The Shovel Seller in the Diamond Industry’s Gold Rush

today we are covering the story of the International Gemological Institute (IGI) and its upcoming IPO.

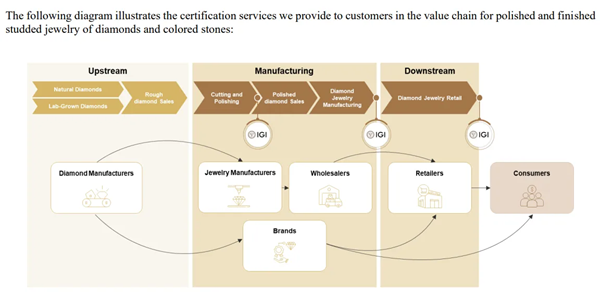

During the California Gold Rush, it wasn’t the miners who struck it rich—it was the people selling shovels and tools to support them. This idea applies perfectly to IGI, a company that doesn’t mine diamonds but certifies them. IGI provides authentication services for natural diamonds, lab-grown diamonds, gemstones, and studded jewelry. These certifications are essential for determining the value of these luxury items in the market.

Unlike miners or manufacturers who need heavy investments and infrastructure, IGI benefits from working with all players in the value chain by offering its expertise in certification. This makes IGI a “shovel seller” in the diamond industry’s gold rush.

Operating in an oligopolistic market, similar to credit rating agencies, IGI holds a strong global position with limited competition. Its business model is highly efficient that requires low ongoing investment. So today, we will talk about it’s business, evolution and what market position it currently holds.

But, first things first!

IPO Details:

Total Issue Size: Rs. 4,225 crore

– Fresh Issue: Rs. 1,475 crore

– OFS: Rs. 2,750 crore (6.59 crore shares) by Blackstone Asia (BCP Asia II TopCo Pte Ltd).

After the IPO, Blackstone will retain a 76.5% stake, remaining the majority shareholder.

Who Founded IGI?

Antwerp, known as a historic hub for diamond trading due to its proximity to India, especially our beloved Surat, played a key role in the founding of IGI. In the 1970s, economic instability caused by the USA delinking the dollar from gold led to the surge in demand for tangible assets like gold and diamonds, boosting activity in Antwerp’s diamond trade as USA remained the largest consumer of diamonds at that time. This condition led to the birth of IGI.

Amid this bustling market in 1970s, Marcel Lorie, a veteran in the diamond business, noticed a major gap: there was no standardized system for grading smaller diamonds or finished jewelry. While the Gemological Institute of America (GIA) had introduced diamond certification in 1934, it was still in its infancy by the 1970s and focused mainly on larger stones over 2 carats. To address this issue, Marcel founded the IGI in 1975 at the age of 50. His goal was to create an independent gemological laboratory providing reliable, impartial, and accessible certification services for a broader range of diamonds, including smaller stones and finished jewelry.

To achieve the above objective, IGI took THREE strategic steps:

• IGI developed tamper-proof security-sealed reports for diamonds and colored stones.

• It launched the patented LaserScribe inscription system, which allowed unique identifiers to be inscribed on diamonds.

• Opened its first School of Gemology in Antwerp to provide professional training in gemology.

These innovations helped the company establish itself as a trusted authority in the gemological field. Marcel, along with his son Roland Lorie and co-founder Herman “Zwi” Brauner, grew IGI from a Europe focused business to a globally recognized brand in the diamond world. Marcel, who founded IGI in 1975, remained actively involved in the business until he passed away in 2006. Following Marcel’s demise, Roland (his son) officially became CEO and played a key role in shaping IGI’s strategy, helping it grow into one of the most prominent players in the global diamond certification industry.

Here are some major milestones achieved by the company under Roland’s leadership:

Global Expansion: IGI grew to 29 labs and 18 Schools of Gemology across 10 countries, establishing itself as a trusted authority in India by educating local dealers on certification.

Lab-Grown Certification: IGI pioneered lab-grown diamond certification in 2005 and became the first lab with ISO accreditation for both natural and lab-grown diamonds.

