Insights from Sankaran Naren

Welcome to this week’s edition of TOPICAL WEDNESDAY! This week, we unpack the buzz created by Mr. Sankaran Naren’s thought-provoking remarks at the IFA Galaxy 2025 conference. His insights have left investors rethinking their strategies. So, is it time to recalibrate your portfolio? Let’s dive in!

In the world of investing, where fortunes are made and lost in the blink of an eye, few voices command as much respect as Mr. Naren, the Executive Director and Chief Investment Officer at ICICI Prudential Mutual Fund. Known for his contrarian approach and razor-sharp insights, he has built a reputation for challenging conventional market wisdom—and winning.

Take the 1999-2000 tech bubble, for instance. While many were chasing overvalued technology stocks, he steered clear and instead placed his bets on underperforming sectors like cement and steel. His calculated risk paid off handsomely when these sectors rebounded. Similarly, in the aftermath of the 2008 financial crisis, when fear gripped the markets, he urged investors to treat it as a “clearance sale” for stocks—a move that proved highly profitable for those who listened.

Mr. Naren has stirred the investment community with his bold and candid remarks at the summit held recently in Chennai. This annual summit, themed Vision 2035: Elevate, Educate, Excel, brought together over 500 mutual fund distributors (MFDs) and industry leaders to discuss strategies for navigating today’s volatile markets while planning for a prosperous future. But it was his thought-provoking session titled “What Are We Worried About?” that truly stole the show. With over three decades of experience in financial markets and a reputation for swimming against the tide, he didn’t hold back as he warned investors about the dangers lurking in small- and mid-cap stocks and emphasized the need for caution in systematic investment plans (SIPs).

His speech has sparked debates across Dalal Street among fund managers and retail investors alike. Is it time to rethink your SIP strategy? Should you pull out of overvalued segments like small- and mid-caps? And where should you park your money in these uncertain times? These are just some of the questions his insights have raised.

As we dive deeper into his speech and its implications, here are some key learnings from his talk:

From Banks to Investors: The New Risk Bearers

Mr. Naren highlighted a key shift in risk dynamics since 2007-08. Back then, companies borrowed heavily from banks, and when projects failed, banks absorbed the losses, indirectly affecting investors. In recent times, companies rely on IPOs and QIPs for funding, transferring the full risk directly to investors and wealth managers. As he aptly addressed it, “Corporates have basically transferred all their problems to all the people in this room.” Today, individual investors must navigate risks on their own.

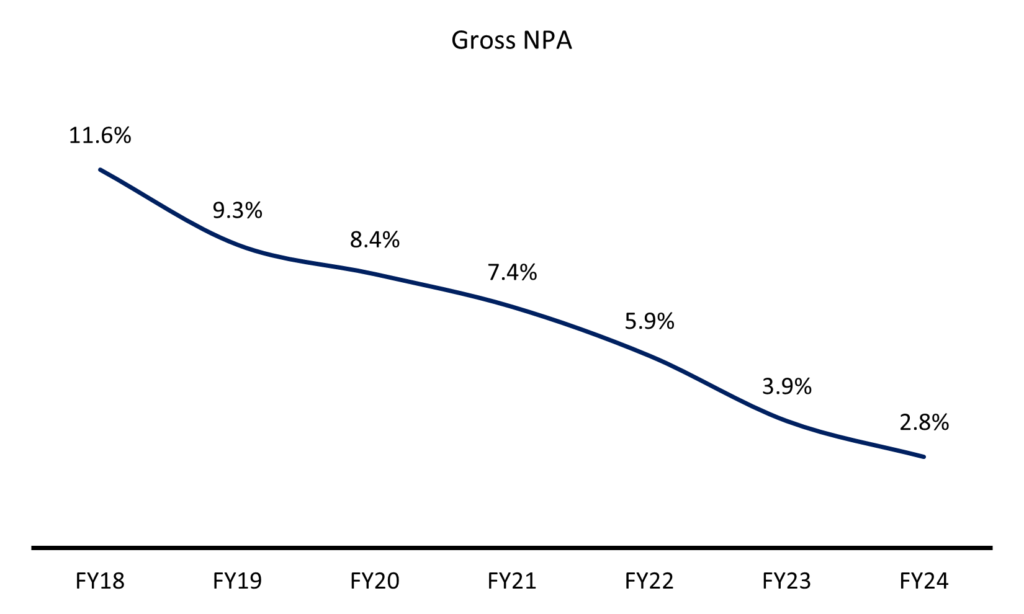

This shift is evident from the staggering growth in IPO activity. In 2024 alone, Rs. 1.62 lakh Cr was raised through 92 mainboard IPOs—a threefold increase from Rs. 49,440 Cr in 2023. Concurrently, the banking sector demonstrated its strengthened balance sheets, with Gross NPAs declining from 11.6% in FY18 to a low of 2.8% by FY24.

