We’re now in Part 7 of our Semiconductor Series, just one step away from wrapping it up. Today, we shift focus to the real market darlings, the companies that command the highest valuations in the semiconductor world. If you’re still guessing who these might be, we won’t keep you hanging. This edition is all about “Fabless” companies.

But first, a quick recap of our journey so far:

Semiconductor Series Letter 1: History of the Semiconductor Industry

Semiconductor Series Letter 2: The Semiconductor Value Chain

Semiconductor Series Letter 3: Key Players Across the Value Chain

Semiconductor Series Letter 4: The Rise and Fall of Intel

Semiconductor Series Letter 5: TSMC: The Global Semiconductor Giant

Semiconductor Series Letter 6: ARM:The blueprint of modern portable computing

Before coming to the most interesting aspect of why these companies command high valuations, let’s first understand the basics:

What are FABLESS Companies?

Simply put, fabless companies are those that design semiconductor chips but do not manufacture them. Instead, they outsource the manufacturing part to companies called foundries, such as TSMC or others, which specialise in manufacturing chips.

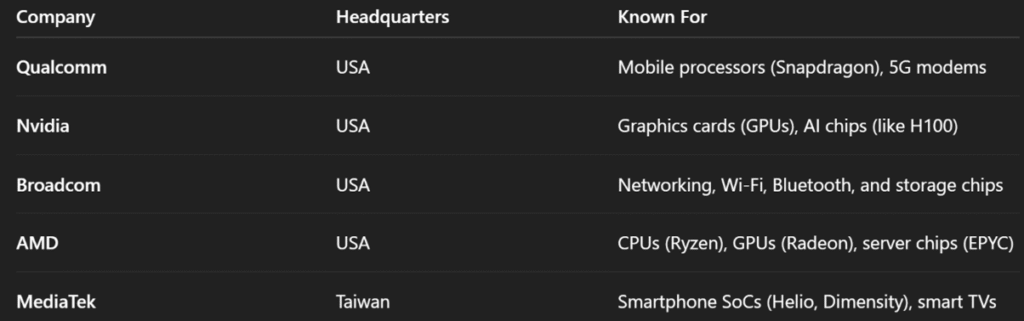

Think of them like a fashion designer who comes up with the design of clothes (style, cut, fabric choice), but doesn’t own a sewing factory. They send their designs to a third-party clothing manufacturer who actually stitches and produces the clothes. That’s exactly how fabless chip companies work. Some prominent names include:

If you widen the lens a bit, even Apple fits the fabless model. It designs its chips through its in-house silicon team, while the actual manufacturing is handled exclusively by TSMC. The difference? Unlike Nvidia or Qualcomm, Apple doesn’t sell its chips to anyone else. Instead, it builds them solely for its hardware — iPhones, Macs, Watches, and more.

Market Darlings

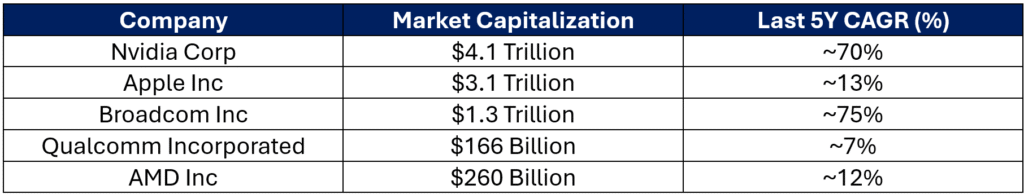

Unless you’ve been living under a rock, you’ve probably noticed the meteoric rise in the market capitalisation of publicly traded companies over the past few years. In fact, a few of the names we just mentioned have now crossed the trillion-dollar mark in market cap, a staggering feat for companies that don’t manufacture a single chip themselves. Here is a quick summary:

(Market Capitalization Number is 2-3 Days Old)

To put that in perspective, as of 2024, only 19 countries had a GDP above $1 Trillion. On a lighter note, if Nvidia, Apple, or Broadcom were countries, their market caps would earn them a seat at the G20 table 😉

Product Companies at Heart

Although, from the outset, it appears that fabless companies are merely chip designers, upon closer examination, there is much more to these companies than just chip design. If you step back and observe, at their core, these companies are product companies that don’t own manufacturing facilities.

