Here is some useful information

In today’s edition of TOPICAL Wednesday, we will talk about the current consumer spending trend in India.

When we were hit by COVID, we became aware of many new phenomena like virus mutation, mRNA, self-isolation, PPE, asymptomatic cases, herd immunity, etc., which we wouldn’t have known if COVID hadn’t happened. However, one new thing we witnessed after the lockdown ended, which remains fascinating and something we wouldn’t have known if things were normal, is Revenge Spending. This phenomenon is where consumers increase their spending on luxury or discretionary goods and services following a period of restrictions or economic uncertainty, driven by the desire to compensate for lost time.

We all have felt it, haven’t we? We have been eating out more, buying clothes more frequently, traveling more, purchasing houses and cars, etc. I am not saying that all of this was just because of revenge spending. We also witnessed good economic growth in the country led by government and private spending. However, the COVID-induced pandemic changed our perspective about savings versus spending, and I think having a new experience became a bigger priority than simply saving. As a result, we observed strong growth across consumer spending in almost all industries, be it food, clothing, houses, cars, electronics; these industries witnessed phenomenal growth.

But recently, some consumer-facing industries have been experiencing a slowdown in sales due to weak consumer demand. Several factors contribute to this decline, including extreme summer heatwaves, the general election period, heavy rainfall across the country, and the impact of a high base from the previous year. But among other things, there is also a slowdown in consumer spending. So, let’s explore a few industries that have been affected by this dip in consumer sentiment.

Automobile Industry

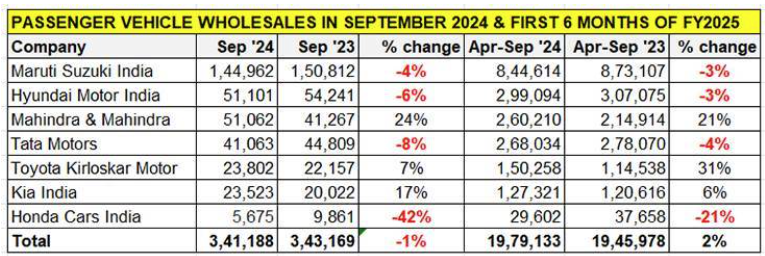

In September 2024, the PV industry in India experienced its 3rd consecutive month of declining sales in the second quarter of FY25. This downturn was due to delayed purchase decisions and heavy rainfall across the country, leading to a slowdown in dispatches from major OEMs to their distributors. Following is the sales volume highlight for major OEMs for the first six months of FY25.

– Maruti Suzuki: As the largest automaker in India, dispatched ~8.45 lakh cars, marking a 3% decline YoY.

– Hyundai Motors India: The company dispatched ~3 lakh cars, also experiencing a 3% YoY decline.

– Tata Motors/ M&M: It dispatched ~2.7 lakh cars in the quarter, with a 4% YoY decline. In September alone, Tata Motors dropped to fourth place in dispatches, overtaken by M&M, which continued to see robust growth.

(Source: Autocar Professional)

Inventory Levels: According to the Federation of Automobile Dealers Associations (FADA), there has been a significant build-up of inventory at dealerships, reaching 7.8 lakh vehicles valued at Rs. 77,800 Cr. The stock days (how long it takes for dealers to sell cars and pay OEMs) have almost doubled from 30-45 days to 70-75 days. Consequently, dealers have urged OEMs to adjust their supply strategies to avoid inventory overload. Maruti Suzuki, which struggled to meet demand just months ago, is now cutting back production. Meanwhile, Tata Motors has reduced prices on some models by up to Rs. 2 lakh.

Retail Fashion

In Q1 FY25, the Indian fashion retail sector recorded a mixed performance. According to ICRA, the industry saw an 18% sales growth YoY, driven by expanding store networks and introducing new product categories. However, growth in same-store sales was impacted by a slowdown in discretionary spending, and the premium segment experienced a 3% drop in average sales per square foot.

– Shoppers Stop: Sales increased by 5% YoY in Q1 FY25. Despite the rise in sales, the company faced margin pressures, with its EBITDA margins falling by 19% YoY, resulting in losses.

– Raymond Lifestyle: The company saw an 8% YoY decline in consolidated revenue compared to the previous year. Its EBITDA margin dropped significantly by 52%, from 14% to 7%.

– Reliance Retail: As the largest brick-and-mortar retailer, Reliance Retail experienced strong revenue growth of 8% and an EBITDA growth of 10.5% in Q1 FY25. This was driven by increased foot traffic and an expanded storefront.

– Aditya Birla Fashion & Retail: The company reported nearly flat revenue for Q1 FY25 but managed to reduce its losses.

QSR Industry

In Q1 FY25, the quick-service restaurant (QSR) industry in India saw a decline in same-store sales and revenue growth for listed companies.

– Westlife Foodworld: This company, which operates McDonald’s in West and South India, reported a 6.7% decline in same-store sales. Their profit plummeted by ~89% YoY due to subdued demand and higher expenses.