Jewelry Certification: IGI expanded services to include finished jewelry and colored stone certification, catering to a broader market.

Consumer-Centric Services: IGI adopted a B2C approach with educational courses and the IGI School of Gemology, enhancing its leadership in gemological education.

“Glocalization” Strategy: Roland combined global leadership with local expertise, empowering regional managers and fostering employee loyalty with low attrition rates.

During Roland’s time as CEO, IGI grew to become the second-largest player globally. In 2018, the company was sold to Fosun International, but Roland retained a 20% stake in the business after the deal.

Stake sale to Fosun International: In 2018, Roland and Marcus Brauner sold 80% of IGI to Shanghai Yuyuan Tourist Mart for $109 Mn. This deal was part of Fosun International’s strategy (Yuyuan’s parent company) to grow its consumer investments. Fosun planned to use IGI’s expertise to expand into emerging markets like China, then the second-largest diamond market.

The entry of Blackstone – After COVID, Fosun faced financial troubles with $36 Bn in debt and therefore in 2022, decided to sell $11 Bn in assets to stabilize its finances. As part of this, in 2023, Fosun sold IGI to Blackstone for $456 Mn, earning a 3.6x return in just five years. Roland also sold his 20% stake in the company for the remaining $114 Mn making Blackstone Asia the sole promoter of IGI.

Now, with the ownership history out of the way, let’s understand the business of IGI.

International Gemological Institute – Business

IGI specializes in certifying natural diamonds, lab-grown diamonds (LGDs), colored stones, and studded jewelry.

Its business is divided into four key areas:

1. Diamond Grading: This includes grading both natural and lab-grown diamonds, which together make up around 65% of IGI’s revenue (~46% from LGDs and ~19% from natural diamonds).

2. Colored Stones Certification: IGI evaluates the quality and authenticity of gemstones like rubies, emeralds, and sapphires.

3. Jewelry Grading: It also assesses finished jewelry pieces for quality and authenticity.

These two segments combined contribute about 32% of total revenue.

4. Educational Programs: IGI offers courses in gemology, diamond grading, and jewelry design, accounting for the remaining 3% of revenue..

(Source: DRHP)

Diamond grading is essential across the entire value chain, and IGI stands out as one of the leading global players. It is one of the only three organizations worldwide offering a full range of certification services for natural diamonds, lab-grown diamonds, colored stones, and studded jewelry, making it a key player in the industry.

(Source: DRHP)

IGI’s Customer Base – IGI operates mainly as a B2B business with a global customer base of 7,500 clients across 10 countries, including lab-grown diamond producers, natural diamond and colored stone wholesalers, jewelry manufacturers, and retailers. In 2023, IGI ranked as the second-largest independent certification provider worldwide for diamonds, studded jewelry, and colored stones.

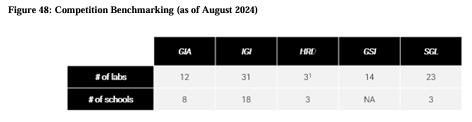

Leadership Position – As of August 2024, IGI is the largest global gemological institute with 31 laboratories and 18 schools, leading its peers in scale. IGI held a 42% share in studded jewelry certifications and led the LGD segment with a dominant 65% market share, solidifying its leadership in the certification industry.

(Source: DRHP)

So, a pretty cool business. Right? But let’s come to the main topic: IGI India.

IGI India

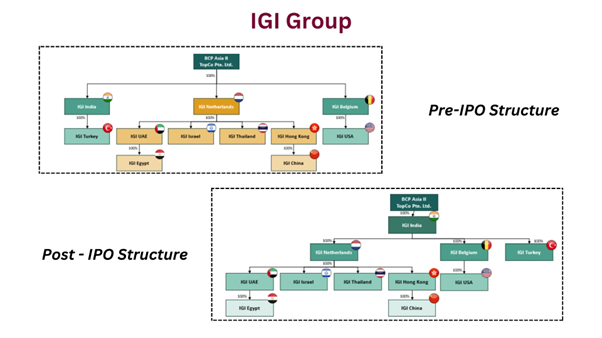

Currently, Blackstone owns the IGI group via. three different entities, IGI India, IGI Belgium Group and IGI Netherlands Group. Out of these, ~75% of the group’s business comes from India, making IGI India the flagship organization, and that is the one getting listed on Indian exchanges.