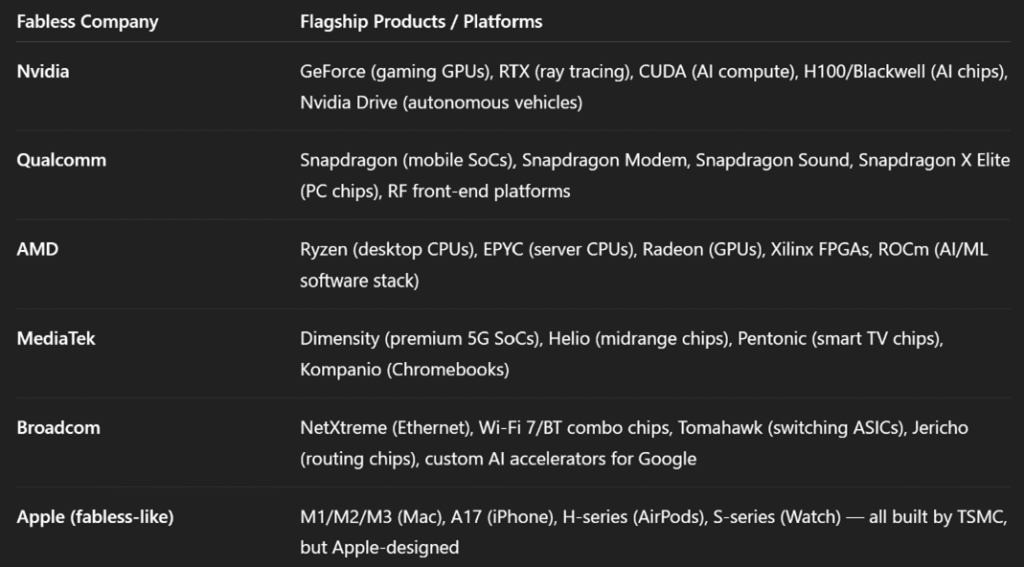

Fabless companies don’t only sell anonymous silicon; they also brand their chips (Snapdragon, GeForce, Rayzen, etc.) and enjoy strong brand recall (this phone has a Snapdragon 8 Gen3!). Here are some examples:

