Welcome to this week’s edition of TOPICAL WEDNESDAY! Today, we highlight companies that showed strong growth in Q1 FY26 and positive forward-looking outlook.

We’re now completed Q1 FY26 earnings season, and majorly all companies have reported their results. Overall, this result season was more or less in line with previous quarter results. While broader market sentiment remains cautious, some businesses have shown strong growth, solid execution, and positive guidance.

In this edition, we’ve put together a List of Companies – companies that not only delivered across key financial metrics but also look well-positioned going forward.

Selection Method

The approach is simple:

We filtered out companies with Mcap more than Rs. 100 Cr. From the remaining pool, we selected only those that met these criteria:

- At least 10% YoY sales growth

- No decline in sales, operating profit, or PAT on either a YoY or QoQ basis

Next, we combed through their earnings reports, investor presentations, and concall transcripts to shortlist the top 10 companies. These firms not only posted strong numbers across key metrics but also operate solid businesses and have issued positive guidance.

A final, more subjective filter: we skewed towards companies that hold earnings calls and whose businesses or sectors we have some understanding of.

That’s it. Straightforward, but not easy—it took time. But we believe the effort was well worth it.

List of Companies

Keep in mind: this list is only a starting point. It’s not a recommendation. Treat it as a launchpad—do your own research and build your own thesis.

If you are looking for investment recommendations, then we invite you to explore our research platform – Bastion CORE.

Coming back, here are the companies / Sectors (in no particular order), along with notable commentary from their management:

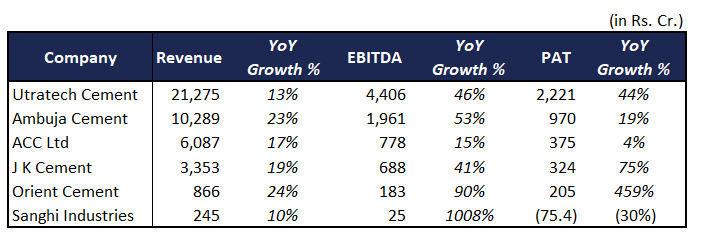

- Cement (Sector wide)

Cement companies have reported excellent results this season driven by capacity expansion and green energy initiatives.

(Source: Bastion Research)

Few of the commentaries by cement majors are:

Key demand driver

“Government spend on roads continues… We are seeing rising state government spend… On a full year basis, we believe that the government capex will generate a good growth… This should be all in all, very good for cement demand.” – Ultratech Cement

“The monsoons now having spread across the country will be good for the rural market… we expect [rural markets] to grow favorably in the future months and future quarters.” – Ultratech Cement

“We expect the Indian cement industry to grow by 7%–8% in FY26.” – Adani Cement

“We see robust cement demand given strong government focus on infrastructure, pickup in real estate and rural housing.” – Adani Cement (incl Ambuja Cements, ACC, Orient Cement and Sanghi Industries)

Future Guidance & Capex

“[Capex] has been around INR 2,000 crores [this quarter]. Generally, that’s been the run rate every quarter.” – Ultratech Cement

“This expansion program is progressing well… 11 MTPA [by] March 2026… another 13 MTPA by March 2027…Capex for the June quarter was almost ₹2,000 crores.” – Adani Cement

“We have given a guidance of about 20 million [tons] in this financial year. We could be… announcing a project every year… there will be two projects going on at a particular time… [to] get to 50 million tons by 2030.” – JK Cement

“This year… a CAPEX of about ₹360 crores… ₹160 crores… for the Shahabad plant, about ₹110 crores… for the coal block, ₹59 crores… for WHR and ₹3.5 crores for solar…” – Sagar Cement

“We would target a double-digit growth given the fact that we have got new capacities into our fold.” – Ultratech Cement

“We are up on our demand estimates by 1% from 6-7% before to now 7-8%.” – Adani Cement