Here are some interesting facts about IGI India that show its dominance:

• IGI’s Entry and Leadership: IGI was the first international certification lab in India (established in 1999) that holds a 50% market share in diamond, studded jewelry, and colored stone certifications.

• Lab-Grown Diamonds (LGDs): IGI is the largest certifier for LGDs in India, serving over 5 Indian growers and earning more than Rs. 100 crore revenue in FY 2023.

• Pan-India Network: IGI has the largest laboratory network in India among global peers, complemented by its international reach, offering a competitive edge.

• D Show Initiative: IGI’s annual D Show, running for 12 years, connects over 80 jewelry manufacturers and 800 visitors.

• Notable Certifications: IGI-certified jewelry for the Ram Lalla idol at Ayodhya’s Shri Ram Mandir (January 2024) and the world’s largest lab-grown diamond, a 75.33-carat gem named “Celebration of India” (March 2024)

(Source: Hindustan Times)

All of this has placed the company at the leadership position in India, set to take advantage of the growing demand for diamond Jewelry in the country.

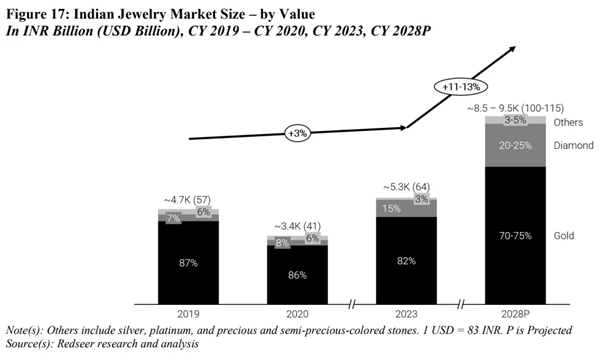

Gold has always been the biggest part of India’s jewelry market, contributing ~87% in 2019. Going forward, the share of gold jewelry is expected to drop to 70-75% by 2028. On the other hand, diamond-studded jewelry has been growing fast—it went from 7% in 2019 to 15% (~Rs. 780 Bn or $9 Bn) in 2023. Thanks to rising incomes, changing tastes, more working women, increasing demand for diamonds in weddings, and affordable LGDs, this segment is expected to grow at a 20% CAGR expecting to contribute 20-25% of the market by 2028.

(Source: DRHP)

This augurs well for IGI as it is well-positioned to benefit from the growth of the diamond industry.

So, why the IPO? Well its all thanks to the promoter company Blackstone, a major private equity player with an AUM of $1.1Tn only.

IPO Rationale: Blackstone

IGI India plans to use Rs. 1,300 crore from its Rs. 1,475 crore fresh IPO proceeds to acquire IGI Belgium and IGI Netherlands from Blackstone, consolidating all three verticals into a single entity. This move aims to integrate IGI’s strong manufacturing base in India with its retail-focused operations in Western markets served by the Belgium and Netherlands entities, creating a unified global structure. By combining its 10 global locations under one entity, IGI wants to streamline operations and enhance collaboration between manufacturers and retailers.

(Source: DRHP)

After the acquisition, IGI’s entire global business will now come under the Indian entity, which is set to list on Indian stock exchanges. If IGI were still a family-owned business, this listing might not have happened. But with Blackstone, a private equity powerhouse, it’s all about maximizing value. And listing IGI in India, currently a hotspot for IPOs, is a smart move.

In this IPO, Blackstone is the biggest winner. Here’s how:

– Money flowing to Blackstone: Rs. 2,750 crore (OFS) + Rs. 1,300 crore for the sale of IGI Belgium and Netherlands = Rs. 4,050 crore in cash for Blackstone.

– Additionally, Blackstone’s remaining 76.5% stake will be valued at over Rs. 13,500 crore.

