List of companies with robust quarterly performance and promising future prospects.

Welcome to this week’s edition of TOPICAL WEDNESDAY! Today, we highlight companies that showed strong growth in Q4 FY25 and positive forward-looking outlook.

We’re now halfway through the Q4 FY25 earnings season, and so far, several companies have reported healthy numbers despite a complex macro backdrop. While broader market sentiment remains cautious, some businesses have shown strong growth, solid execution, and positive guidance.

In this edition, we’ve put together a List of Companies—companies that not only delivered across key financial metrics but also look well-positioned going forward.

Selection Method

The approach is simple:

We filtered out companies with Mcap more than Rs. 100 Cr. From the remaining pool, we selected only those that met these criteria:

- At least 10% YoY sales growth

- No decline in sales, operating profit, or PAT on either a YoY or QoQ basis

Next, we combed through their earnings reports, investor presentations, and concall transcripts to shortlist the top 10 companies. These firms not only posted strong numbers across key metrics but also operate solid businesses and have issued positive guidance.

A final, more subjective filter: we skewed towards companies that hold earnings calls and whose businesses or sectors we have some understanding of.

That’s it. Straightforward, but not easy—it took time. But we believe the effort was well worth it.

List of Companies

Keep in mind: this list is only a starting point. It’s not a recommendation. Treat it as a launchpad—do your own research and build your own thesis.

Here are the companies (in no particular order), along with notable commentary from their management:

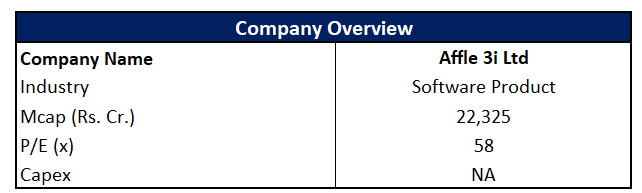

1. Affle 3i Ltd

An adtech company operating on an ROI-linked CPCU model—one of a kind in India—benefiting from the global surge in digital advertising.

(Source: Company, Bastion Research)

Management Outlook:

“As global digital spend continues to rise, the shift towards performance-centric advertising is becoming even more pronounced, unlocking robust growth opportunities across all our key verticals and markets… We are aiming for 20%+ growth in FY26 and are pursuing a mid-term 10x growth target.”

“We will be pushing for margin improvements of a few basis points every year.”

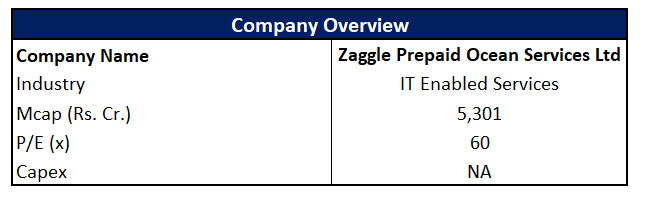

2. Zaggle Prepaid Ocean Services Ltd

India’s largest prepaid card issuer and a key player in business expense and spend management solutions.

(Source: Company, Bastion Research)

Management Outlook:

“Building on our strong performance, we project our organic FY26 topline growth to range between 35% to 40% and we are upping our guidance for EBITDA Margin in the range of 10% to 11%. As we continue to scale, we remain focused on driving margin expansion through increased operating leverage, operational efficiencies, and cross-sell opportunities.”

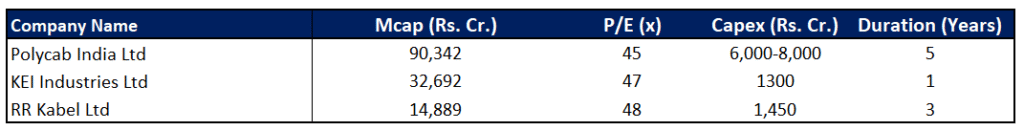

3. Wires & Cables Industry (Sector-Wide)

Strong revenue growth across the board, driven by robust demand in domestic and export markets. Companies are investing heavily in capex to scale up.

(Source: Company, Bastion Research)

Management Outlook:

Polycab – “Regarding the domestic market growth in Wires and Cables: we expect this market to grow between 1.5x to 2x of real GDP growth.”

“Reserving our position as the most profitable company in the electrical industries for third consecutive year with powerful industry tailwind, strong demand outlook, and our transforming agenda under Project Spring. We are energizing and ready to unlock the next phase of sustainable industry leaderboards”

“We remain on track with our Project Spring CapEx roadmap of INR60 billion to INR80 billion over the next five years, which will power our capabilities, scale and innovation”

KEI Industries – “Company is hopeful to achieve 17 to 18% growth and improve our operating margins during the FY25-26 considering phase one commercial production in Sanand and strong order book position of domestic institutional for cable sale, export orders for cable sales and extra high voltage cables and the total order book of cable at Rs. 3,416 cr.”

