Welcome to this week’s edition of TOPICAL WEDNESAY! Today, we will explore the business model of GNG Electronics, aka Electronic Bazaar, whose IPO is open for subscription starting today.

From Origins to a Refurbishing Vision

Back in 2006, GNG Electronics began as a small Mumbai-based company operating out of Lamington Road, ground zero for India’s grey-market electronics. What started as a basic hardware trading outfit quietly pivoted in 2014 to something bigger, formalizing India’s fragmented refurbishing market. The idea was simple but powerful, instead of throwing away used electronics, why not repair them properly and extend their life?

That philosophy, repair instead of replace, still guides the company today. GNG now refurbishes lakhs of laptops and ICT (Information Communication Technology) devices annually across its facilities in India, Sharjah, and Dallas, operating under the consumer-facing brand Electronics Bazaar. The company is one of the largest Microsoft Authorised Refurbishers (meaning it can load genuine Windows software on renewed PCs) in India and holds certifications like R2v3 and ISO, which gives it credibility in global markets.

With 75% of revenue now coming from exports and over 5.9 lakh devices processed in FY25 alone, GNG has reached a scale where it wants to clean up its balance sheet and expand further.

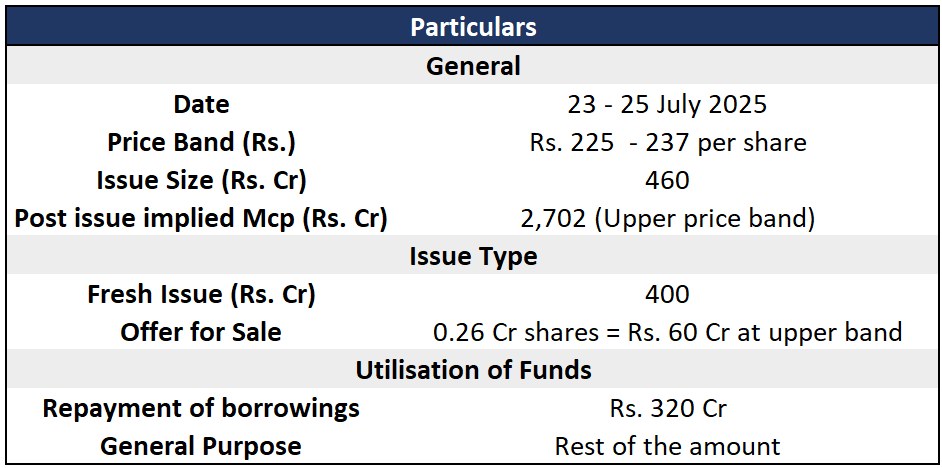

Before we move ahead, here are some of the details about the IPO:

A Full-Cycle Refurbishing Model

GNG isn’t a resale marketplace. It runs a full-cycle operation, from bulk sourcing, teardown and reconditioning, to sale and after-sales service. It focuses on business-grade laptops and ICT equipment (desktops, tablets, servers), doing both light repairs (L1/L2) and advanced fixes (L3) like motherboard or LCD-level work.

In other words, GNG isn’t just reselling used laptops with a dusting off; it’s doing deep restoration, backed by rigorous QC processes and industry certifications.

They’re also deeply integrated into global refurb flows. For instance, GNG supports the buyback and refurbishment programs of HP and Lenovo, handling bulk return lots that then get reconditioned and resold. This tight linkage with OEMs helps it secure steady sourcing and maintain quality standards.

What sets GNG apart is its deliberate strategy of not going after the public resale market. Unlike Cashify or other recommerce platforms, GNG does not buy devices from individuals, nor does it aggressively market to end consumers. Instead, it focuses squarely on enterprise customers and volume sales, a more consistent and a less chaotic model. Devices are sourced from a small pool of trusted corporates, ITAD partners, and leasing firms, and sold in bulk to institutions, distributors, and overseas buyers.

