Insights for Investors from the 25-year journey of India’s flagship index

In this edition of TOPICAL Wednesday, we’re diving deep into the NIFTY 50’s performance since its inception, drawing from an insightful whitepaper published by the National Stock Exchange (NSE) in July ’24. While the timing of this newsletter might seem late, we believe the compelling insights within are too valuable not to share with a wider audience.

Necessity is the Mother of Innovation – Birth of NSE

In the last decade of the 20th century, India witnessed LPG reforms that opened up the economy and boosted the country’s IT prowess. Businesses in India began going digital and automation started transforming how Indian businesses operated, significantly improving efficiencies.

The NSE was founded in 1992, a year that should ring a bell. If it doesn’t, let me remind you: this was the year India witnessed the infamous Harshad Mehta Scam (cue Scam 1992 series BGM). Prior to the scam’s exposure, equity markets were soaring, largely due to Mehta’s manipulations. However, on April 29, 1992, when the scam was uncovered, the Sensex plummeted by 12.77% in a single day. In the immediate aftermath, it dropped nearly 40%, marking one of the worst periods in Indian stock market history as the scam shook the nation to its core.

If you’ve read about the scam or watched Scam 1992, you’ll know just how inefficient and outdated the BSE was at that time. It operated on an open-outcry system, where trades were executed manually, leading to inefficiencies, delays, and a lack of transparency. A small group of brokers had significant control over prices, and the settlement process could take weeks. To address these issues, the NSE was established in 1992 at the behest of the Government of India, following recommendations from the Pherwani Committee. NSE revolutionized Indian markets by introducing an electronic order-driven system, ensuring transparency, reducing manipulation, and speeding up settlements (initially T+3, now T+1). These changes helped NSE overtake BSE as India’s largest stock exchange.

So without much delay, let’s unpack the Nifty 50 Index and explore its journey over decades.

Introducing the Nifty 50:

The Nifty 50 is the flagship index of the NSE, comprising the 50 largest and most actively traded stocks across various sectors. It serves as a barometer for the Indian equity markets and is widely used to gauge the performance of the country’s blue-chip companies.

These 50 stocks represent:

– 57% of the Free-Float Market Capitalization.

– 47% of the total Market Capitalization.

– 28% of the Total Liquidity of all traded companies.

Creation Methodology of Nifty 50:

The stocks in the index are the top 50 stocks in the market, selected based on their 6-month average FREE-FLOAT (the number of shares of a company that are available for regular people to buy and sell) Market Capitalization.

Formula: Free Float Market Capitalization = Share Price x (Total Shares Outstanding – Shares Held by Insiders)

(Source: Nifty Indices)

The 50 stocks in the index are weighted according to their free-float market cap. Companies with a higher free-float market cap carry more weight in the index. As a result, if the stock price of a large company rises, it will have a greater impact on pushing the index up compared to a smaller company, and vice versa. The composition and weightage of these stocks are reviewed semi-annually in March and September.

Evolution of Nifty 50

Since its inception, the number of companies actively traded on the NSE has grown from 1,350 to 2,468 today, reflecting the stock exchange’s expansion. As a result, the average turnover contribution of the Nifty 50 index (Trading volume of the NIFTY as a % of total trading volume of NSE) has decreased from 62.20% in November 1995 to 28.34% as of March 2024.

(Source: Nifty Indices)

However, what’s even more fascinating is the fact that the market cap of the Nifty 50 as a % of the total NSE’s market cap has increased from 33.7% in November 1995 to 47.35% in March 2024.

This indicates that while the market cap of Nifty 50 stocks has grown relative to the total market, their trading activity (buying and selling) as a percentage of total market turnover has decreased. This suggests that investors may be holding these stocks for the long term, as opposed to frequently trading them, compared to other stocks on the exchange.

Now, let’s take a closer look at the exceptional gems that make up the Nifty 50 Index.

Sectoral Composition

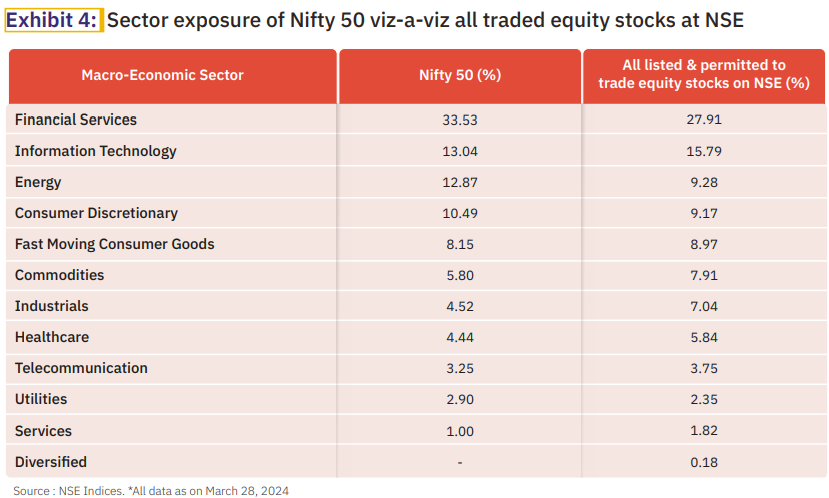

Broadly speaking, the sectoral composition of the Nifty 50 closely mirrors that of all the stocks listed on the NSE.

