Understanding the UPI Boom in India and the Payment Relay behind the Scenes

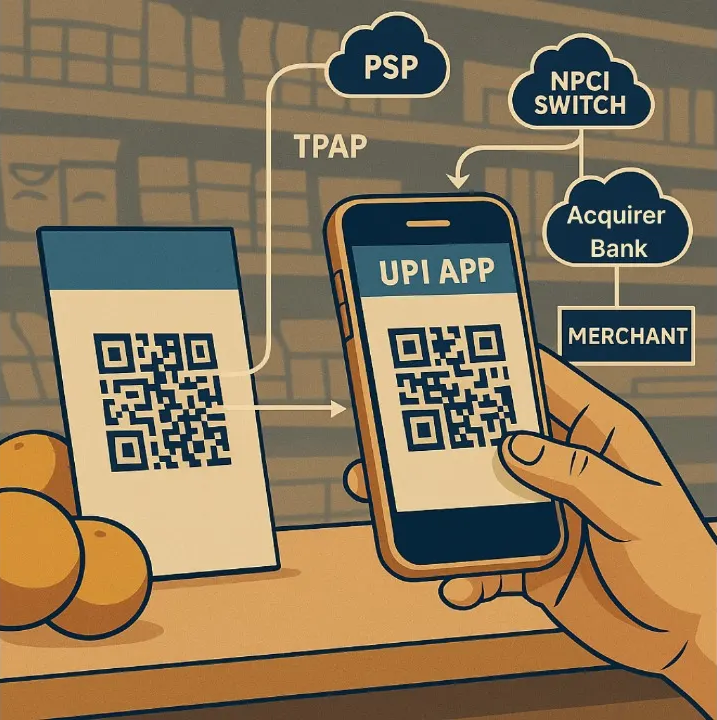

Welcome to this edition of learning of the week. Today, we unpack the surge in UPI transactions and the fintech wave that turned India into a global leader in digital payments. A simple QR scan now moves money in seconds, but behind that scan sits a powerful stack of apps, banks, and national rails working in sync. We will break down how a UPI payment actually travels. By the end, you will see why UPI is more than a convenience feature. It is the operating system for everyday money in India.

As you scan a QR for Rs 28 at a chai stall and see “Payment successful” even before your tea cup gets filled. If we look at the background activity, in those couple of seconds, your phone spoke to your app, your app spoke to a bank, a national switch checked your balance, another bank prepared a credit and a confirmation raced back to two screens. No one saw it, but in essence, an entire relay team just sprinted on your behalf to enable this payment. This is the payment revolution that UPI has brought about and lets dive deep into it.

A Glance at the Nine Year History of UPI

UPI began in 2016 as a simple idea of linking your bank account to a UPI app through a UPI ID and move money instantly. In the early years volumes were tiny, but the experience felt different from cards and wallets. One app, any bank, instant confirmations, and no fees for the user. That simplicity set the flywheel in motion.