Supported by favourable realisation & margins

“As of now, the prices are favorably poised… I have seen prices improving in July also over the exit quarter. So, prices are holding up. [There was a] 2%–2.5% increase in pricing… South and East… took the maximum… followed by North and West.” – Ultratech Cement

“We also saw a price gain of about 4% during the quarter. Consolidated EBITDA per ton was ₹1,039, up from ₹780 YoY.” – Adani Cement

“[On prices] on average… more or less flat… South realization increased… in the North and central, there was a marginal pressure…[White cement] margins… ranging between 15% to 20% and we feel that it will continue to be in that region.” – JK Cement

“We have seen improvement in pricing… around ₹15 per bag in Telangana… ₹20–25 per bag in Karnataka and AP… ₹25–30 per bag in MP and ₹20–25 per bag in Maharashtra” – Sagar Cement

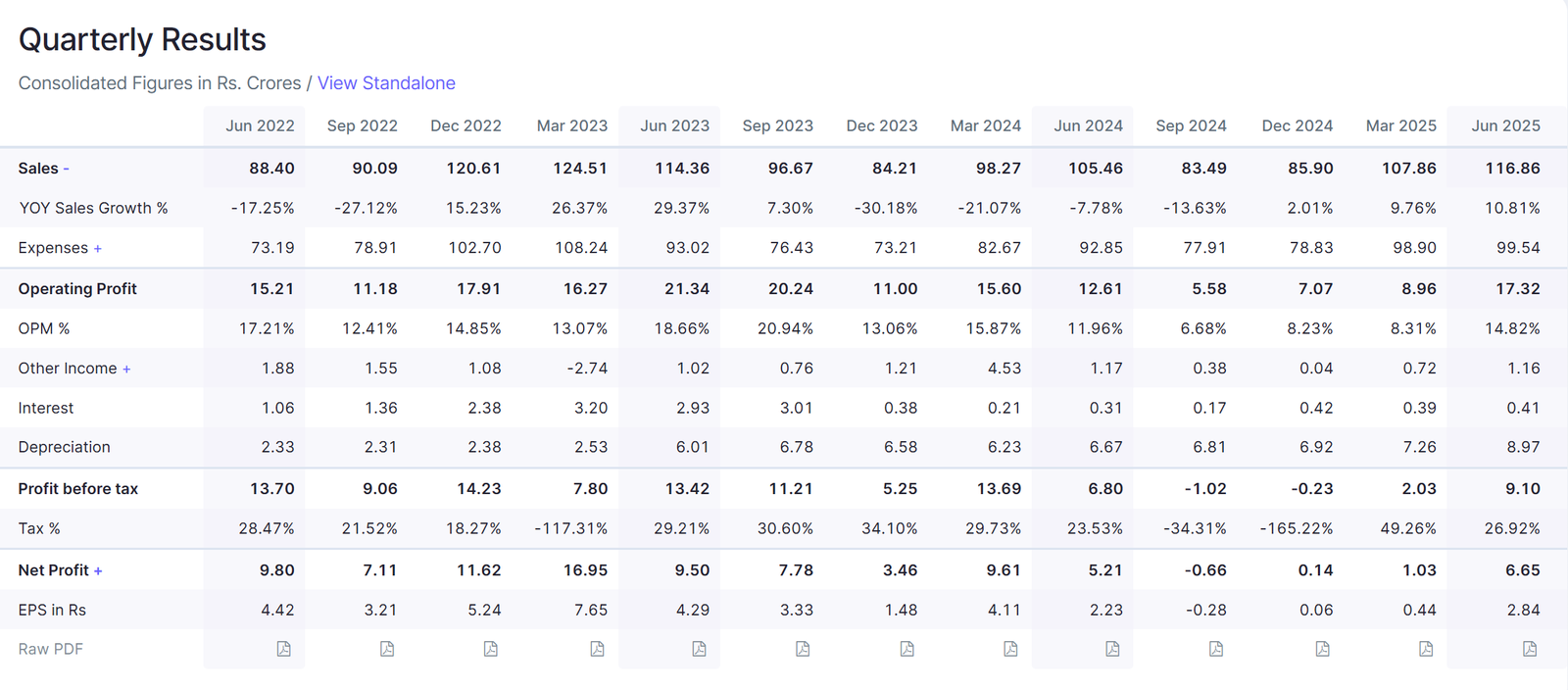

2. Tatva Chintan Pharma

This specialty chemicals company is demonstrating clear signs of recovery after a challenging period.

