But Not All Deals Are Equal

In today’s edition of TOPICAL Wednesday, we will talk about the ongoing M&A activities across different markets in India.

So, the Nifty and Sensex finally witnessed a correction of 3.24% and 3.33% respectively in the past 5 days (can you even call it a correction?) as foreign investors sold Indian stocks for the good old Chinese stocks. Whether this will be a long-term trend, could the market fall more from here, is this just a normal hiccup, and can domestic buying be strong enough to accommodate this selling, is something I would like to know too (so that I am prepared to keep sulking with the red in my portfolio). However, getting our head out of the stock market is a necessity of the day.

In today’s newsletter, we will explore two sides of the market that are at distinct stages of development, where there is a lot of M&A activities taking place.

These markets are:

1. PE/VC Funds and Startups: Private equity and venture capital-funded startups that are showing signs of maturity.

2. Established Companies: Companies that are witnessing consolidation.

So, let’s get started with what’s happening with PE/VC funds.

Private Equity/ Venture Capital:

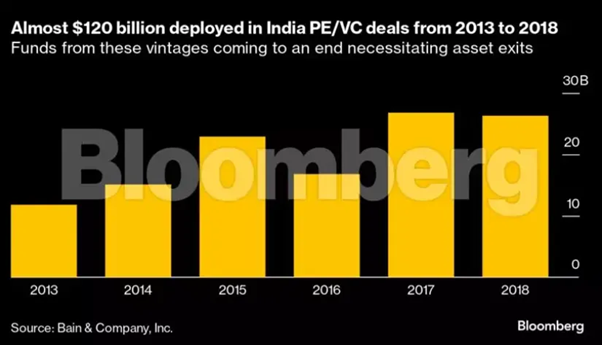

In the 2000s, Indian private equity and venture capital gained traction, funding new startups such as Flipkart, InMobi, and Yatra.com. However, significant investments arrived in the mid-2010s with the rise of companies like Paytm, Swiggy, Zomato, Byju’s, and OYO. Between 2013 and 2018 alone, ~$120 Bn was invested in the Indian private market through multiple fundraising rounds.

Private equity and venture capital funds invested in ideas with the expectation of benefiting from the business’s growth. These funds typically have a holding period of 5-10 years, depending on the type of fund they run after which they have to pay back their investors or limited partners (LPs). The investments made in the 2010s are now maturing, and it’s time for these VCs to return funds to their LPs along with their profits.

(Source: Economic Times)

These funds have a couple of options when it comes to selling their stake in a company. They can either take the company public or sell their stake to another fund or company. Despite some impressive public listings of Indian tech companies like Nykaa, Zomato, and Indiamart, and notable buyouts such as Caratlane by Titan and Flipkart by Walmart, exiting investments in startups remains challenging for investors. When it comes to IPO, startups that debuted their IPOs are still low compared to the many startups funded by PE/VC funds. As a result, the next best option or rather the only option has been Secondary sale

Secondary Sale

In a secondary sale, investors purchase existing shares or commitments from primary investors or directly from the private equity fund. Currently, venture capitalists (VCs) in India are holding onto $92 billion in unrealized deal value from companies they have supported for over six years. As a result, VCs that cannot take their portfolio companies public are turning to secondary sales.

According to Moneycontrol, shares of companies like BharatPe, ShareChat, Cultfit, Meesho, and Swiggy (which is preparing for an IPO) are actively being traded in secondary transactions. These deals involve not only investors but also founders and employees with stock options.

Interestingly, even prominent VC managers who traditionally focused on primary fundraising have shifted to participate in the secondary sale market. The appeal of this market is further enhanced by the fact that shares of private companies are often available at a 20-25% discount, and sometimes as high as 40%, due to the less liquid nature of primary markets.

Continuation Funds: The New Frontier in Private Equity

Continuation funds are emerging as a strategic tool for private equity sponsors to extend the investment period of their top-performing assets. These funds allow assets to be transferred from an existing fund to a new one, providing liquidity options for current investors who want to exit, while attracting new investors interested in mature, high-performing assets. Managed by the same sponsor as the original fund, continuation funds come with distinct terms and conditions that can be negotiated with investors.

ChrysCapital has successfully raised $700 Mn through a continuation fund to maintain its stake in the National Stock Exchange (NSE), offering liquidity options to its existing investors. This move allows ChrysCapital to continue benefiting from its investment in NSE without selling it outright. The success of this approach has sparked significant interest among private equity firms, with expectations that three to four similar continuation funds may launch in India over the next year, further invigorating the secondary market for Indian private equity assets.

Key Characteristics of Private Markets

Unlike in the US, Europe, and some parts of Asia where secondary markets mainly focus on buyouts, India’s secondary deals typically involve minority stakes. Currently, there’s a growing interest from secondary investors looking to take advantage of a strong deal pipeline in India.

This includes:

– Companies that are expected to go public in the next 18 to 24 months

– Sales of asset portfolios by venture capital funds

– New continuation funds being established by private equity and venture capital firms

As per some estimates, these transactions have the potential to reach a value of ~$20 Bn annually. I think, even if you have a small network of investors, you might have already heard about the buying and selling of companies in the secondary or unlisted market which shows the level on interest even at retail level.

This is how PE/VC companies that have funded startups for the last 5-10 years are behaving as their portfolio companies reach their next stage of corporate life.

Now, let’s discuss the M&A situation in established companies.