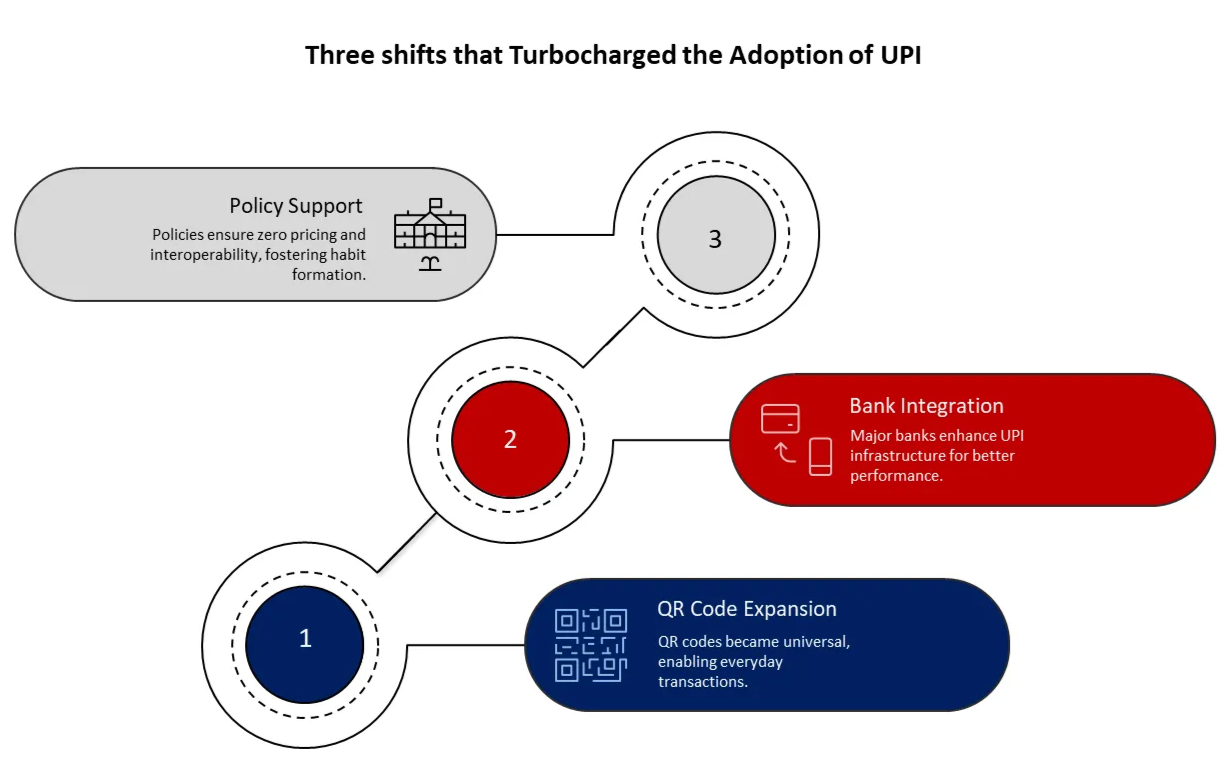

Three shifts that turbocharged the adoption of UPI

First, QR codes spread to the smallest merchants, from chemists to chai stalls, so acceptance met everyday use.

Second, most major banks integrated deeply with the UPI, which improved uptime and speed.

Third, policy choices kept consumer pricing at zero and nudged interoperability, so people formed a habit.

(Source: NPCI, Bastion Research)

As a result, by 2019 UPI was handling billion-plus monthly payments. By 2023 it crossed ten billion a month and now in 2025 it has surpassed a twenty billion monthly run-rate. UPI went from niche to default. Following are the UPI transaction volumes since inception.

*2025 Figures are YTD

(Source: NPCI, Bastion Research)

From Many QRs to One: The Fix

Early Days

- Counters were cluttered with separate QR stands for different apps or wallets. If a customer used the wrong app, the payment failed and had to be retried using the correct QR.

- Merchants juggled multiple dashboards and settlement trails, which made reconciliation and refunds messy.

- Staff confusion slowed queues and led to duplicate or missed payments.

Today

- A single interoperable UPI QR links to the merchant handle, so any UPI app works.

- Settlement lands in one bank account with one trail, which simplifies accounting, refunds and dispute handling.

- Fewer failed scans and faster checkouts encouraged everyday acceptance.

The headline is not just volume. It is reliability and reach. UPI now works across person-to-person and person-to-merchant flows, online and offline, with features like collect requests, mandates, Lite, and credit on UPI. For most Indians, this is how money moves every day.

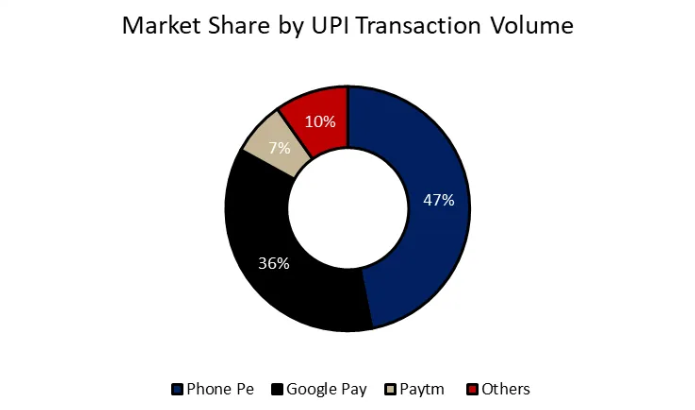

The Market Share is calculated on the basis of UPI transaction volume processed in Aug 2025.

(Source: NPCI, Bastion Research)

– Two players account for ~83% of monthly volumes; long tail remains fragmented.

– This is volume, not value; user mix and ticket sizes differ by app.

How is a UPI Payment Made and Captured?

People begin a UPI payment in THREE simple ways. All three end up in the same backend flow you’ll see next.

- Scan a QR: Most common at shops. You scan, enter the amount, approve.

- Enter a UPI ID: Type a handle like `name@bank` and pay.

- Use a Mobile Number: Pick a contact linked to UPI and pay.

What your app captures? (quietly, every time):

- Who you’re paying, the amount, and a short note if you add one.

- Your approval with your UPI PIN.

The system behind every UPI payment

Think of a UPI payment as a friendly relay race with each runner having a clear job:

1. Your UPI app: Google Pay, PhonePe, Paytm, BHIM and others. In UPI language, this is a TPAP (Third Party App Provider). It gives you the experience and talks to your bank.

2. Your bank: called the Payer PSP (Payment Service Provider) bank. It uses a PSP Switch to verify your PIN and debit your account.

