Welcome to this week’s edition of TOPICAL WEDNESDAY! This week, we examine the sharp slowdown in India’s IT hiring cycle and what it signals for the industry’s next phase.

Over the past two decades, India’s IT sector has been synonymous with stability. Predictable hiring cycles, mass campus placements, and consistent double-digit growth became the norm.

But today, the story looks different. Headlines are no longer about offer letters; they’re about layoffs, delayed onboarding, and hiring freezes.

So what’s changed? What’s Really Happening?

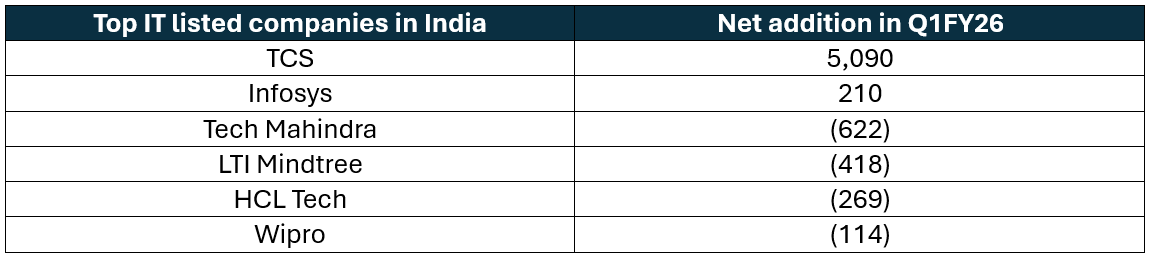

A few years ago, companies like TCS and Infosys were onboarding tens of thousands of freshers straight out of college. Today, most of those pipelines have dried up. In Q1 FY26, here’s how net employee additions looked:

(Source: Bastion Research)

The biggest news? TCS, despite adding over 5,000 people in Q1, has internally laid plans to cut around 12,000 roles this year, a sharp reversal from its traditional image of lifetime employment and stability. Elsewhere in the sector, hiring remains muted, onboarding is delayed, and quiet restructuring is underway. The steady flow of IT jobs that once launched engineering careers is now tapering off.

Salary hikes are muted too. At HCL, junior employees received only token raises of 1-4%, and mid-level staff are still waiting. Lateral hiring, once the fastest-moving lane, is now almost completely frozen.

What’s Causing the Shift?

The hiring slowdown in Indian IT isn’t just about weak demand or tighter budgets. It’s being driven by two deeper structural changes, both of which question the very foundation of India’s traditional outsourcing model.

1) AI is taking over entry- and mid-level work

A lot of the work that Indian IT has historically done, writing repetitive coding tasks, testing, bug fixing, monitoring systems, etc., is increasingly being handled by machines.

Tools like Copilot, ChatGPT, and other such platforms can now automate what used to take junior developers hours or even days. These tools are making life easier for senior engineers, helping them code faster, debug smarter, and manage more with less. But at the same time, they’re quietly replacing the need for many junior roles altogether.

And it’s not just entry-level roles. Even mid-level tech jobs, which involve coordinating teams, managing releases, pulling reports, or doing repetitive client servicing work, are slowly being chipped away. AI agents are getting better at executing structured tasks with precision and speed, without requiring sick days or appraisals.

Indian IT’s business model has long been built on scale; the more people staffed on a project, the higher the revenue. But that equation only works when manual effort is central to delivery. Now, with machines doing round-the-clock work, faster and more accurately, that formula is breaking down. When automation takes over large chunks of execution, charging clients based on headcount stops making sense and starts becoming a competitive disadvantage.

2) GCCs are eating the lunch of traditional IT vendors

The second major shift is in where the work is being done.

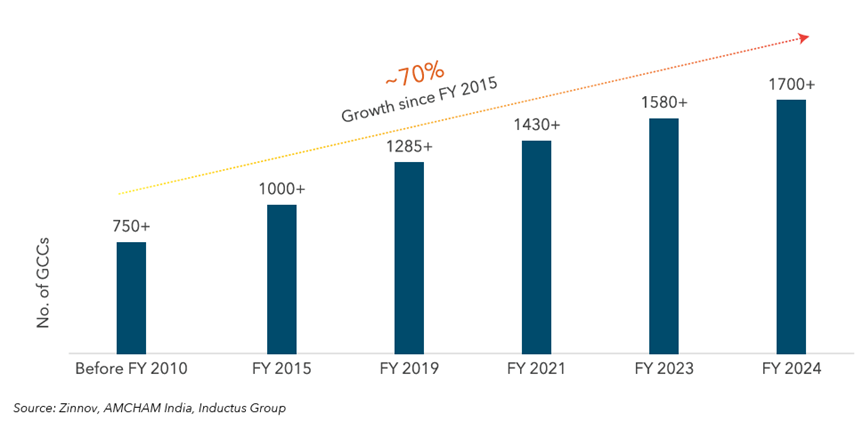

Instead of outsourcing to Indian IT service providers, global firms are flocking to Global Capability Centres (GCCs), their captive tech hubs set up inside India.

