Welcome to this week’s edition of TOPICAL WEDNESDAY. Today, we’re looking at the wild ride of Paytm, one of India’s biggest fintech stories. From a massive 83% stock drop after a highly anticipated IPO to a 283% recovery from the lows, Paytm’s journey has been full of highs, lows, and tough decisions.

What started as India’s biggest fintech moment has turned into a battle for survival and growth. In this newsletter, we’ll dive into what went wrong after the IPO, the bold steps Paytm took to fix its business, and how it’s now setting itself up for future. The big question is: Can Paytm turn things around?

Few stories in India’s business world combine regulation, market dynamics, and strategic moves as Paytm’s does. At the heart of it all is Paytm’s rise, its struggles, and now its comeback a journey that could shape the future of India’s fintech sector.

Paytm’s Stock: From Crash to Comeback

Paytm’s stock has seen one of the wildest rides in India’s market history. When it listed in November 2021, the hype was unmatched it was billed as India’s biggest fintech moment. But the euphoria didn’t last. Within months, the stock had crashed nearly 83%, shattering investor confidence and turning Paytm into the classic “what not to do” IPO story.

But markets have short memories and a soft spot for turnarounds. From its 2024 lows, Paytm’s stock has surged 283%, clawing back nearly 60% of its IPO value. Naturally, the question everyone’s asking is – what changed?

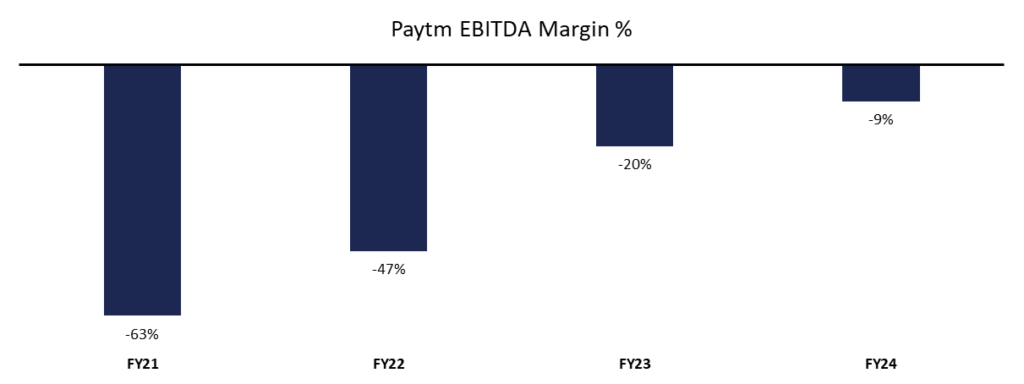

The answer lies in how the company grew up. Paytm stopped chasing every shiny object, cut back on cash burn, and began operating like a disciplined business. It simplified its structure, doubled down on its core – payments and financial services and showed the market that profitability was finally within reach.

As operating margins improved and losses narrowed, Paytm began winning back trust. This recovery wasn’t about hype or luck, it was about focus, discipline, and the willingness to reset.

The Pre-IPO Journey: Building India’s Fintech Flagbearer

Before it became a publicly listed company, Paytm’s story was already a decade-long evolution of bold bets and reinvention.

Founded in 2000 by Vijay Shekhar Sharma, One97 Communications started as a telecom value-added services (VAS) provider selling ringtones, news, and cricket scores to mobile users. The big change came in 2009, when it launched Paytm, a mobile-first payments platform. This move positioned it perfectly for India’s upcoming digital wave.

By 2015, Paytm had become a household name with over 2.5 crore wallets and 10 lakh daily transactions. Global investors noticed Ant Financial (Alibaba Group) bought a 25% stake, and Late Mr. Ratan Tata joined as an advisor and investor, calling Paytm “India’s most trusted mobile payments brand.”

Then came demonetization in 2016 – the turning point. Almost overnight, Paytm went from a small digital wallet to a household name. Millions of users and shopkeepers started using its QR codes, and it quickly became the go-to app for payments across India.