(Source: RBI)

SIPs: Timing and Choice Matter More Than You Think

While SIPs are celebrated for promoting disciplined investing, Mr. Naren cautioned that they are not immune to poor timing or bad asset selection. SIPs work best in undervalued and volatile asset classes but struggle when started in overvalued segments like small-cap and mid-cap stocks where P/E ratios have reached unsustainable levels (43x). He highlighted few historical examples—such as SIPs in Indian equities between 1995-2002 or mid-caps from 2006-2013—show how poor timing can lead to zero or negative returns.

There have been periods in the past where small-cap and mid-cap indices delivered minimal or no returns. For instance, between 2004 and 2009, the mid-cap and small-cap indices achieved a CAGR of just 6% and 9%, respectively. Similarly, from 2004 to 2010, their returns were even more subdued, with the mid-cap index delivering 0% CAGR and the small-cap index posting a negative CAGR of -6%. While these figures may seem like cherry-picked data points, they highlight specific market cycles. For example, in one extraordinary year (2008), mid-caps surged by 69%, and small-caps skyrocketed by 96%. However, both indices experienced sharp corrections following these peaks. It took the mid-cap index 7 years to regain its previous high, while the small-cap index required a decade to return to its earlier levels.

Bigger AUMs, Bigger Mistakes: The Redemption Test

As assets under management (AUM) grow, even small errors can lead to massive financial consequences. For instance:

- A 2% mistake on ₹1,000 crore AUM costs ₹20 crore.

- The same error on ₹1 lakh crore AUM results in a staggering ₹2,000 crore loss.

Mr. Naren expressed concern that many fund managers today haven’t experienced a redemption cycle—a period when large investor withdrawals force funds to sell holdings quickly at unfavorable prices.

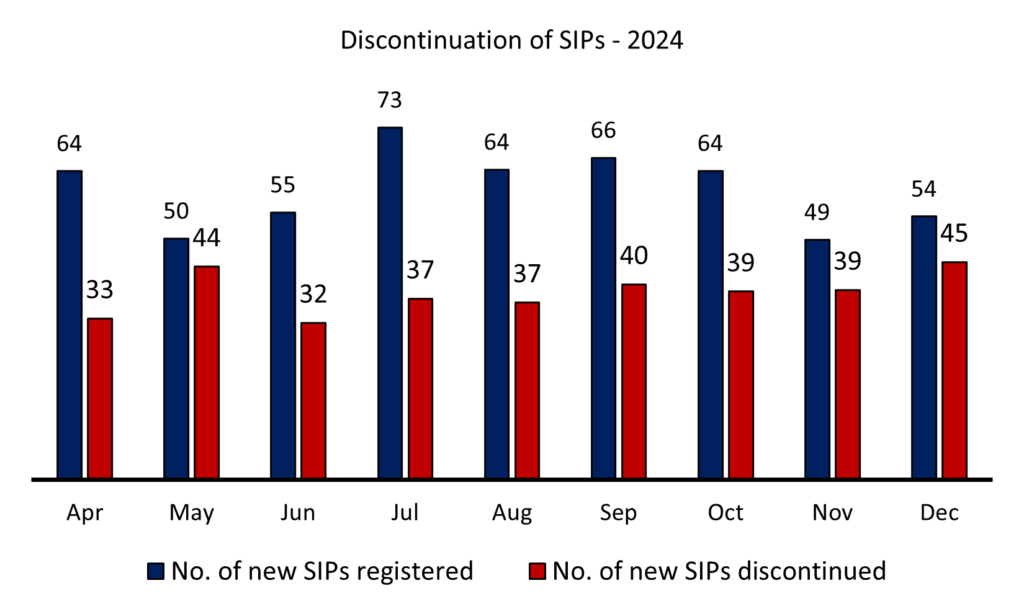

Recent data shows that 60-80% of new SIPs started recently have already been redeemed, reflecting investor impatience amid market volatility. Naren’s key question remains: Canfund managers’ portfolios withstand such large-scale redemptions?