“…after completing the Sanand project as and with the continued strong demand in domestic and overseas markets, we are hopeful to grow by 19 to 20% in next 2 to three years.”

RR Kabel – “Currently valued at Rs. 90,000 cr, the industry is expected to grow at a CAGR of 15% and reach approximately Rs. 2 lakh cr by FY ’31”

“Over the next three years, we aim to deliver a Wire and Cable revenue figure of 18% and FMEG revenue figure of 25%, together driving a 2.5x growth in EBITDA”

“We are also strengthening our export business, targeting 1.7x growth by leveraging our strong brand equity and India’s favorable trade dynamics”

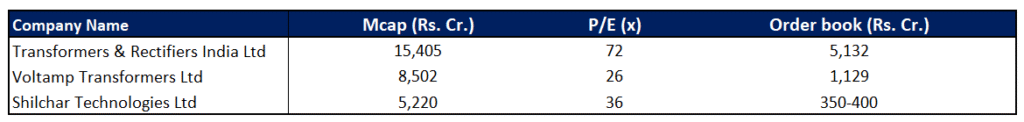

4. Transformers (Sector-Wide)

Massive tailwinds from electrification, renewable energy, and grid modernization have fueled broad-based growth.

(Source: Company, Bastion Research)

Management Outlook:

Transformers & Rectifiers India – “The transformer industry continues to benefit from several favorable trends”

“the market for the special transformer is growing very fast, mainly because of the speed which has taken up for production of the green hydrogen and ammonia. There is going to be huge requirement of transformers for that”…”there is going to be a huge requirement for those transformers as well in the coming years”

“Our long-term vision to become a US$1 billion revenue company within next 3 years remains intact, and we are confident of achieving it through consistent execution and customer-centric innovation and robust financial discipline”

“next financial year, our order book input will be around Rs. 8,000 Cr”

Voltamp Transformers – In the near to medium term, the outlook for the power sector in India is promising and transformative. The ongoing shift towards renewables should continue, with a focus on capacity addition. The Indian Power sector is slated for sustainable growth and will be one of the key sectors enabling the country’s future development.

Market momentum is continuing. Enquiry pipeline continue to be strong. The Company at present not foreseeing slowdown in CAPEX spending in its addressable market segments and that will ensure full utilisation of production capacity. The new capacity addition in transformer industry will impact price realization with margin normalization over period of time.

(Not exact quote since the company does not do concalls)

Shilchar Technologies – “The transformer industry continues to benefit from several favorable trends. India’s electricity consumption is rising and is projected to peak at 273 gigawatts in June ‘25”

“Everybody is expanding, so there will be huge capacity coming in the market in the next two to three years”…But at the same time, the government data shows that there will be a huge demand for transformers also because they will be in a very huge demand for power, and government is doing their best to meet this power demand”

“So, for this coming year, Year ‘25-‘26, we are targeting around Rs. 750 crores in sales in top line”

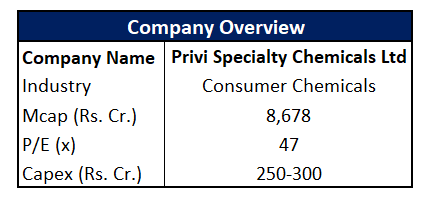

5. Privi Specialty Chemicals Ltd

India’s largest manufacturer and exporter of aroma chemicals.

(Source: Company, Bastion Research)

Management Outlook:

“This is only the beginning of our growth story, my friends. It is also our endeavor to be #1 Aroma Global Chemical Company. Friends, we are not far from it.”

“we are actively working to expand our production capacities for our key products and take it up from 48,000 metric tons to 54,000 metric tons. We expect this expansion to be completed by March 2026.”

“We are confident that we will be able to keep our growth rate at about 20% to 25% for sure and we are planning and working out the growth potential for several products which are in demand from our customers. We are working out the project cost. There will be a CAPEX plan in coming year where we are confident that we will be able to multiply and keep a continued growth for the company.”

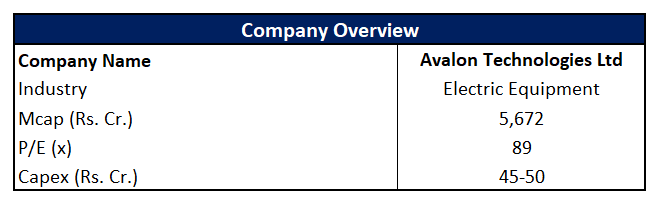

6. Avalon Technologies Ltd

An EMS company offering full-stack manufacturing, with facilities in both India and the US—giving it strategic flexibility in global supply chains

(Source: Company, Bastion Research)

Management Outlook:

“Avalon’s dual manufacturing presence in both US and India positions us well to navigate these shifts. On one hand, higher tariffs on imports from select countries are driving opportunities to India to emerge as a preferred manufacturing hub, resulting in an increased engagement from global customers aiming to diversify their supply chains. At the same time, our US manufacturing facility offers strategic flexibility to support customers looking to localize production and meet regional requirements.”