Not bad for an acquisition made just 18 months ago for $456 Mn (~3,500-3,700 crores)!

I guess they are called Smart Money for a reason. Now let’s look at the financials of the company.

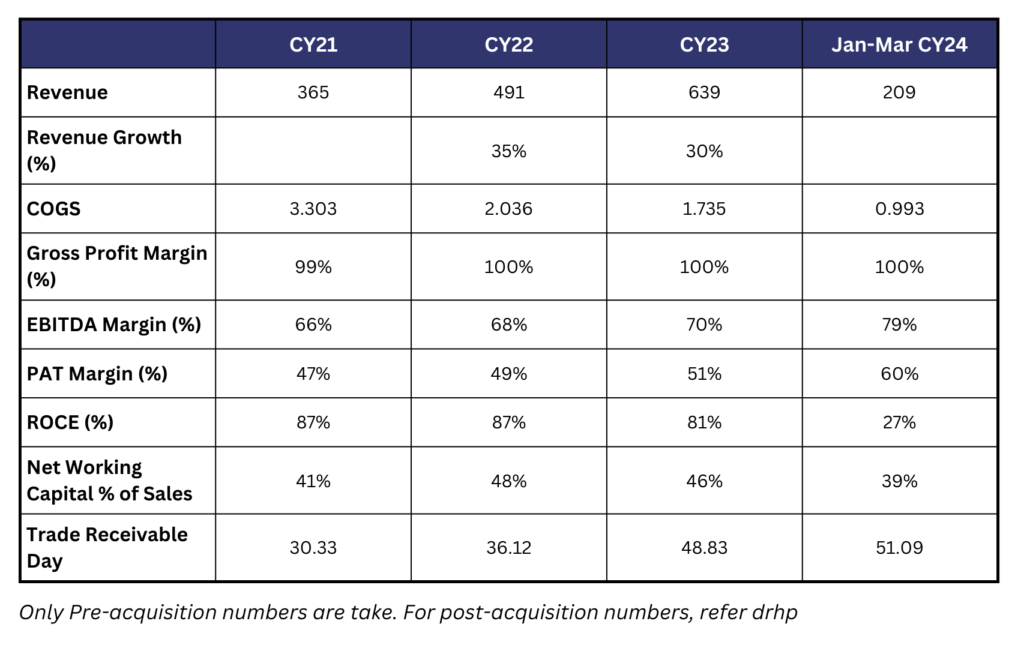

Financial Overview: A Piece of Art

I mean how many businesses do you know that has such pretty margins?

(Source: DRHP)

In summary, a Quick Look at numbers suggests that this is a fast growing business with mouthwatering margins. However, no businesses in this world are without risks.

Risk

As per the DRHP, these are the major risks for the company:

- Advanced Counterfeiting: Improved synthetic production and treatments make it harder to distinguish natural from lab-grown diamonds, requiring investment in cutting-edge equipment and skilled personnel.

- Reputation Risks: Fraud or inaccuracies in certification can harm trust and damage the reputation of certification bodies.

- Technological Disruption: AI and automation in grading may reduce the need for human expertise, altering industry dynamics.

- Counterfeit Certificates: Fake certificates undermine trust, necessitating advanced security features and anti-counterfeiting measures.

- Colored Stone Challenges: New treatments and synthetic technologies for colored stones require constant innovation to stay ahead.

- Economic Downturns: Reduced disposable income during economic slowdowns, like the COVID-19 pandemic, impacts demand for jewelry and certification services.

- Geopolitical Risks: Conflicts in diamond-producing regions disrupt supply chains, causing delays and potential revenue losses.

Closing Remarks:

Deciding to invest in this IPO is up to you, but IGI is undoubtedly a unique and niche business with huge growth potential worldwide. Its strong position in diamond certification, especially lab-grown diamonds, makes it a key player in the industry. Listing the company in India shows how important the Indian market has become as a global hub for diamond manufacturing and certification, proving it’s a great place for high-growth businesses to base themselves.

Disclaimer: This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter. Bastion Research and its associates do not have any stake in IGI Ltd.

Meme of the Week

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.