Welcome to this week’s edition of TOPICAL WEDNESAY! Today, we will explore the business model of Lenskart Solutions, whose IPO is open for subscription from 31st Oct.

Before we get started, we have an announcement to make. We are moving our blog to substack.

We’re shifting to Substack to make your reading experience smoother.

Same content, same schedule. Two newsletters every Wednesday and Saturday.

Join us here:

Already moved? You can unsubscribe from this list via the button at the bottom of this email.

For decades, eyeglasses in India were a symbol of necessity, not style. The term ‘chashmish’ (a colloquial, often teasing term for someone who wears glasses) captured a cultural perception of eyewear as a purely medical device, a marker of poor vision. The market reflected this: a fragmented landscape of thousands of local opticians, inconsistent quality, opaque pricing, and a limited selection that prioritized function over fashion. It was a grudge purchase, made infrequently and without enthusiasm.

Then came Lenskart. Founded in 2008, by applying a tech-first, direct-to-consumer (D2C) mindset to a deeply traditional industry, Lenskart transformed eyewear from a medical necessity into a fashion accessory. It made stylish, high-quality glasses accessible and affordable, turning a once-static product into an object of aspiration and personal expression.

Now, after more than a decade of relentless disruption, Lenskart is heading for a landmark IPO, one of the largest consumer-tech listings of 2025. As the company is about to hit this milestone, it is raising a crucial question for investors: what exactly is the machine that Lenskart has built, and is its vision for the future as clear as the lenses it sells?

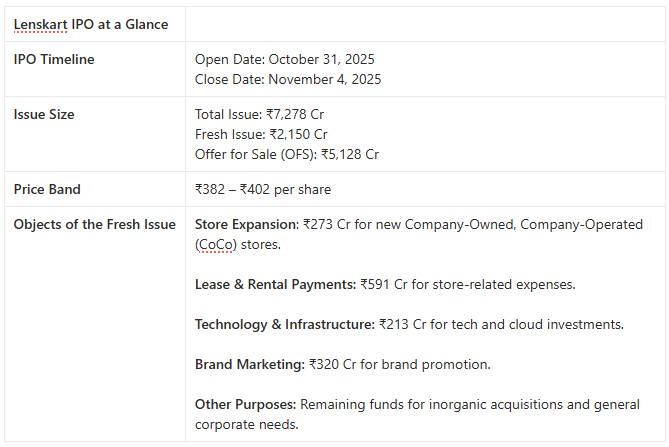

The IPO in Sight

Lenskart’s public offering is a significant event, combining a fresh infusion of capital for growth with a substantial exit for its early backers. The numbers provide a clear snapshot of the scale and ambition of this market debut.

The IPO structure reveals a dual objective: fueling the company’s aggressive expansion plans through the fresh issue while providing a lucrative exit to early backers like SoftBank, Kedaara Capital, and Temasek through the OFS.

Interesting, none of the promoters are selling stake in the OFS.

From a Basement to Billions: The Lenskart Story

Lenskart’s origin is a classic startup tale of a tech-savvy founder identifying a massive, unsolved problem in a traditional Indian market. The journey began not in an optician’s workshop, but in the mind of Peyush Bansal, an ex-Microsoft engineer who returned to India with a desire to build something impactful. His first venture, SearchMyCampus.com, was a student classifieds portal launched in 2008 from his parents’ basement with a capital of ₹25 Lakh. This digital-first endeavor was the seed for a larger ambition, leading to the incorporation of ‘Valyoo Technologies Private Limited’ on May 19, 2008.

Initially, Valyoo Technologies was a horizontal e-commerce play, testing verticals like jewelry (Jewelskart), bags (Bagskart), and watches (Watchkart). However, Bansal and his co-founders, Amit Chaudhary and Sumeet Kapahi, soon realized that competing with e-commerce giants like Flipkart and Amazon in established categories was a losing battle. The real opportunity lay in a market that was complex, fragmented, and underserved: EYEWEAR.

The Indian eyewear market was ripe for disruption. It was plagued by middlemen who inflated costs, a lack of quality control, and a severe deficit of choice. Recognizing this, the founders made a pivotal decision to shut down their other ventures and focus solely on eyewear. Lenskart was born in 2010 as an online-only platform for contact lenses, soon expanding to eyeglasses and sunglasses.

