Welcome to this week’s edition of TOPICAL WEDNESDAY. Today, we examine India’s IT giant, Tata Consultancy Services (TCS), and its ₹55,000–₹60,000 crore ($6–7 billion) plan to build ~1 GW of sovereign, AI-ready data centre capacity in India. We also talk about what does it mean for TCS, shifting from its historically asset-light, services-led model and the country’s IT playbook.

What TCS Is Building and How

TCS has set up a ring‑fenced subsidiary to build and operate sovereign data centres in India, with its own leadership and governance but tight adjacencies to TCS’s services engine.

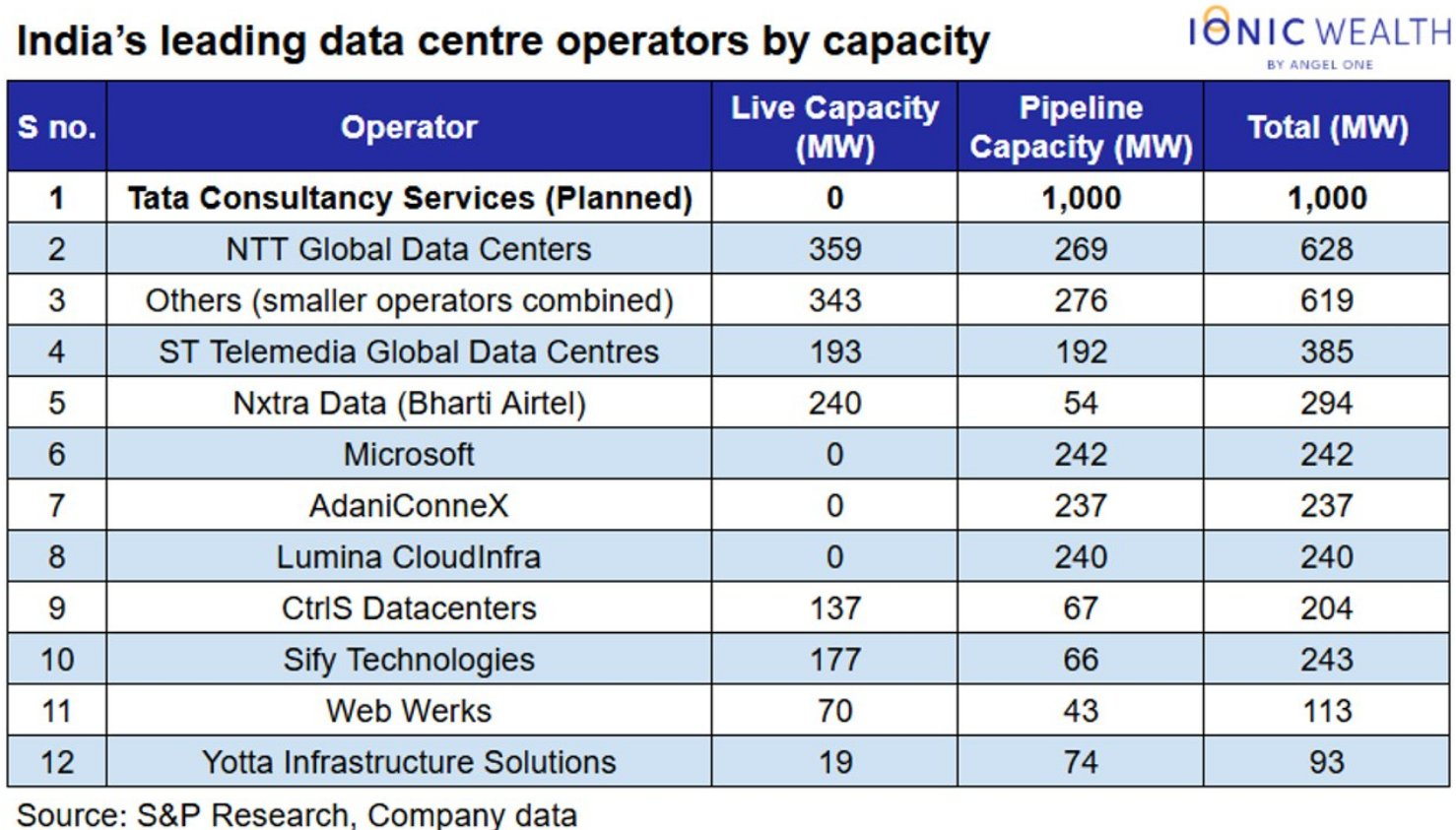

The goal is large and will be undertaken in phases: TCS targets ~1 GW capacity over 5–7 years, rolled out in multiple ~150 MW tranches. Today, India has ~1.2 GW capacity installed with ~5–6 GW in committed capacity, which underlines the massive scale of TCS’s plan. Management pegs capex at roughly $1 billion for every 150 MW, or ₹55,000–₹60,000 crore across the programme, with first revenue expected ~18–24 months after the initial site is commissioned.

What is being stood up is a sovereign co-location setup for AI. TCS provides the site (power, cooling, network and security) so data stays in India, while customers bring their own GPUs, storage and cloud stacks.

The first wave of demand is expected from pure‑play AI firms, deep‑tech players, hyperscalers, government and regulated enterprises that need residency, low latency, and auditability. If utilisation ramps on schedule, the unit should generate annuity‑style revenue and pull through modernisation, migration, security, and managed operations.

Set against TCS’s asset-light, services-led past, this is a clear shift. Early co-location returns are lower and the capital outlay is large, so the move is better read as a turning point than a routine extension. Management has kept the unit separate and plans to keep overall margins steady using equity funding and project debt.

Why Now: Market, Policy, and Capacity

Q2 FY26 was the catalyst. Growth stayed muted as clients tightened discretionary spend and consolidated vendors; TCS booked a one-time severance charge and ended the quarter with about 20,000 fewer employees. Client’s cyber incident delayed some program ramps, though recovery is underway. Together, these factors strengthened the case for an AI-led delivery push and for building an onshore compute layer that TCS can attach services to.

