This is the 6th part of our Semiconductor Series. Last Saturday, we talked about TSMC and how it took the leadership from Intel in terms of manufacturing excellence pertaining to semiconductors. Today, we are going to talk about another company which took the leadership from Intel when it comes to designing chips that perform at low power.

But first, a quick recap of our journey so far:

Semiconductor Series Letter 1: History of the Semiconductor Industry

Semiconductor Series Letter 2: The Semiconductor Value Chain

Semiconductor Series Letter 3: Key Players Across the Value Chain

Semiconductor Series Letter 4: The Rise and Fall of Intel

Semiconductor Series Letter 5: TSMC: The Global Semiconductor Giant

If you have followed this series till now, you would have probably guessed it. Yes, today we are going to talk about ARM Holdings, a chip blueprint design company that took the world by the storm, changed the entire semiconductor value chain, and became the industry standard that powers the majority of smart portable devices that we use today and will probably use in the future.

Cambridge Roots and the Birth of an Unusual Idea (1980s)

In the early 1980s, while the likes of Apple and IBM were leading the personal computing charge in the United States, a small British company named Acorn Computers was quietly building something revolutionary in Cambridge. Tasked with developing the BBC Micro as part of a national computer literacy project, Acorn succeeded in placing computers into thousands of UK homes and classrooms. But inside these machines were processors built by others, first Motorola, then Intel chips that were powerful, but far too energy-hungry to be used in anything portable.

Acorn’s engineering duo, Sophie Wilson and Steve Furber, saw an opportunity. What if a processor didn’t need to be big, hot, and power-thirsty? What if it could be small, efficient, and built from scratch for lean performance? Embracing a design philosophy known as Reduced Instruction Set Computing (RISC), they stripped away the unnecessary complexities of traditional chip architectures and focused on doing fewer things, but doing them exceptionally well. The result was ARM1, a processor with just ~25,000 transistors that consumed a fraction of the power of its contemporaries. It wasn’t powerful enough to run full desktop applications, and it lacked compatibility with the dominant Intel and Motorola software ecosystems. But it worked. Most importantly, wasn’t power hungry.

The Formation of ARM and a New Business Model (1990s)

This tiny chip became the foundation of something much bigger. In 1990, with Apple planning a new handheld device called the Newton, it partnered with Acorn and VLSI Technology to spin out a new company: Advanced RISC Machines, ARM for short. From the outset, ARM defied convention. It didn’t manufacture chips. It designed them and licensed those designs to others. With just 12 engineers at the start, ARM focused on one thing: building efficient processors for portable, battery-powered devices.

The Apple Newton, powered by the ARM610 chip, launched in 1993. Though the Newton failed commercially, it validated the potential of ARM’s architecture. What could have been a dead end became a proof of concept. Over the next decade, ARM’s processors quietly became the go-to choice for embedded electronics and handheld devices from PDAs and feature phones to early gaming consoles and digital cameras.

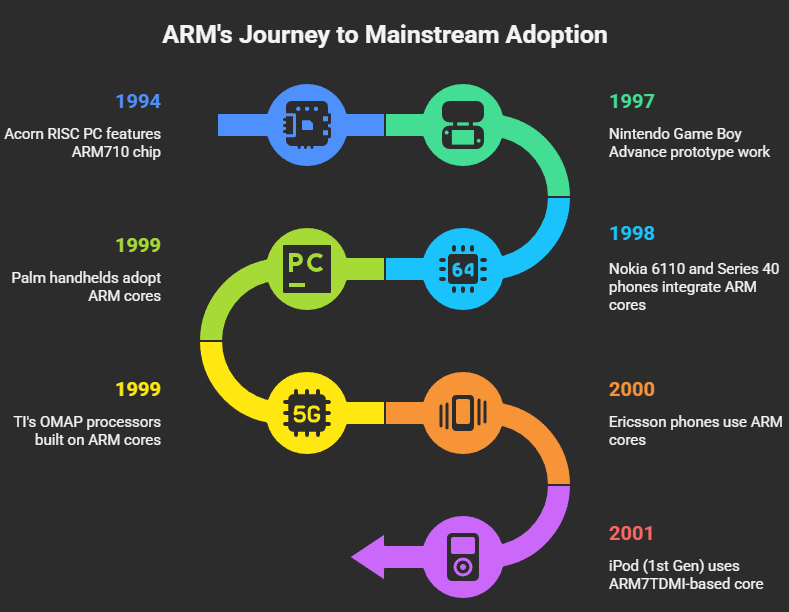

Key customers and devices that adopted ARM (before smartphones)

By the time smartphones emerged in the mid-2000s, ARM was everywhere. Its energy-efficient chips were inside millions of portable devices well before the category exploded.