However, the team quickly learned that selling a high-involvement, medical-cum-fashion product entirely online was a challenge. Customers wanted to touch, feel, and try on frames. They needed trust in the prescription and the fit. This insight led to the next crucial evolution in Lenskart’s strategy: the move into physical retail. In 2013, the company opened its first brick-and-mortar store in New Delhi, laying the foundation for the powerful omnichannel model that defines it today. This was not just about adding a sales channel; it was a strategic move to build trust, acquire customers, and bridge the gap between digital convenience and physical experience.

The Lenskart Machine: How It’s Built

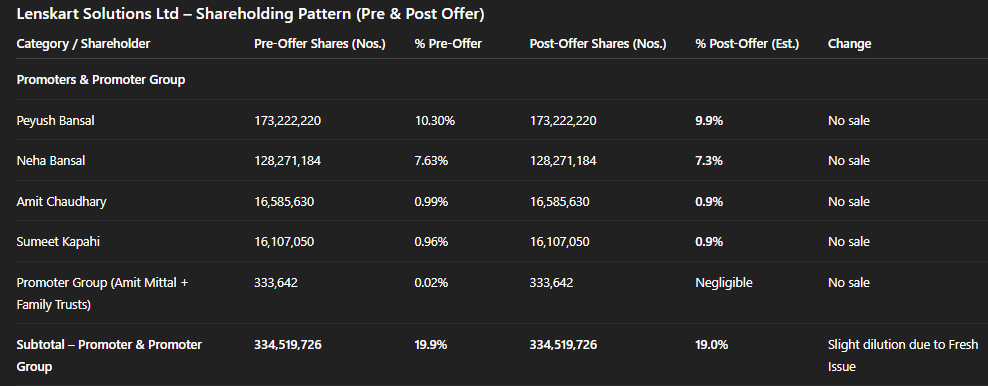

Lenskart’s dominance isn’t just a result of being an early mover. It’s the product of a meticulously engineered business model, a vertically integrated machine built on three core pillars: end-to-end supply chain control, a seamless omnichannel network, and a deep-rooted technology-first culture.

Vertical Integration: From Design to Doorstep

Unlike traditional retailers who rely on a long chain of importers, distributors, and wholesalers, Lenskart controls nearly every step of its value chain. This vertical integration is its most formidable competitive moat. The company designs its own frames, manufactures a significant portion of its products in-house, and sells directly to the consumer. This model eliminates multiple layers of middlemen, allowing Lenskart to offer products at a 35-40% lower cost than its competitors. This helps the company in maintaining high gross margins, which stood at nearly 69% in FY25.

Its manufacturing prowess is significant. The company operates automated facilities in Bhiwadi and Gurugram, supplemented by regional hubs in Singapore and the UAE, and a joint venture in China for frame production. The Bhiwadi plant, for instance, is 75% automated and uses German robotic technology for lens cutting and edging, ensuring a precision of up to three decimal places. This control over production not only ensures quality and reduces costs but also enables rapid innovation, allowing Lenskart to launch new collections frequently and respond quickly to changing fashion trends.

Interestingly, company has managed to deliver customized single vision eyeglasses within 24 hours in over 58 cities in India and within 72 hours to customers in 49 cities.