Demand is also firming. India is building out its AI stack, national programmes are adding more servers, and regulators are tightening data localisation and sovereignty norms. With AI training and inference still GPU-hungry and supply constrained, well-powered domestic sites are the practical choice.

The capacity math creates the opening. India has around 1.2 GW of installed data centre capacity and only 5–6 GW in committed builds over the next few years, while management sees demand over the next five to six years running well ahead of that. A sovereignty-first, co-location footprint can help close that gap.

Competition is active. Hyperscalers and specialist operators are adding megawatts across the main hubs. TCS’s angle is a sovereign posture with service attach, plus potential Tata group advantages in power, real estate, and project execution to compress cost and time.

Impact: How the Pivot Changes TCS and Its Customers

With this move, TCS’s model shifts from a purely asset-light, services-led business to a services + infrastructure stack. Revenue gains a steady, annuity-like layer from co-location, with the services engine (modernisation, security, managed ops) on top. The customer base widens from global enterprises to AI-native firms, hyperscalers, and public-sector anchors and the sales motion turns more “infrastructure-first”. Internally, skills broaden to include site operations, energy procurement, and reliability engineering, even as delivery stays services-heavy. Done well, this boosts relevance in the AI era and smooths cash flows, though returns will hinge on utilisation and disciplined capital use.

For customers, this pivot simply means AI‑grade compute that’s closer, cleaner, and easier to trust. With capacity built in India and wrapped in sovereignty controls, banks can modernise core systems and train risk or fraud models without shipping data offshore; hospitals and insurers can run privacy‑sensitive analytics; state agencies can scale citizen platforms; and manufacturers can crunch plant data for predictive maintenance,all with lower latency and fewer compliance headaches.

It also shortens the path from plan to go-live. Instead of juggling different vendors for advice, migration, hosting, and operations, buyers get one accountable partner. TCS can design the plan, move the workloads, and run them on on-shore infrastructure built for high-throughput AI. Fewer hand-offs mean faster delivery, exactly what CIOs want when budgets are tight and boards want visible progress.

