In this blog, we discuss about Hyundai Motor India (HMI), the second largest car manufacturer in India by sales volume.

Last Friday, something cool happened in the Indian market! Hyundai Motors India (HMI), the second-largest car company in India, filed its Draft Red Herring Prospectus (DRHP) with SEBI for an IPO. If everything goes smoothly, we could see this IPO hit the market in the next 1-2 months. So, why is this such a big deal, you ask? Well, this IPO is set to break records and achieve several No.1s and No.2s!

Let me explain:

- Major Auto IPO after 20 Years: Hyundai Motor India will be the first major car manufacturer to go public in India after 20 years, since Maruti Suzuki’s listing back in 2003.

- Exclusive Club: With this listing, HMI will become the only other pure-play car company in India aside from Maruti Suzuki (at least until Tata Motors’ demerger).

- Hyundai’s First International IPO: This will be Hyundai Motor Co’s first IPO outside of its home country, South Korea (yes, Hyundai is a South Korean company).

- Record-Breaking Fundraise: The company is expected to raise around ₹25,000 crore, making it the biggest IPO in India. The record is held by LIC which raised Rs. 20,557 crore back in 2022.

- Largest Foreign-Owned Fundraising: This will also be the largest amount of money raised by any foreign-owned company in India.

Pretty cool! right?

Before we move ahead, here are some details about the IPO:

Offer Size – Rs. 25,000 cr. ($3bn)

Expected Valuation – Rs. 1.5 Lac Cr. ($18Bn)

Dilution – 17%

Promoter Holding After IPO – 83%

Type of Offer – Offer For Sale

That’s right, the entire offering is an OFS, meaning all the funds will go to the promoters. After the offering, they will need to reduce their holding by another 8% to meet the minimum public shareholding requirement of 25%.

Fun Fact: With this IPO, all four major passenger vehicle players—Maruti Suzuki, Tata, Mahindra and Mahindra, and Hyundai—will be listed on stock exchanges. Together, they account for 80% of the Indian passenger vehicle market.

Now, let’s understand the business of Hyundai Motor India before it comes out with its bumper IPO.

Hyundai Motors India: The Beginning

When the Indian economy opened up, Hyundai saw a great opportunity and entered India in 1996. At that time, the Indian automobile market was dominated by a few major players like Maruti Suzuki, Hindustan Motor, and Premier Auto. But Hyundai wasn’t deterred.

It recognized the immense potential in India and was confident in its ability to capture the market by offering innovative and reliable vehicles. Their Japanese rival, Suzuki Motors, had already shown that with the right approach, one could make a significant impact in India.

Armed with a manufacturing unit in Chennai, Hyundai Motor India (HMI) launched its first car, the “Santro,” in 1998 (90’s kids, feeling old yet?). The Santro introduced the first tall boy design in India, featuring a higher roofline and more upright stance, and it became an instant hit. Within just two years, 600,000 units were sold, and the car won multiple accolades.

From the start, Hyundai focused on selling products with the latest premium features. By offering features like AC and power windows in a car priced at around ₹3 lakh, the Santro became a strong competitor to the popular Maruti Suzuki Zen.

The cherry on top was making Shah Rukh Khan the brand ambassador. Soon, the Santro and Hyundai became household names in India.

Trial & Errors: Struggling with Identity

As Arthur Ashe once said, “Early success is a terrible teacher. It seduces smart people into thinking they can’t lose.” In the 2000s, Hyundai Motor India (HMI) struggled to find its identity.

After their initial success, HMI thought they had mastered the Indian market. However, they soon faced challenges with new cars like the Sonata and Getz. Despite being technically good, these models failed to attract consumers due to their high prices.

While the Verna became a massive success, helping the company reach 1 million cars sold by 2006, HMI still struggled with brand positioning. Don’t get me wrong, HMI was so successful that they had to start another manufacturing plant in 2007 to keep up with demand. However, they still found it hard to position their products effectively and launched failed products.

Building a Brand

Hyundai Motor India (HMI) realized they needed a change. They dove deep into understanding the Indian market through extensive research. The result? Innovative, feature-rich products at attractive prices.

HMI diversified its product portfolio and continuously updated successful models with new features. They found the sweet spot by offering cars packed with the latest features at prices that were neither too premium nor too cheap, maintaining a strong brand image.

This strategy paid off. Failures dropped drastically, and HMI hasn’t seen a major disaster since.

SUV: The ‘Aha’ Moment

As the Indian market grew, so did the preference for premium products, especially SUVs. The appeal of a large car with more space and a tall ride height for navigating uncertain Indian roads was undeniable.

Post-COVID, the SUV craze skyrocketed. To meet this demand, all OEMs introduced SUVs, further fueling the segment’s growth. When Tata and Maruti Suzuki launched their own compact, affordable SUVs, the demand for hatchbacks plummeted.