The Omnichannel Playbook

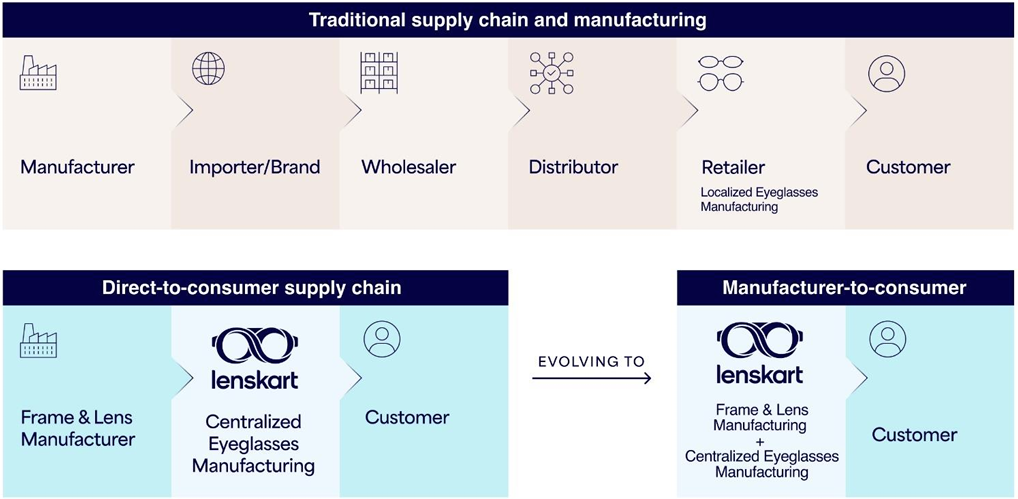

Lenskart has masterfully blended its digital and physical presence into a single, cohesive customer experience. While it began online, the company now operates a vast network of 2,806 stores globally (Singapore, UAE, etc) as of June 30, 2025, with 2,137 of those in India. This physical footprint is central to the business model.

The strategy works in a symbiotic loop. Digital channels, powered by a mobile app with over 10 crore downloads, drive brand discovery and customer acquisition. However, the physical stores act as crucial points of trust and service. Here, customers can get free eye tests, physically try on frames, and receive personalized assistance from trained staff. This hybrid model de-risks the purchase for consumers who are hesitant to buy a prescription product online. Innovative services like “Try at Home,” where customers can select up to five frames to try before buying, and at-home eye check-ups further blur the lines between online and offline, offering unparalleled convenience.

This model is not just about sales channels; it is a sophisticated data collection engine. The thousands of free eye tests conducted in-store provide Lenskart with invaluable, high-fidelity data on customer prescriptions and facial biometrics. This data feeds back into every part of the business, from inventory management and product design to personalized marketing.

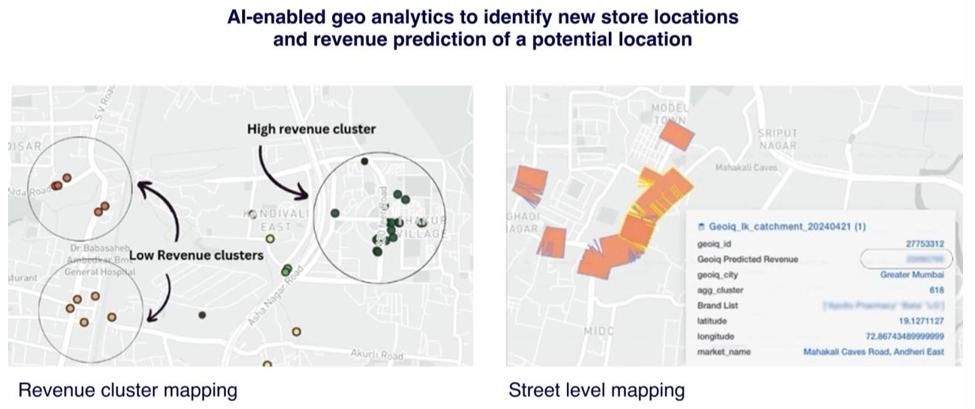

The company’s recent acquisition of Quantduo, a geo-analytics firm, to optimize new store locations underscores this data-centric approach to physical expansion. They employ AI-tools to evaluate new store locations, forecast revenue potential, and estimate payback periods prior to lease commitments. This has resulted in 80% of new stores opened in FY23 & FY24, achieving payback period of 10.3 months.

The stores, therefore, are not just retail outlets; they are data-gathering nodes that fuel the company’s tech-driven core.

Tech at its Core

At its heart, Lenskart identifies as a “technology-driven eyewear company”. This is not just a marketing tagline; it is embedded in its DNA. The founder, Peyush Bansal, has explicitly stated that the rapid advancement of Artificial Intelligence (AI) was the “biggest trigger” for the IPO, signaling a desire to double down on technological innovation. Central to this is a sophisticated data collection ecosystem designed to capture customer information and turn it into a strategic asset.