Building on that momentum, Paytm stepped into financial services. It launched Paytm Payments Bank in 2017, introduced FASTag for toll payments, and later rolled out Paytm Money for investments and an insurance platform. Big names backed the vision too, SoftBank came in with massive funding, and even Warren Buffett’s Berkshire Hathaway made its first-ever investment in India through Paytm.

By 2021, Paytm had built a vast ecosystem across payments, lending, insurance, and wealth serving over 3 crore merchants and millions of consumers. Confident in its scale, it launched India’s largest-ever IPO that November, raising ₹18,600 Cr at a valuation near $20 billion (~Rs. 140,000 Cr)

What followed, though, was a harsh reality check.

How Paytm’s Story Unfolded: A Phase-by-Phase View

Phase 1: The Great Unraveling (Nov 2021 – End 2022)

Paytm’s journey as a listed company began with huge excitement and an even bigger fall. When the IPO launched in November 2021, it was priced at the top of the band at Rs 2,150 a share, raising a massive Rs 18,300 crore. But the dream debut didn’t last long. On the very first day of trading, the stock crashed 27%, wiping out over $5 billion in investor wealth.

The problem was simple: the company’s valuation didn’t match its business reality. Investors couldn’t justify paying 26 times sales for a business that had never made a profit. A report from Macquarie calling Paytm a “cash-burning machine” sealed the sentiment the market had lost faith.

As investors dug deeper, they found more reasons to worry. Paytm was spread too thin, operating in too many areas without clear focus. Its biggest business digital wallets was being rapidly eaten away by UPI, which offered free payments and made wallets less relevant. Competition from PhonePe and Google Pay made things worse.

When the first lock-in period for anchor investors ended in December 2021, many rushed to sell, pushing the stock even lower. By mid-2022, Paytm had gone from India’s biggest IPO dream to one of its harshest market lessons. The message from investors was clear growth without profits doesn’t impress anyone anymore.

Phase 2: The Turning Point – A Glimmer of Hope

After hitting its lowest point, things slowly began to turn for Paytm. The company, known for its ability to bounce back, started showing signs of stability. The market, which had once written it off, began to take notice again and Paytm’s stock price started to recover.

This comeback wasn’t because of a sudden turnaround or flashy new idea. It happened because Paytm went back to basics. The company stopped chasing growth for the sake of it and focused instead on making money the right way. It simplified its operations and doubled down on areas that truly worked financial services and merchant payments.

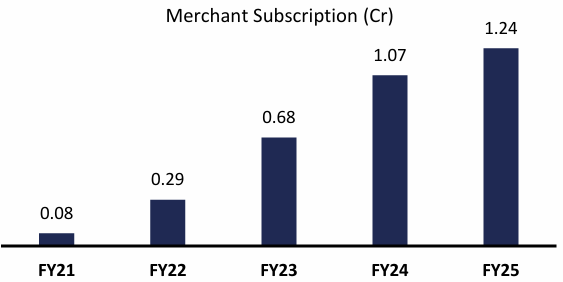

During this phase, Paytm’s focus shifted from just expanding to doing business profitably. It sharpened its model and began scaling services that actually made money. Its payments business, especially merchant subscriptions (soundbox business), grew steadily as the company tapped deeper into its vast network of merchants across India.

What really helped turn things around for Paytm was the strong growth in its financial services business. The company realized that just being a payments platform wasn’t enough and more importantly, it wasn’t where the money was. The real opportunity lay in offering loans, insurance, and other financial products to the same customers already using its app.

This shift changed everything. By cross-selling these services, Paytm started earning more from each user boosting its average revenue per user (ARPU) and building a more stable, long-term business.

