E20s early arrival and the backlash it sparked

Welcome to this week’s edition of TOPICAL WEDNESDAY. This time, we unpack India’s ethanol blending story. What was meant to be a clean energy milestone—hitting the E20 target five years ahead of schedule—has instead sparked a wave of public uproar.

Drivers are reporting mileage drops, engine concerns, and lack of choice at the pump, while policymakers highlight forex savings, farmer income gains, and climate benefits.

In this newsletter, we’ll break down what ethanol is, why it’s being blended, where the execution faltered, how it compares internationally, and what it all means for consumers, industries, and investors.

The Noise Around E20

If you’ve been driving lately, chances are you’ve heard the chatter. Not about rising petrol prices this time, but about the fuel itself. Mileage seems to be dropping. Engines feel rougher. Insurance companies are giving cagey answers about coverage. And at the centre of it all is something called E20, petrol blended with 20% ethanol.

What makes this controversy odd is that it follows a policy win. India hit its E20 target five years ahead of schedule. In government language, that’s efficiency. In public language, it feels more like being blindsided.

The Supreme Court even saw a petition claiming motorists were being forced into this shift without choice. It dismissed the plea in minutes. The government defended itself with strong arguments: forex savings, farmer welfare, climate goals. All valid. But for drivers, that defence confirmed their worst suspicion: their pain points weren’t part of the equation.

That’s the paradox: ethanol blending is not a bad idea. In fact, it’s widely used worldwide. But India’s execution turned what should have been a quiet climate success into a noisy public backlash.

India’s Ethanol Journey

To understand why tempers are flaring, we need to rewind. India’s ethanol story isn’t new.

- In the early 2000s, blending started small with 5% ethanol mixed into petrol (E5). It barely registered.

- By 2014, blending was around 2%. For most motorists, petrol meant petrol.

- Then came a policy push: the National Policy on Biofuels 2018 set clear targets.

- In 2022, India achieved E10 ahead of schedule. For once, a government deadline was beaten.

- And in 2025, the big leap: E20, a goal originally set for 2030, achieved five years early.

On paper, this was textbook policymaking: moving fast, reducing oil dependence, and joining the league of Brazil and the US. Globally, blending is not controversial. In fact, in Brazil, flex-fuel cars have been running on ethanol for decades.

So why is India’s case different? The answer lies in how fast the policy moved versus how slowly the ecosystem was prepared.

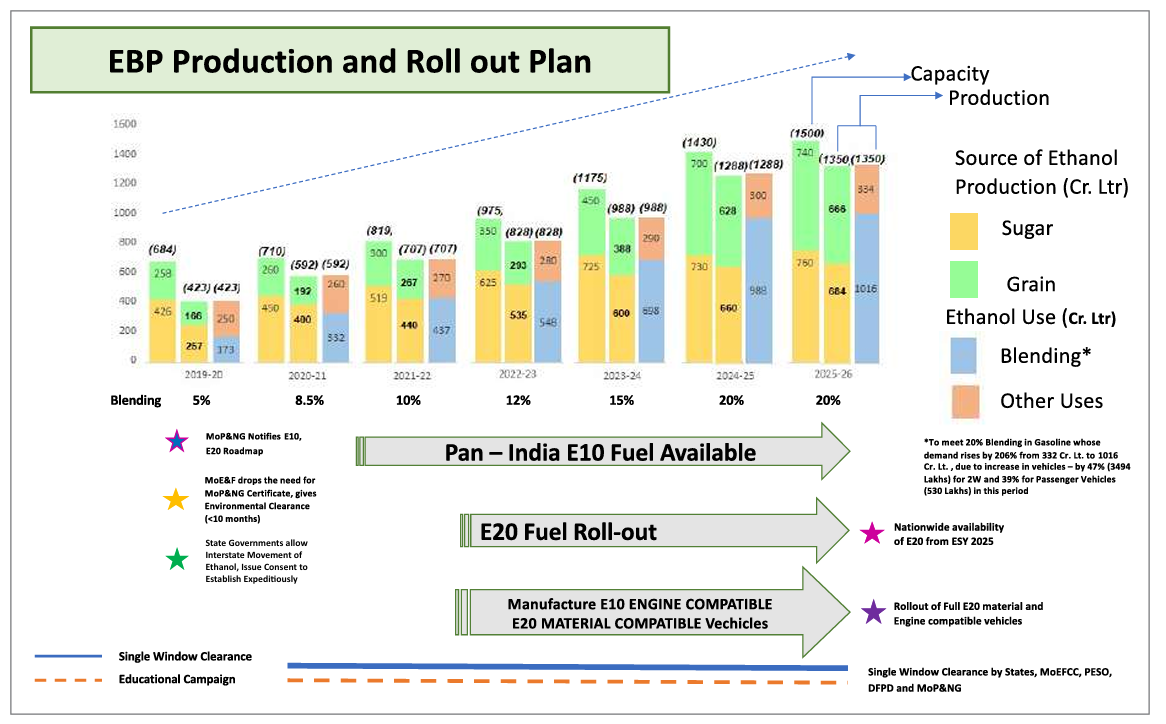

(Source: Niti Aayog)