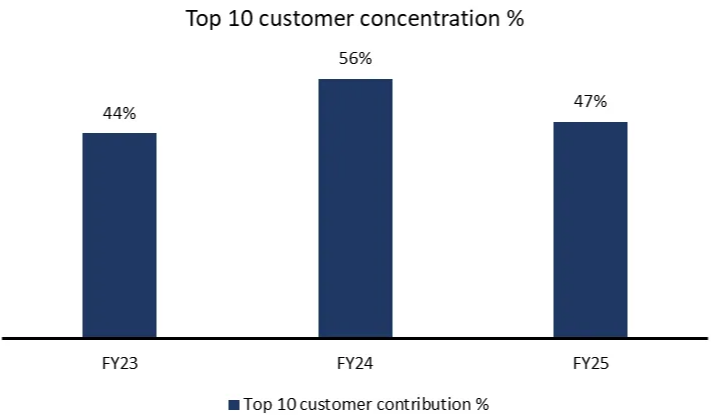

This approach has trade-offs. It results in high customer and supplier concentration in FY25, top 10 customers made up nearly 47% of revenue. But that’s by design. The company seems comfortable playing the B2B game, where reliability trumps brand buzz.

Value Proposition

What makes GNG’s proposition stand out is consistency. Refurbishing has always had a trust problem. Quality is uncertain. Warranty is rare. GNG fixes this by standardizing its refurb process, offering 1 to 3-year warranties, and complying with strict data-wipe and QC protocols.

Its facilities span 58,000 sq. ft. across three countries (India, UAE and USA), giving it the capacity to process large volumes and strategically serve key markets. Each device goes through software resets, component-level repairs, cosmetic rework, and full data sanitization. By the time it’s out the door, the product looks and works like new, but costs nearly one-third of the original price. (Trust me when we say “as good as new”, we have seen the output in their facility in Navi Mumbai during our recent plant visit, it’s nothing short of impressive.)

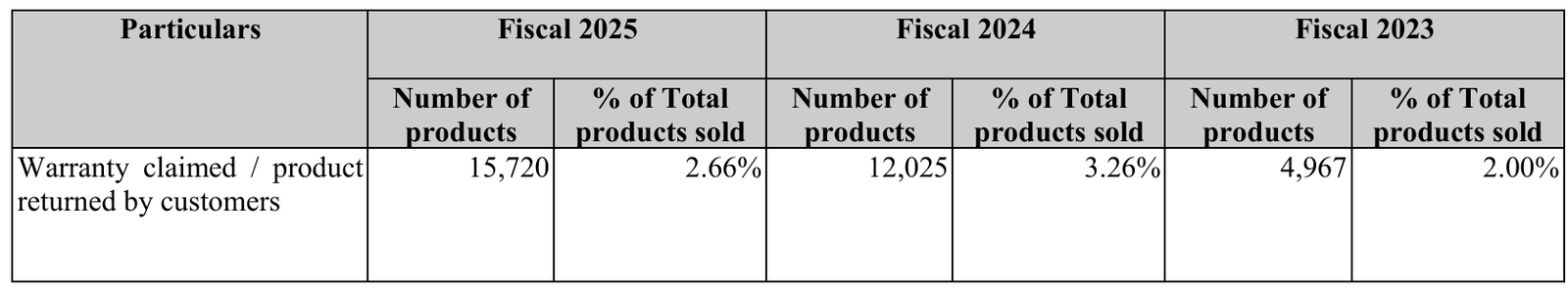

It’s no surprise then that GNG’s warranty claim rate is under 3%, even with lakhs of devices shipped. That’s a quality benchmark few in this business can claim.

(Source: RHP, Bastion Research)

This number is also not surprising based on our observations from the plant visit. The company follows proper, rigorous steps and has SOPs in place for every type of laptop.

