From PC Dominance to Smartphone Silence, & now, an all-in bet on reinvention

Continuing with our Semiconductor Series, today’s story is about the rise, fall, and ongoing reinvention of a company that once defined the semiconductor era, a pioneer that lost its way but is now mounting an audacious comeback.

You’ve probably guessed it already. Today, we talk about Intel.

But first, a quick recap of our journey so far:

Semiconductor Series Letter 1: History of the Semiconductor Industry

Semiconductor Series Letter 2: The Semiconductor Value Chain

Semiconductor Series Letter 3: Key Players Across the Value Chain

And now, to Intel. Once a heroic innovator, now an underdog trying to reclaim the crown. But to understand its present, let’s rewind to the very beginning.

The Spark Behind the Silicon – The Birth of Intel

Intel was founded in 1968 by Robert Noyce and Gordon Moore, two of the legendary “Traitorous Eight” who helped build Fairchild Semiconductor. At Fairchild, they played a central role in inventing the planar integrated circuit — the foundation of all modern chips.

Frustrated by growing bureaucracy at Fairchild, they struck out on their own. Backed with $2.5 million from venture capitalist Arthur Rock, they started Integrated Electronics Corporation, soon shortened to Intel.

One of their earliest hires? Andy Grove, who would later become CEO and the cultural architect of Intel’s high-performance ethos.

If you’re assuming Intel jumped straight into microprocessors, hold that thought. In its early days, Intel was all about memory chips — both Static RAM (fast but expensive) and Dynamic RAM (cheap and scalable). In 1970, Intel launched the 1103, the world’s first commercially available DRAM chip, which began replacing bulky magnetic core memory. By 1973, Intel had become the global leader in memory chips.

A Twist in the Tale – The Accidental Microprocessor Revolution

In 1971, a Japanese calculator company (Busicom) asked Intel to design 12 custom chips. Intel’s engineers, led by Ted Hoff and Federico Faggin, proposed a radical idea: instead of 12 chips, build one general-purpose chip that could be programmed for different tasks.

That became the Intel 4004, the world’s first commercially available microprocessor.

At the time, it was just for calculators. But Intel saw the broader potential. Quietly, the 4004 planted the seeds of the personal computing revolution. That said, Intel’s core business remained memory, at least for a few more years.

Quick Side Note #1: Confused between “chip” and “microprocessor”? Think of a microprocessor as one type of chip, just like memory, graphics, or sensor chips. All microprocessors are chips, but not all chips are microprocessors.

Quick Side Note #2: Each chip houses many, many transistors (think of them as tiny switches on a chip). With the advent of technology, chip sizes are getting smaller i.e. a 3nm (nm – nanometer) chip will have more transistors in the same area compared to a 5nm chip. Therefore, electricity moves faster, and the device uses less power and releases less heat compared to before.

Intel Goes All In on Chips – Enter x86

Around 1975, Japanese firms began undercutting Intel on memory chips. In response, Intel pivoted hard from memory to microprocessors. In 1978, it launched the 8086, a 16-bit chip that laid the foundation for the x86 architecture still the backbone of most PCs today.

In 1981, IBM selected Intel’s 8088 processor to power its first personal computer. The partnership exploded Intel’s visibility. To encourage competition, IBM pushed Intel to license the chip to others (like AMD), but Intel’s design leadership kept it ahead.

By the 1990s, Intel had become the heart of the PC world. It launched the Pentium in 1993, a branding masterstroke and its “Intel Inside” campaign turned a behind-the-scenes supplier into a household name. At its peak, Intel held over 80% of the desktop CPU market. It was, without question, the king of the computing hill.

Back then, performance was everything. Power efficiency? Not a concern as desktops were always plugged in.

Intel’s Blind Spot – The Rise of Mobile

During the 2000s, Intel was thriving — but missed the quiet signals of disruption.

At the time, mobile computing meant laptops, where Intel was strong. Mobile phones? A niche. Smartphones were clunky, lacked real internet access, and were still seen as luxury items. Intel doubled down on its core belief: Faster chips = Better PCs = Continued dominance.

But while Intel was cruising, the world was changing. Two undercurrents gathered momentum:

1. The arrival of faster mobile networks (3G in 2004–05)

2. The demand for smaller, power-efficient chips

2007–08: The iPhone and Android Era Begins

The iPhone wasn’t the first smartphone, but it felt like the future, full touchscreen, slick interface, real internet, media, and later, apps. Android followed quickly, and suddenly the world didn’t crave faster desktops; it wanted portable, efficient, and always-connected devices.

Performance took a back seat. Power efficiency became king.

These new devices needed chips that used less energy, ran cooler, and fit into tight spaces. That wasn’t Intel’s strength, but it was ARM’s.