A Full Stack Playbook – Key to the success of fabless companies

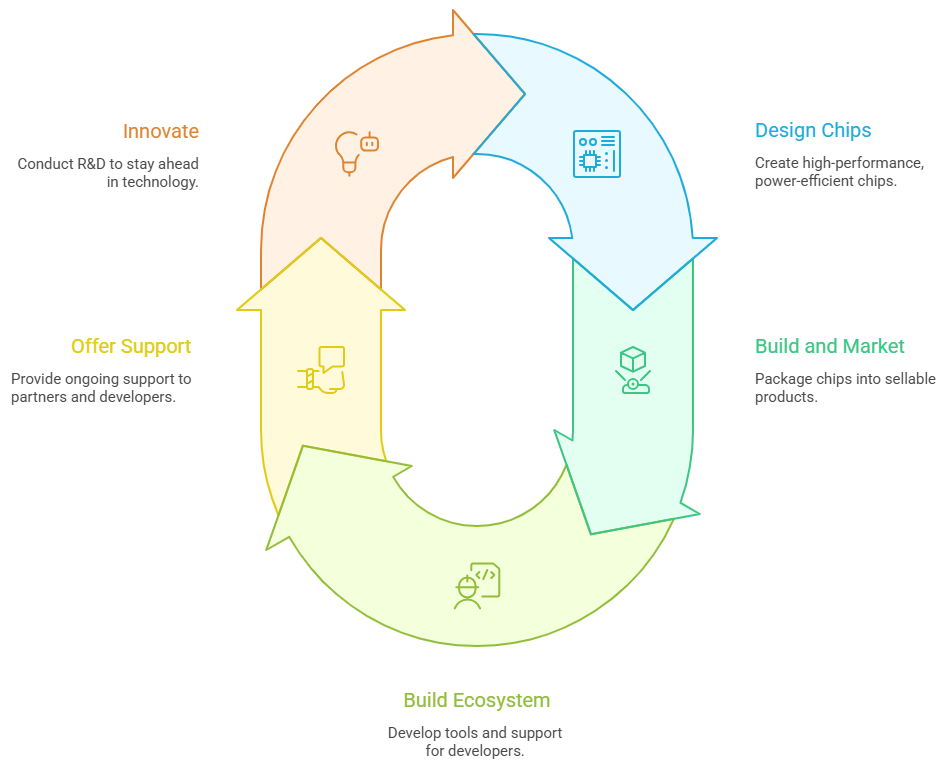

If we have an overview, running a successful fabless company is about effectively managing the following FIVE steps:

Step 1, Chip Design > This is where it all begins, designing high-performance, power-efficient chips tailored for specific use cases. Companies often use a mix of third-party IP (e.g., ARM cores, DSPs) and proprietary blocks to design chips.

Step 2, Build and Market the Product > A chip is useless unless it’s packaged as a product. This is where design becomes a sellable platform (e.g., Snapdragon, GeForce, Ryzen, etc). This step turns engineering into revenue.

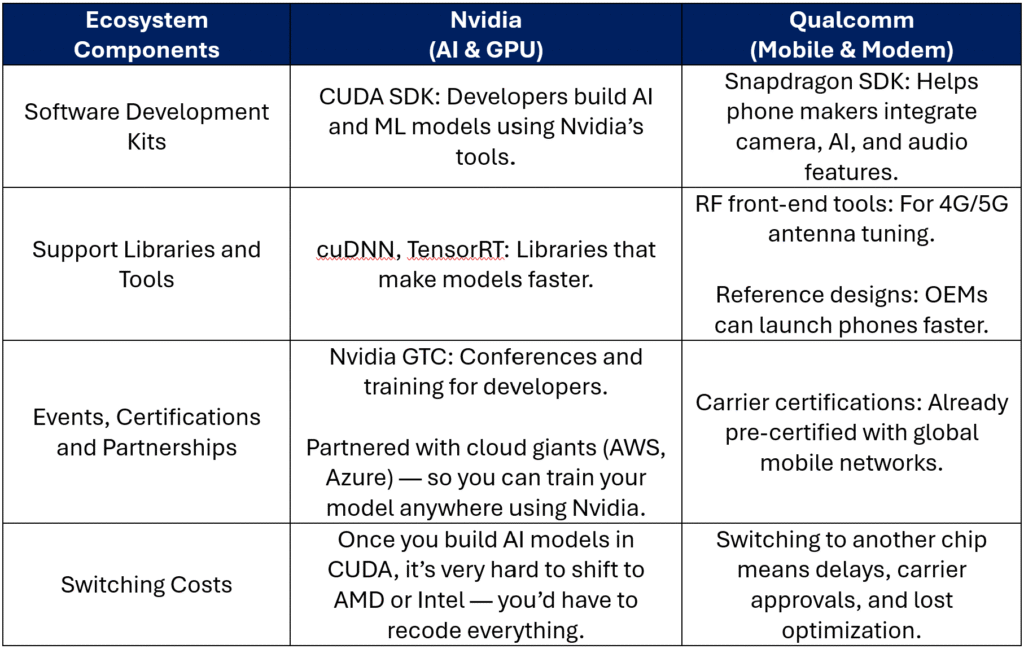

Step 3, Ring fence by building an Ecosystem > This is where their IP gets supercharged. The best fabless companies build development tools, software development kits (SDKs), support libraries, certifications and training programs. These tools attract developers and customers. Companies often try their best to make these tools easy to use, but extremely difficult to let go. Examples include Nvidia’s CUDA, Qualcomm’s Snapdragon SDKs, and Apple’s tight integration with iOS/macOS, among others. This is what creates stickiness (more on this below). Even if someone builds a better chip, switching is painful.