(Source: Screener)

This is further supported by bullish management commentary.

Management has guided for 25% revenue growth and 20% EBITDA margin. (FYI: 5 Yr Revenue CAGR is 8%)

“for ’25, ’26, we have given a guidance of upward of 25%.” — Ashok Bothra, CFO

“100% confidence because we have orders on hand most of the things… At least till December, we have very clear visibility of what we are getting into.” — Chintan Shah

“The revival of demand in our SDA segment is now happening and we shall continue to see increase in revenue over coming quarters… The growing customer uptake, coupled with the upcoming implementation of Euro 7 norms positions this segment to grow over foreseeable future.” — Chintan Shah

“We have started getting orders beginning from October for supplies for Euro 7.” — Chintan Shah

“We also have one small production block coming up. We expect to commercialize production from there in January… we have 2 large products which are getting into commercialization. And both these products are now being consistently made at the plant to execute orders in Q3.” — Chintan Shah

“This shift towards more of SDA and healthier sales happening from Q2 will have even better numbers in terms of EBITDA… because plants are nearly getting fully occupied on a full quarter basis.” — Chintan Shah

3. Le Travenues Technology

This company has likely been on your radar, as its stock has surged 60% in the past month following impressive quarterly results.

(Source: Screener)

“In FY ’25, we managed to grow our revenue nearly 40% while growing our employee base by less than 10%…”

”We kicked off FY ’26 with a fantastic quarter…” and “With the help of our AI augmented customer support and newly launched voice AI capabilities… we were able to demonstrate more agility and responsiveness… helping us to continue to gain market share.”

“This quarter, we’ve made significant strides in cross-selling buses and flights… thanks to… Travel Guarantee… capturing spillover demand from wait-listed customers.”

“Our unique peace of mind stack of value-added services… and our ability to use AI to price and personalize all these products has been accretive to our growth and margins.”

“Today, more than 60% of our customer support voice interactions are handled end-to-end by fully autonomous AI agents.” and “a better question would be what percentage of the end-to-end engineering process is now… handled or significantly accelerated by AI? … that number currently would be north of 40%.”

”Our biggest achievement has been our ability to maintain leadership in the OTA category in terms of user base, not by outspending competition, but by continuing to see a lot of organic product-led growth… leading to market share gains on all three lines of business.”

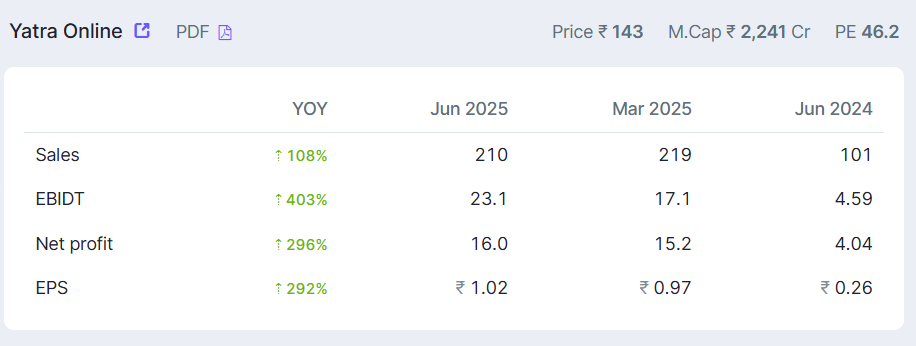

4. Yatra Online Ltd.

Peer of IXIGO, Yatra Online Ltd. surprised markets with its Q1 FY26 results, driving the stock up 50%.