3. NPCI’s UPI switch: the national “traffic controller” that routes messages between banks and clears settlements.

4. Merchant’s bank: called the Payee PSP bank. It uses the PSP Switch to credit the merchant’s account.

5. Merchant tech: QR code or payment gateway that shows “payment received” and keeps records.

RBI sets the rules, certifies who can join, and publishes lists of live PSP banks and app providers.

What is a PSP Switch?

A PSP switch is the technology system that connects a UPI app (like Google Pay, PhonePe, Paytm, etc.) to NPCI’s UPI network. Banks either run their own PSP switch or use one operated by a technology provider.

When you make a UPI payment, the PSP switch acts like a checkpoint. It takes the transaction request from the app, runs a quick set of checks like verifying your balance, PIN, and security details and then decides whether to process or reject it. If everything looks good, the PSP switch forwards the transaction to NPCI so the money can move to the receiver’s bank account.

On the other side, when the PSP switch receives a credit transaction (i.e., money coming into your account), it validates the incoming request from NPCI, ensures the account details are correct, runs security checks, and then routes the funds to your bank account so the payment is successfully credited.

These PSP switches are a bridge that securely handles both debit (money out) and credit (money in) transactions, making your UPI payment experience seamless.

What is a UPI Switch?

The UPI Switch is NPCI’s central switching system. It’s the **CORE ENGINE** of the UPI network that routes payment instructions between banks. When you send money via UPI, your app doesn’t talk directly to the receiver’s bank. Instead, both banks’ systems are connected to the **UPI switch at NPCI**, which makes sure the request is routed correctly and securely. Here is how it works:

- Receives the request → It gets the transaction request from the sender’s bank (via its PSP switch).

- Identifies the receiver’s bank → Based on the UPI ID (like user@icici), it finds which bank needs to receive the money.

- Routes the transaction → Sends the debit request to the sender’s bank and the credit request to the receiver’s bank (to its PSP switch).

The UPI switch is NPCI’s backbone system that makes sure every UPI transaction is routed correctly between the sender’s bank and receiver’s bank in real time.

