Takeaways from the Market Marvel Conference by Philip Capital

In this edition of LEARNING OF THE WEEK, we’re excited to share key takeaways from the Philip Capital’s Market Marvel Conference where sustainability took center stage. The event brought together many companies from the solar, water, and recycling space. In this edition, we’ll focus on solar energy and what we learned from meeting some of the emerging players in this fast-growing sector.

As we’ve explored in previous newsletters, India is is going through a renewable energy revolution. This transformation is fueled by the nation’s ambition to reduce energy dependence on other countries, meet surging power demands, and achieve sustainable economic growth. At the heart of this revolution lies solar power, a key driver of change propelled by technological advancements, which resulted in significant cost reductions, and strong government support.

With GoI plans to nearly double renewable energy capacity by 2027, solar is expected to make up most of this growth. This support has created a lot of opportunities for companies in the sector. A great example is Waaree Energies, which recently launched a Rs. 4,300 Cr IPO, showing how much confidence investors have in solar energy.

At the conference, we had the privilege of engaging with the management teams of several leading and emerging companies in the solar sector that include the following:

Bondada Engineering

Bondada Engineering, known for its expertise in EPC (Engineering, Procurement & Construction) and O&M (Operations & Maintenance) services, has built an impressive portfolio with over 11,000 telecom towers and 600 MW of solar projects executed so far. The company is now focusing on larger utility-scale solar EPC projects, with 75% of its order book dedicated to this segment. Bondada is also venturing into railway-radio towers under the government’s KAVACH initiative and plans to add over 9 lakh towers in the coming decade.

Sahaj Solar

Sahaj Solar, based in Ahmedabad, specializes in manufacturing solar PV modules and providing solar water pumping systems under the PM KUSUM scheme. While solar pumps dominate its revenue stream, Sahaj is expanding into African markets with products like solar streetlights and off-grid power plants. Competing against Chinese manufacturers, it leverages quality customization services to gain an edge. The company is also working to increase its EPC revenue share.

Australian Premium Solar (APS)

APS also manufactures solar modules and offers installation services for residential and industrial clients. The company mainly focuses on the rooftop solar market and is actively expanding its retail presence, while also exploring new opportunities in solar cell manufacturing.

Gensol Engineering

Gensol Engineering is an EPC player with a diversified portfolio that includes solar tracker technology and Battery Energy Storage Solutions (BESS). The company is also making strides in the EV space by leasing EVs to B2B clients and venturing into EV car manufacturing. Gensol plans to launch a Made-in-India, all-electric, two-seater car designed specifically for business customers.

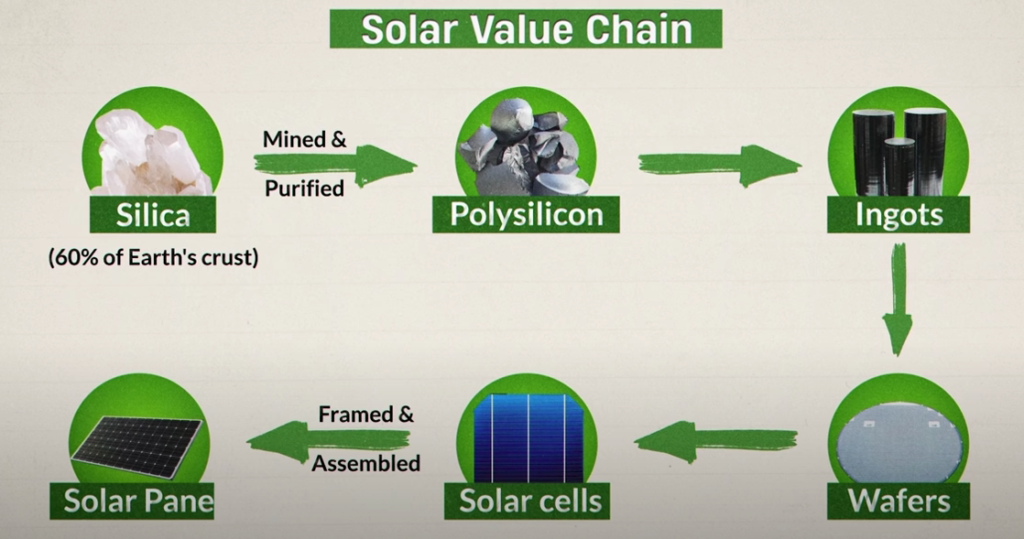

Our Take: Winners in the Solar Value Chain

While the solar sector is thriving, not all business models are equally resilient. Solar module manufacturers face significant challenges due to their reliance on imported raw materials (primarily from China), volatile margins, and intense price competition. Without backward integration into solar cell production or R&D-driven innovations like heterojunction or tandem cells, these manufacturers risk being commoditized in an increasingly competitive market.

Adding to these challenges are macro-level risks. Falling solar panel prices and the sector’s dependence on government policies—such as tariffs, subsidies, and duties—make it vulnerable to sudden regulatory shifts. Additionally, global trade uncertainties, such as potential tariff hikes on imported solar modules under the incoming Trump administration in the U.S., could disrupt exports. This could lead to an oversupply in the domestic market, further driving down prices and pressuring manufacturers’ margins

| (Know more about solar value chain in our previous newsletter) |

On the other hand, solar EPC players appear better positioned within the value chain. Their asset-light business models allow scalability and adaptability, while their ability to execute complex utility-scale projects and offer customized solutions gives them a competitive edge. With growing demand for rooftop installations and utility-scale projects, EPC players are well-poised to capture sustainable growth opportunities.

Conclusion

India’s solar revolution is undoubtedly transformative, but it comes with unique challenges across different segments of the value chain. While panel manufacturers face commoditization risks without vertical integration or innovation, EPC players stand out for their execution capabilities and adaptability. As the industry evolves, it will be fascinating to see how companies navigate these dynamics to sustain long-term growth.

(Author: Bhavik Narang LinkedIn)

Disclaimer: These insights are based on our observations and interpretations, which might not be complete or accurate. Bastion Research and its associates do not have any stake in any of the companies mentioned above. This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

MEME OF THE WEEK