Step 4, Offer Support > Fabless companies don’t act like a vendor but a partner. They provide ongoing support to OEMs, integrate chips, and assist developers with documentation and forums, while also partnering in co-designing and optimisation. For example, Qualcomm helps phone brands integrate chips across hundreds of SKUs and regions. Similarly, NVIDIA works with cloud providers to optimise AI workloads. This deepens relationships and helps win repeat business.

Step 5, Keep building Cutting-Edge IP > In this business, if you’re not inventing, you’re losing. fabless companies future-proof their edge by doing R&D into new process nodes, packaging, or vertical capabilities. In the past, some companies have also acquired others to stay ahead of the curve (AMD → Xilinx, Nvidia → Mellanox). The idea is to stay ahead of the curve because chip cycles are brutal and fast.

In short, a successful fabless player has a full-stack playbook where each step compounds the previous one. Design gets you in the door, but product, ecosystem, support, and innovation keep you in the game, and miles ahead of commoditised players.

The Moat – You don’t fall in love with the chip, but the experience it enables

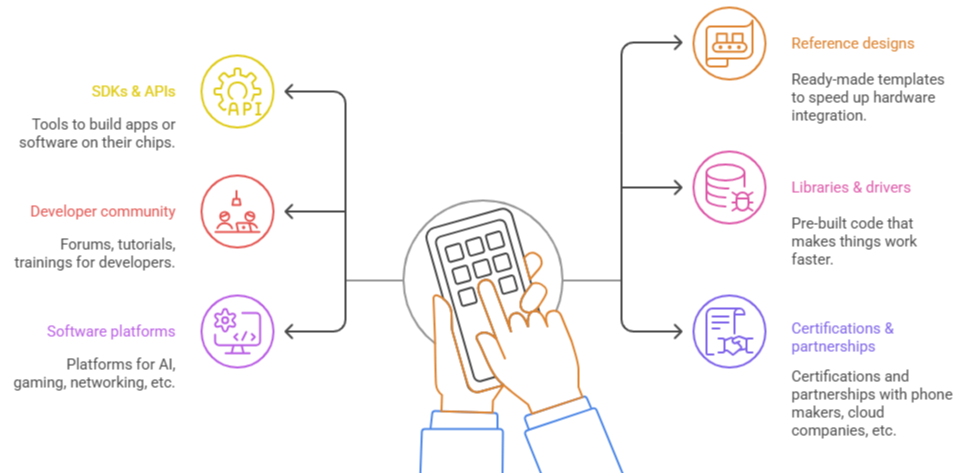

If you have read the above step with absolute precision, one thing must have become extremely clear: Ecosystem is the real moat that fabless companies have created around themselves. Now, before getting into the nuances of ecosystems, let’s first define an ecosystem of a fabless company.

Ingredients of an ecosystem

An ecosystem is everything a company builds around the chip to help customers, developers, and partners use it easily and powerfully. It includes: Software Development Kits (SDKs) & APIs, Reference designs, Developer community, libraries and drivers, Software platforms, certifications, and partnerships, etc.

The step where MAGIC happens

Holistically seeing, this is the step where the chip stops being “Just a Part” and becomes a complete solution. At this stage, it’s not just about the chip; it’s about the whole experience built around using it. This is because of the following reasons: a) an ecosystem makes life easy for engineers and developers, b) an ecosystem unlocks the full power of the chip, and c) an ecosystem creates a “sticky” platform that keeps customers coming back. In summary, with an ecosystem, a chip becomes a platform everyone wants to build on.

