Sambhv Steel’s IPO Unwrapped

The importance of steel in any economy cannot be overstated. It’s one of the most fundamental sectors underpinning national development. In India’s case, its role becomes even more critical as the country accelerates growth through large-scale government spending in infrastructure and real estate. Steel, being central to this momentum, is poised to continue or increase.

Today, after a long gap, we’re covering an IPO, Sambhv Steel Tubes Ltd. The name says steel, and rightly so. But what drew us in wasn’t just the sector. It was Sambhv’s position in it. This is no ordinary steel pipe maker. Sambhv is a single-location, backward-integrated manufacturer of ERW steel pipes and structural tubes, with operations spread across the entire value chain. In plain English: it controls every single step from raw material to finished pipe. That’s rare.

India is the second-largest steel producer globally, but still lags in per capita steel consumption, which means the long-term runway for growth is wide open. Steel plays a foundational role across infrastructure, housing, automotive, water, and capital goods, making it one of the economy’s core drivers. Government schemes like the National Infrastructure Pipeline, Smart Cities Mission, etc are fuelling structural steel and pipe demand. The industry itself is split between integrated giants (like JSW and Tata Steel) and mid-sized players focusing on pipes, long products, and value-added steel.

The landscape has become more competitive, helped by local availability of iron ore and coal, and a shift to organized supply chains post-GST. But it’s not all smooth. The industry wrestles with input cost volatility, environmental regulations, shifting global trade flows, etc. Despite its cyclical nature, steel remains a barometer of infrastructure activity, and a key beneficiary of India’s CAPEX story..

Coming back to Sambhv, as we go along, we’ll try to understand what makes Sambhv steel a unique player in this important but highly competitive industry.

But first things, first:

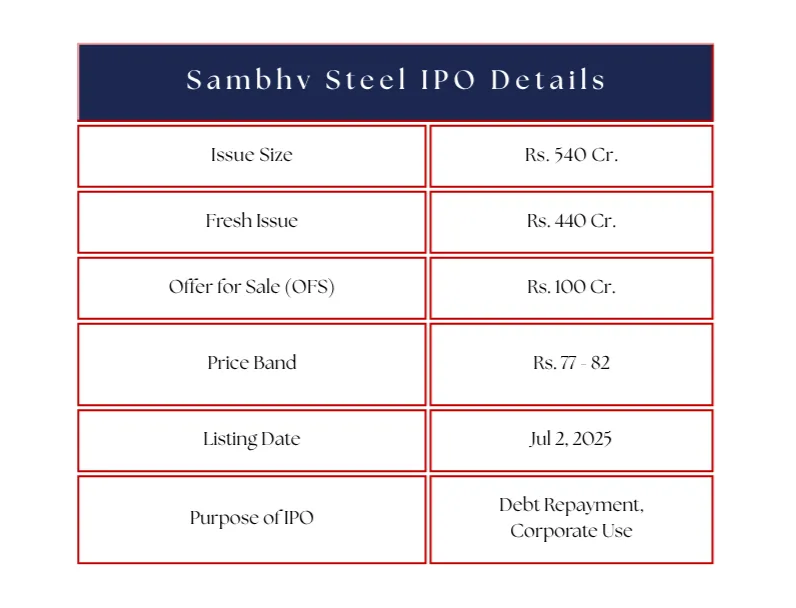

(Source: Company, Bastion Research)