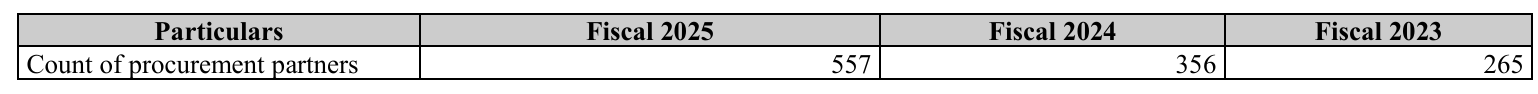

Sourcing and Sales Channels

Where does GNG get all these used devices, and who buys them? The company has cultivated a multi-source procurement network. It partners with IT leasing firms, large corporates, banks, and even OEMs themselves to take in bulk lots of end-of-life or surplus IT assets. (For instance, GNG serves as an IT asset disposition partner for one of India’s largest software companies, handling their retired hardware.) These steady B2B sourcing relationships give GNG a reliable feedstock of used laptops and gadgets to refurbish.

(Source: RHP, Bastion Research)

On the sales side, GNG uses multiple channels: its own online marketplace (targeting value-conscious retail buyers), a network of resale distributor partners and large-format retailers (who bring reach into different geographies), and even fintech tie-ups to offer leasing or buyback options. This omni-channel approach means GNG can move volume, whether it’s a startup ordering 50 refurbished laptops via a portal, or a distributor in Africa buying a container-load. The added services like on-site installation for bulk clients and assured buyback offers further sweeten the deal. In short, GNG’s model is not just about fixing old gadgets; it’s about providing an ecosystem of services around refurbished electronics, much like the new device market.

(Source: RHP, Bastion Research)

Target Markets and Customers: Who Buys Refurbished Devices?

GNG Electronics sits at the intersection of multiple demand pools. On one end, it caters to price-sensitive individual consumers and small businesses in need of affordable tech. Through its website and online platforms, GNG actively courts budget-conscious MSMEs, startups, institutional clients and retail buyers by offering them business-grade laptops/desktops at a fraction of new prices. These customers get the benefit of genuine software and warranties, making refurbished devices a viable alternative to buying new devices. The company’s marketing emphasizes that buying refurbished is not just about cost-cutting but also a sustainable choice, appealing to a growing segment of eco-aware consumers.

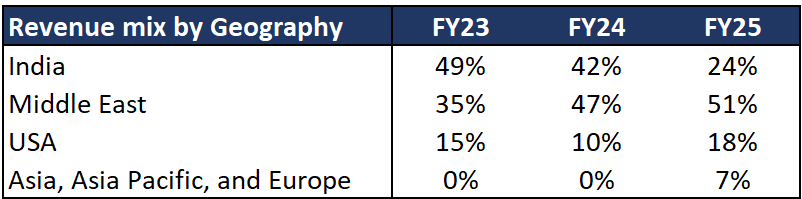

Crucially, GNG’s market isn’t confined to India. The company has established a global footprint across North America, the Middle East, Africa, and Europe. Its Sharjah facilities serve as a hub to reach buyers in Africa, the Gulf, and Europe, while the Dallas center covers North and South America. This geographic spread is a big asset, it allows GNG to tap into regions where demand for refurbished electronics is rising, or where the price differential versus new is especially attractive. In fact, exports have become the growth engine: in FY25, ~75% of GNG’s revenue came from outside India (primarily driven by sales in international markets), up from ~51% in FY23. Basically, company has the capability to access ~70% of global GPD from its base.

On the domestic front, GNG has seen a shift in its customer mix. Its B2C (direct retail) segment has actually been shrinking in recent years, indicating that much of the growth is coming from B2B and institutional buyers – whether distributors, companies outfitting offices on a budget, or government/education initiatives seeking cost-effective hardware. GNG’s top ten customers account for a significant chunk of sales (nearly 44%–56% of revenue in the past three fiscals), underscoring its reliance on a few big relationships. These likely include large buyers or channel partners that regularly source in bulk. While that concentration brings volume stability, it also means GNG must keep those key customers satisfied (a lost major client would leave a dent).

(Source: RHP, Bastion Research)

Overall, the target consumer profile spans value-seeking tech users of all stripes with a clear value proposition: why pay more for new, when refurbished can do the job?

