Suyog Telematics Rs. 60 cr warrants issue

let’s explore the topic of SHARE WARRANTS using the example of Suyog Telematics Ltd. We believe that learning through examples enhances understanding and boosts retention significantly

About Suyog Telematics Ltd.

Established in 1995, Suyog Telematics provides telecom tower infrastructure solutions in rural and urban areas. Simply put, Suyog installs telecom towers for leading telecom companies (including the likes of Airtel, JIO, and VI) in India. Interestingly, the company is expecting to attract major business, which will include the installation of what they call “Small Cell Towers” as India becomes 5G ready.

As you would appreciate, growth requires companies to commit investments, and that requires money. This brings us to the Warrants that Suyog recently issued to its promoters. But before that, let’s understand what warrants are.

What are Warrants?

Warrants are instruments that confer the right, but not the obligation, to buy a company’s stock at a specified price. But wait. It has some regulations and compliance around it that are important to understand.

Key points regarding the issuance of warrants

Approvals: The issuance requires necessary approvals from various stakeholders.

Regulatory Compliance: Guidelines provided by the SEBI, exchanges must be followed.

Pricing: Issue price is determined as guided by the regulator

Payment: An initial payment of 25% is required at the time of warrant issuance.

Lock-in Period: The warrants come with a lock-in period

Tenure: A maximum tenure of 18 months for exercise and conversion.

Exercise: If the holder chooses to exercise the warrants, a balance of 75% payment must be made

Expiry: If the warrants are not exercised within 18 months, they expire, and the initial payment is forfeited.

Now, coming back to Suyog,

In terms of products, it is the largest surgical needle manufacturer by volume worldwide and ranks 4th in manufacturing sutures globally. The company has a presence in 90+ countries currently.

We believe that the above section must have given you a satisfactory answer.

Issuance of Warrants to Promoters

On 12 August 2023, Suyog’s board approved the issuance of warrants to promoters at Rs. 570/warrant, each of which will be converted into one equity share of the company. Interestingly, the stock saw a strong rally since warrants were issued and is now trading at Rs. 1,176. Who will not exercise warrants in such a case, one would ask? The answer is pretty straightforward: NO ONE.

What happens when warrants are issued?

Warrant issuance leads to two activities.

A. It results in a cash inflow to the company (initially 25% and 75% at the time of conversion, as mentioned above)

B. It also results in an increase in % shareholding of the exerciser. In other words, this reduces the portion of future earnings attributed to “Non-Exercising” shareholders. The jargon used for this is called Equity Dilution.

This is exactly what will happen in the case of Suyog as well. The promoter will pay Rs. 60 cr. to the company in exchange for 10.55 lakh shares. Upon conversion of the warrants, the promoter’s stake in the company will substantially increase from ~47% to ~57%.

Why does Suyog need money?

The short answer is expansion. STL has announced plans to significantly expand its tower asset base, aiming to add 10,000 small cell towers to the current 4,300 over the next two years. If you are still guessing who makes the capital expense, it is Suyog and not the telecom operator.

The total cost of setting up 10,000 SMALL CELL TOWERS is Rs. ~600 Cr. (Rs. ~6 lakh per tower). This Capex will be divided into two years. Out of this, Suyog plans to invest Rs. ~250-300 cr. in FY25 itself.

Now, we believe the dots should connect. The promoter’s Rs. 60 cr. capital infusion against warrants will fund the large expenditure that Suyog is planning to incur.

How are we reading this?

Generally, warrant issuance is a positive signal, reflecting the promoters’ confidence. In the case of STL, it is also good to see the promoter showing confidence in the business with his personal money.

Well, the recent price move and the growth prospects more than compensate for this confidence, but nevertheless, this is a positive move and is expected to enhance the company’s financial flexibility and support its ambitious growth plans.

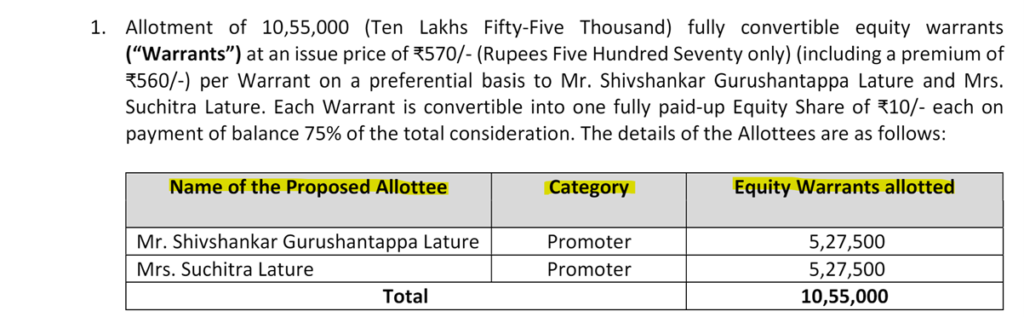

Important contents of the announcement

There are a couple of important tables that we investors must go through to extract (highlighted below) all the important information pertaining to the warrant issue.

Firstly, the below piece of information tells us the “Name of the Proposed Allottees”, “Category” and “No of Warrants Issued”

Secondly, the below piece of information tells the “Issue Price”, “Total Amount expected to be received by the company,” and “Change in Shareholding”.

Fin Meme of the Week

Bidding adieu on a lighter note