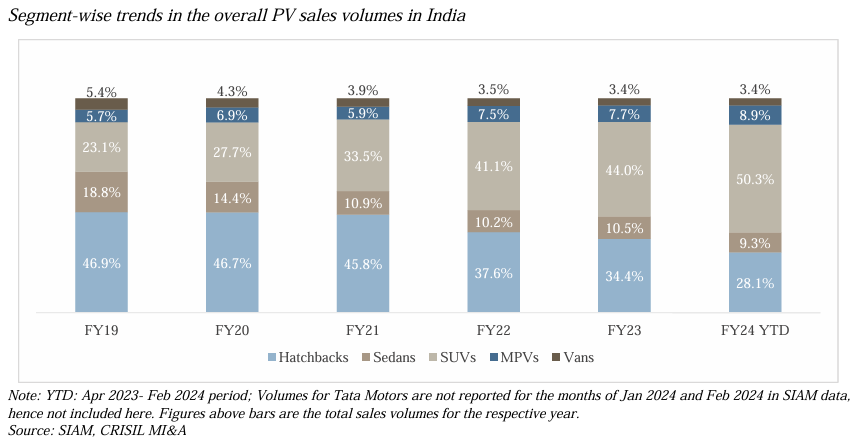

Let me share a data point with you, in the last 5 years, over 30 SUVs were launched in India, compared to just 4 hatchbacks and 3 sedans. This shift led to SUV segment experiencing a 23% CAGR growth between FY19-24, four times the industry growth rate of 5%. Consequently, the share of SUVs in overall passenger vehicle sales jumped from 23% in FY19 to 50% in FY24.

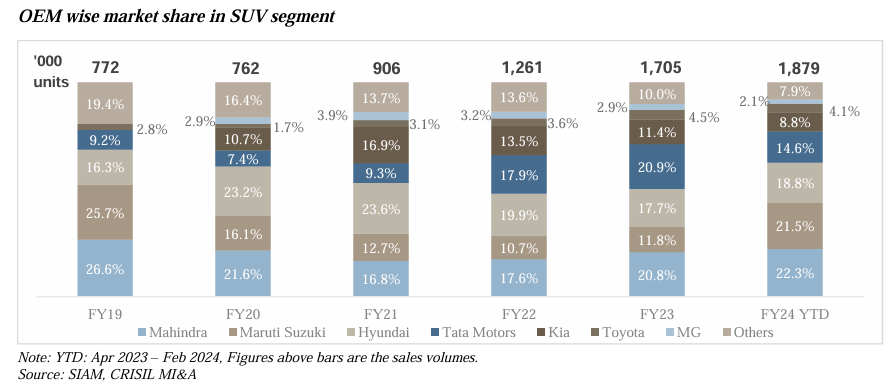

One of the biggest beneficiaries of this shift was Hyundai. Starting with the Creta, Hyundai saw strong growth and held a market share of around 68% in mid-sized SUVs in FY19. Although competition intensified with Maruti Suzuki, Tata, Mahindra, and Hyundai all launching multiple SUVs, Hyundai’s market share decreased to 30%.

Despite the contraction, the overall segment’s growth boosted Hyundai Motor India’s sales over the years. This success was driven by the Creta, which Hyundai continuously upgraded with the latest tech, and the introduction of the Venue in India.

As a result, over the last 5 years, HMI has managed to maintain and increase its market share in the SUV market from 16% to ~19%.

Hyundai India: A Powerhouse

Today, Hyundai India is the second-largest car manufacturer in the country , a position it has held since FY09. It’s also the second-largest exporter, selling cars across Asia and LATAM, boosting India’s image as a manufacturing powerhouse. The company clocked sales of ~Rs.60,000 crore in FY23.

With an output of 1.1 million units in CY23, Hyundai India accounts for 29.5% of Hyundai Group’s total production and boasts the largest overseas production. India is Hyundai’s largest market after South Korea and the US. And the company is just getting started.

Future Plans

With the growing preference for EVs and government support, Hyundai is ready to seize the opportunity. It already offers two premium EV models and has acquired a manufacturing plant in Talegaon from General Motors India to boost its production capacity and support EV manufacturing.

Looking ahead, Hyundai Motor India (HMI) plans a massive expansion program worth ₹33,200 crore. This includes increasing production capacity, launching new models, and investing in new technologies like EVs and batteries. Specifically, ₹26,000 crore will be invested in Tamil Nadu and an additional ₹7,000 crore in the Talegaon factory.

As I mentioned earlier, Hyundai Motor India is just getting started. Buckle Up, the second largest car manufacturer in India, is aiming for a successful listing soon.

Fin Meme of the Week