What Ethanol Is & How Blending Works

Strip away the jargon, and ethanol is just alcohol. The same chemical base you’d find in liquor, only purified to “fuel grade.”

- It’s made from crops, mainly sugarcane, maize, and surplus rice in India.

- When mixed with petrol, ethanol burns cleaner, lowering carbon monoxide and carbon dioxide emissions.

- The mix defines the grade:

- E10 = 10% ethanol, 90% petrol.

- E20 = 20% ethanol, 80% petrol.

Think of it like watering down a drink: the stronger the ethanol blend, the weaker the mileage punch your car gets from each litre.

Why Blend Ethanol?

The government’s pitch was ambitious, and in theory, compelling. Ethanol blending was meant to solve four big problems:

- Cut crude imports: India imports 85% of its crude oil. In FY25, the crude import bill was $137 billion (PPAC). NITI Aayog estimates E20 could save ~$4 billion a year in forex.

- Boost farmer incomes: Since 2014, ethanol sales have channelled over ₹1.2 lakh crore to farmers (PIB). For sugarcane farmers, ethanol became a buffer against volatile sugar prices.

- Lower carbon emissions: PIB claims blending has already avoided 736 lakh tonnes of CO₂ emissions.

- Strengthen energy security: Domestic ethanol reduces dependence on oil-exporting nations.

On paper, it looked like a rare win-win policy for farmers, the exchequer, and the environment.

The Reality on the Road

That’s the vision. Here’s the reality that drivers are living with:

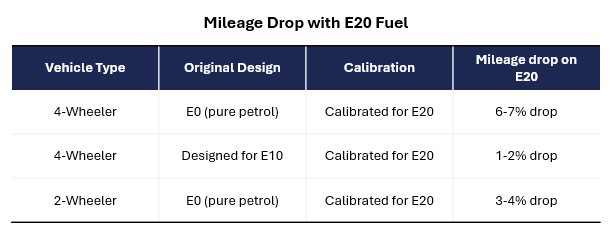

- Mileage drop: Petrol delivers more energy per litre than ethanol. According to NITI Aayog, cars designed for E0 and calibrated for E20 face a 6–7% drop in mileage; two-wheelers lose 3-4%. For a 15 kmpl car, that’s down to 14.1 kmpl, costing about ₹400 extra per 1,000 km.

(Source: Niti Aayog)

- Mechanical strain: Ethanol absorbs moisture and corrodes pipes, seals, and pumps. Engines need stronger injectors and ethanol-proof parts. Older vehicles aren’t ready.

- Insurance grey zone: Insurers such as Acko publicly stated that using the wrong fuel could void claims. For example, if an E10‑compliant car suffered engine damage after being run on E20, the claim would not be admissible. Motorists are left in limbo.

- No consumer choice: Unlike Brazil or the US, Indian pumps offer no E0 or E10. It’s E20 or nothing.

For drivers, it feels less like clean fuel and more like a hidden tax.

Industry Response: Winners and Worriers

Sugar & Distilleries: Capacity now exceeds 1,000 crore litres a year. Large integrated sugar producers benefit from steady margins, but smaller mills have taken on heavy debt to build distilleries and risk financial stress if timelines or procurement prices change.

Automakers: Maruti, Hero, Honda and others are scrambling to adapt. Retrofit kits are being readied for older models, while two‑wheeler makers admit bikes sold before April 2023 need modifications. Even “E20‑ready” models are often tuned for E10, leaving consumers caught between two fuel standards.

OMCs: For IOCL, BPCL, and HPCL, ethanol blending guarantees demand but requires major upgrades in storage, transport, and blending infrastructure across depots and pumps.

Execution Gaps-Where it Went Wrong

The backlash isn’t against ethanol itself. It’s against how it was rolled out, and more importantly, how the execution skipped key steps that other countries handled with care.

- Compatibility gap: Vehicles tuned for E0 or E10 were suddenly pushed onto E20. Older two‑wheelers and cars were not designed for higher ethanol levels, leading to faster wear and higher costs.