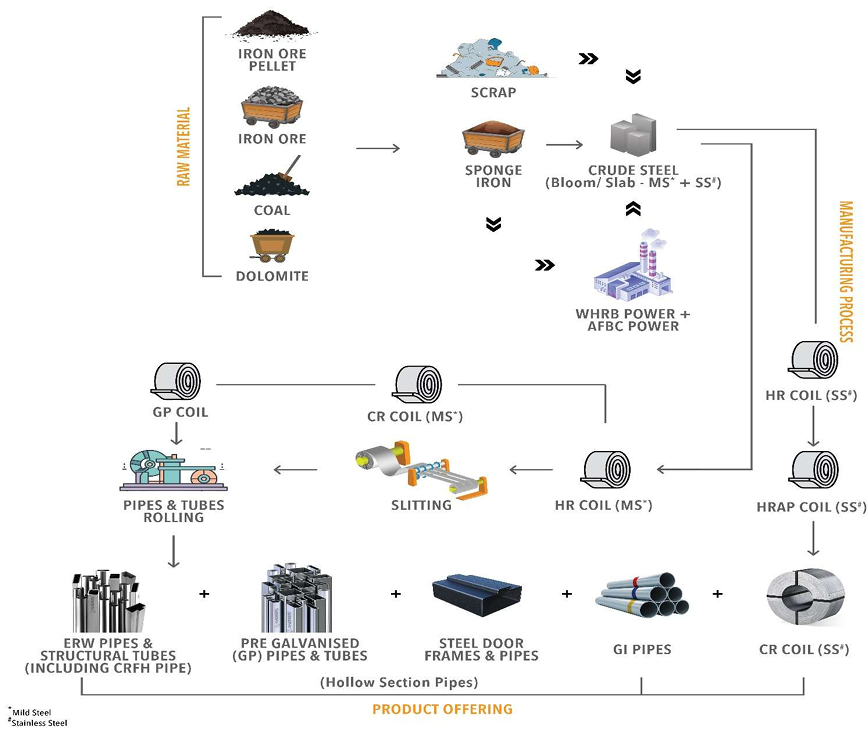

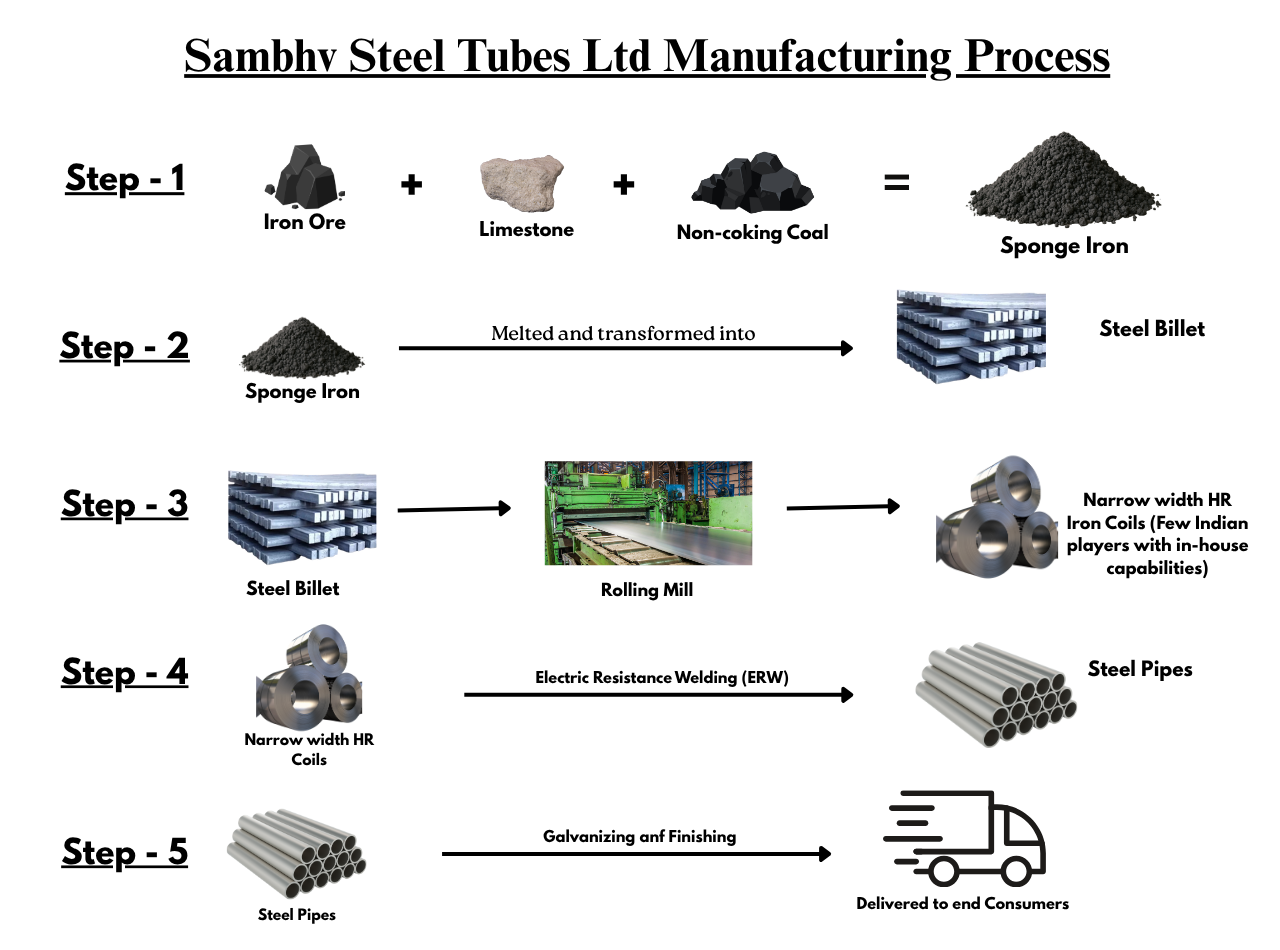

Before we start talking in detail about the company, let’s understand the value chain first. This will give a good idea of why backward integration is such a special thing that this company possesses.

Steel Pipes Value Chain:

(Source: Company)

Sponge Iron – Sponge iron is the basic raw material used to make steel. It’s produced by removing oxygen from iron ore, usually with coal or gas in a furnace. The result is a porous, rough-textured material that looks like a sponge, hence the name.

Steel Melting & Billet Casting – The next step is to convert sponge iron into steel billets, long, rectangular or square-shaped bars of solid steel. These are created by melting the sponge iron in a furnace. Once casted, the billets are reheated and converted into different forms such as hot-rolled (HR) coils, steel rods, and pipes and tubes.

Rolling Mill, HR Coil Production – In this step, billets are heated and rolled into hot-rolled coils (HR coils), flat steel sheets that are widely used as input material for manufacturing pipes. Many companies don’t make their own HR coils and instead buy them from others.

Pipe Manufacturing – HR coils are fed into forming machines where they are shaped into round or square pipes using Electric Resistance Welding (ERW) technology. ERW pipes are widely used in construction, water supply, and industrial applications.

Galvanizing & Finishing – Some steel pipes go through a galvanizing process, where they are coated with a layer of zinc. This helps protect the pipes from rust and corrosion, especially important for pipes used outdoors or in water distribution.

This is basically, the value chain for steel pipes, especially the ERW and GI pipes. The raw material goes through different stages of processing to create the final product, i.e. steel pipes. There are multiple players working at every stage of the process.