(Source: Screener)

The performance and future growth outlook are further backed by bullish management commentary.

Management has guided growth of ~20% in revenue and ~30% on EBITDA.

“We had given a 20% growth guidance on gross margin [Revenue – service cost] and 30% growth for adjusted EBITDA. We remain firm on that… we are very confident of achieving our guidance and continue to outperform.” — Dhruv Shringi (CEO)

“The advantage which we have now is given the higher mix of corporate business, there is much more stability of earnings… much lesser volatility… which we had seen when we were more B2C skewed.” — Dhruv Shringi

**“**Revenue from operations grew 108% year-on-year… driven by continued momentum across key segments, including robust growth in our Hotels & Packages business and a meaningful contribution from our MICE business.” — Anuj Sethi (CFO)

“We have also recently launched the beta version of our AI assistant DIYA… AI-enabled servicing will provide us with further operating leverage in the quarters to come… Early indications are that we would be able to optimize the work of about 70 to 100 people by the end of this fiscal year and about 200 people by the end of next fiscal year.” — Dhruv Shringi

“These results reaffirm the strength and sustainability of our business model…” and “The corporate travel market is expected to reach around US$20 billion by FY ’27; however, online penetration… remains low at just around 20%… This indicates substantial headroom for digital adoption… Overall, this large and expanding market, coupled with increasing digital adoption presents a significant opportunity for Yatra, particularly in the underpenetrated corporate segment.” — Dhruv Shringi

“In Q1, we onboarded 34 new corporate clients, collectively adding an annual billing potential of approximately INR200 crores.” — Dhruv Shringi

“…optimization of discounting… we’re able to now drive customer acquisition without needing to discount to the same level…” and “…a higher mix on the corporate side, where margins are better from a net retention point of view…”

5. Affle 3i Ltd.

Q1 FY26 has marked Affle 3i’s highest ever quarterly Revenue, EBITDA, PAT, and consumer conversions.

(Source: Screener)

Company has guided for 20% revenue growth and 23% EBITDA margin.

*“We are looking at an organic, sustainable, consistent growth pattern of about 20% on the revenues. Our goal in the medium term is to achieve about 23% EBITDA margin as we continue our margin expansion goals.”

“With the first 3 months already reported today for this financial year, for July, we can already see that we have a pretty consistent growth momentum at this moment, which should yield us a good outcome for FY2026. That’s why our commentary is that this is sustainable and we are confident about beating expectations.”

“Our differentiated CPCU model, strong strategic moat and focused localized execution positions us well to exceed the growth expectations in FY2026.”

We also achieved a significant milestone by becoming an Apple-certified partner…”

“We received a new patent grant in India… augments our fraud detection capabilities… and reinforces our focus on delivering quality user conversions for advertisers globally.”

Our localized operating structure across all regions will keep us insulated from direct exposure to ongoing tariff developments or broader macroeconomic uncertainties. Further with our diversified footprint across markets, verticals and use cases, we remain naturally hedged.”*

6. Elecon Engineering Company Ltd.

Elecon Engineering has delivered robust performance this quarter

(Source: Screener)

The management has guided steady growth and EBITDA Margins of ~24%. Additionally, has guided for their future focus on defense and export opportunities.

“At a consolidated level, we expect to maintain an EBITDA margin of 24% on a steady-state basis.” [in line with current margins]

“Compared to last year, the demand momentum currently is relatively better.… supported by improving market sentiment and ongoing capital investment across key industries… we are seeing very strong growth coming from power sector this year.”

“This growth is driven by a strong demand in both the product supply and aftermarket segment across the core end-use sectors of power, steel and cement.”

*“All in all, the current order backlog and momentum of the order inflows across both our divisions provides a strong foundation and visibility for healthy growth in the coming quarters.”