From the Shadows to the Spotlight: ARM’s Rise in the Smartphone Era

By the early 2000s, the world was on the cusp of a mobile revolution. Internet access was going wireless, phones were turning smarter, and consumers were expecting more computing power in their pockets. Devices needed to be fast, connected, and most importantly energy-efficient. It was the perfect storm for ARM.

Having already made quiet inroads into feature phones and PDAs in the late ’90s, ARM entered the 2000s with a key advantage: its chips were lightweight, power-efficient, and scalable, everything smartphone makers needed to build the next generation of mobile devices.

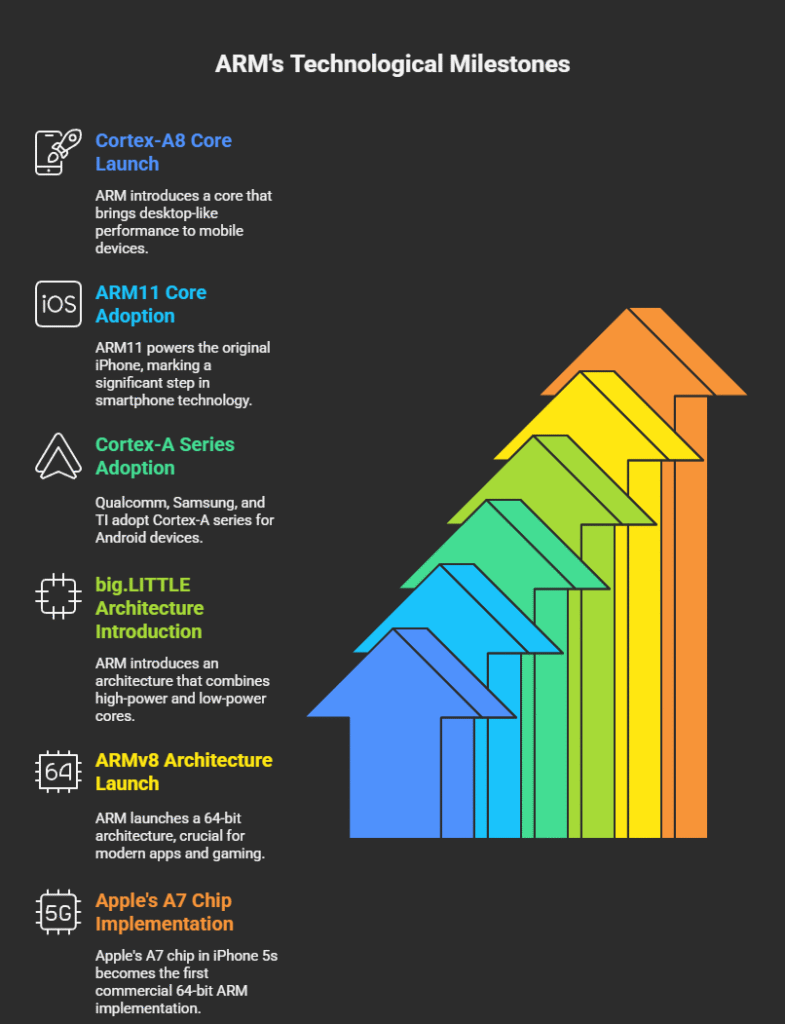

Then in 2000s, the company made inroads big-time in terms of tech that helped it achieved some major milestones.

Throughout 2000s-2010s, ARM’s processor designs became near-universal across mobile and steadily expanded into adjacent categories. Additionally, smartphone companies also started designing their own chips using ARM’s architecture license, allowing deep customization.

