India may feel the heat of inflation

Welcome to this week’s edition of TOPICAL WEDNESDAY! Today, we will explore how the recent sanctions on Russian oil exports are impacting India’s oil imports and refining strategies.

Oil, as we all know, is one of the most important sources of energy in the world because there is hardly any industry that does not rely on it. Whether as fuel, raw material, or an alternative, oil is a commodity that undergoes multiple processing stages to create various products used across industries, either directly or indirectly. To give you a sense, just open an annual report and look at the “Expenses” section in the P&L statement—chances are, one of the largest expenses will be power and fuel. This is a fact observable across industries, with only a few exceptions.

Globally, almost every country is involved in producing, importing, or exporting oil, but a handful of nations dominate production. Out of 195 countries, 100 produce oil, yet the top 10 producers—including Saudi Arabia, the USA, Russia, and Canada—account for 73% of global oil output, significantly influencing prices. The remaining countries include smaller nations where, in some cases, oil production and export form the primary or sole source of national income. As a result, oil has also been at the center of numerous wars and invasions worldwide. This commodity holds such power in the global economy that countries have used it as a political tool to control or confront other nations.

Asian nations like China (15% of global consumption) and India (5%) are major consumers and heavily dependent on imports. However, India has carved out a niche by importing crude oil from countries like Russia—now one of its largest suppliers—and exporting value-added refined petroleum products to other nations. This strategy has been highly profitable for India but is now under threat due to recent U.S. sanctions on Russian oil. Today, we will explore how India benefitted from the Russia-Ukraine war, the geopolitics of oil, and the implications of these sanctions.

But to understand it better, let’s understand the basics first.

Russian Oil History:

Russia’s journey in oil production has been one of highs and lows. By 1900, it was the world’s largest oil producer, contributing over 50% of global output. However, the collapse of the Soviet Union brought economic turmoil, and by 1996, oil production had fallen to just 6 million barrels per day (bpd)—half its peak. To recover, the government modernized the industry, supported by strong oil prices, leading to the rise of companies like Rosneft, Lukoil, and Gazprom Neft.

Under Vladimir Putin’s leadership, state control over the oil sector grew further. Companies like Rosneft and Gazprom Neft became dominant players, together accounting for 7% of global oil production. Russia also leveraged these vast reserves as strategic tools for geopolitical influence.

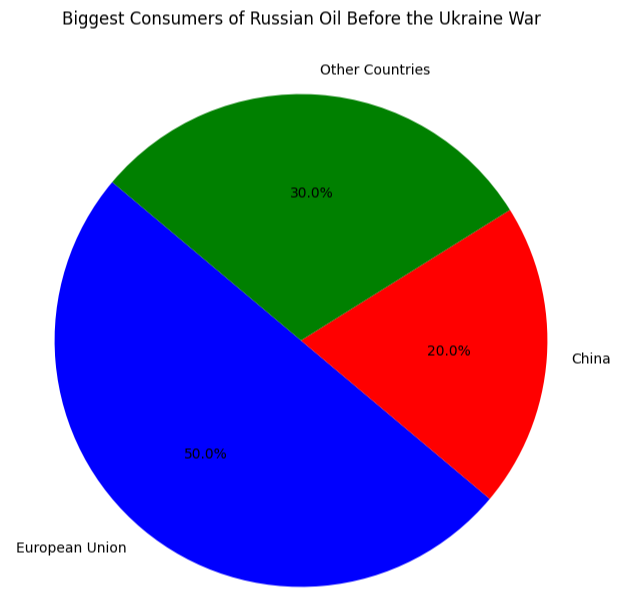

Before the Russia-Ukraine war, the EU and China were its largest oil buyers. But after the war began, things changed drastically.

(Source: IEA, Eurostat)

India’s History of Oil Import

Oil accounts for 26% of India’s total energy consumption, and with limited domestic production, India imports over 88% of its crude oil requirements, processing it domestically for use. These imports significantly impact India’s trade balance, as rising oil prices increase the import bill, widening the current account deficit (India is a net importer).