”We are also seeing a positive outlook in the defense industry and expecting to receive orders in later part of this year.*

“We are mainly gearing up ourselves for our export market, where we see a good momentum… from the OEM business, and we have to keep ourselves ready for any kind of volume. “

“We aim to increase the share of exports to 50% of total revenue by FY ’30.”

7. Mold Tek Packaging Ltd.

The growth in the Company was driven by turnaround of Paint Segment and improvement of realization per kg,

(Source: Screener)

“Revenues have shot up by 22%, on YoY basis and EBITDA margin to 19.7%. EBITDA per kg grew by 29%, and net profit is up by ~35%.”

“The volume outlook, we are aiming at least 45,000 tons for the full year, 43,000 tons to 45,000 tons, depending upon how the other quarters go by. That’s why we still hold on to the expectation of 12% to 15% value growth or at least 18%, 20% of revenue growth.”

“I said INR42 is our target and we are already there at INR41.6. I’m still confident we will be in the bracket of INR41, INR42 for the full year.”

“We are confident that 15%, 16% growth, what we achieved in Food & FMCG can continue.”

“Paint segment, thanks to ABG (Aditya Birla Group), the numbers have gone up…”

”Invincea, MN, Laurus Labs, Pulse… have been… testing our products… now they… started… giving commercial orders”

“Food & FMCG growth is what contributed to the EBITDA margin considerably. And, of course, a part of the paint moving towards IML also is one of the reasons.”

“Per kg sales revenue… shot up… because of the product mix is improving… more of a pharma… and Food and FMC have grown considerably.”

“Food & FMCG growth has come because of our improved serviceability in terms of label connectivity and supplying in time… we have corrected [it] by adding efficient capacities in printing and die cutting.”

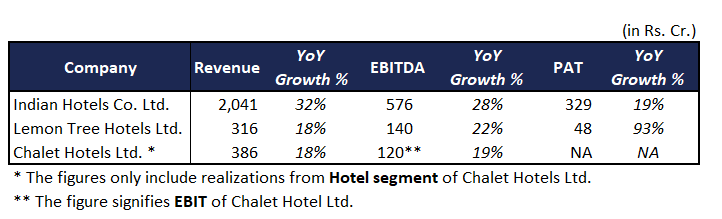

8. Hospitality Industry

The Hospitality Industry has delivered a robust performance in Q1 FY26 backed by healthy domestic travel ecosystem with demand outpacing supply and operational efficiency. Industry seems to be untethered by unfortunate aviation accident & terrorist activity during the quarter.

“… significant disruptions across the travel ecosystem. But yet again, the sector demonstrated strong resilience.” – Chalet Hotels

(Source: Bastion Research)

Few of the commentaries by Hospitality majors are:

Demand Drivers

“We are able to fill the weekdays… but we are not able to fill the weekends. So, to get the weekends, you have to focus on staycations… This time it is a bigger focus on filling our troughs… overall, the ARR grew 10% and the negotiated business ARR grew 9%…” – Lemon Tree Hotels Ltd.

“Overall, I think for the country, the demand is still outpacing supply quite comfortably… we remain very, very bullish.” – Chalet Hotel Ltd.

Future Outlook

“In terms of Accelerate 2030 plan where you’re targeting 700 hotels… Think all routes are open… it’s about mid-scale leadership… this is… a beginning of the inorganic journey.” – Indian Hotels Ltd.

”I absolutely hold our belief that double-digit RevPAR growth is pretty much given for the next few years… for the next 3 to 4 years, at least.” – Chalet Hotel Ltd.

“July has been a tough month for hospitality in general… August and September look strong.” – Chalet Hotel Ltd. “Q2 will see moderation… July has not been so good. All the festivals which affect demand for business hotels or city hotels will happen in Q2 this year.” – Lemon Tree

Margin Improvements and Expansion

“The Ginger brand with the property improvements, with the transition to Lean Luxe is very much capable of driving higher average rates, higher occupancies and… all drive more than 50% EBITDA.” – Indian Hotels Ltd.