- Apple used custom ARM-based chips in all iPhones and iPads.

- Qualcomm dominated Android with Snapdragon processors was built on ARM cores.

- Samsung produced ARM-based Exynos chips for its flagship Galaxy phones.

- Nvidia built its Tegra line of mobile processors on ARM, used in tablets and gaming consoles.

- MediaTek and Spreadtrum built low-cost ARM-based chips for emerging markets.

Interestingly, the story does’nt end with phones and tablets. Today, ARM processors are being embedded in Smart TVs (e.g., LG, Samsung), Wearables and fitness trackers (Fitbit, Android Wear), Consumer electronics like printers, routers, and game consoles, Automobiles, handling infotainment systems, sensor control, and early autonomous functions, IoT devices, from smart thermostats to industrial sensors, etc.

By 2015, over 15 Bn ARM-based chips were being shipped annually. It had gone from a niche UK-based licensing firm to the world’s most prolific chip architecture company, found in over 95% of smartphones and billions of other connected devices.

What Made Customers Stick? ARM’s Moats

ARM wasn’t the only chip designer in the world but it built a combination of following technical and non-technical moats that made it nearly impossible to displace.

- Developer Ecosystem: ARM invested early in building tools, documentation, and partnerships with software developers, making it easy to write apps, drivers, and firmware that “just worked” on ARM chips.

- Licensing Flexibility: Customers could choose to license standard ARM cores or go deeper by licensing the ARM architecture itself, giving them freedom to customize, differentiate, and control their supply chains.

- Power Efficiency Focus: In an increasingly mobile-first world, energy efficiency is more important than raw speed and ARM’s designs are light years ahead in that department.

Intel’s Missed Shot: How ARM Won the Smartphone War?