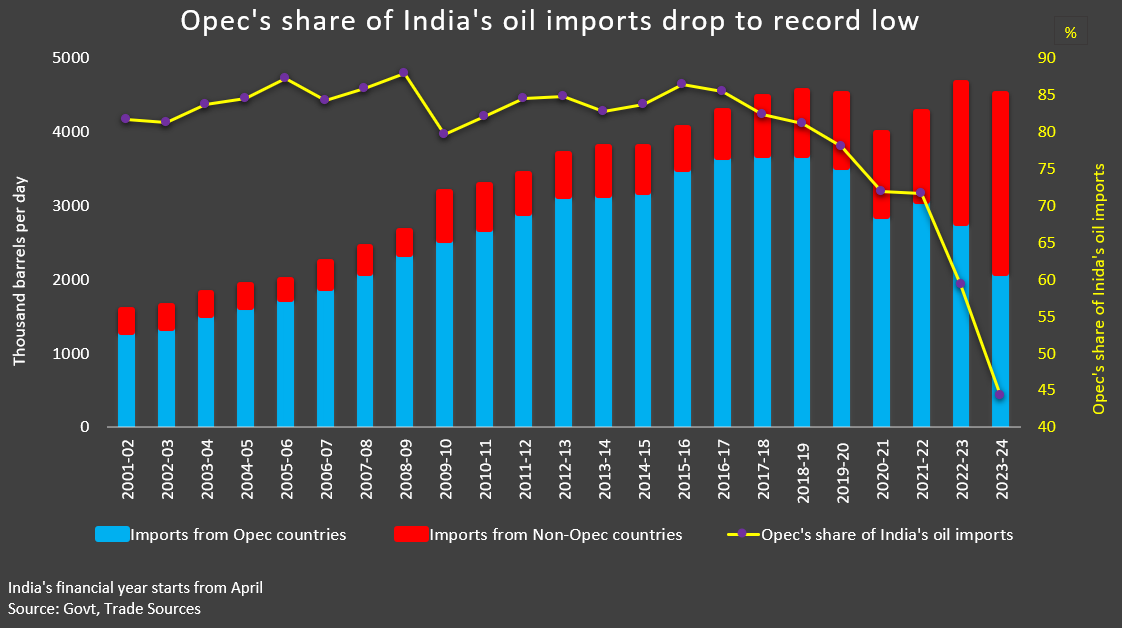

After independence until the late 1980s, India’s oil imports were minimal due to low industrial activity and limited vehicles. Economic liberalization in the 1990s led to rapid industrialization and a sharp rise in crude oil imports. Initially reliant on the Middle East, India faced challenges like regional instability and U.S. sanctions on Iran in 2012, which reduced imports from a key supplier.

To reduce reliance on specific regions, India diversified its oil imports from 27 countries in 2007 to 42 by 2021. It also built Strategic Petroleum Reserves (39 million barrels, covering 10 days of consumption) and launched the Ethanol Blending Program to cut crude dependency. However, it is expected that India will continue to depend on imports which are expected to increase to 96% of India’s crude needs by 2035.

Over time, Iraq and Saudi Arabia became India’s largest suppliers as the country continued expanding its import network..

(Source: IEA, Eurostat)

But this again changed drastically when the Russia-Ukraine War began.

So, what actually happened after the war?

Russian-Ukraine War: Sanctions on Russian Oil

On February 24, 2022, Russia’s invasion of Ukraine triggered widespread condemnation and economic sanctions from Western nations, led by the U.S. and EU.

Instead of direct military intervention, these countries used economic tools to weaken Russia’s economy, heavily reliant on oil exports, which account for 45-50% of its federal budget and ~60% of total exports.

Following Sanctions were Imposed

- 1. The EU banned seaborne imports of Russian crude oil on December 5, 2022, extending the ban to refined products like diesel and gasoline on February 5, 2023.

- 2. The EU and G7 introduced a $60-per-barrel price cap on Russian crude sold to non-EU countries.

- 3. The U.S. banned imports of Russian crude oil, natural gas, and coal in March 2022.

These sanctions forced Russia to sell its Urals crude at steep discounts—trading $32 below Brent crude in early 2023. Consequently, Russia’s oil export revenues fell by 14% (EUR 34 billion) in the first year after sanctions.

But, these sanction were blessings for India.

Strengthened India-Russia Energy Ties

Soon, India began importing oil from Russia, and with limited options beyond India and China, Russia started selling its oil at steep discounts. Together, India and China accounted for 80% of Russia’s oil exports. To maintain export volumes, Russia offered significant discounts on Urals crude, which traded far below Brent crude prices. In the April–June 2022 period, discounts were around $9 per barrel, peaking at $15–20 per barrel in early 2023. On average, discounts stood at $10.5 per barrel during FY2022-23, helping India cut its oil import costs significantly. Between April 2022 and May 2023, India saved ~$7.2 Bn by purchasing discounted Russian oil.