What makes Sambhv unique is the fact that it is completely backward integrated, controlling all the aspects of the value chain. Thus, creating a differentiation for itself in the industry.

Backward Integration:

(Source: Bastion Research)

As a result, Sambhv is much more isolated from the macroeconomic conditions than its peers.

Now, let’s explore the journey of the Company to understand how it has been able to achieve this feat.

Sambhv Steel’s Evolution: Journey from Raw Iron to Integrated Pipe Powerhouse

By 2018, India’s steel sector was just emerging from one of its most difficult phases. The years 2015 to 2017 had been marked by a price collapse, rising imports, and multiple insolvencies across the industry. But as the government rolled out protectionist duties and infrastructure demand picked up, the sector began turning the corner. It was at this pivotal moment that Sambhv Steel Tubes Ltd. entered the scene, with a focused bet on backward integration and cost control.

Phase 1: Laying the Foundation (2018–2021)

The company began operations in 2018 with a clear strategic insight: steelmakers relying too much on market-sourced inputs were vulnerable to price volatility and quality risks. To mitigate this, the company acquired a sponge iron plant (60,000 MTPA) through NCLT, securing control over the very first step of the steelmaking process. The company turned it profitable within the first year of operations.

Over the next three years, it took bold but structured steps to reduce external dependencies:

- 2019: Expanded sponge iron capacity to 90,000 MTPA

- 2020: Commissioned a 15 MW captive power plant (using WHRB and AFBC technologies) and started in-house billet manufacturing

- 2021–2022: Added a hot rolling mill with capacity to produce 150,000 MTPA of HR coils, further strengthening vertical integration

By 2022, Sambhv was no longer just a raw-material processor, it was a self-reliant producer of key steel intermediates.