“Accordingly, we are approaching FY ’26 with measured optimism, mindful of the macroeconomic environment influenced by policy decisions, we are guiding for a revenue growth of 18% to 20% for FY ’26 and will reassess this as the year progresses in line with market developments.”

“So saying that we are also setting up two more factories, okay, in the next six to 12 months.”

7. Laurus Labs Ltd

A leader in APIs, CDMO services, and generic formulations, with a growing global footprint.

(Source: Company, Bastion Research)

Management Outlook:

“Our EBITDA for quarter 4 stand at INR477 crores and margins at 27.7%, whereas for the full year it is around 20.1%, which is in line with our outlook provided a couple of quarters back. On full year basis, we expect these margins to be higher as we continue on path to operational deliveries, especially execution of long-term long lead programs, new asset ramp up, driving better asset utilization.”

“Our business is well positioned and we are readily evolving towards our goal to become a more diversified CDMO-CMO company with promising pipeline, enabling technology platforms and coupled with commercial excellence.” He added, “We will continue to increase and deepen our collaboration with major clients and execute on CDMO potential while improving resourcing in generic business.”

we have good projects on hand. And the opportunities looks interesting, and we expect growth of CDMO revenues from year FY ’25 to FY ’26.

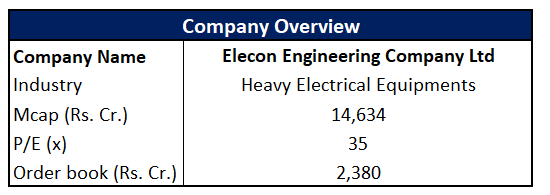

8. Elecon Engineering Company Ltd

One of Asia’s largest industrial gear manufacturers, with material handling and power transmission capabilities.

(Source: Company, Bastion Research)

Management Outlook:

“We remain confident that the division will continue its upward momentum in FY ’26 and beyond, backed by a healthy order book and a robust outlook across core sectors”… “Normally, the material handling business is on the rise because a lot of new power plants are likely to be tendered or ordered for. And therefore, there is going to be a larger demand for material handling equipment”

“As we look ahead to FY ’26, we are providing a guidance of INR 2,650 crores in consolidated revenue with an EBITDA margin of 24%. This reflects our confidence in the continued strength of our business model, the resilience of our core markets and the strategic initiatives we have put in place to drive growth”

“We are expecting INR 2,000 crores from gears division and INR 650 crores from MHE division. Both put together we’ll have the revenue of INR 2,650 crores”. He expects overseas revenue to be between 27% and 30%”

Material handling will have a sustainable margin of 23% and gear division will have a sustainable margin of 25.5%. So overall it’ll be 24% sustainable margin at a company at a console revenue level”

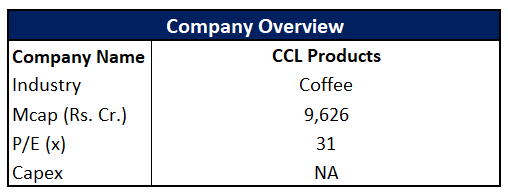

9. CCL Products (India) Ltd

A global private-label coffee producer, serving 90+ countries with 900+ blends.

(Source: Company, Bastion Research)

Management Outlook:

For the company’s overall profitability, they reiterated their long-term guidance: “our profitability… that will kind of grow between 15% to 20% year-on-year basis… at a long-term-ish levels… we have given a guidance to grow between these levels”. He later reinforced, “at an overall level, bottom line level, we try and see that how well or how can we protect our EBITDA per kg… at an absolute level, we say that, okay, how are we growing our EBITDA at the absolute level? And that’s the guidance we are giving that 15% to 20%”

“In international markets, particularly mature ones like Europe and America where the category is stagnant, their growth strategy will be driven by the goal to “gain market share”. For developing markets like China and the Middle East, growth will be driven by the category growth itself”

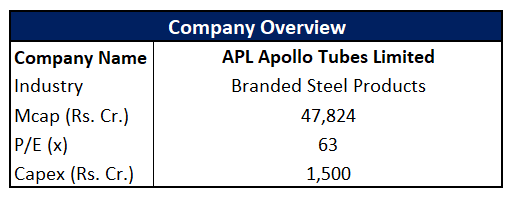

10. APL Apollo Tubes Ltd

A market leader in value-added steel products.

