Rapid urbanization and infrastructure projects are further expected to boost demand, particularly for plumbing and hardware applications.

The way sanitary giants like CERA and Jaguar meet their brass component needs is that they manufacture a small proportion in-house by setting up their own plants, sourcing ingots, billets, and rods from Jamnagar recyclers. For major additional requirements, they directly purchase components from Jamnagar manufacturers.

China’s Shift to Semi-Brass Imports Opens Doors for Indian Exporters – China is reducing brass scrap imports due to growing pollution concerns and is increasing imports of semi-brass products like ingots, billets, and rods from India, creating export opportunities for Indian brass recyclers.

Reduce dependence on China – The global move to reduce reliance on China presents a significant opportunity for Indian brass recyclers to meet rising international demand for brass components.

Now that we have discussed the importance of Jamnagar, the brass component manufacturing process and the drivers of industry growth, let’s turn our heads towards discussing specific companies and sharing company specific insights which will help you better in putting things into context. During our visit to Jamnagar, we got an opportunity to visit facilities of Siyaram Recycling Industries Ltd, Poojawestern Metaliks Ltd, and Sprayking Ltd.

Company 1: Siyaram Recycling Industries Ltd

Incorporated in 2007 by Mr. Ramgopal Maheshwari, Siyaram Recycling Industries Ltd is Jamnagar’s largest brass recycling company by turnover. It handles the entire process in-house, from importing brass scrap to manufacturing ingots, billets, rods, and brass components (plumbing and sanitary parts) under one roof. The primary focus of the Company is on segregating and trading imported brass scrap. Siyaram exports ingots, billets, and rods mainly to China and supplies domestically to clients like Astral, Kajaria, and AGI. Its brass components portfolio includes inserts, cartridges, fittings, andvalves, catering to clients such as Hindware, ROCA, Somany, and Ashirvad Pipes. Company’s export revenue is ~11-12%.

Insights on manufacturing facilities – The company operates three units in Jamnagar: Unit A (scrap handling and plating), Unit B (forging, extrusion, and component manufacturing), and Unit C (scrap segregation). It has ~3 furnaces (2-ton capacity each), ~50 CNC machines producing 200-500 components daily, ~20 tapping/drilling machines, and ~200 manual precision machines. A fourth plant dedicated to component manufacturing is under development and it plans to shift all the component manufacturing activities in this 4th unit.

Insights from management interaction – Company is shifting its focus to the higher-margin brass components business. Additionally, the Company is also expecting robust order inflow from export clients for their components.

Company 2: Poojawestern Metaliks Ltd

Founded in 1991 by Mr. Sunil Panchmatiya in Jamnagar, the company specializes in manufacturing and exporting brass fittings for plumbing, sanitary, and automotive industries, with minimal focus on scrap segregation.

Insights on manufacturing facilities – Company operates two units in Jamnagar GIDC: Unit 1 (segregation and rods) and Unit 2 (components, packaging, and quality checks). It has a 500 kg furnace (to be upgraded to 1.5 tons) and 36 automated CNC machines, ensuring high-quality output with strong capacity utilization.

Insights from management interaction – Company’s key clients include Minda Automobiles (India), Muller Corporation (USA, 60% of component revenue), Brennar (Canada, 20%), several German companies, and Gulf brands like BK Plumbing. Exports contributed 75-80% to FY24 revenue. Total revenue for FY24 stood at ₹60 crore, split between ₹30 crore from components and ₹30 crore divided into exports of billets/rods to China (~₹10 crore) and segregation (~₹20 crore). Focused on expanding its components business, the company raised ₹50 crore through a rights issue to fund a new manufacturing unit that will consolidate existing operations. It is also developing unique products like lead-free plumbing components for U.S. clients, advanced automotive components, and iron-based components for Brennar.

Company 3: Sprayking Ltd

Incorporated in 2005 by Mr. Hitesh Dudhagara in Jamnagar, Sprayking Industries initially focused on manufacturing brass agro equipment (sprayer parts and garden fittings) but later diversified into brass plumbing and electrical parts. The company operates primarily through its subsidiary, Narmadesh Brass Industries Ltd, in which Sprayking holds a ~61% stake (acquired in FY24), with the remaining stake held by its promoter.

Insights on manufacturing facilities – The company operates two units: Narmadesh (1 furnace with 750 kg–1 ton capacity) and Sprayking (1 furnace with 500 kg capacity). A key differentiator from peers is its continuous production production of brass rods, followed by component manufacturing using manual, semi-automated, and automated machines. To support growth, the company is building a new unit near Narmadesh, funded by its recent capital raise. This facility will house advanced machinery for new products like chromium/nickel-plated faucets and walls, with plans to shift operations from the Sprayking unit to this site.

Insights from management interaction – Sprayking focuses solely on components and rods, with no involvement in scrap segregation or trading. It has also significantly reduced its agro product mix due to low margins and seasonality, aiming to further scale down. Its major client, SP American, contributes ~80% of revenue.

We hope this virtual journey through Jamnagar’s brass recycling industry and our visits to the manufacturing facilities of key players have given you deeper insights into the business and the companies highlighted. If you enjoyed this newsletter, be sure to explore our previous editions and share them with anyone who might find them valuable. You can find the archive link in the next section.

Happy Investing!!!

Disclaimer: These insights are based on our observations and interpretations, which might not be complete or accurate. Bastion Research and its associates do not have any stake in GMM Pfaudler Ltd. This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

MEME OF THE WEEK