Welcome to this week’s edition of TOPICAL WEDNESDAY. This time, we examine the abrupt collapse of India’s lounge aggregation leader. DreamFolks, once the go-to gateway for card-linked lounge access, saw its dominance unravel within days as airports and operators shut it out. From market darling to survival mode, the company is now racing to prove it has life beyond lounges.

In mid-September 2025, DreamFolks announced it would discontinue its domestic airport lounge program after key suppliers (Encalm/GMR, Adani Digital/Semolina, and others) terminated contracts. This blow – wiping out nearly 90% of its revenue base – effectively shuttered DreamFolks’ core business.

The stock quickly hit lower circuits. While management emphasizes that its global lounge services and non-lounge travel and lifestyle offerings (rail lounges, golf, airport transfers, etc.) will continue, the exit will have a “material” near-term P&L impact.

We recap how a market leader with 90% share saw its moat collapse, what remains of its model, and the scenarios for investors now that the core is gone.

The Primer: Who DreamFolks Is

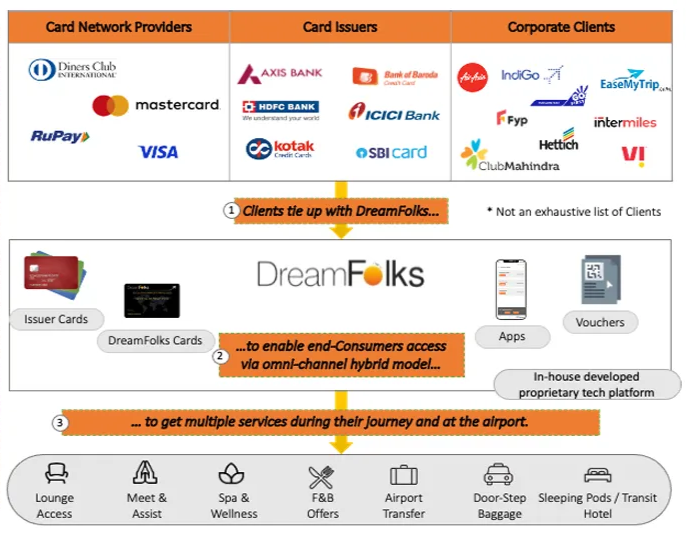

DreamFolks is India’s dominant airport lounge services aggregator. It connects issuers (banks/card networks) and lounge operators through a proprietary platform that lets cardholders access lounges and other travel perks. Banks pay DreamFolks per lounge visit (or through fixed programs), and DreamFolks in turn pays the operator – pocketing the spread. This structure gave the company ~95% share of India’s card-linked lounge business and ~68% of overall lounge access in the country. Beyond lounges, DreamFolks also bundled services like railway lounges, spa, golf, transit hotels, and highway dining.

(Source: Company, Bastion Research)

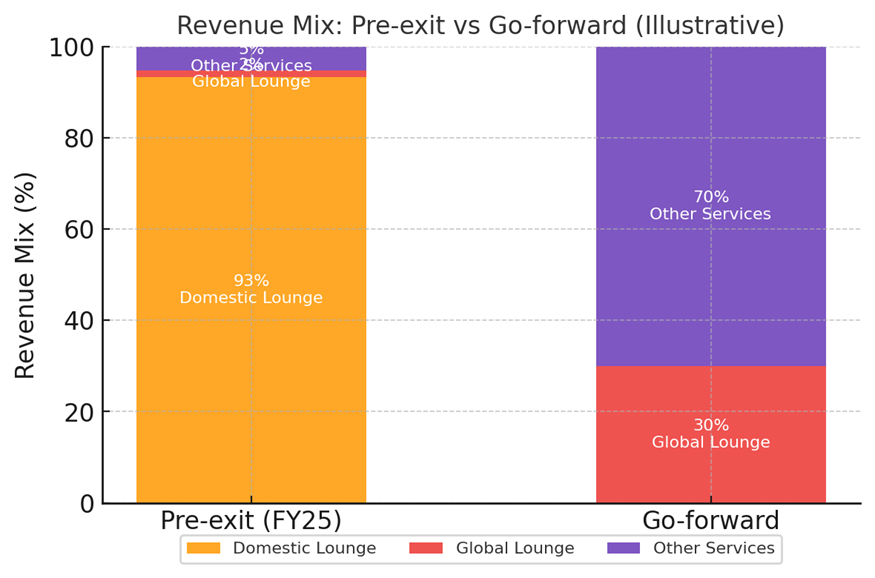

Crucially, DreamFolks was a middleman, not an exclusive franchise. Banks maintained parallel programs (e.g., Priority Pass overseas), and operators could serve multiple aggregators or go direct. Until 2023, DreamFolks faced little domestic competition. Its scale fueled rapid growth, revenue doubled from FY2022 to FY2024, but also masked structural risks. By FY2025, ~93% of revenue still came from domestic lounges, with non-lounge services a small ~7%. In effect, it was a single-SKU business dependent on a few suppliers, a vulnerability that set the stage for the hard pivot now underway.

How the Model Worked (Pre-Exit)

At its core, DreamFolks coordinated a three-sided marketplace:

- Issuers (Banks/Card Networks): e.g., HDFC, ICICI, Axis, Visa – offering lounge privileges to cardholders.

- Aggregator (DreamFolks): authenticating customers at lounges, tracking usage, and billing issuers.

- Lounge Operators: airport concessionaires providing the service, paid per visit. the early 2000s, blending started small with 5% ethanol mixed into petrol (E5). It barely registered.