(Source: Nifty Indices)

The Nifty 50 index spans 13 sectors, with Financial Services holding the largest weightage at 33.53%. This is followed by the IT sector, which accounts for 13.04%, and Oil, Gas & Consumable Fuels, contributing 12.9%. These sectors typically encompass industries known for their high growth and sustained high margins over time. At the lower end of the spectrum, sectors like Telecom and Utilities, which are heavily regulated by the government, generally exhibit lower margins and more cyclical growth patterns.

Sectoral Composition Over the Years

Over the past 3 decades, the sectoral composition of the Nifty 50 has undergone significant changes, reflecting which sectors have outperformed and which have lagged. These shifts highlight the evolving dynamics of India’s economy and market trends.

(Source: Nifty Indices)

The IT sector, which now holds the second-largest weight in the Nifty 50, was not originally part of the index. However, as Indian IT companies gained prominence on the global stage, particularly during the rapid expansion of the 1990s and 2000s, their representation in the index grew significantly. Today, the IT sector plays a crucial role in the index, reflecting India’s status as a global IT powerhouse. Meanwhile, Financial Services have also seen their weight increase from 20% in 1995 to 33.53% today. This growth reflects the sector’s evolution and expansion, as it forms the backbone of any economy.

On the other hand, sectors like FMCG and Metals & Mining have seen declines in their representation. FMCG’s share has dropped from 19% to 8.15%, while Metals & Mining has decreased from ~11% to ~4%.

Interestingly, there are only 12 companies in the Nifty 50 that have remained part of the index since its inception. These companies have stood strong through competition, regulatory changes, and market headwinds, etc. thereby becoming benchmarks in their respective industries.

(Source: Nifty Indices)

Now let’s talk about the main chapter for which we wrote this newsletter.

Performance of the Nifty 50 Since Inception:

(Source: Nifty Indices)

The Total Return (TR) of an index assumes that dividends are reinvested, reflecting both Price Return (PR) and Dividend Return. Since 1999, the Nifty 50 Total Return Index has delivered an impressive 14.10% return. While the index’s returns have experienced fluctuations in volatility over time, it has maintained a solid risk-return profile in the long run, balancing growth with manageable risk.

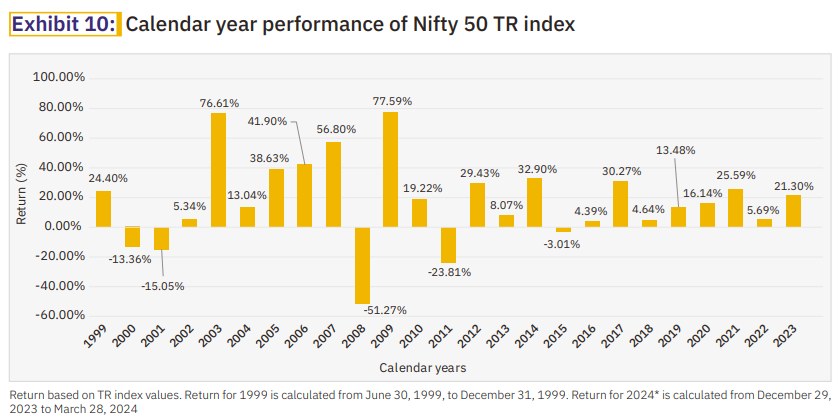

In terms of calendar year performance, the Nifty 50 Index has exhibited a mix of positive and negative returns over the past 25 years.

(Source: Nifty Indices)

Over the past 25 years, the Nifty 50 Index has delivered positive returns in 20 out of 25 calendar years. In 5 years, returns ranged between 0-10%, while in 8 years, they fell within the 10-30% range. Notably, in 7 years, the index provided returns exceeding 30%.

Of the 5 years with negative performance, 3 years saw returns between 0 to -20%, and only 2 years experienced a decline of more than (-)20%—specifically in 2008 and 2011, both of which were marked by significant market downturns. Surprisingly, the distribution is not normal.

(Source: Nifty Indices)

Nifty 50 Rolling Returns:

When analyzing rolling returns, which measure performance over multiple time periods rather than just one fixed period, the Nifty 50 Total Return (TR) Index has delivered positive returns ~93% of the time over a 3-year horizon. This indicates strong, consistent performance for long-term investors.

(Source: Nifty Indices)

As the investment horizon extends beyond 3 years, the Nifty 50 TR Index has delivered positive returns nearly 100% of the time. This means that if you had invested in the index with a horizon of more than 3 years, you would have almost certainly made a profit. However, the same cannot be said for shorter horizons.

For a 10-year horizon, the index’s performance has been quite stable, with maximum returns reaching 22.4%, minimum returns at 5.13%, and an average return of 14.24%. Overall, the analysis shows that over the long term, the index consistently delivers positive returns, with stable median and average CAGRs across different time horizons. However, in the short term, returns are more volatile, with a 18-24% chance of negative returns, highlighting the importance of a longer investment horizon for better risk-adjusted outcomes.

Closing Thoughts

Cut the noise around and INVEST FOR LONG-TERM!

Meme of the Week

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.