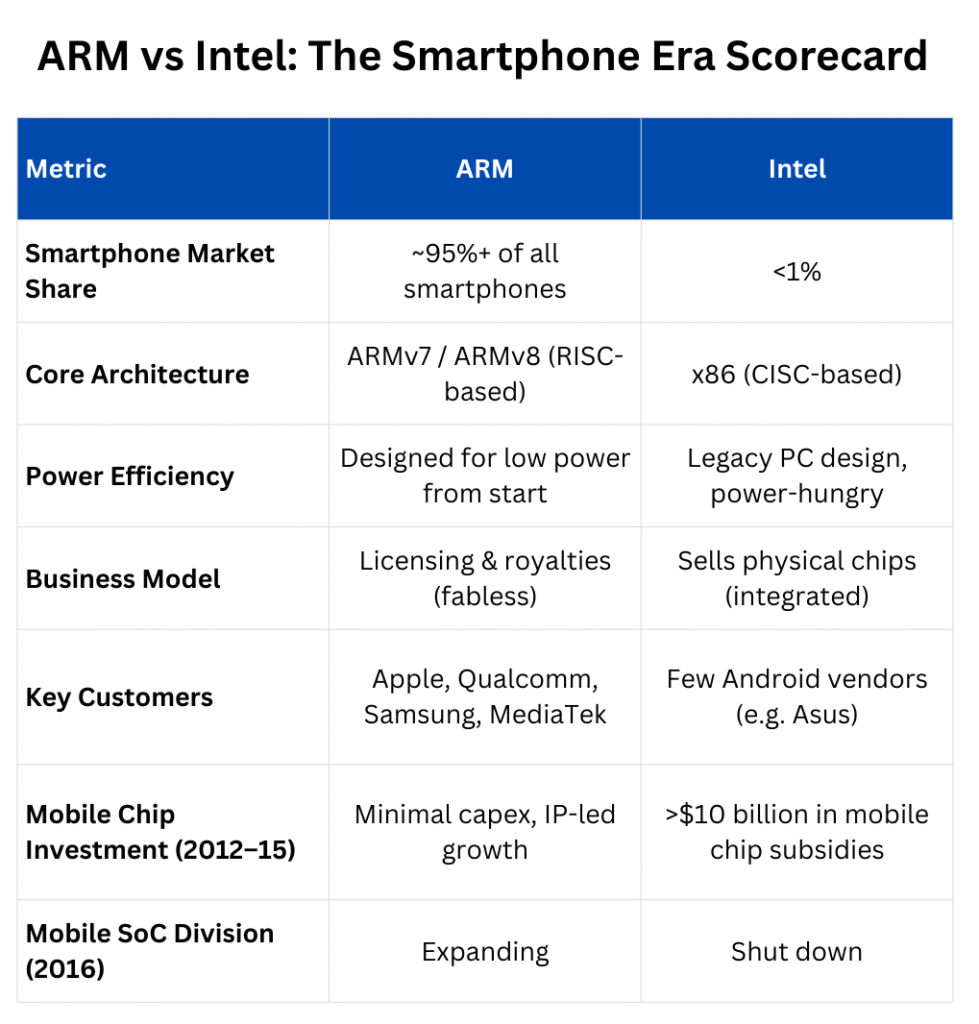

While ARM was quietly embedding itself into billions of devices, Intel, the king of PC processors, watched the smartphone boom from the sidelines. For decades, Intel’s x86 architecture had dominated desktops and laptops. But as the world shifted toward mobile computing in the 2000s. Unfortunalety, Intel failed to adapt.

Its processors, though powerful, were built for performance, not power efficiency. Attempts to shrink desktop-class chips into smartphones led to thermal issues and poor battery life, which was a non-starter for handheld devices. Intel did launch Atom, a line of low-power chips aimed at smartphones and tablets, but it came too late and couldn’t match ARM’s efficiency or ecosystem adoption.

- Between 2012 and 2015, Intel reportedly spent over $10 Bn subsidizing Atom chips to win mobile market share, including partnerships with device makers like Asus and Lenovo, but with little success.

- By 2015, ARM-based chips were powering over 95% of all smartphones, while Intel held less than 1% of that market.

ARM’s architecture was flourishing because it had been purpose-built for mobile from the start. Its lightweight design, customizable licensing model, and massive software support made it the go-to choice for every major smartphone chipmaker: Apple, Qualcomm, Samsung, MediaTek, Huawei, and others.

In 2016, Intel quietly shut down its mobile SoC division, effectively exiting the smartphone race. As mobile became the dominant form of computing, ARM became the architecture of the future, and Intel, once synonymous with chips, faded from the mobile conversation entirely.

Acquisition by SoftBank and a Broader Vision (2016–2020)

That same year (2016), ARM became the center of a different kind of story. Japanese conglomerate SoftBank, led by Masayoshi Son, acquired the company for $32 billion in one of the largest tech deals of the decade. Son wasn’t just buying a chip designer. He believed ARM would power the next era of computing, across IoT, AI, robotics, and cloud infrastructure. Taking ARM private gave it the flexibility to invest in longer-term bets without the short-term pressure of quarterly earnings.

ARM used this breathing room well. It expanded into new markets, introduced the Neoverse line for cloud data centers, launched the Ethos AI processor family, and developed the Cortex-X series for premium smartphones. Even though the company operated outside the public spotlight, it continued to dominate mobile and edge computing, with its architecture spreading to cars, smart homes, and industrial devices.

The NVIDIA Deal that Wasn’t (2020–2022)

As you know, SoftBank is not an (Not Berkshire ;)) holding company. It is a venture investor. And exits are always part of the plan.

In 2020, SoftBank announced a proposed $40 billion sale of ARM to NVIDIA. The deal promised to merge ARM’s universal CPU ecosystem with NVIDIA’s graphics and AI acceleration prowess. But this move immediately triggered regulatory alarms across the globe. Governments saw ARM not just as a business but as critical infrastructure. In the UK, it was a matter of national pride. In the US and EU, it raised antitrust concerns. Additionally, in China, the optics of an American company taking over such a vital component of the global tech stack added fuel to an already tense geopolitical standoff.

After nearly 18 months of investigations, lobbying, and delays, the NVIDIA-ARM deal collapsed in 2022. SoftBank pivoted. It restructured ARM, focused it more sharply on AI and cloud applications, and prepared it for a public offering.