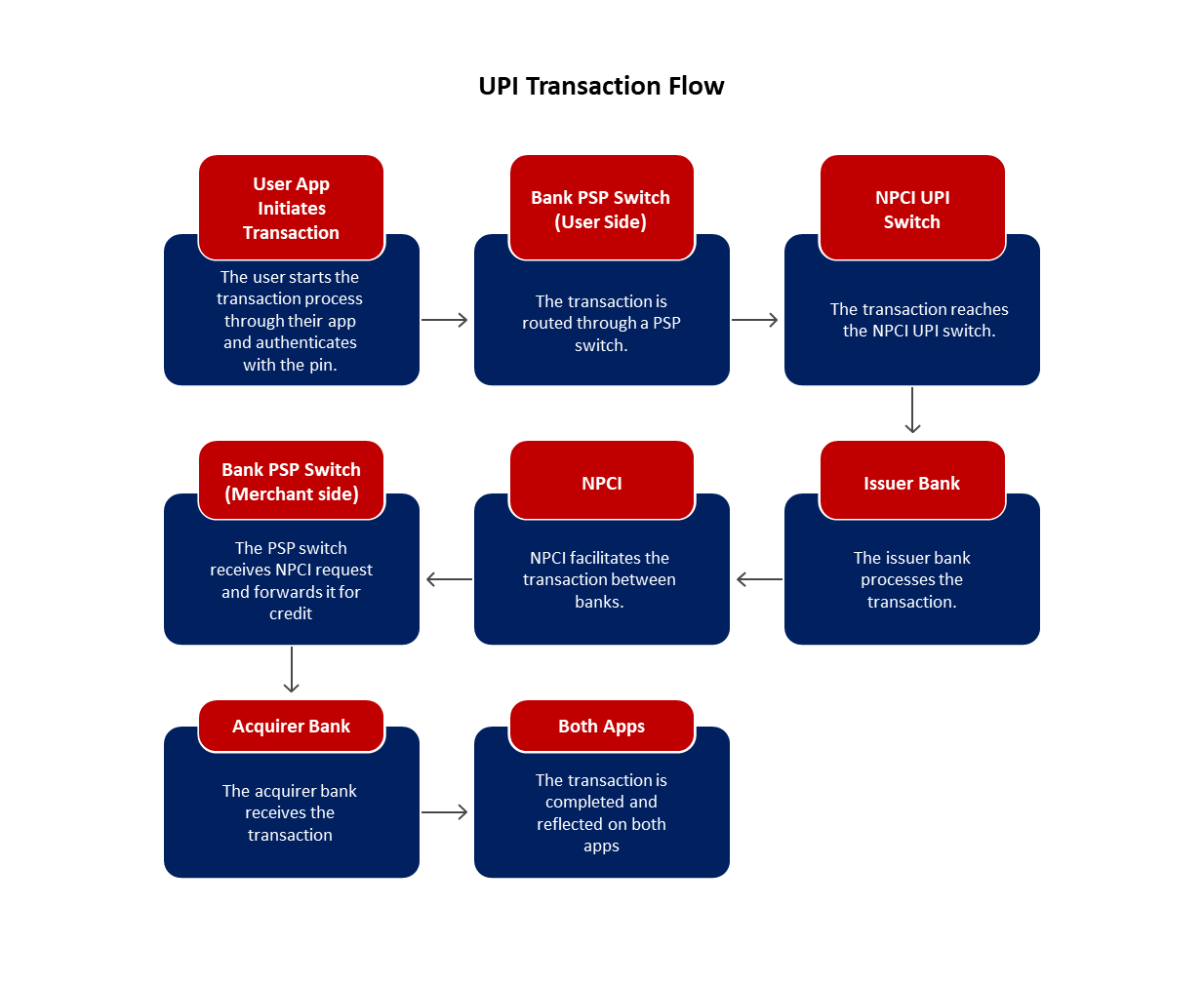

What actually happens after you tap “Pay”

Step-by-step Process of a UPI Payment

1. You enter the amount or scan the QR: Your app builds a payment request. Your VPA (Virtual Payment Address – user@bank), merchant VPA, amount, note.

2. You enter your UPI PIN: Your bank verifies the PIN cryptogram and device binding. If verified successfully, the bank gives a green signal.

3. Your app sends this to your bank: The app is the presenter. Your bank is the gatekeeper for your money. The PSP Switch of the bank processes the transaction and moves it to NPCI.

4. NPCI routes the request: NPCI checks the format and risk flags. If everything is okay, it then forwards the request to the merchant’s bank. Think of it as a very fast post office for payments.

5. Merchant’s bank confirms the merchant: It resolves the merchant’s VPA to the actual account and confirms the account is ready to receive money.

6. Money moves: Your bank debits your account. NPCI relays a credit instruction to the merchant’s bank. The merchant’s bank credits the shop.

7. Both sides see success: The “success” message travels back to the app and the merchant system. You see a tick. The shop’s screen also lights up.

8. Back-end settlement: Banks settle among themselves in multiple cycles per day under NPCI’s clearing process. You and the shop see instant results but the interbank balancing happens behind the scenes.as phase two should have required less thinking from a human perspective.

(Source: NPST, NPCI, Bastion Research )

Variations you meet in real life

- Person to person or merchant (P2P or P2M): Same path, just another individual or merchant on the other side.

- Collect requests: The receiver asks you for money. You open the app and approve.

- Autopay: You create a mandate once. After that your app and bank pay on schedule within set limits. Useful for OTT, electricity, school fees, SIPs.

- Credit on UPI: Your bank gives you a pre-approved credit line that works through UPI. You choose that line at checkout, then repay later. It shows inside your UPI app with EMI and repayment options.

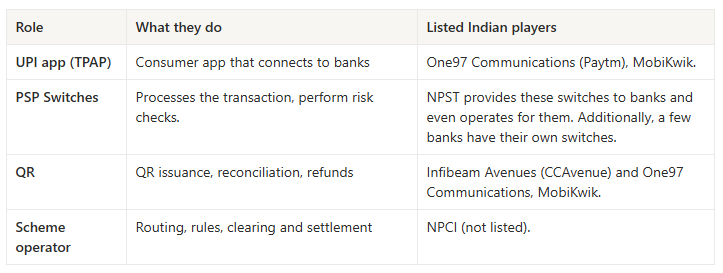

Some listed companies that often touch UPI payments

Many private companies also play key roles, and the exact mix changes by shop and by user.

(Source: Bastion Research )

Many leading players are not publicly listed across key segments. In the TPAP segment, the top two players, PhonePe and Google Pay together account for roughly 80–83% of UPI volumes and are not listed in India. In PSP switch technology, major players like Mindgate Solutions and Sarvatra technologies are major providers, and both are unlisted.

Conclusion

In less than a decade, UPI has transformed from a promising experiment into India’s default way to pay. What looks like a two-second tap hides a sophisticated relay of banks, apps, switches, and regulators working in harmony. With innovations like credit on UPI, autopay, and deeper merchant integration, the rails are still evolving. The next phase of UPI is not just about more transactions, but about enabling smoother credit, cross-border reach, and smarter financial experiences continuing India’s unique journey of building digital payment infrastructure at scale.

If you enjoyed reading this newsletter, please feel free to share it with others who might find it insightful. We’d also love to hear your thoughts and feedback on X. Connect with us there at @bastionresearch.

Happy Investing!!!

😂Meme of the Week🤣