Exiting bottling in India to focus on what matters

Today we will dive into the fascinating journey of Coca-Cola. We’ll look at the key moves that propelled it to global fame and why it’s now stepping away from its bottling business. Yes, you heard that right. Coca-Cola is exiting the bottling venture. Let’s break it down from the beginning.

Innovation to Cure Headache and Hangover

Even the simplest innovation, when marketed well, can become an iconic and timeless brand. Take Coca-Cola, for example. It all started when pharmacist John Stith Pemberton, struggling with morphine addiction from a war injury, created a tonic using caffeine from kola nuts and a small amount of cocaine from coca leaves. This mixture, initially intended to cure headaches and hangovers, was sold with soda water at a local pharmacy. Little did Pemberton know that this humble beverage would evolve into the globally recognized drink we all know today.

(First pharmacy to sell Coca Cola)

(Left: Dr. John Stith Pemberton, Right: Original tonic of Coca Cola)

Coca Cola Company

The real credit for Coca-Cola’s global success goes to Asa Griggs Candler, an American pharmacist who bought the formula and brand from John Stith Pemberton for $2,300 in 1888. By 1892, he had formed The Coca-Cola Company, trademarked the brand, and created a large-scale operation.

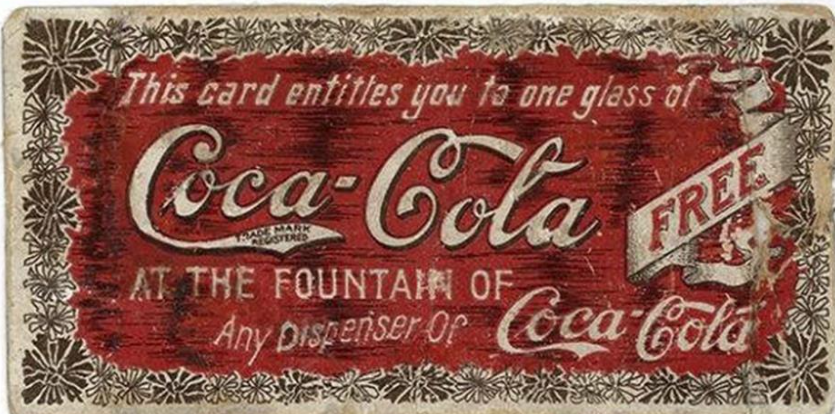

Candler was a marketing genius. He plastered the Coca-Cola name on everything from calendars to clocks. Back then, the company only made and sold barrels of syrup to pharmacists, who mixed it with soda water and sold it to customers. The entrepreneur, Candler gave away coupons for a free glass of Coca-Cola and offered pharmacists the first barrel of syrup for free. Those pharmacists quickly became paying customers when they saw people flocking in with their coupons. By 1895, Coca-Cola was selling its products across the USA.

(Coupon for a free glass of Coca Cola)

Bottling Operations

Coca-Cola’s journey to becoming a global brand took a significant turn in 1899. Asa Candler, initially reluctant about bottling Coca-Cola, sold the exclusive rights to bottle the drink across the USA to Benjamin F. Thomas and Joseph B. Whitehead for just $1. This “$1 contract” led to rapid expansion, and by 1906, Coca-Cola was being bottled not just in the USA but also overseas by various bottling companies.

In 1915, the iconic Coca-Cola bottle was created by Root Glass Co. and approved by the Bottlers Association, becoming the standard bottle we recognize today.

Between 1900-1920, the number of bottling plants grew from two to over 1,000, with 95% being locally owned and operated.

By 1926, Coca-Cola began selling its concentrate overseas, establishing bottling operations in countries such as Belgium, China, Colombia, Haiti, Italy, Mexico, and Spain through independent bottling partners. This marked the beginning of Coca-Cola’s global presence.

Over the years, Coca-Cola continued to invest heavily in marketing and promotion, granting exclusive bottling rights to different bottlers for their territories. This strategy helped Coca-Cola become a beloved global brand, enjoyed by generations.

Agreement With Bottling Partners

Coca-Cola’s business strategy involves partnering with bottling companies, here’s how it works:

Initial Investment: Coca-Cola initially invests in bottling partners’ operations to support them.

Exclusive Rights: These partners are authorized to prepare, package, distribute, and sell Coca-Cola beverages in their designated territories.

Syrup Supply: Bottling partners must buy the syrup from Coca-Cola or authorized suppliers.

Exclusivity: Coca-Cola refrains from selling or distributing its products in the partner’s territory to guarantee exclusivity.