Phase 2: The Integration Advantage (2022–2023)

- Blooms/slabs capacity was scaled to 150,000 MTPA

- ERW pipe manufacturing was launched in 2023 with an initial capacity of 150,000 MTPA, later ramped up to 250,000 MTPA

- Sponge iron, HR coils and billet capacities were increased to meet the integrated flow of production

- Captive power generation continued expanding in line with plant requirements.

As government-led infrastructure projects gained pace, especially in irrigation, pipelines, and housing, Sambhv scaled up both capacity and complexity.

This tight in-house ecosystem enabled:

- Lower input costs, thanks to captive iron, billets, coils, and power

- Faster order fulfillment, due to on-site raw material availability

- Stronger quality control, supporting repeat institutional business

The strategy was working, Sambhv began delivering industry-leading EBITDA and PAT margins by FY24.

Phase 3: Advancement and Expansion (2024–2025)

With a fully integrated value chain in place, the company set its sights on advanced manufacturing and capacity leadership.

- 2024: Added GI pipe production, increased billet capacity to 317,000 MTPA, and commissioned a 132 kVA power line

- 2025:

- Sponge iron scaled to 280,000 MTPA

- ERW & GI pipes expanded to 350,000 MTPA

- Captive power enhanced to 25 MW

- Introduced stainless steel bloom/slab and HR coil production (58,000 MTPA each)

The ramp-up of GP pipes and stainless steel coils is expected to play a key role in driving the company’s next phase of revenue growth.

Parallelly, the company launched a new greenfield facility at Kesda, targeting:

- Larger volumes

- Product diversification

- Entry into infrastructure-grade and export-quality pipe segments

In just seven years, Sambhv Steel has evolved from a 60,000-tonne sponge iron startup into one of India’s most integrated ERW pipe manufacturers, with full control from raw ore to finished product. The company’s strategy has been clear, bold, and closely aligned with industry cycles. This marks a remarkable seven-year journey of rapid expansion to establish itself as a truly integrated player in the Indian steel sector.

Key Strengths

Fully Backward-Integrated and Cost-Efficient Model

Sambhv is among the very few players in India to operate an integrated setup, from sponge iron to ERW and galvanized pipes, all within a single campus. It recycles in-house scrap to produce billets and blooms and generates captive power through WHRB and AFBC technologies. This tightly controlled model reduces cost per tonne and supports higher operating margins, reflected in its industry-leading EBITDA margin of 12.4% in FY24.

Strategic Manufacturing Capabilities

It is one of only two companies in India with in-house technology to produce narrow-width HR coils, which are used directly in its pipe-making process. This technology is a big deal because it eliminates the need for slitting, reduces wastage and costs, and enables faster, more efficient production, giving the company a unique edge in serving high-precision, value-added pipe segments with faster production turnaround, less cost, and better quality and consistency on par with largest industry players.

Its advanced hot rolling mill, precision controls (HAGC), and use of AOD technology for stainless steel coils position it among a niche group of quality-driven steel processors. The company also produces GP pipes using zinc-efficient methods, making its output both cost-effective and environmentally lighter.