- Ecosystem gap: NITI Aayog’s roadmap advised phasing with four years’ notice for automakers to adapt. Instead, deadlines were advanced by five years, leaving manufacturers and insurers scrambling.

- Food vs fuel: FY24 saw maize‑based ethanol rise to 42% of output, diverting food crops into fuel and forcing India to import 0.9 million tonnes of maize (Down To Earth). That raises concerns over food security and inflation.

- Price paradox: Ethanol costs ₹62–72 per litre at the ex‑mill level, often pricier than refined petrol. Consumers see no pump relief, as gains flow mainly to the exchequer and producers.

- Water stress: Producing one litre of ethanol uses 3,600–4,600 litres of water (NITI Aayog), intensifying pressure in drought‑prone states like Maharashtra and UP.

- Insurance and legal risks: Insurers such as Acko clarified that if an E10‑compliant vehicle suffers damage from E20 usage, claims may not be admissible. That leaves motorists exposed to risks created by a mandated shift.

In short, what was designed as a forward‑looking clean fuel policy stumbled in execution. The intentions remain strong, but the sequencing and preparation gaps have created avoidable friction for consumers, industry, and the economy.

International Lessons-How Others Did

When critics say “but other countries also blend ethanol,” they’re right. The difference is in how those countries rolled it out and what safeguards they put in place for consumers.

- Brazil: Began experimenting in the 1970s after the oil crisis, gradually moving from E10 to today’s E27. Crucially, it invested in flex‑fuel vehicles that can run on any mix of petrol and ethanol, with pumps clearly labelled. Over 80% of cars sold are flex‑fuel, putting consumer choice at the centre.

- United States: Runs mostly on E10 by default, with the option to buy E15 or E85 at thousands of stations. The Renewable Fuel Standard created a structured market for corn‑based ethanol while keeping clear labelling and alternatives, limiting backlash.

- European Union: More cautious, mandating E10 in some countries while retaining E5 in others. Uptake has been slower due to consumer scepticism and engine concerns, but motorists still have the option to stick with lower blends.

The comparison makes India’s situation clearer: other regions took decades, paired blending with compatible vehicle technology, and always kept consumer choice visible at the pump.

Investor Lens-Why It Matters for Capital

For investors, ethanol blending is less about the technical chemistry and more about the flow of capital, policy credibility, and how risks are distributed across sectors.

- Execution risk: Policies that move faster than industry readiness can trigger consumer backlash, litigation, or even partial rollbacks. That creates the risk of stranded capex in distilleries, fuel infrastructure, and auto R&D.

- Cost dynamics: NITI Aayog and PIB highlight forex savings, but if ethanol procurement prices remain above refined petrol costs, the fiscal advantage narrows. Investors must weigh the stability of these cost curves against global crude price swings.

- Sectoral implications:

- Agri: Rising demand for sugarcane and maize could shift cropping patterns, raising food inflation and impacting input costs across FMCG and feed industries.

- Energy/OMCs: Oil marketing companies have assured procurement, but their margins are exposed if the government does not pass higher costs through to consumers.

- Auto: Compliance means higher re‑engineering costs and possible pressure on sales if consumer trust weakens due to performance issues.

- Macro balance: Ethanol is best viewed as a transitional policy tool. The next cycle of capital allocation will likely shift toward EVs, hydrogen, and other clean tech. How India manages this overlap phase will matter for investors with longer time horizons.

In short, ethanol blending redistributes value—from motorists who pay more at the pump, to farmers who gain steady incomes, and to the state via forex and fiscal benefits. Whether this redistribution is sustainable, both economically and politically, is the real question for investors.

Closing Thoughts

The debate around ethanol is far from over. Moving towards E27 has been floated, but the ecosystem is clearly not ready. The next phase must be slower, more transparent, and coordinated to avoid repeating the backlash. At the same time, ethanol should be seen as a bridge fuel alongside EVs, not as a distraction from the electric transition.

Ethanol blending is not a scam and not a silver bullet either. It is a sound idea undermined by rushed execution. Farmers and the exchequer are gaining, while motorists feel penalised and investors weigh the risks. The challenge is to shape ethanol into a just transition—supporting farmers without burdening drivers, cutting carbon without draining aquifers, and balancing food with energy security. Whether E20 becomes a bridge to a cleaner future or a costly detour will depend on how carefully the next phase is handled.

We’d also love to hear your thoughts and feedback on X. Connect with us there at @bastionresearch.

Happy Investing!!!

Disclaimer: This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

😂Meme of the Week🤣

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.