By the Numbers: Financial Performance and Growth

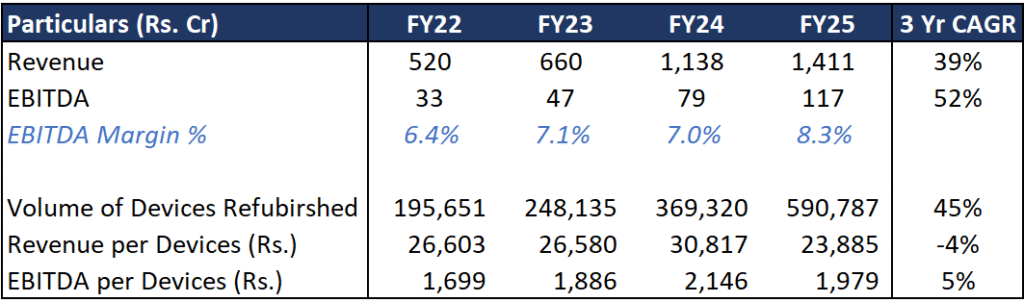

GNG’s financial trajectory in recent years mirrors its operational story of rapid scaling. The company has been on a steep growth curve, outpacing the industry by a wide margin. From FY22 to FY25, GNG’s revenue from operations surged from Rs. 520 Cr to Rs. 1,411 Cr, CAGR of 39**%**, even as the global refurbished electronics market grew at about 10.7%.

(Source: RHP, Bastion Research)

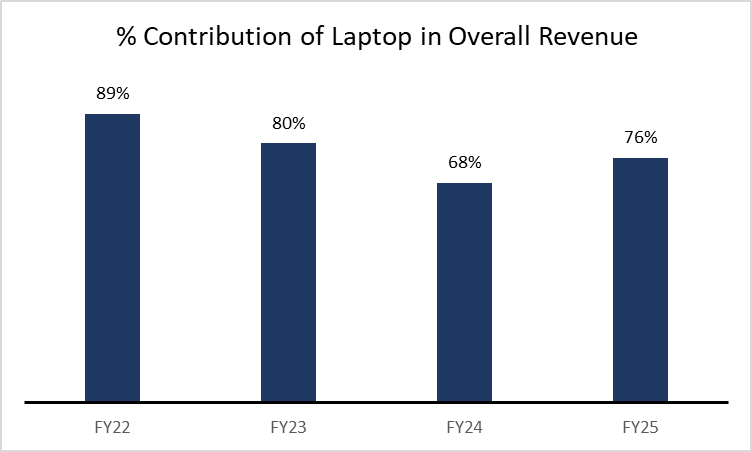

A few aspects of the financials stand out. First, product mix: laptops dominate GNG’s sales, contributing about 75% of revenue in FY25. The remainder comes from other ICT devices, including desktops, tablets, high-end smartphones, workstations, and related services. This skew toward laptops isn’t surprising, given the ubiquitous demand for notebooks, but it does highlight the company’s reliance on a single key segment.

(Source: RHP, Bastion Research)

Second, as mentioned, the geographical mix shifted heavily toward exports, while India’s revenues actually dipped in FY25, international sales more than made up for it. This suggests GNG is prioritizing markets where it sees faster uptake or better margins for refurbished gear.

(Source: RHP, Bastion Research)

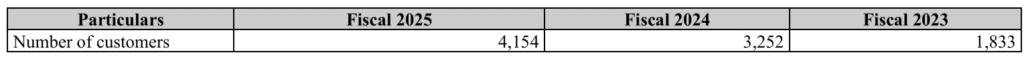

Third, GNG has managed to improve its EBITDA margins recently (8.3% in FY25, up from 6.4% in FY22), possibly due to a higher-value product mix or operational efficiencies at scale. Handling nearly 5.9 lakh devices in FY25 (versus ~2 lakh in FY22) gives an idea of how volumes have ramped up, which can drive economies of scale in procurement and processing. The company also served over 4,150 customers in FY25 (up from ~1,263 three years prior), showing broadened market reach even as some big buyers account for a large portion of sales.