Consider this: instead of paying TCS or Infosys to roll out enterprise software or crunch data, a Fortune 500 company can open a unit in Bengaluru or Hyderabad, hire its own engineers, and keep the entire workflow in-house. It gains tighter control, faster turnarounds, stricter data security, and, over time, a lower total cost.

The scale is no sideshow. India already hosts about 1,950 GCCs employing roughly 1.9 million people, and one in two centres plans to add more headcount in FY26. While legacy IT vendors crawled at 4–5% growth in FY24, GCC revenue jumped nearly 40 %, and the momentum is only building.

There is a strong talent pull, too. A Google or Walmart-branded badge feels more prestigious to a young engineer than life inside a vendor pyramid, making recruitment easier for captives.

Cost arbitrage no longer favors Indian vendors either. Nations such as Vietnam, Mexico and the Philippines now match India on price for routine work, so multinationals looking purely for cheaper labour can shop elsewhere. When quality and IP control matter, captives still win.

In short, Indian IT vendors sit in the middle: not the lowest-cost option and no longer the first pick for high-value tech. GCCs are filling that gap fast.

Together, AI and GCCs are pulling the rug from under the old playbook. A playbook that was built on large campuses, pyramid structures, and a simple promise: keep adding people, and you’ll keep growing. That promise is starting to break.

And it isn’t only India feeling the tremors

- In the US, unemployment among fresh computer-science graduates hovers around 7.5%, nearly double the overall jobless rate for young adults.

- In the UK, new tech grads routinely blast out hundreds, sometimes a thousand, applications before an interview lands.

- Recruiters from Toronto to Tokyo report the same pattern: AI tools take care of routine coding and back-office chores, squeezing the very roles that once served as a proving ground for junior talent.

The message is simple. India’s IT slowdown is only one chapter in a broader rewrite of how tech work gets done and that rewrite is throwing light on business models still built purely on selling human hours.

Hiring Is No Longer the Heartbeat

For decades, the quickest way to gauge the health of India’s IT sector was to look at campus offers and net headcount additions. More freshers meant a fatter project pipeline, and a bigger bench usually translated into higher revenue growth a few quarters down the line.

That link is breaking.

Industry-wide hiring has largely stalled, barring rare pockets like Infosys, and layoffs are even on the cards, yet management guidance suggests no sharp slowdown is expected.

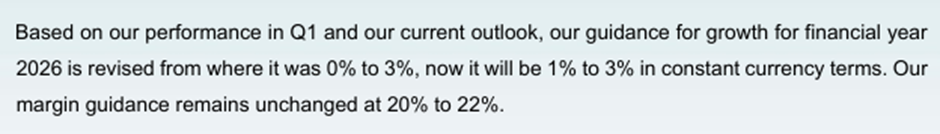

Infosys

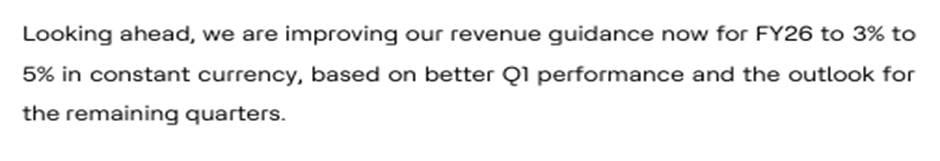

HCL Tech

Wipro

Growth guidance, earlier pegged at 2–5%, has only moved up marginally, yet even this small lift signals stability rather than a slowdown.

LTI Mindtree

TCS

(Source: Q1FY26 concalls)

In short, the industry’s vital signs are changing. Hiring spikes once signaled growth; soon, productivity per employee will tell the real story.

Pivot, Pivot & Pivot…

We believe IT companies will have to pivot towards a product-based offering.

The pain is sharpest at firms that trade headcount for revenue instead of owning differentiated technology. When a vendor’s chief offering is a bench of engineers, a lower-cost rival can undercut rates, or a client can bring the same work in-house through a GCC. Margins shrink, utilisation drops, and pricing power fades.

Products follow a different logic. Ship a piece of proprietary software that solves a real pain point and sits behind an IP wall, and a moat appears. One well-designed product can scale to thousands of users without thousands of new hires, command premium pricing year after year, and lift productivity metrics such as revenue per employee.

Investors have long judged tech companies on that very yardstick, and the gap is glaring. India’s big services players hover around US$45-60K per employee (TCS ≈ $50k; Infosys ≈ $60k). Product-led giants operate on another planet: Alphabet and Meta metrics are around US$2 mn. GCCs and SaaS firms sit much closer to that upper tier because each hire is tied to a product roadmap or platform, not a billing spreadsheet. By contrast, services vendors with large benches and idle buffers are starting to look bloated on this metric.

That is the road Indian IT firms will likely have to take to stay relevant over the next decade: pivoting from billing hours to building value, shifting focus from service projects to product platforms.

Why has the pivot been slow?