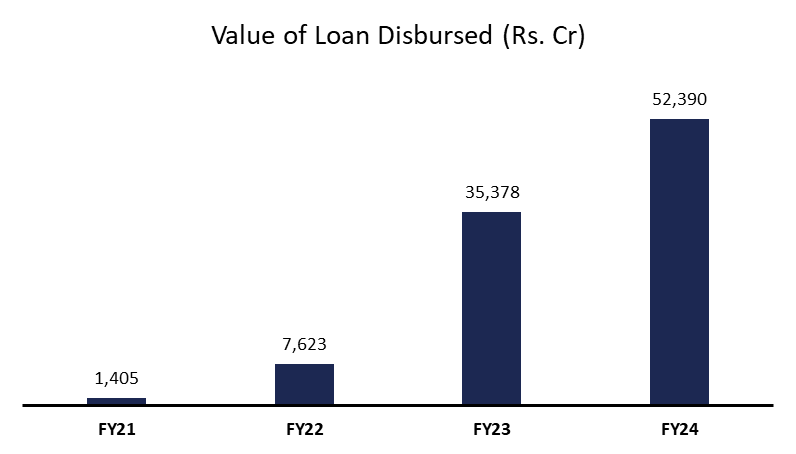

The results spoke for themselves. The value of loans disbursed jumped almost five times, from Rs 7,623 Cr in FY22 to Rs 35,378 Cr in FY23. As a result, revenue from financial services also rose sharply from Rs 437 Cr in FY22 to Rs 1,540 Cr in FY23.

Revenue from loan distribution grew as Paytm partnered with various financial institutions, helping it diversify its revenue streams. This was particularly important because Paytm was no longer just seen as a payments app it was now also becoming a significant player in the financial services space, offering everything from merchant loans to insurance products (this is still at nascent stage though). As these services started to scale, Paytm’s financials looked more promising, and its profitability began to improve.

And, most importantly, the market began to take notice. With signs of profitability emerging, investors began to show renewed interest. The stock price, which had been in a freefall, began its slow but steady recovery.

Phase 3: The Regulatory Shock (Jan 2024 – Mid 2024)

Just as things were improving, another storm hit. On January 31, 2024, the RBI dropped a bombshell: Paytm Payments Bank was barred from taking any new deposits or top-ups after February 29.

The reason? Repeated non-compliance with KYC and data rules. Investigations found thousands of duplicate accounts, weak controls, and even potential risks of money laundering. It wasn’t a surprise RBI had already stopped the bank from adding new customers in 2022, but Paytm hadn’t fixed things.

The market reaction was instant. The stock hit its lower circuit two days in a row, wiping out over $2 billion in market value. Analysts cut targets sharply, with some calling it an “existential crisis.”

Inside the company, chaos followed. Paytm had to act fast to keep its main app running. It shifted its merchant nodal account to Axis Bank and applied for a TPAP license to continue offering UPI services independently. Approval came just in time March 14, 2024 allowing Paytm to partner with multiple banks (Axis, HDFC, SBI, and YES Bank).

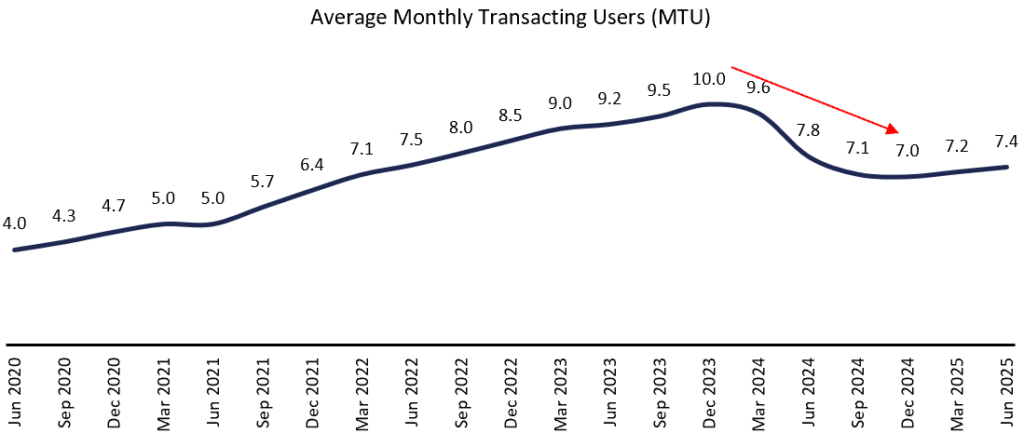

The financial hit was big. Q1 FY25 revenue dropped to Rs 1,502 crore, users fell from 10 Cr to 7 Cr, and Paytm slipped back into losses. But this crisis, as painful as it was, forced the company to rebuild itself on stronger ground no longer dependent on one troubled bank.