“Once all these incremental investments are complete; over the next 15 months, then: The occupancy or ARRs or both will go up meaningfully… The renovation and tech costs will… drop… power and fuel costs [fell] from 8.7%… to 6.9% this quarter… target 50% renewable energy in our owned portfolio.” – Lemon Tree Hotels Ltd.

Renovation and Property Upgradation

“During the quarter we added 120 rooms to the inventory… at Marriott Whitefield.” – Chalet Hotel Ltd. ”During the quarter ~350 rooms were shut for renovation… and we shall continue to spend on renovation into FY27 until the entire portfolio of owned hotels has been fully renovated and refreshed.” – Lemon Tree Hotels Ltd.

9. Borosil Renewables

The Company’s exponential YoY EBITDA growth stems primarily from increased realization following the reintroduction of Anti-Dumping Duty.

(Source: Screener)

The management expects a slight improvement in margins in coming quarters, backed by expansion plans and cost-saving projects.

“Sales rose by 37%… a major increase has come from the increase of selling prices as the average selling prices during the quarter increased to INR 138.1 per millimetre as compared to INR 105.5 per millimetre… This has led to an improvement in margins.”

“The imposition of anti-dumping duty on imports of solar tempered glass from China and Vietnam in December 2024 has provided a great relief on the prices, which have now reverted back to where they were a few years ago.”

”So, on the margins, there will be somewhat a little bit better margin than what we had in this quarter. But we are already at 28%… maybe a couple of percent more we can expect.”

“The Company is confident to achieve good improvement both in sales and EBITDA numbers for the year, on the back of better performance of the Indian operations as its selling prices maintain an upward bias, in addition to cost-saving measures and the stoppage of the drag of losses from the German operations.”

“In terms of the other cost optimizations which we are attempting, we have done some work on the coatings and also, we have invested money into our own solar wind hybrid project which will give further savings. So, these two together should bring in about 1.5% to 2% savings in the percentage terms of the EBITDA you can say.”

”Our work on the expansion project of is in progress, and we expect the project to be commissioned by the third quarter of financial year ‘26-27.” (The plan is to increase capacity by 60%)

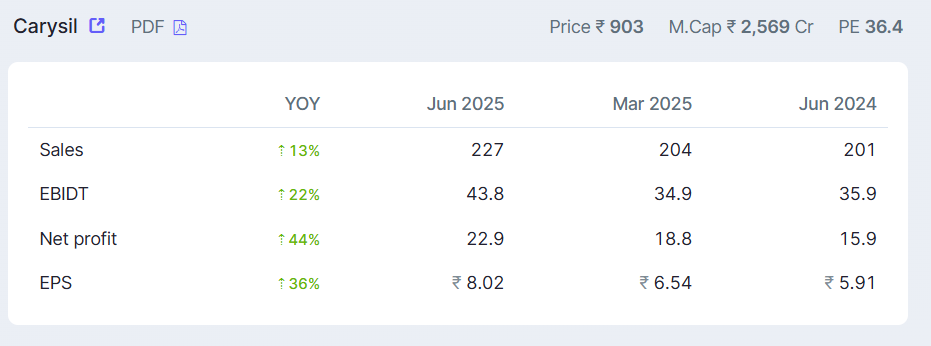

10. Carysil Ltd.

The Company achieved a decent growth in the quarter backed by global partnerships and cost improvement measures.

(Source: Screener)

The management is confident in achieving significant growth in future driven by strong demand momentum and repeat orders from Global partnerships. Management has maintained its EBITDA margin guidance of ~20%.

“Consolidated total income stood at INR227.3 crores… registering growth of 12.9%. EBITDA margin expanded by 112 basis points to 19.4% on Y-o-Y basis due to stabilization of raw material and freight costs, along with ongoing initiative to cost improve and increase capacity utilization.”

