Welcome to this week’s edition of TOPICAL WEDNESDAY! This week, we will try to understand the tariffs that may be imposed by the USA on India.

Since President Donald Trump’s victory in the U.S. election of November 2024, the world has anticipated significant changes in geopolitics and trade relations—two of the key themes of his campaign. Given that the U.S. is not only the world’s largest economy but also one of the largest markets for most global industries, these developments hold substantial importance.

As expected, within a month of taking office, President Trump prioritized tariffs, targeting Mexico, Canada, and China. Meanwhile, India had been preparing its own strategy to address these changes. Like many other emerging economies, India imposes higher import tariffs on U.S. goods and has maintained a trade surplus with the U.S. for the last 20 years. President Trump has even repeatedly criticized India’s tariff policies, calling them disproportionately high compared to U.S. tariffs on Indian imports.

During Prime Minister Modi’s recent visit to the U.S., tariffs were a major discussion point. However, the meeting ended with a positive note and provided some clarity on how trade relations might evolve if the U.S. imposes tariffs on Indian goods and services. So today, we analyze the current trade relations between the two nations, the potential impact of new tariffs, and the sectors that would be most affected.

India-USA Trade Relations and Surplus

India and the U.S. have historically maintained strong trade and political ties, driven by their shared democratic values and economic synergies. Their trade relationship is characterized by complementary strengths:

- The U.S. exports high-value industrial goods (e.g., machinery, aircraft) and energy products (e.g., crude oil) to India.

- India exports labor-intensive manufactured goods (e.g., textiles, pharmaceuticals, gems and jewelry, agricultural products, and IT services) to the U.S.

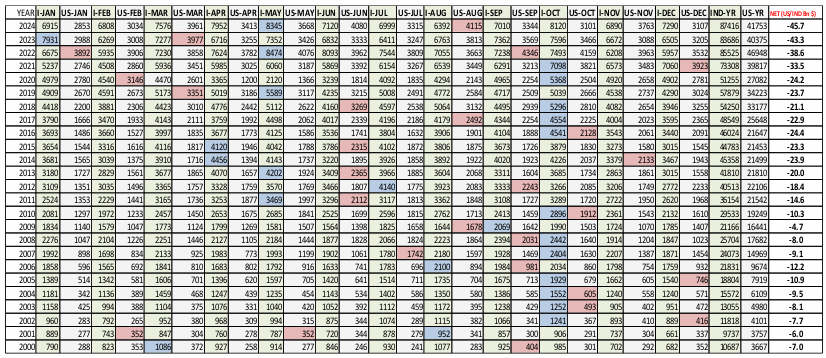

Despite exporting primarily lower-value manufactured goods and IT services, India has maintained a trade surplus with the U.S. due to the sheer volume of its exports. While India imports machinery, aircraft, and oil from the U.S., the quantities remain relatively small and energy sourcing of India is diversified because of Russia and the Middle East. Therefore, there is no dependent on USA. In contrast, India exports large quantities of textiles, spices, pharmaceuticals, and jewelry—products with steady, growing demand. This consistent demand has sustained India’s significant trade surplus with the U.S.

(Source: SBI Research)

The Tariff Landscape

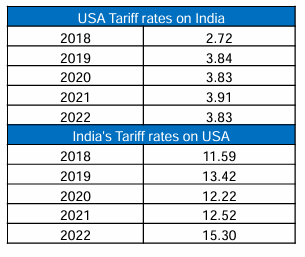

Both India and the U.S. have adjusted their tariffs over the years. The U.S. tariffs on Indian goods increased from 2.72% in 2018 to a peak of 3.91% in 2021, slightly declining to 3.83% in 2022. Meanwhile, India’s tariffs on U.S. imports remain significantly higher, averaging 15.30% in 2022, up from 11.59% in 2018.

Examples of high Indian tariffs include:

Machinery and wood products: ~7%

Food items: Up to 68%

Transport equipment and footwear: 15-20%

(Source: SBI Research)

India’s higher tariffs serve multiple purposes:

- Protecting Domestic Industries – Safeguarding local businesses from technologically advanced and highly competitive U.S. industries.

- Balancing Trade Deficits – Generating revenue to offset trade imbalances with countries like China.

- Promoting Domestic Manufacturing – Encouraging local production under the Atmanirbhar Bharat initiative.

The new U.S. reciprocal tariff imposition could change this dynamics.

Upcoming U.S. Tariffs

The U.S. is set to impose reciprocal tariffs of 15-20% on Indian goods starting April 1, 2025, as part of President Trump’s Fair & Reciprocal Plan. This move will bring U.S. tariffs closer to India’s levels. However, according to SBI Research, these tariffs are expected to reduce India’s exports to the U.S. by only 3-3.5% due to the following factors:

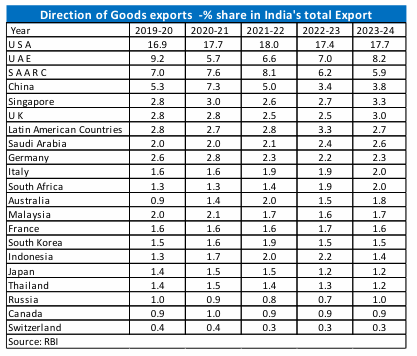

Export Diversification – India exports to multiple global markets, reducing reliance on the U.S. While the U.S. remains India’s largest market (accounting for 17.7% of exports in FY24), India’s exports are increasingly diversified.

Source: SBI Research

Value Addition – Indian exports are shifting toward high-value products, which are less sensitive to price changes.

Supply Chain Adjustments – India is establishing alternative trade routes through the Middle East and Europe.

Export Elasticity – Indian exports are moderately elastic, meaning a 1% tariff increase results in only a 0.5% export decline.

Currency Cushion – A weaker Indian rupee makes Indian exports cheaper, offsetting some tariff effects.

Resilient Sectors – Critical sectors like pharmaceuticals and IT services will likely remain unaffected due to sustained demand.

Despite these mitigating factors, some industries will experience a significant impact.

Sectoral Impact of U.S. Tariffs

Three major Indian export sectors will be most affected:

Textiles & Apparel – The U.S. is a key market for Indian textiles. Tariffs of 15-35% could severely impact competitiveness, leading to potential job losses in this labor-intensive industry.

Gems & Jewelry – Higher tariffs may reduce U.S. demand, as pricing plays a crucial role in this sector.

Pharmaceuticals – India supplies 40% of generic drugs to the U.S., with monthly exports of $2-3 billion. Tariffs could increase drug prices in the U.S., potentially lowering demand for Indian pharmaceuticals.

(Source: OEC, PIB, ET, TOI)

Now, the Indian government has already taken steps to strengthen trade relations with the U.S. ahead of President Trump’s second term. Recent meetings between Indian and U.S. leaders have resulted in new trade agreements, including major purchases of aircraft and oil by India.

Closing Thoughts

While the imposition of tariffs may cause friction between India and the U.S., their financial impact is expected to be limited to a 3-3.5% reduction in exports, which India could offset by shifting toward higher-value goods. The situation appears more political than economic, and ongoing diplomatic discussions could further shape the outcome. The true impact will become clear on April 1, 2025, when the tariffs take effect. If they are not as severe as feared, blanket tariff would’ve served its purpose as a negotiation tool, wielded by the world’s largest economy.

Disclaimer: This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

😂Meme of the Week🤣

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.