When a cardholder swiped at a lounge, DreamFolks confirmed eligibility, recorded the visit, invoiced the bank, reimbursed the operator, and kept the spread. It was a thin-margin, volume-driven model, but the company’s scale (50+ clients on one platform) created bargaining power and data insights.

Revenue mix: In FY24, 94.2% of revenue came from Indian lounge programs; in FY25, the share was still 93.3%. Even in Q1 FY26, management confirmed lounges contributed 93% of revenue vs. 7% non-lounge. Post-exit, the domestic lounge segment drops to zero.

(Source: Company, Bastion Research)

Operationally, DreamFolks’ dominance was built on coverage, convenience, and cost. It offered banks a one-stop solution, while operators benefited from higher footfall. But because operators ultimately owned the lounges and customer experience, they could cut out the middleman for higher margins or control. That is exactly what played out in 2025.

The Chain of Events

- Jul 2025: Airport operators began signaling intentions to disintermediate aggregators. DreamFolks’ CEO cited “pressure tactics by two large airport operators” entering the lounge business. That same month, Axis and ICICI switched their programs off DreamFolks’ platform.

- Aug 29, 2025: DreamFolks disclosed that Encalm, Adani Digital, and Semolina Kitchens had served exit notices. The company warned of “material” financial impact and sought a Delhi HC injunction against Encalm.

- Early Sep 2025: Travel Food Services (TFS) also exited. Legal battles intensified as DreamFolks sought to enforce its 5-year contract with Encalm. The HC found no exclusivity; operators were free to deal directly with banks.

- Sep 16, 2025: Delhi HC declined relief. Justice Amit Bansal ruled DreamFolks had no exclusivity and banks could multi-source lounge access. DreamFolks immediately announced discontinuation of domestic airport lounges effective Sept 16.

- Sep 17–19, 2025: Shares plunged on consecutive lower circuits – down 10% over two days, then to ~₹118 by Sept 19. The company’s near-monopoly story was broken, and survival would depend on reinvention.

What Changes Now

Stopped: All domestic airport lounge access via DreamFolks has ended effectively from September 16. Cardholders from banks like Axis, ICICI, and IDFC must now rely on alternate aggregators or direct bank tie-ups. Operators like Adani, Encalm, and TFS have taken aggregation in-house, offering banks similar platforms with global tech partners.

Continues: DreamFolks’ global lounge programs and non-lounge services (railway lounges, meet-and-assist, spa vouchers, airport transfers, golf, dining, etc.) remain intact. The company operates 850+ international lounges across 100+ countries and 3,000+ non-lounge touchpoints. Management is pushing banks to adopt these alternate services, though retention remains uncertain.

P&L impact: With ~93% of revenue gone, DreamFolks faces a severe near-term collapse. While other services carry higher margins, the loss of scale means EBITDA will shrink. Fixed costs will weigh heavier, even as reported gross margin % may improve. Management has hinted at cost cuts and headcount trimming to adjust.

Could We Have Seen It Coming?

Yes. Several warning signs were visible well before the collapse (obviously with the benefit of hindsight):

- Lack of pricing power: One major vulnerability was the company’s lack of pricing power in the value chain. DreamFolks acted as an intermediary with little leverage: banks controlled the demand side, while airports/operators controlled the supply side. Lounge access was priced on a per-visit wholesale/retail spread, leaving DreamFolks unable to dictate terms to either side. This meant its margins were thin and easily squeezed if suppliers or issuers renegotiated or bypassed the platform altogether.

- Price-led stickiness: The company’s value proposition to both banks and operators was largely transactional – volumes and margins – rather than differentiated technology, brand, or proprietary user base. As soon as operators saw they could keep more of the margin by going direct, the incentive to retain DreamFolks evaporated.

- Airport/operator ambitions: Airport operators had been publicly hinting at building their own platforms, reflecting a broader trend of infrastructure owners internalizing profitable services. Their commentary foreshadowed a strategic shift that would make an intermediary like DreamFolks dispensable.

- Supplier concentration: DreamFolks relied heavily on just two or three operator groups, meaning a single dispute could jeopardize nationwide coverage. Such dependence created a textbook single point of failure.

- No exclusivity: The contracts in place lacked strong lock-ins. Banks could simultaneously work with multiple aggregators, and lounge operators were free to engage others directly. This absence of exclusivity left DreamFolks with little contractual moat.

Investor Takeaway

DreamFolks’ collapse highlights the fragility of aggregation businesses without exclusivity or proprietary control. High coverage is not a moat when suppliers and clients can bypass the middleman. As one observer put it, DreamFolks was a toll-collector on a road it didn’t own – and when the owners decided to stop paying, the toll vanished.

The lesson: don’t confuse market share with structural power. For platform businesses, ask not just how big the network is, but what stops others from walking away. In DreamFolks’ case, when the core customer walked, so did the moat.

Looking ahead, the test for DreamFolks is whether it can rebuild relevance through international lounges, non-airport services, or new consumer-facing products. If it reshapes its network into a differentiated platform with sticky users, a smaller but durable role is possible; if not, the episode will remain a cautionary tale of how quickly dominance can unravel when control is weak. For investors, the key takeaway is broader: scrutinize concentration risks, exclusivity terms, and supplier leverage before underwriting any aggregation play. Monitoring DreamFolks’ pivot is one part of the story, but applying these lessons to other intermediaries will help distinguish true moats from fragile toll-collection models.

We’d also love to hear your thoughts and feedback on X. Connect with us there at @bastionresearch.

Happy Investing!!!

Disclaimer: This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

😂Meme of the Week🤣

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.