One financial point to note is GNG’s leverage. The rapid growth was accompanied by substantial borrowing, as of March 2025, the company had Rs. 434 Cr in total debt (1.9x Debt to Equity), used to fund working capital. This debt load pushed up finance costs and made up a significant portion of its capital structure. However, as we’ll see next, the IPO proceeds are largely intended to clean up the balance sheet, which could improve net margins going forward. Overall, GNG’s financials depict a fast-growing, profitable refurbishment business with a scalable model. The challenge ahead will be to maintain growth momentum and margins as competition and volumes increase.

Why the IPO, and Why Now?

GNG’s IPO timing makes sense. Internally, it needs to de-lever. Externally, the refurbished tech market is finally getting its due.

Globally, e-waste norms are tightening, and governments are nudging producers to take responsibility for end-of-life devices. In India, E-Waste Management Rules 2022 mandate 60% recycling compliance in FY25. GNG, being CPCB-registered, is well-positioned to ride this trend.

Meanwhile, consumers have warmed to the idea of refurbished electronics. The stigma is fading. If it works well and saves money, why not?

GNG’s export-heavy model is also ESG-friendly. It extends device life cycles and reduces landfill burden, a plus in global markets that reward sustainability.

In essence, GNG is riding two macro trends, the digitalization of emerging markets (driving device demand) and the push for circular economy solutions – which together create a favorable growth environment.

Risks to look out for 👀

Like any fast-growing business, GNG Electronics faces an intriguing mix of opportunities and risks as it steps into the public arena.

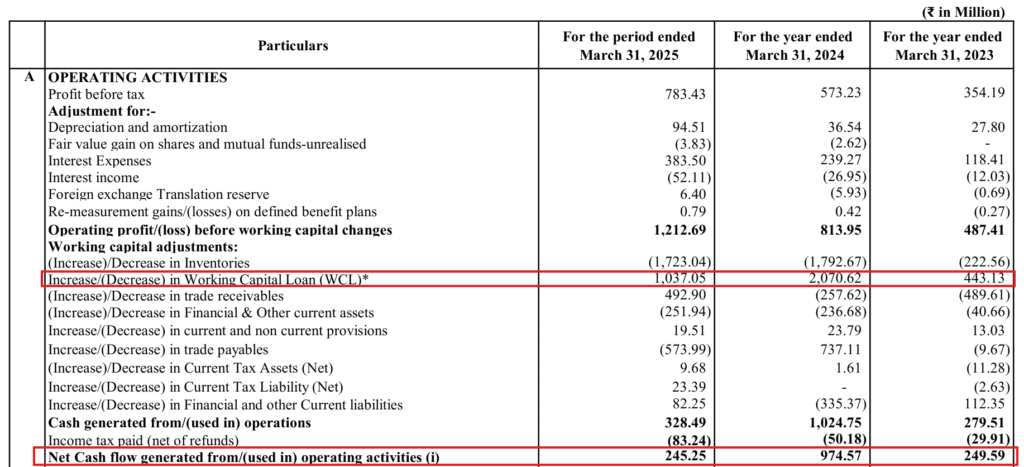

At first glance, its cash flow from operations (CFO) appears healthy. But dig a little deeper, and things get murky. The company has been classifying short-term bank loans, taken to fund working capital, as part of “changes in working capital,” effectively inflating the reported CFO. In simple terms, it’s like taking a loan and then claiming, “Look, we’re generating cash.” Technically true, but economically misleading.

From an investor’s lens, this feels like questionable accounting. I’m not sure how IndAS permits this treatment, certainly wasn’t something we came across in CA textbooks.