The Virtual Try-On: A Facial Data Powerhouse

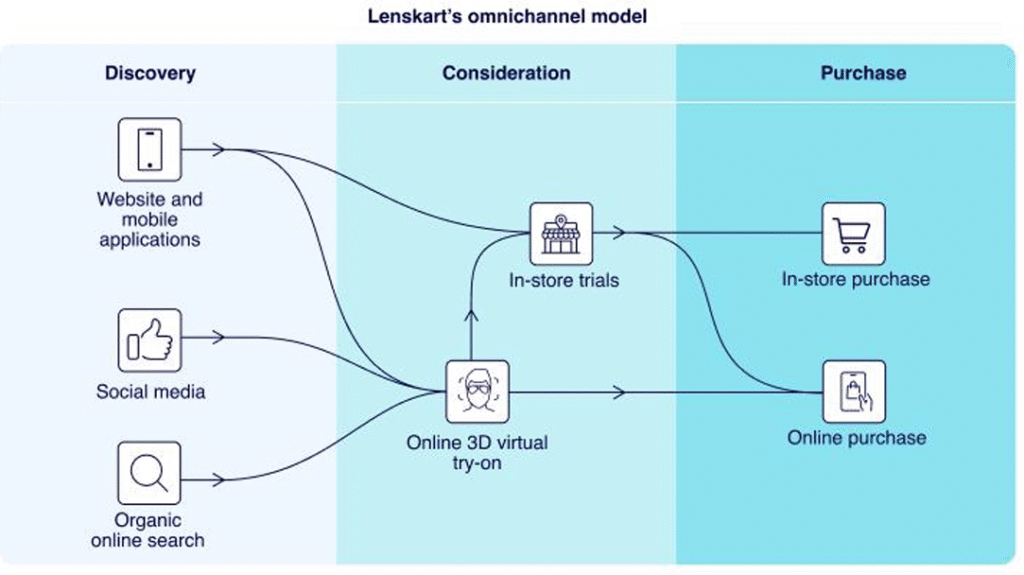

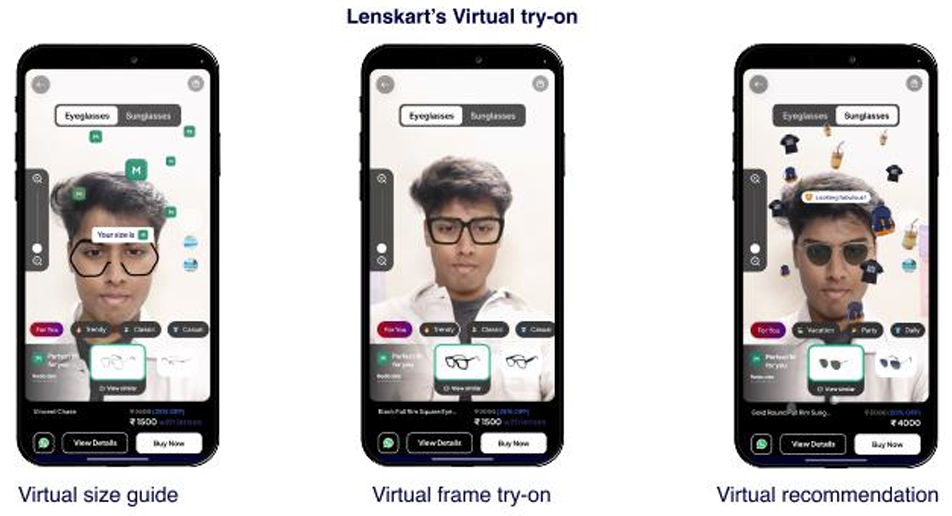

The most significant source of this data is Lenskart’s in-house developed facial analysis and frame recommendation tool. This technology powers the 3D virtual try-on feature on its mobile apps and websites, which customers used 3.86 crore times in FY25 alone.

When a customer uses the feature, a selfie video is used to create a detailed 3D model of their face. The system then fits a “face mesh” over the scan to identify and extract over 500 unique facial features, creating a rich dataset of facial biometrics that includes precise measurements like face width and pupillary distance. The image below gives an idea of how it works

This data is leveraged in several ways:

Enhancing the Customer Journey: By reducing the uncertainty of buying online, the feature boosts customer confidence and has been shown to increase online conversion rates by as much as 17%.