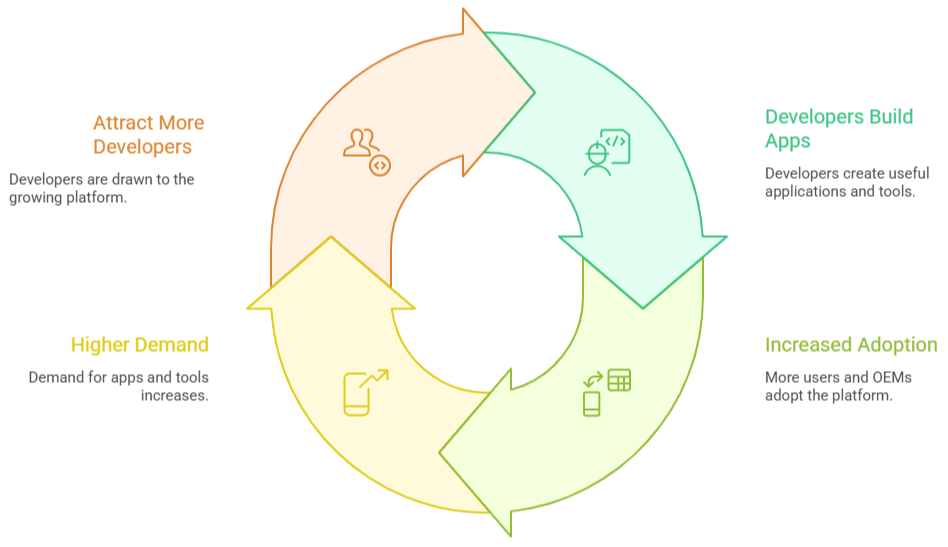

Network Effect at Play

Giving up an Ecosystem is Extremely Difficult

Once a developer, partner, or customer becomes part of the ecosystem, it becomes difficult to leave the ecosystem, even if a rival product is developed. This happens because of very high switching costs because switching the ecosystem means Rewriting code, Relearning tools, Retesting everything, Retraining people, and, most riskily, risking bugs, delays, and performance issues. Imagine having to relocate your entire office to a new city just because the rent is slightly cheaper. Most won’t do it unless the benefit is enormous. So even if a rival chip is 10% better, it’s often not worth the hassle of leaving a mature ecosystem.

Real Ecosystems at Play – Examplesof Nvidia and Qualcomm

Some Probable Reasons – Why Fabless Companies get a high PE?

Now, we come to the most interesting aspect, the question with which we started this newsletter at the first place. It is essential to understand that there can be numerous answers to this abstract question, and all of which can be a probable explanation. The following are the few factors that we believe fetch a higher multiple to fabless companies:

1. This is an IP-driven, scalable business

Fabless firms own the chip design, not the factory. Once the design is complete, it can be manufactured in millions at nearly zero incremental cost. Margins stay high, and scaling doesn’t require more physical assets.

2. Brand Recall

Brands like Snapdragon, GeForce, Ryzen, Dimensity have become product signals both to OEMs and end users. This gives fabless companies pricing power and customer pull, even in B2B markets. This kind of brand recall has turned a commodity (chip) into a premium product.

3. The Moat of Ecosystem, Supercharged by Experience

As discussed, Ecosystems include SDKs, reference designs, partnerships, developer support, etc. They create network effects and make switching painful. But most importantly, they create an excellent experience for customers, developers, and integrators. Customers don’t just use the chip, they live in the world built around it.

4. Ecosystem enables Repeat Business > Annuity Income

OEMs who integrate a fabless chip into their product and use its tools, dev kits, and certifications rarely switch every cycle. This leads to multi-year design wins, follow-on business, and roadmap loyalty. That lock-in nature converts a project-based business into a sticky on with repeat-revenues.

5. Investors love Annuity Businesses

Predictable cash flows, high gross margins, low churn, and scalable IP = Strong Stability. Add in optionality for growth (AI, Auto, IoT, 5G…), and you get growth + stability, the combination every investor wants in markets.

In summary, Fabless companies command premium valuations because they don’t just sell chips, they scale ideas. In the world of semiconductors, it’s easy to get lost in talk of factories, machines, and tiny chip sizes. But the real power lies elsewhere, with fabless companies. These aren’t just chip designers; they’re product creators, brand builders, and masters of experience. The chip is just the engine; the magic is in the smooth, reliable world they build around it. They don’t just sell hardware; they sell confidence, loyalty, and something people come back to again and again. And that’s why the market rewards them with rich valuation premiums. Because, in an industry powered by circuits, fabless companies have figured out how to build something even more powerful: EXPERIENCE.

If you enjoyed reading about TSMC’s rise to dominance, feel free to share it with others who might find it insightful. We’d also love to hear your thoughts and feedback on X. Connect with us there at @bastionresearch.

Happy Investing!!!

😂Meme of the Week🤣