“Carysil delivered a resilient performance… driven by strong demand momentum and repeat orders… Our diverse customer base, strong channel partnerships, strategic capacity expansion positioned well to meet this growing demand while enhancing operational leverage and profitability.”

“We emphasize that the market share globally of quartz sink is growing rapidly. And hence, we have the traction and the momentum of business globally. From every corner of the world, we have a strong demand of quartz kitchen sinks.”

“In the present 25% tariff situation, we are still better priced than most of our competition, which are from Germany and Canada… we have a great cost advantage over the European competition.”

“We participated in IKEA’s global RFQ, non-U.S. business and successfully secured a significant order… We have entered into a purchase agreement… full volume expected to commence from as early as quarter 3 FY ’26.” [Company is spending Rs. 20 Cr for capacity expansion to fulfill IKEA order ]

“ We are pleased to inform you that our supply to Karran our U.S. retail has commenced with our products now displayed over more than 1,800 stores at Lowe’s in cooperation. The orders from the retail client have exceeded our initial expectation.”

11. Navin Fluorine International Ltd

The Company has delivered the robust quarterly results.

(Source: Screener)

Management has maintained its EBITDA margin guidance of 25%

“In Q1 FY ’26, our revenue rose by 39%… Operating EBITDA more than doubled… Our net profit grew by 129%… All three of our business divisions reported robust growth.” — Chairman.

“ I think there is reasonable confidence to say we’ll be north of 25% [EBITDA margin]… I don’t think we are at the stage where we would like to update the guidance today.” – CFO

“ With a solid order book in place, we remain optimistic about sustained momentum in the coming quarters.” — Chairman.

“Given the accelerating global demand for R32, we are firming up our plans with international partners to further capitalize on this opportunity.” — Chairman.

“It is fair to assume that our capex frame… will be expanded to INR700 crores to INR1,000 crores.” — CFO.

“Our R32 project was successfully commercialized in March ’25 and is running at optimal capacity… our AHF project continues to advance steadily with completion target for the end of Q2 FY ’26… our cGMP4 facility Phase 1… commercialization expected in Q3 FY ’26.” — Chairman.

“In the Specialty Chemicals segment, we are set to deliver supplies for 3 new molecules in Q2 FY ’26… [the] fluoro specialty project… is expected to deliver a meaningful contribution this year.” — Chairman.

12. One97 Communications Ltd (PayTM)

Once the poster boy of fintech and a frequent target of investor community trolling, the company is now quietly staging a turnaround.

(Source: Screener)

“This quarter, for example, we grew 31 percent on a like for like basis, 28 percent headline number. We do think in future quarters that number should be at least that much, if not higher.”

“We do see significant improvements in EBITDA margin between now and the end of the year. We’re currently at about 4 percent.”

“We do think that what we had said earlier about 15% to 20% EBITDA Margin over the next two, three years is still the number to drive towards… we are seeing that keeping a tight leash on indirect expenses overall does still allow us to grow very well. “

”The DLG has gone down very, very significantly.” [Deafult Loss Guruantee]

“We’re not doing adjusted EBITDA anymore… Next quarter onward, we will stop giving the ESOP line, and it will be only the employee cost… No more adjusted anything.” — Vijay Shekhar Sharma

“I do think there is always a corner where we are able to find some cost, but they will not be material… we are not actively pursuing cost cuts, while I’m definitely pursuing whatever is not necessary drop it out of the window.” – Vijay Shekar Sharma

Closing thoughts

The companies discussed above is selected based on specific criteria. While the list offers snapshot of companies that have delivered strong performance during the quarter, by no means is this list exhaustive. Think of it as a starting point for further research.

Also note, we may have investments in few of the companies discussed above and we might have recommended few of the companies discussed above to our clients. Please do your own due diligence while making an investment decision.

If you like our research, we invite you to explore our research platform – Bastion CORE

We’d also love to hear your thoughts and feedback on X. Connect with us there at @bastionresearch.

Happy Investing!!!

Disclaimer: This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

😂Meme of the Week🤣

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.