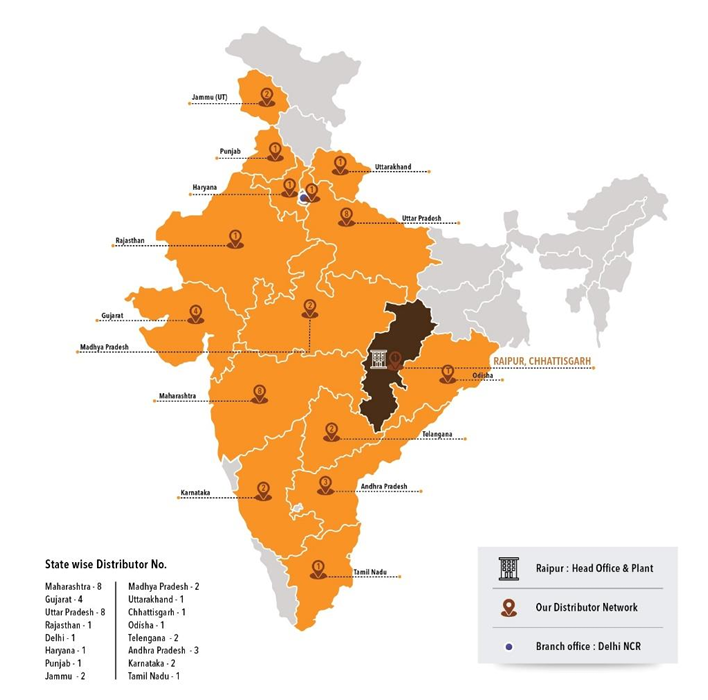

Strong Distribution and Market Presence

With a growing network of 43 distributors and over 700 dealers, the company’s distribution strength now rivals that of larger, more established peers. It maintains a strong physical presence across high-demand states like Maharashtra, Gujarat, Uttar Pradesh, Madhya Pradesh, and Telangana.

(Source: Company)

Location Advantage in India’s Steel Belt

Its Raipur-based facility gives Sambhv direct access to iron ore from Navratna and Maharatna PSUs, while being geographically central for pan-India logistics. This keeps raw material transport cost low and enhances supply chain speed for both east- and west-bound deliveries.

Proven Execution Trackrecord

Sambhv tripled its ERW pipe volumes in FY24, from 64,000 MTPA to 179,000 MTPA while steadily expanding capacity across segments. As of FY25, its capacities stand at 3,50,000 MTPA for ERW & GI pipes, 1,00,000 MTPA for pre-galvanized pipes, and 58,000 MTPA for stainless steel coils. These expansions are expected to drive margin improvement in the coming years. Additionally, its promoters bring decades of experience in steel manufacturing and have demonstrated sharp execution capability with prudent capital allocation and scaling.

The benefits of its unique position can be seen when we compare Sambhv to its peers in the industry.

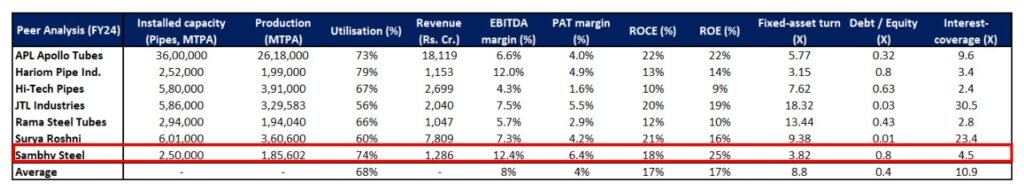

Peer Analysis:

(Source: Bastion Research)

From the above chart, it’s evident that Sambhv Steel, despite being one of the smallest players by capacity, outperforms peers with the highest EBITDA margin (12.4%) and a leading PAT margin (6.4%), reflecting strong operational efficiency. Additionally, Its 74% capacity utilization exceeds the industry average of 68%, signaling optimal asset use currently.

With a ROCE of 18%, the company is close to the industry average, while its ROE of 25% is the best in the peer set.

However, the downside of being a fully integrated player shows up on the balance sheet, with total debt (including lease liabilities) at ~Rs. 351 crore, pushing the debt/equity ratio to 0.8x, nearly twice the peer average (As IPO funds will be used to repay debt, the debt/equity ratio is expected to improve to a healthier level post-IPO). Overall, Sambhv’s fully integrated model is clearly boosting margins and returns, but tighter control on leverage will be key as it scales.

But as we all know, no business comes without risks. Here are the major risks faced by the company.

Risks & Challenges

High Related-Party Exposure and Financial Entanglements

Sambhv has extended advances, conducted large transactions, and provided guarantees to several promoter-linked entities (e.g., Ganpati Sponge Iron, S. Pyarelal Ispat). This level of interdependence raises governance concerns and reduces transparency around pricing, risk-sharing, and operational autonomy.