Phase 4: Rebuilding and Refocusing (Mid-2024 – Present)

After surviving its biggest storm, Paytm entered a rebuilding phase – focused not just on recovery, but on stability and earning back trust.

By mid-2024, the numbers finally began to settle. Merchant sign-ups and transaction volumes were inching back toward pre-crisis levels, and the user base, which had dropped sharply earlier in the year, started to stabilize. This showed that Paytm’s brand and core products still held strong ground among both merchants and consumers.

The company also rolled out a simpler, sharper strategy. It decided to focus on what it does best:

- Payments, by strengthening its lead in merchant devices and QR transactions.

- Financial services, by leveraging the vast network in payments business to cross sell high margin financial services like distributing loans, insurance, and investment products in partnership with regulated lenders instead of taking credit risk on its own.

Small-ticket loans were paused, and the focus shifted toward higher-quality merchant and personal loans a move that brought more predictability and cleaner balance sheets.

At the same time, Paytm got serious about cost control. It began using AI and automation to drive efficiency, aiming for Rs 400-500 crore in annual savings. This, along with tighter spending discipline, helped protect margins as the business stabilized.

Divesting Non-Core Assets: A clear signal of this sharpened focus came in August 2024, when Paytm announced the sale of its entertainment ticketing business, including the movie and events platforms TicketNew and Insider, to Zomato for ₹2,048 crore. This strategic divestment of a non-core asset was a deliberate move to streamline operations and double down on the core, high-growth areas of payments and financial services distribution. The all-cash deal not only generated substantial cash flow but also make its balance sheet stronger, reinforcing its commitment to a leaner, more focused business model post-crisis.

The results soon started to show. In Q1 FY26, Paytm reported ₹1,918 crore in revenue, and EBITDA of (+) ₹72 crore, a sharp improvement from the ₹792 crore loss it had posted in Q1 FY25. Within its loan portfolio, merchant loans started making up about 60% of total disbursements. The company also maintained a healthy cash balance of ₹12,872 crore, giving it room to invest in future growth while reassuring investors of its financial strength.

What made this phase stand out was Paytm’s ability to win back market confidence. Investors began to see a leaner, more focused company that was finally scaling profitably. Regulatory clarity around UPI and loan distribution further strengthened its position, removing the uncertainties that had once clouded its future.

With a clearer playbook, stronger unit economics, and growing confidence in its model, Paytm’s stock began to recover. This time, the rise wasn’t driven by hype it was backed by results. The company had learned from its past mistakes, cut the noise, and built a more stable, predictable business.

Paytm isn’t chasing flashy growth anymore. It’s rebuilding the right way slowly, steadily, and with both feet on the ground.

Conclusion

Paytm’s recovery isn’t about a single quarter of profit it’s about a mindset shift. The company has finally found a model that balances growth with discipline, use payments to acquire users, and monetize them responsibly through financial services.

The initial collapse was a stark reminder that public markets have a different set of rules. The “growth-at-all-costs” narrative, so potent in private funding rounds, was summarily rejected in favor of a demand for clear, sustainable profitability.

Regulation remains the biggest variable. Approvals for Paytm Payments Bank and evolving UPI/data rules could shape how it scales next. Competition is also intensifying, especially from deep-pocketed rivals expanding into merchant devices and small business lending.

The next test for Paytm is consistency, can it maintain profitability quarter after quarter, while expanding its merchant network and keeping costs in check?

For now, investors are cautiously hopeful. The same company that once symbolized excess is now becoming an example of what a maturing fintech looks like in India. The road ahead will need the same focus and patience that powered this turnaround no shortcuts this time.

We’d also love to hear your thoughts and feedback on X. Connect with us there at @bastionresearch.

Happy Investing!!!

Disclaimer: This newsletter is for educational purposes only and is not intended to provide any kind of investment recommendation. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

😂Meme of the Week🤣

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.