(Source: RHP, Bastion Research)

And this is what company has to say about this. 👇

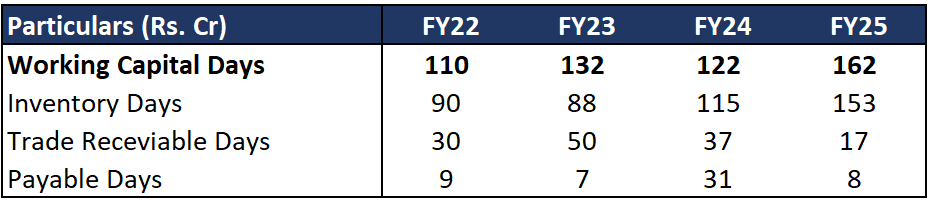

Once you adjust for the short-term loan inflows, the picture flips, GNG is actually running a negative CFO and relying on external funding (debt and equity) to keep operations going. A large chunk of this IPO is essentially aimed at repaying its working capital loans. That’s not surprising, given it operates in an extremely working capital-intensive business, with inventory sitting idle for over 3–4 months at a time.

(Source: RHP, Bastion Research)

Company’s cumulative fund flow analysis, suggest reliance on debt and now equity (via IPO) to fund working capital of the business.

(Source: RHP, Bastion Research)

This was one of the reason for rejecting Manorama Industries from recommending to our subscribers (Research Recommendation). We have documented the reason for dismissing the business here.

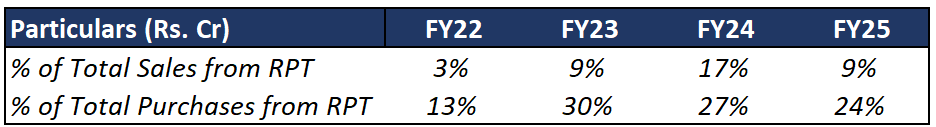

Another risk is related party transactions.

Roughly 25–30% of GNG’s laptop purchases come from a related party. We’re not implying anything improper, but as an investor, you’ll need to decide whether you’re comfortable with that level of related-party dependence.

That said, one point in GNG’s favour is its track record of consistent profitability. The real test, however, lies ahead: maintaining financial discipline while scaling, fending off competition, and adapting to a fast-evolving market. The IPO gives it some breathing room and growth capital, but ultimately, it’s execution that will shape what comes next.

Low Returns, High Touch

Refurbishing, by nature, is messy work. Devices come in all conditions. Some need only software resets, others need parts replaced or components rebuilt from scratch. GNG handles all of this manually. It’s a business that relies heavily on skilled hands, not robots.

And yet, the company runs a tight ship. Out of the 5.9 lakh+ devices it processed in FY25, the warranty claim rate was under 3%. That’s impressive, considering refurbished electronics aren’t always seen as reliable. It shows that GNG’s quality control process is working, and that buyers aren’t just getting cheap gadgets, they’re getting dependable ones.

But there’s a flip side to this manual intensity. Scaling the business isn’t as simple as adding another production line. Each new facility needs a fresh batch of trained technicians. Hiring, training, and retaining workers is a constant operational lift. And since automation opportunities are limited in this line of work, GNG’s growth will likely be measured. Will they be able to deliver 40-50% kind of CAGR, as they have done in the past? Well, we will find out.

A Second Life for Electronics – and a New Chapter for GNG

GNG isn’t chasing the hottest new tech. It’s repairing old tech and in doing so, tapping into a long-term global theme: reuse, don’t replace.

In a world that discards electronics every few years, GNG’s model is a quiet rebellion. It takes used devices, fixes them properly, and puts them back into circulation with new warranties and fresh purpose. The company’s refusal to play the B2C game, and its focus on volume-driven refurbishing for enterprises and exports, reflects a grounded ambition.

The IPO isn’t a moonshot. It’s a clean-up act, a way to deleverage and formalize operations before the next leg of steady growth. For investors looking beyond high-gloss tech stories, GNG offers a refreshing narrative: a profitable, quality-first refurbisher giving electronics (and capital) a second life.

We’d also love to hear your thoughts and feedback on X. Connect with us there at @bastionresearch.

Happy Investing!!!

Disclaimer: This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

😂Meme of the Week🤣

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.