Hyper-Personalized Recommendations: The biometric data fuels an AI algorithm that filters through thousands of SKUs to suggest frames that are a precise technical fit. Lenskart’s model can predict frame size with an accuracy of ±1.5 mm, approximately three times more accurate than many competing solutions.

Improving the AI Model: Each virtual try-on serves as a new data point to train and refine the recommendation algorithm, creating a powerful feedback loop where more data leads to smarter recommendations.

In-Store Analytics: The Computer Vision Platform

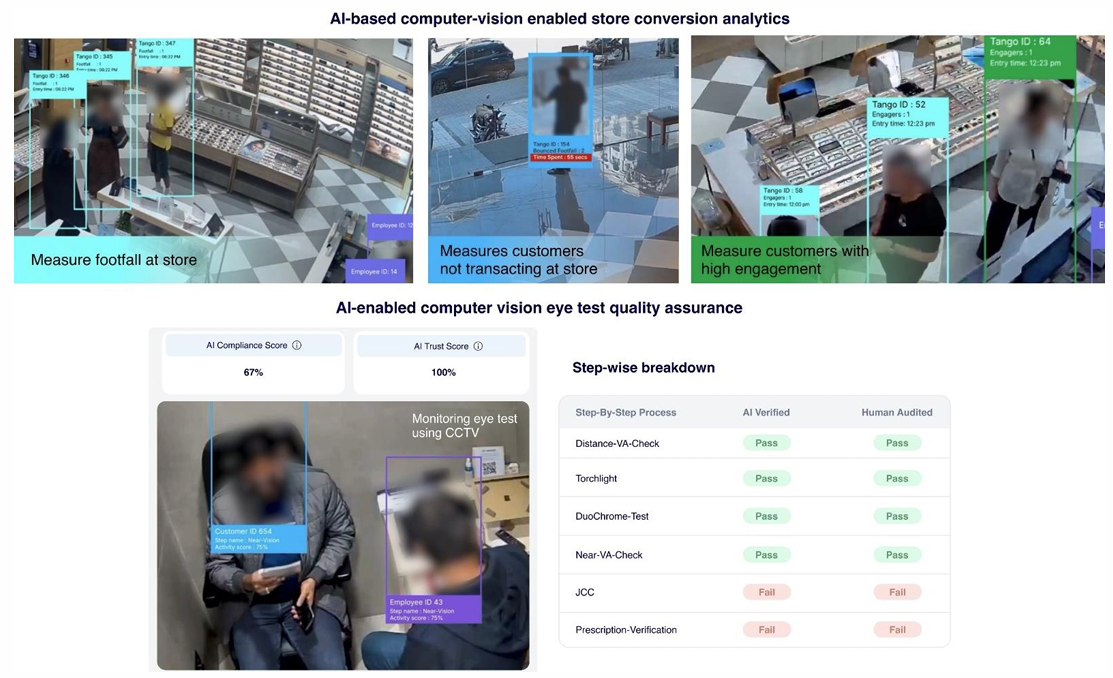

Beyond individual scans, Lenskart uses an AI-enabled Computer Vision platform in its physical stores. This system analyzes CCTV footage to gather anonymized, aggregated data on in-store behavior, such as foot traffic, customer flow, and interactions with products. To protect privacy, the technology converts video data into numerical information before deleting the original images. This business intelligence allows Lenskart to optimize store layouts, improve operations, and increase in-store conversion rates.

This deep integration of technology across the customer journey—from discovery to fulfillment—enhances the customer experience, drives operational efficiency, and creates a powerful, scalable platform for growth. The image below gives an idea of how it works.

A Spectrum of Choices: The Product & Brand Strategy

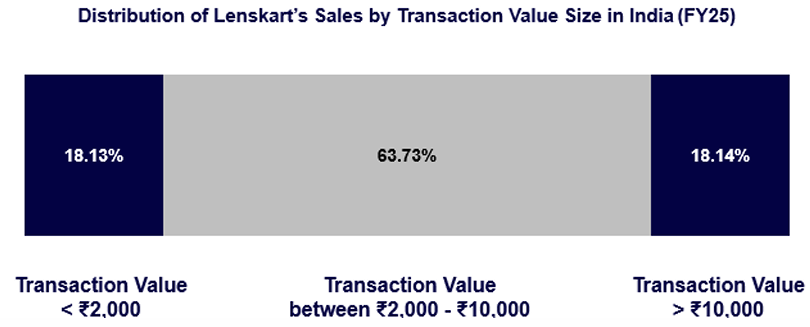

Lenskart’s success is also rooted in its sophisticated product and brand architecture, which has successfully transformed eyewear into a fashion category. The company has moved the market away from a single-pair-for-all-occasions mindset to the concept of “wardrobing”, owning multiple pairs of glasses for different looks and activities.