– Tata Consumer – Starbucks: Starbucks opened 17 new stores during the quarter, averaging 1 every 5 days. This pace was slower than their plan to open 1 every 3 days to reach 1,000 stores by the end of FY28. The business was impacted by a strong summer that reduced out-of-home consumption, resulting in only a 4% revenue growth due to lower footfall.

– Restaurant Brands Asia: Operating Burger King in India, RBA reported a modest same-store sales growth of just 3.3% YoY.

The QSR sector is experiencing weak sales growth, with brands seeing a 15-20% drop in average daily sales compared to FY23. Challenges like increased competition, rapid store expansions, and rising costs have impacted profitability, especially in the dine-in segment. Seasonal periods like ‘Shravan‘ and ‘Shraadh‘ further dampened sales in July and September 2024, and despite a brief recovery in August, demand remained weak. The festive season is unlikely to significantly boost the sector, with operating margins still under pressure and only modest improvements expected in sales growth.

FMCG:

– Marico: It faced rising input costs, especially for copra and vegetable oils, and geopolitical uncertainties that squeezed its gross margins. Despite these challenges, the company is focused on achieving double-digit revenue growth through price hikes in both domestic and international markets.

– Dabur: It saw a drop in revenue in Q2 FY25, mainly because of inventory adjustments in general trade and bad weather, like heavy rains and floods, which hit consumer spending and out-of-home consumption, especially for beverages. The company expects consolidated revenue to decline by mid-single digits for the quarter.

We’ve discussed how some consumer-facing industries experiencing slowdown or mixed results in the first two quarters of FY25 mainly due weak consumer demand and external factors.

Dussehra

During the Dussehra this year, consumer durable retailers experienced slower growth, with retail chains reporting a 6-7% YoY increase over the last weekend. This is less than the 10-15% growth seen during the same time last year. Additionally, new movie releases like “Jigra” and “Vicky Vidya Ka Wo Wala Video” failed to draw large crowds to theatres, contributing to the overall slow start of the festive season.

Rural Factor

In recent years, rural India has struggled with consumption due to high food inflation, low employment, delayed government spending on rural economic activities, etc. These challenges have kept rural consumption below pre-pandemic levels. However, the situation could start changing. Rural demand may bounce back as farmers benefit from good monsoon rains and promising harvest prospects, signaling a potential recovery in the rural economy.

Effects of Slowdown

The effects of the economic slowdown are becoming more evident, as highlighted by Nomura Holding Inc.’s Chief Economist for India. There is expected to be a shift in consumption patterns this year, with rural consumption likely to improve due to easing inflation and favorable monsoon conditions. However, urban consumption is expected to moderate, which could dampen overall growth and impact industrial and investment activities.

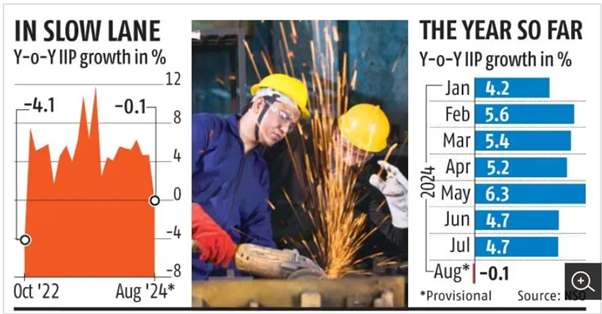

This trend is reflected in the recent contraction of the Index of Industrial Production (IIP) in August, marking the first decline in 22 months. The IIP dropped by 0.1% YoY, influenced by heavier-than-usual rainfall affecting sectors like mining, electricity, and infrastructure. Additionally, a high base from the previous year contributed to this decline. Weak demand further exacerbated the situation, with slowdowns observed in consumer durables and continued contraction in consumer non-durables.

(Source: Business Standard)

Going Forward

As we enter the festive season, online sales have surged, with e-tailers selling goods worth ~Rs. 55,000 Cr. in just one week—an increase of 26% from last year. This strong start has spread optimism for the Diwali season, with many expecting double-digit growth as consumer spending peaks. The momentum is expected to continue through Christmas and the upcoming wedding season, suggesting a positive outlook for the rest of FY25.

However, questions remain about what will happen after this period. Rural demand tends to be cyclical and can fluctuate based on various conditions. The big question is whether the rest of India can maintain the spending levels seen over the past few years. If not, this could mean a shift to a lower growth trajectory for India.

In FY24, India’s real GDP grew by 8.2%, and the RBI expects FY25 to end with 7% growth. However, some economists have started to moderate their forecasts, with Nomura now expecting 6.7% growth by the end of FY25. As post-COVID growth fades and consumption doesn’t fully revive, it could signal a new but lower growth path.

As investors we need to closely watch upcoming economic data and numbers by consumer facing companies to understand the emerging trends.

Meme of the Week

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.