(Source: Company, Bastion Research)

Management Outlook:

“This demand is expected to double to 18 million tons (from 9 MTPA) in five to six years.”

“Capacity utilization in the industry is currently around 75 to 80%. However, overcapacity exists in the general segment, not in the value-added products where the company holds market leadership.”

“highly confident that we can continue to deliver 20% growth year-on-year over the next three four years”

”For the first half of FY26, they expect volumes of 1.7 million to 1.8 million tons.” “In the second half of FY26, they expect volumes to cross 2 million tons.”

“The total plan for 2030 is 10 million tons minimum” ”The capex for expanding capacity to 7 million tons is around 15 billion INR, or approximately 1500 crore” ”Total capex by 2030 is expected to be around 2500 crore”

Banks – Industry Snapshot:

In the banking sector, we’ll take a pulse check on Q4 performance, explore key industry shifts, and examine how different banks are responding through strategic decisions and leadership actions.

Struggling MFI Segment:

Axis Bank – “In retail asset quality for unsecured products across the industry, including MFI, a normalization cycle is in progress. The primary reasons are credit hungriness and over-leverage.”

HDFC Bank – “at the industry level, the nonperforming loans going up and the credit cost beginning to go up. ”whether the credit NPAs and credit costs will normalize over the next 1 year, 3 years, it should, but that should be at a lower level than what historically we have seen is the assessment of our credit officers”

Kotak Bank – “the microfinance industry has seen significant credit strains, something we had highlighted in Q1 of fiscal year ’25… Having said that, we expect credit cost to stay at this elevated level for the next two quarters

“Microfinance. I think enough has been said. The industry showed delinquency. This had impacted us as well and that’s why we degrew our portfolio. We continue to tread cautiously in most markets in this space”

“will wait to see in the next few quarters whether this is a cyclical or a structural trend, and then grow our business cautiously”

Change in loan book:

Kotak Bank – “Due to significant credit strains in the microfinance industry, management stated they “have proactively managed the business to bring down the retail microfinance book by 33% Y-on-Y”. The microfinance book now constitutes only 1.6% of total net advances. They continue to tread cautiously in this space.”

“They reported that consumer assets growth was primarily led by secured businesses, which grew 19% YoY”

DCB Bank – “to get to where we want to get to, I don’t think we will be moving away from our strategy of secured assets”

“The risk profile will not change. We are conservative. We are proud to be conservative. We really believe that the hallmark of a bank is the ability to manage its portfolio health.”

Axis Bank – “continue to remain conservative, which is 100% provision on unsecured loans once classified”

Due to underwriting actions on the personal loan portfolio, which are showing positive early reads but where vintages are not yet mature, they expect it will take a few more quarters for this book to stabilize.

They explicitly stated that due to strengthened credit parameters over the last 12 to 15 months, they have “taken effective steps to reduce the growth rate” in unsecured personal loans, which declined significantly from 32.5% in Q4FY24 to 4.2% in Q4FY25. This action was taken “in line with our assessment of the opportunities and risks that we see in the portfolio”. They expect the unsecured portfolio to stabilize and will be happy to grow it as it does.

Pressure on NIM:

AU Small Finance – But NIMs can be in pressure because still — the real benefit of interest rates coming down will only get materialized maybe in quarter 3, quarter 4

The challenge is on NIM. So, as of now, it’s so difficult to predict whether we’ll go down by 10 bps or 20 bps or 30 bps, but there will be a challenge on the NIM.

Aavas Financier Ltd. – “yields and margins could be under pressure in H1FY26 because of the time lag and eventually catch up”

Bandhan Bank– Management indicates that as the secured mix increases, “the NIM — margin pressure are there”

Bajaj Housing Finance – Management indicates that if the book mix remains the same, they “can see NIM compression of a 10 to 15 bps during the year”. This is linked to their expectation of potential rate cuts

CASA Ratio:

HDFC Bank – Management reports that the CASA ratio mix “has not been favorable”

Bandhan Bank – Management notes that “the overall liquidity tightness in the system has impacted both growth and profitability at an industry level”

IDFC First Bank – Management recalls the recent past where the deposit market was perceived as a “very, very tight market, very difficult to get share”

Closing Thoughts:

The companies highlighted above were selected based on our specific criteria, and while this list offers a snapshot of strong quarterly performers with promising outlooks, it’s by no means exhaustive. Think of it as a starting point for further analysis and discussion.

If you liked this newsletter, feel free to share it. Also, feel free to share your thoughts on X, where you can find us as @bastionresearch.

Disclaimer: This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

😂Meme of the Week🤣

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.