ARM chips weren’t as powerful, but they were: a) Far more power-efficient, b) Highly customizable and, c) Perfect for mobile

Every major smartphone chip, Apple’s A-series, Qualcomm Snapdragon, Samsung Exynos, was based on ARM.

A famous misstep? In 2006–07, Apple offered Intel a chance to design chips for the iPhone. Intel said no, the margins looked slim, and the volumes were uncertain. That chip later became the Apple A4, built on ARM and manufactured by Samsung. The rest, as they say, is history.

How Did Intel Lost Its Way?

Before getting to the above topic, let’s revisit what we covered last week: Intel operates as an Integrated Device Manufacturer (IDM) — it both designs and manufactures its own chips.

1. Losing the Design Battle

Fearing ARM’s rise, Intel tried to shrink its x86 chips to fit smartphones and tablets. It partnered with Lenovo, ASUS, Motorola and ran massive subsidies to push Atom processors. But Atom chips still consumed too much power and underperformed ARM products.

Even Apple didn’t bite. Despite multiple efforts, Intel couldn’t convince it to replace ARM, not even in entry-level iPhones or iPads. After nearly a decade of struggle, Intel shut down its smartphone processor business in 2016. Then-CEO Brian Krzanich candidly called it Intel’s “greatest mistake.”

2. Losing the Manufacturing Edge

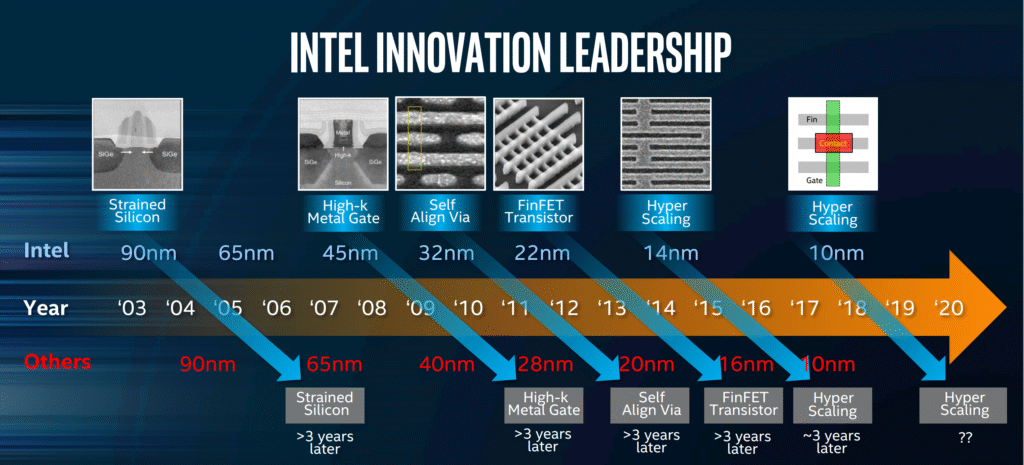

Intel didn’t just stumble on design, it also lost its long-held manufacturing lead. For years, Intel led the industry in process node innovation. From 90nm to 14nm, it was ahead of everyone. But its 10nm launch, planned for 2016, was plagued by yield issues (more defective chips than desired) and delays. As a result, it shipped in volume only around 2019–20.

Meanwhile, TSMC pulled ahead by launching:

– 10nm in 2016

– 7nm in 2018

– 5nm in 2020

– 3nm by 2023

While Intel was stuck on 10nm, TSMC powered ahead. AMD, Apple, Nvidia, and others rode that wave. For example, AMD’s Ryzen chips (on TSMC’s 7nm) outperformed Intel. Apple’s M1 chip, on 5nm, shocked the world with its efficiency. Major cloud players also followed suit, moving away from Intel chips and fabs.

This is how Intel lost its edge in both design (to ARM) and manufacturing (to TSMC).

Can Intel Make a Comeback?

After missing the smartphone boom and losing its manufacturing dominance, Intel is now attempting one of the most ambitious turnarounds in tech history.

Under CEO Pat Gelsinger, the strategy is bold and three-pronged:

1. Reboot chip design with modular architectures like Meteor Lake

2. Rebuild world-class fabs across the U.S. and Europe

3. Open Intel Foundry Services (IFS), making chips not just for itself, but also for others, including rivals

This new approach is called IDM 2.0. In Gelsinger’s words, Intel wants to be both the chef and the kitchen, and rent the kitchen out too.

Billions are being invested. Intel aims to reclaim the manufacturing lead by 2025. It’s not just about powering laptops anymore, it’s about enabling everything: data centers, AI factories, and beyond.

Will it work? Time will tell. But one thing’s for sure, Intel isn’t going down quietly.

Let us know what do you think about Intel’s comeback plans? Tell us by replying to this email. You can also let us know your thoughts and feedback on X, where you can find us as @bastionresearch.

Happy Investing!!!

🤣MEME OF THE WEEK🤣