Despite being a cash-generating industry, Indian IT majors have underinvested in R&D. TCS generates about Rs 50,000 Cr of operating cash each year, yet spends only Rs 2,500 Cr on R&D. Across the sector, research spend hovers at 0.5-1 % of revenue. Stack that against Microsoft, which ploughs 12-13% of revenue back into R&D, and the gap is stark. The money was always there; the product mindset was not.

Why do they underinvest?

Indian IT firms have never faced real pressure to pour money into their own labs because their model rewards supplying engineers, not inventing products. Leaders stay laser-focused on keeping 20%-plus profit margins, so anything that dents near-term earnings, like multi-year research programs, is quickly pared back. Meanwhile, the big, headline-grabbing breakthroughs are funded by global tech companies and their own GCCs; Indian vendors are hired mainly to turn those blueprints into reality. With customers footing the innovation bill and margin math discouraging long-range spending, in-house R&D budgets remain paper-thin.

At first glance, the current shake-up can feel like a reckoning for the entire sector. Yet this isn’t the first time an “IT apocalypse” has been forecast. From the dot-com crash to the post-2008 slowdown and the visa clampdowns of the late 2010s, Indian firms have repeatedly stared down crises and come out stronger.

2001 · Dot-com Bust

What went wrong: Many US tech start-ups shut down. These were the companies giving lots of work to Indian IT firms. Suddenly, projects stopped, and engineers had no tasks.

What Indian IT did: Instead of waiting around, companies took up basic software maintenance work, helping large companies keep their systems running. They also started doing tech support and back-office work for global banks, which was more stable.

2008 · Global Financial Crash

What went wrong: Big banks and companies cut their tech spending. Some projects were cancelled. Budgets shrank, and Indian IT companies had to lower their prices.

What Indian IT did: They agreed to take on cost-saving projects to stay useful. While things were slow, they trained their teams on new skills like cloud computing. These skills became super valuable once the economy bounced back.

2017 · US Visa Squeeze

What went wrong: The US made it harder to send Indian engineers abroad. Getting work visas became slower and more expensive. This affected projects that needed people on-site.

What Indian IT did: They changed their model. More work started getting done in India itself. For jobs that had to be done in the US or Europe, they hired local talent there. This mix of remote + local became the new normal.

Every time trouble hit, Indian IT changed lanes. Each time the industry hit a wall, it survived. Reinvention, more than coding itself, has been Indian IT’s superpower.

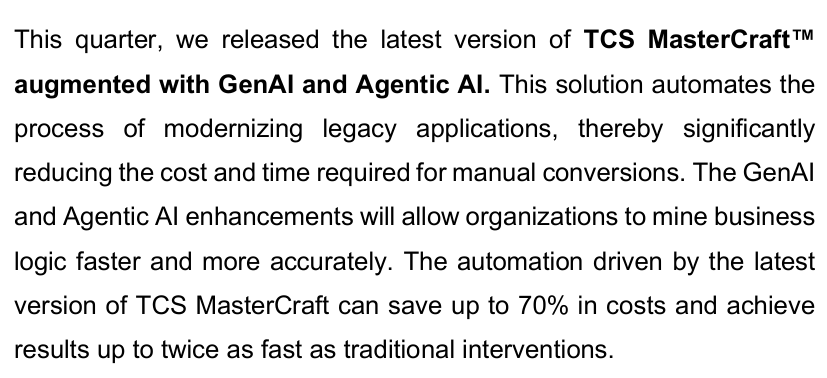

Proof that the shift is underway

Recent earnings calls show big-name vendors talking less about how many engineers they can staff and more about the AI toolkits they now own. Their new suites bundle hundreds of pre-built “agents” that read documents, write code, and flag fraud, so clients plug them in instead of hiring extra hands. Take TCS’s MasterCraft: its GenAI add-ons can slash modernisation costs by up to 70 % and finish jobs in half the time. In short, the headline shift is from “rent our people” to “use our software.”

Similarly, Infosys has Topaz and AI Next, which is a library of 300+ pre built AI agents.

Moving beyond the tools, vendors are also rethinking where the work gets done.

They now sell “GCC-as-a-Service”, a ready-made tech centre in India that they set up, staff, and run for the client. The vendor handles all the paperwork and day-to-day operations; the client just plugs in, pays a service fee, and can take full control later if it wants.

Keep an eye on how quickly these AI-led products win paying customers and push up revenue per employee. Their adoption will show whether India’s IT giants can truly evolve from service vendors into product creators or if the transformation remains mostly on paper. That verdict will shape the sector’s next decade.

Closing thoughts

Indian IT has rewritten its playbook whenever a crisis struck, moving from dotcom builds to maintenance work, from rate-cut shocks to cost-saving deals, and from visa limits to remote delivery. The twist today is that AI and GCCs are shifting the goalposts far faster than past disruptions. Can the sector pull off another gearshift at that speed? History says yes, but the next few years will reveal whether the tradition of timely pivots still holds.

We’d also love to hear your thoughts and feedback on X. Connect with us there at @bastionresearch.

Happy Investing!!!

Disclaimer: This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

😂Meme of the Week🤣

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.