This is achieved through a multi-brand strategy that targets a wide spectrum of consumers with a portfolio of in-house and acquired brands:

Affordable-Premium & Economy: This is the core of Lenskart’s offering, with brands like Vincent Chase (trendy and fashionable), Lenskart Air (lightweight and durable), and hustlr (stylish workwear) providing a vast selection at accessible price points.

Premium Segment: Brands like John Jacobs and the acquired Japanese chain Owndays cater to aspirational consumers seeking high-end designs and materials.

This brand architecture is supported by a massive product portfolio. Lenskart offers over 79,000 SKUs in frames alone, with prices for prescription eyeglasses in India ranging from an entry-level ₹399 to a premium ₹41,199.

Beyond eyeglasses, the company has a strong presence in sunglasses, featuring both in-house labels and international brands like Ray-Ban and Carrera, and contact lenses, where it sells products from global giants like Bausch & Lomb alongside its own successful brand, Aqualens. This extensive variety, combined with aggressive marketing featuring celebrity endorsements, has been instrumental in shifting consumer perception and driving higher purchase frequency.

Building a Loyal Following: The Repeat Customer Engine

Beyond acquiring new customers, Lenskart has built a powerful engine for fostering loyalty and encouraging repeat business. The company has successfully shifted consumer behavior from treating eyewear as an infrequent medical necessity to a regular fashion purchase, creating a durable, recurring revenue base.

This loyalty is evident in its strong retention metrics. The two-year order repeat rate for new customer accounts in India has been consistently high, standing at 98.16% in FY23. Furthermore, the frequency of these purchases is increasing. New customers acquired in FY2017 bought an average of 2.30 eyeglasses within 24 months; for customers acquired in FY2023, that number rose to 3.62 eyeglasses.

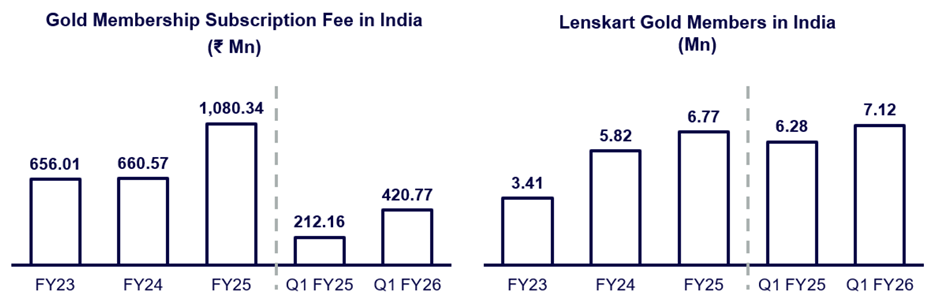

A key driver of this loyalty is the “Lenskart Gold” membership program. Launched in India in 2018, this paid subscription offers exclusive benefits and has become a cornerstone of the company’s retention strategy. The program’s growth has been substantial:

Program Evolution: To cater to its expanding customer base, Lenskart has introduced new tiers like “Lenskart Gold Max” and “Lenskart Gold Max Pro”.

Massive Member Base: As of June 30, 2025, the Lenskart Gold program had 70 Lac members in India.

Consistent Growth: The program continues to attract subscribers, adding 9.5 Lac new members in FY2025 and another 3.5 Lac in Q1 FY26.

This combination of high repeat purchase rates and a thriving loyalty program demonstrates a business that has successfully built a strong, committed customer community, which is a significant asset as it prepares for its next phase of growth.