As a result, Russia became India’s largest oil supplier post-war, with its share rising from less than 2% pre-war to over 40% by late 2023. Meanwhile, imports from Middle Eastern countries dropped from 60% pre-war to about 44% by late 2024, marking a major shift in India’s oil sourcing strategy.

(Source: Reuters)

The benefits of these sanctions extended beyond just oil imports for India. The EU, which previously relied on Russia for 50% of its oil, imported refined petroleum products rather than crude oil from Russia. However, the EU lacks significant domestic energy resources, and while its renewable energy efforts have improved, they are still insufficient to replace fossil fuels. As a result, the sanctions created a major opportunity for India to step in and supply refined products to Europe.

The Effect:

- 1. Europe became India’s largest market for refined products after the EU banned Russian oil.

- 2. Exports to Europe rose from 154,000 bpd pre-war to 360,000 bpd by late 2024.

- 3. Diesel exports to Europe grew by 58% in 2024.

- 4. By November 2024, exports hit 400,000 bpd, making India the EU’s largest supplier of refined oil.

- 5. In early 2024, exports to Europe were valued at ~EUR 6.6 Bn ($6.65 Bn).

These sanctions allowed India to benefit immensely and emerge as a key player in global energy markets. With a refining capacity of over 250 MT per year (5 million bpd)—far exceeding domestic demand—India leveraged this opportunity to expand its global presence and strengthen its position in the energy sector.

Shadow Fleet:

One of the major reasons India could pull it off is because while sanctions have been in place for years, they are not applied stringently. So, Russia relied heavily on its “shadow fleet” to sustain oil exports. This fleet consists of aging, poorly maintained tankers, often owned by opaque entities and registered under flags of convenience in countries like Gabon or the Cook Islands. These vessels evade sanctions by using tactics such as turning off tracking systems, manipulating location data, and conducting ship-to-ship transfers to obscure the origin of their cargo. The shadow fleet has been critical for Russia to bypass sanctions and maintain oil export revenues. By mid-2024, it transported over 70% of Russia’s seaborne oil exports, with top buyers being India, China, and Turkey, collectively accounting for 95% of Russian crude exports via this method.

But now, this could be at risk because of the new sanctions imposed by the USA.

USA Sanctions on Russian Oil

On January 10, 2025, the outgoing Biden administration imposed new sanctions targeting Russia’s oil sector. These sanctions included blacklisting 183 vessels from Russia’s shadow fleet and sanctioning major oil producers like Gazprom Neft and Surgutneftegas, which together exporting nearly 1 Mn barrels per day. The aim is to disrupt Russia’s oil revenues, while tightening enforcement of the $60-per-barrel price cap set by G7 nations, of which India is a part.

Effects on India

1. Impact on Spot and Long-Term Contracts:

- Indian refiners have stopped dealing with sanctioned tankers and entities, reducing spot purchases of Russian oil.

- They are now turning to costlier alternatives from the Middle East and Africa, likely ending the $3-per-barrel discounts on Russian crude.

- Long-term contracts with non-sanctioned entities remain unaffected, and the two-month wind-down period (until March 12, 2025) ensures short-term supply stability.

2. Shift to Alternative Suppliers

- Indian refiners are exploring increased imports from Middle Eastern countries like Iraq and Saudi Arabia to compensate for potential disruptions in Russian supplies.

3. Economic Impact

- Global oil prices surged by about 7%, with Brent crude reaching over $81 per barrel, a four-month high.

- Higher oil prices could strain India’s economy by increasing import bills and create inflationary pressure. Refiners may face reduced margins due to higher costs for alternative supplies without discounts.

So yeah, we may be in for a bumpy 2025.

Closing Thoughts

Term contracts with national oil companies (NOCs) provide assured volumes over a fixed period, typically a year or more, while spot purchases are used to meet additional refinery needs or take advantage of favorable pricing. The new sanctions are unlikely to have an immediate impact due to long-term contracts, but short-term spot purchases could face challenges, which will reduce margins of Indian refiners due to higher spot market prices.

Looking ahead, the situation remains uncertain. While the Biden administration has been strict on Russia, the incoming president, Donald Trump has shown a less aggressive stance. This could mean that while the situation may not improve significantly, it might also not worsen further. For now, we will have to wait and see how things unfold.

Disclaimer: This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

😂Meme of the Week🤣

How long do you stare at your wife?

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.