M&A Activities in India

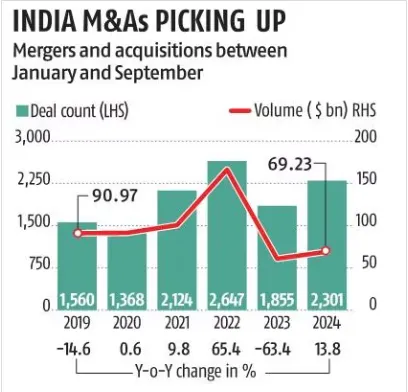

From January to September, M&A activities in India reached $69.2 Bn, marking a 14% increase compared to $60.8 Bn during the same period last year. This growth comes after a year of decline in M&A activities, highlighting a resurgence in the market.

(Source: Business Standard)

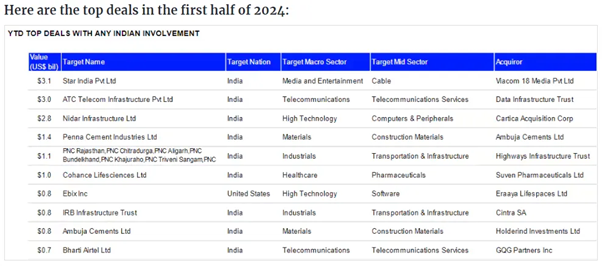

This growth is driven by both Indian public companies and private equity firms. Some of the major acquisitions that took place in H1FY24 are:

(Source: Bastion Research)

In recent years, deal-making has seen its share of ups and downs across various industries. However, some sectors have experienced a surge in M&A activities as they undergo consolidation.

Great Consolidation

While private equity and VC-backed startups are scaling up and reaching maturity through IPOs or secondary sales, traditional sectors are experiencing a different kind of maturity. In these industries, only a few companies are likely to thrive in the long run, while others may be phased out, shut down, or acquired.

These sectors are:

Cement

The Indian cement sector has seen a surge in M&A activities, especially since Adani entered the market in 2022 by acquiring Holcim’s local units, Ambuja Cement and ACC.

Adani Group’s Expansion

– Holcim Acquisition (May 2022): Adani entered the cement industry by acquiring Ambuja Cements and ACC from Holcim for $10.5 Bn, marking the largest deal in the sector.

– Penna Cement (June 2024): Ambuja Cements, part of Adani Group, bought Penna Cement Industries for $1.25 Bn to strengthen its presence in South India.

– Sanghi Industries (August 2023): Adani acquired an 83% stake in Sanghi Industries for $295 Mn, Adani’s first major move after earlier scrutiny.

– Heidelberg Materials India: Talks are underway for Adani to acquire Heidelberg’s Indian operations, potentially worth $1.2 Bn.

UltraTech Cement’s Strategic Moves

– India Cements (July 2024): Acquired a controlling stake for $472 Mn, following an earlier 23% stake purchase for $228 Mn, countering Adani’s expansion.

– Kesoram Industries (November 2023): Purchased cement assets for $645 Mn to boost its position in South India.

Dalmia Bharat

– Jaiprakash Associates (December 2022): Dalmia Bharat acquired assets for $687 Mn to enhance its Central India footprint.

These acquisitions reflect a broader trend of consolidation driven by competition, rising costs, and the need for economies of scale. As major players like Adani and UltraTech continue their strategic expansions, further consolidation in the Indian cement industry may take place.

Media & Telecommunications

Recent mergers and acquisitions in India’s media and telecommunications sector showcase strategic moves by major players to enhance their market presence.

Reliance and Disney India Merger:

Reliance’s media companies have merged with Disney India in a deal valued at $8.5 Bn. This merger combines Disney’s rich content with Reliance’s distribution network, significantly boosting Reliance’s influence in the Indian media sector.

Adani Group’s Acquisition of NDTV:

The Adani Group increased its stake in NDTV by acquiring an additional 27.26%, valued at ~₹602.30 Cr. This move strengthens Adani’s position in the Indian media industry.

Bharti Enterprises’ Telecom Investment:

Bharti Enterprises acquired a 25% stake in a British telecom group for $4 Bn, marking one of the largest deals in the telecommunications sector and reflecting Bharti’s strategic expansion into international markets.

After the merger between Reliance and Disney, the Indian media sector will primarily consist of three major conglomerates: Reliance-Disney, Zee Entertainment, and Sony Television. These entities will dominate the market, with additional competition only coming from OTT platforms like Netflix and Amazon Prime.

Healthcare

The Indian healthcare sector is buzzing with mergers and acquisitions, driven by the need for consolidation, tech integration, and expansion into underserved markets.

Healthium MedTech by KKR:

KKR Asian Fund IV acquired Healthium MedTech for $843 Mn, the largest deal of the quarter, highlighting interest in health tech.

HCG’s Cancer Hospital Acquisition:

Healthcare Global Enterprises bought Mahatma Gandhi Cancer Hospital in Vizag for ₹414 Cr. to standardize cancer care across India.

Max Health Institute’s Expansions:

Acquired Alexis Multi-Speciality Hospital in Nagpur for ₹412 Cr. and Sahara Hospital in Lucknow for ₹940 Cr. to expand its network.

Dr. Reddy’s Laboratories:

Acquired Northstar Switzerland SARL for $633 Mn, marking a significant international expansion.

These activities reflect a trend of consolidation in Indian healthcare, focusing on strategic expansions and improved care across wider regions, especially in Tier 2 and Tier 3 cities.

Closing Thoughts

On one side, the PE/VC market is witnessing increased M&A activity out of necessity, while established companies are doing so for survival. As India continues to progress and grow, such activities will be seen across various markets.

Meme of the Week

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.