Sovereignty is the practical edge. Data and logs stay within India; audit trails are straightforward; controls are built for regulated workloads from day one. For AI training and inference, which are GPU-hungry, putting compute near the data makes performance and costs easier to predict.

Economics: Capex, Returns, and Ramp

TCS plans about $1 billion of capex per ~150 MW, phased over 5–7 years (~₹55,000–₹60,000 crore for ~1 GW). Co-location yields are structurally below the core services business in early years; most street models see ROCE around 8–12% at ramp, rising with higher utilisation, firm pricing, and low-cost power. Cash flows are back‑ended: revenue begins ~18–24 months after set‑up/commissioning, while depreciation, energy and interest expense hit upfront. Management indicates the programme should be margin‑neutral at the consolidated level thanks to a ring‑fenced subsidiary, project debt and external equity; even so, subsidiary ROE will sit well below TCS’s >50% group ROE.

Upside comes from faster sovereign and regulated adoption and early anchor logos. Downside is under-utilisation or cost creep that stretches payback and drags free cash flow. If execution tracks plan, the unit can add a stable annuity layer without compromising payouts. If not, expect a longer capital workout until capacity fills.

Funding: Structure, Partners, and Stake Sale

The capital plan matters as much as the concrete. TCS has ring‑fenced the data‑centre business in a dedicated subsidiary, making it easier to bring in partners and raise project financing without over‑burdening the parent. The objective is clear: build ~1 GW over 5–7 years while keeping group margins and payouts steady.

Funding will be staged to match the build. Each ~150 MW phase carries roughly $1 billion of capex; in aggregate, management guides to ₹55,000–₹60,000 crore across the programme. Expect a mix of project debt, outside equity, and cash from operations. Management is already in talks to sell a minority stake in the subsidiary to financial investors, proceeds that would de‑risk capex, accelerate the rollout, and limit drag during the ramp.

For investors, two guardrails matter. First, management says the programme should be margin-neutral for the group, helped by partner equity and project debt. Second, TCS still targets returning 80–100% of “substantial” free cash flow to shareholders, with flexibility only if a large acquisition comes up.

Looking Ahead: What Could Make This Work

For TCS,and, by extension, India’s other IT majors, the next chapter looks more “services + infrastructure” than the asset‑light decade we’ve just lived through. If TCS executes, a sovereign co‑location layer can add a steady annuity stream on top of transformation and managed services, deepen customer lock‑in, and create larger, longer‑tenor deals. It also sets a reference model peers may follow through partnerships or selective ownership. The trade‑off is clear: near‑term returns at the subsidiary (think ROCE ~8–12% at ramp) won’t resemble the services core, and cash flows are back‑ended, but the group can still keep consolidated margins steady if it sticks to a ring‑fenced structure, partner equity, and disciplined project debt.

For India’s data‑centre market, the runway is real. Against ~1.2 GW installed today and ~5–6 GW already committed, TCS is proposing another ~1 GW over 5–7 years, a scale that, if matched by a few others, could meaningfully raise domestic compute. Demand drivers are clear: AI moving closer to data, big public-sector digital pushes, and stricter data-localisation rules. On supply, power is the key edge. Long-term renewable deals, better energy efficiency, and strong grid connections will separate the winners.

A realistic view is still necessary. Success rests on three things: (1) pre-leases that take early phases above 50–60% before work starts; (2) power at the right price, locked in early via PPAs/open access; and (3) on-time delivery; getting first sites from FID to revenue in 18–24 months. Miss any of these and payback stretches; go 10–15% over capex or slip by a couple of quarters and the ramp gets harder. Get them right and the unit adds a durable, sovereign layer to TCS without weakening the parent’s payout policy.

Looking ahead, the signs will arrive before the P&L does: the identity and valuation of the equity partner, site disclosures with power contracts attached, and credible pre‑lease levels for Phase‑1. If those land in the coming quarters, expect other Indian IT giants to lean in,through alliances, capacity reservations, or their own targeted builds,marking the start of a more infrastructure‑aware era for the sector.

We’d also love to hear your thoughts and feedback on X. Connect with us there at @bastionresearch.

Happy Investing!!!

Disclaimer: This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

😂Meme of the Week🤣

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.