ARM Returns to the Public Markets (2023)

By September 2023, ARM returned to the markets with a NASDAQ IPO that valued the company at over $65 billion. For SoftBank, it was about unlocking value but for ARM, it was a public reintroduction, not just as a mobile chip licensor, but as the foundation of next-generation computing.

What made the entire saga remarkable was not just the corporate drama, but the consistency of execution throughout. While executives and lawyers debated ownership, ARM engineers kept shipping. It continued powering 99% of smartphones. It struck new deals with Amazon for Graviton processors and Tesla for its Full Self Driving chips. It became increasingly relevant in cloud data centers and edge AI, where its power efficiency and flexible architecture gave it an edge over legacy incumbents.

A Business Model that Scales as Customers Scale

ARM operates on a licensing-and-royalty model which scales beautifully with the success of its customers. Today, ARM makes money by licenses its chip designs or architecture to companies like Apple, Qualcomm, Samsung, MediaTek, and many others. ARM mostly earns from companies in two ways:

- Customers pay ARM an upfront fee to access processor core designs or license the entire ARM instruction set architecture (ISA) to design custom chips (what Apple does). This licensing fee is usually a multi-million dollar contract, paid once or over a few years.

- Once a customer starts manufacturing and selling chips based on ARM’s design, ARM earns a royalty on each chip shipped. This is typically a small percentage of the chip’s price, often between 1 to 2 percent. So yes, when Apple sells an iPhone with an ARM-based A-series chip inside, ARM gets a royalty for each unit. Same goes for chips sold by Qualcomm (Snapdragon), Samsung (Exynos), MediaTek, and others. If it uses ARM’s cores or architecture, ARM earns a slice.

Where ARM Stands Today? The Silent Standard of Modern Electronics

As of today, ARM is no longer just a mobile-first company. It is the default architecture across nearly every category of electronics, and its dominance is not symbolic, it is backed by scale.

- ARM-based chips power over 99% of smartphones, 80% of digital cameras, 95% of wearable devices, and over 60% of smart TVs and home appliances.

- In automotive, ARM powers infotainment systems, driver-assistance features, and in many cases, sensor fusion chips used in ADAS (Advanced Driver Assistance Systems).

- In data centers, ARM is making rapid progress. Amazon’s Graviton processors, built on custom ARM architecture, are now powering a significant portion of AWS workloads, offering better performance per watt than traditional Intel Xeon-based servers.

- In AI and edge computing, ARM’s low power and scalable designs are being used in smart cameras, industrial sensors, and on-device inferencing for vision and language tasks.

ARM’s competitive edge lies in its DNA. Unlike Intel, which designed chips originally for desktops and later tried to adapt them to other devices, ARM’s architecture started with power-sensitive use cases. That advantage has compounded over decades. ARM designs are modular, license-friendly, and optimized for customization, all of which allowed it to scale across device categories and geographies.

Its ecosystem is another moat. Tens of thousands of developers are trained on ARM’s tools. Device makers, operating systems, and software platforms, from Android to embedded Linux, are tightly integrated with ARM.

In a world that is going from billions of devices to trillions, where every toaster, drone, and satellite is essentially a computer, ARM is not just relevant. It is foundational.

Closing Thoughts

Today, ARM is the default computing architecture across consumer electronics, automotive systems, and increasingly, the data center. Its chips run over 250 billion devices worldwide. They live inside thermostats and smartphones, drones and satellites. Its software ecosystem spans Android, Linux, and custom real-time operating systems. And its business model, licensing rather than manufacturing remains as scalable and capital-efficient as ever.

ARM’s success was never built on hype. It was built on insight: that the future would not belong to the biggest chip, but to the smartest one. At the cost of repeating, in today’s fast moving world, ARM’s role is not just important. It is foundational.

While others battled for control over fabs, supply chains, and chip inventories, ARM sold the blueprints. It let the world build on top of its architecture, and in doing so, embedded itself into everything from your phone to your thermostat and may be even to the cloud server routing this very newsletter.

If you enjoyed reading about TSMC’s rise to dominance, feel free to share it with others who might find it insightful. We’d also love to hear your thoughts and feedback on X. Connect with us there at @bastionresearch.

Happy Investing!!!

😂Meme of the Week🤣