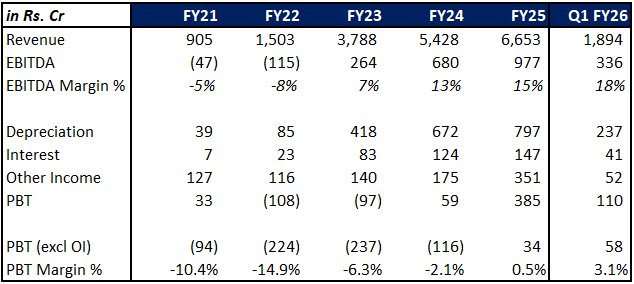

Profitability Still Optically Inflated

Lenskart’s topline has grown at a remarkable 65% CAGR between FY21–FY25, and on the surface, margins appear to have turned around, EBITDA improved from -5% (FY21) to 15% (FY25).

But looking only at EBITDA to judge profitability would be misleading.

Under Ind AS 116 (Leases), store rents are no longer treated as operating expenses. Instead, lease obligations are capitalised as “right-of-use assets” and the rent outflow is split between depreciation (on the leased asset) and finance cost (on the lease liability).

So if Lenskart pays Rs 100 as rent, you won’t see Rs 100 under “operating expenses”, instead, it’ll show up as, say, Rs 70 in depreciation and Rs 30 in finance cost.

That accounting shift artificially inflates EBITDA, since rent is effectively excluded.

Therefore, the more appropriate lens for assessing true profitability is PBT (excluding other income) rather than EBITDA. On that basis, the business has only just turned profitable in FY25.

Whether this is a sustainable structural turnaround or a pre-IPO clean-up remains to be seen. Monitoring PBT margins post-listing will reveal if the profitability is real or just accounting optics.

The Clear Opportunities & The Blurry Risks

Though Lenskart’s IPO arrives at a moment of significant potential, but it is not without its challenges. Investors must weigh the vast market opportunity against the inherent operational and external risks.

Opportunities

- A Massive, Underpenetrated Market: The Indian eyewear market, valued at nearly ₹79,000 Cr, is large and growing. However, with only about 35% of Indians who need vision correction actually using it (compared to over 70% in developed markets), there is a massive runway for growth.

- The Shift to Organised Retail: The market remains overwhelmingly fragmented, with unorganised local opticians controlling an estimated 77% share. As a market leader with a trusted brand, a vast network, and a superior value proposition, Lenskart is perfectly positioned to capture market share as consumers shift towards organised retail.

- International Expansion: Lenskart has already proven its model can be exported. Its international business, primarily in Southeast Asia and the Middle East, already contributes nearly 40% of its total revenue and is growing at a healthy pace, demonstrating a significant global opportunity.

Risks

- Supply Chain & China Dependency: The company’s dependence on China for its supply chain remains a key operational risk. Nearly 54% of its frames are manufactured through a joint venture in China. Any escalation in geopolitical tensions, trade restrictions, or logistics disruptions could materially affect production continuity, lead times, and cost structure.

- Intense Competition: While Lenskart is a market leader, it faces a two-front war. It competes with a vast network of unorganised players who often operate at lower overheads, and with established organised players like Titan Eyeplus, who also command significant brand trust.

A Final Perspective

Lenskart’s IPO is more than just the public debut of a successful eyewear retailer, it is a case study in how technology can reorganize an old, fragmented Indian industry. Over the past decade, the company has built a deeply integrated ecosystem that controls everything from design and manufacturing to retail experience and customer data. It has not just sold glasses; it has built a machine, efficient, data-rich, and remarkably scalable.

The IPO proceeds will strengthen its balance sheet and fuel global expansion.

But the real question is valuation. At 10–11x sales and an EV/EBITDA multiple near 70x, Lenskart is asking to be valued like a global tech leader, not a consumer brand. Does it deserve that premium? Or are we too old-school to appreciate the value of data, technology, and brand that this business sits on?

Perhaps the answer lies somewhere in between. Lenskart has the vision, infrastructure, and execution track record to justify optimism, but sustaining these valuations will depend on how consistently it can translate scale into steady, cash-backed profitability.

For now, Lenskart represents both the promise and the price of ambition in Indian retail.

We’d also love to hear your thoughts and feedback on X. Connect with us there at @bastionresearch.

Happy Investing!!!

😂Meme of the Week🤣

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.