Promotional Support: Coca-Cola handles promotional and marketing activities on behalf of its partners.

This strategy has been immensely successful, allowing Coca-Cola to maintain a strong global presence while leveraging the expertise of local bottlers.

Coca-Cola India

Coca-Cola first entered India in 1956 and quickly became a popular beverage. However, due to political challenges, the company had to exit the market in 1977. Coca-Cola made a return in 1993, following India’s economic liberalization. To grow aggressively, Coca-Cola acquired local beverage brands from Parle, including Thumbs Up, Limca, and Gold Spot. This move helped diversify its product portfolio and provided access to an extensive distribution network, enabling it to compete effectively with PepsiCo.

(Early Coca Cola ad in India)

To support this growth, Coca-Cola established Hindustan Coca-Cola Beverages Pvt. Ltd. (HCCB) in Bengaluru, a wholly-owned bottling company.

Expansion and Consolidation

Over the years, Coca-Cola expanded its operations in India and other countries like Malaysia, Myanmar, Nepal, Bangladesh, Singapore, and the Philippines. However, some operations faced challenges related to quality, production infrastructure, and product delivery. To address these issues, Coca-Cola created the Bottling Investments Group (BIG) in 2006 to manage and consolidate its owned bottling operations worldwide, including HCCB.

Since its re-entry in 1993, Coca-Cola’s strategic moves and resilient approach have made it a significant player in the Indian beverage market, ensuring sustained growth and success. Ever since its establishment, HCCB has also performed remarkably for the beverage giant. To give you a sense of its current scale, in FY23 alone, the company reported a 40% increase in revenue, reaching ₹12,840 crore, while profits more than doubled to ₹809 crore compared to ₹375 crore in FY22.

The Great Divestment: Coca-Cola’s Strategic Shift

Since 2017, Coca-Cola has been selling its ownership in bottling companies once they become self-sufficient. The company started by transitioning its U.S. bottling operations to nearly 70 independent bottlers. Now, it looks like HCCB’s turn has come.

This is a part of Coca-Cola’s journey towards becoming an asset-light company. The company has been gradually reducing its ownership in bottling operations to focus more on brand-building, marketing, and innovation. This strategy involves divesting bottling assets to independent bottlers who can operate more efficiently and leverage local market expertise.

The biggest move in this strategy was dissolving BIG. Coca-Cola started winding down its Bottling Investments Group (BIG) in 2023, and just a few days ago, on June 30, 2024, the corporate office of BIG was shut down. Now, HCCB and its operations in India, Nepal, and Sri Lanka are directly under Coca-Cola’s control. This is a major step toward Coca-Cola’s goal of becoming a truly asset-light company.

It’s pretty clear that with BIG’s operations now stopped, Coca-Cola is also planning to sell its stake in Hindustan Coca-Cola Beverages (HCCB). In fact, HCCB has already handed over its bottling operations in several regions to different local bottlers:

Rajasthan: Divested to Kandhari Global Beverages in January 2024.

Bihar: Divested to SLMG Beverages in January 2024.

North-East and West Bengal (Select Areas): Divested to Moon Beverages in January 2024.

Approaching Potential Buyers

Various media articles indicate that Coca-Cola India has already approached at least four top Indian business families to sell a significant minority stake in HCCB:

Bhartia Family (Jubilant Group, Dominos Pizza), Burman Family (Dabur Group), Parekh Family (Pidilite Industries) and the Promoter family of Asian Paints.

The asking price for the stake is between $800 million to $1billion. The idea is to sell it to someone with a deep understanding of the Indian market. For instance, the Jubilant Group could explore investment through its group companies, as pizza pairs perfectly with Coke.

Effects of Divestment

- Operational Efficiency: Partnering with local bottlers could enhance operational efficiency and market penetration, potentially increasing market share. The shift will allow Coca-Cola to reduce fixed costs and streamline operations by transferring bottling responsibilities to independent partners

- Focus on Core Competencies: By divesting bottling operations, Coca-Cola can focus on brand-building and marketing, which may strengthen its market position.

- Local Expertise: Independent bottlers with local market knowledge can better navigate regional preferences and distribution challenges, potentially boosting sales.

- Financial Flexibility: The substantial capital raised from the sale can be reinvested in strategic growth areas, further solidifying Coca-Cola’s market presence.

To conclude, Coca Cola is taking necessary strategic moves to enhance its focus on brand-building, innovation, and taking care of market competition while leveraging the efficiencies of independent bottlers. Now the company can focus on enhancing its greatest asset – the “Coca Cola” brand.

Fin Meme of the Week