Leverage and Capital Intensity

The company has gone through multiple rounds of capex-heavy expansion in a short period, resulting in a debt/equity ratio of 0.80x as of FY24. While IPO proceeds aim to pare down debt, any delay in cash conversion or sub-optimal capital deployment could constrain the balance sheet and reduce financial flexibility.

Single-Site Concentration Risk

All of Sambhv’s operations are concentrated at a single site in Raipur. While this drives cost efficiency, it also heightens business continuity risk as any regulatory, environmental, or logistical disruption could affect the entire value chain.

Execution Risk from Greenfield Expansion

Sambhv is setting up a greenfield facility at Kesda, expected to significantly expand capacity and product range. However, greenfield projects are complex and often face execution challenges, including delays in approvals, machinery setup, and labor readiness. Cost overruns due to inflation or estimation errors could stretch budgets and raise debt. If the plant doesn’t ramp up on time or fails to meet cost-efficiency targets, it could weigh on industry leading margins and return ratios.

Working Capital and Liquidity Pressure

As a backward-integrated player, Sambhv’s model requires high inventory, credit cycles, and energy usage to function efficiently. The company must buy raw materials like coal and iron ore in bulk, maintain work-in-progress across multiple stages (sponge iron, billets, coils), and wait for receivables from institutional or government clients. This makes it a working capital-intensive business. Even minor delays in collections or spikes in input prices can trigger liquidity stress. Additionally, Sambhv relies heavily on working capital support, and its interest coverage ratio of 4.5x is well below the peer average (~11x). Any stretch in receivables could further tighten liquidity.

Limited Scale in a Competitive Market

Despite recent capacity expansions and vertical integration, Sambhv remains a mid-sized player in India’s steel pipe market. Industry giants like APL Apollo, Jindal, and Tata Steel have far greater production volumes, diversified portfolios, and stronger brand equity. They dominate private-sector contracts, exports, and large infra projects, leveraging their reputation, scale, and distribution strength. While Sambhv is operationally sound, its limited scale and visibility may constrain its ability to win marquee contracts or compete on equal terms in national or export tenders.

These are things that one need to look out for when tracking the company.

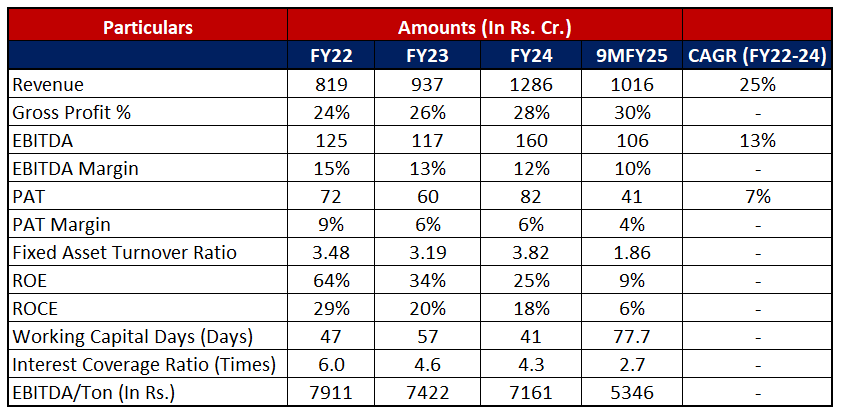

Financials

(Source: Bastion Research)

Conclusion

Sambhv Steel enters the public markets as an integrated, cost-efficient pipe manufacturer, well-positioned to benefit from India’s infrastructure and water-centric capex cycle. Its backward integration, recent capacity expansions, and use of modern manufacturing technologies enhance its margin profile and support market share gains in an industry that’s steadily formalizing.

That said, investors should weigh the execution risks tied to its greenfield project, working capital intensity, and exposure to government-led demand cycles. As a mid-sized player in a competitive space, its ability to scale efficiently without margin dilution will be key.

The IPO offers exposure to India’s infrastructure growth story through a company built from the ground up with capital discipline and operational depth. However, like most industrial stories, the payoff will depend on how well it delivers from here.

Happy Investing !!!

If you liked this newsletter, feel free to share it. Also, feel free to share your thoughts on X, where you can find us as @bastionresearch.

Disclaimer: This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

😂Meme of the Week🤣

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.