(Source: Association of Mutual Funds of India)

Small and Mid-Caps: Flying Too Close to the Sun?

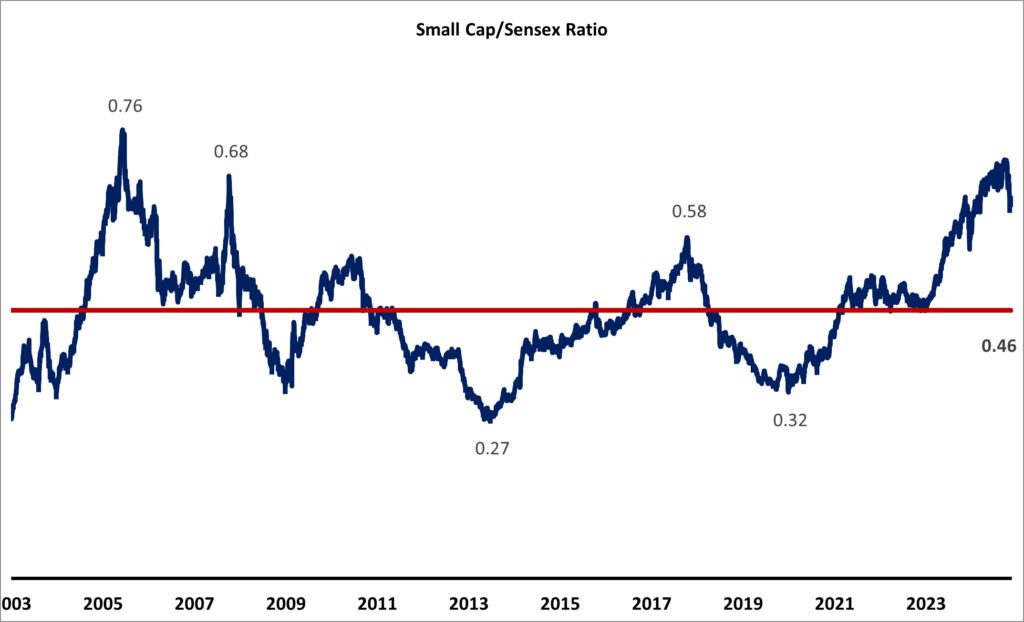

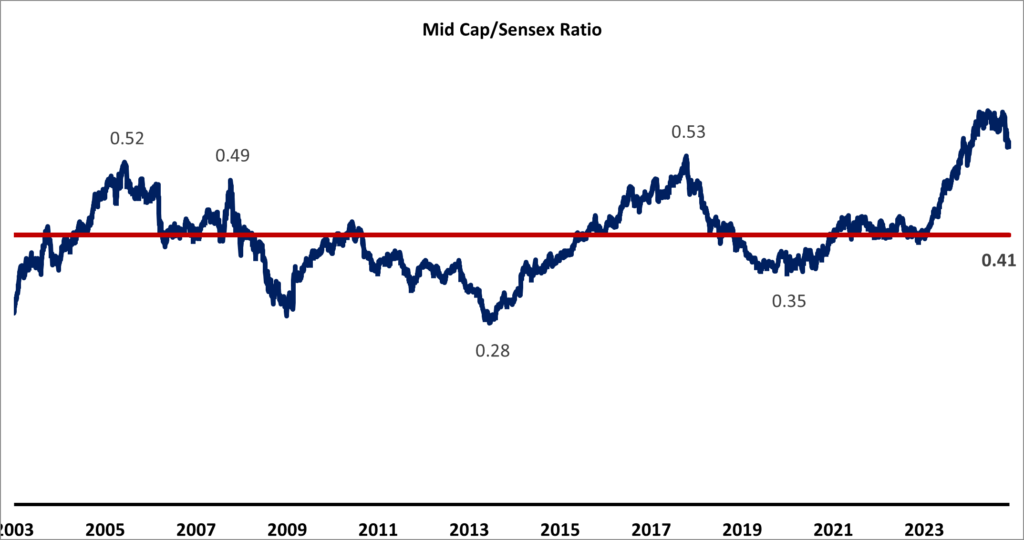

Small and mid-cap stocks have been on a wild ride, with valuations hitting sky-high levels. To put things into perspective, small-caps have been among the top 5 performing indices in 4 out of the last 5 years—a stellar run by any measure. But here’s the catch: momentum seems to be losing steam. So far in 2025, the Nifty Small Cap Index has already dropped by around 11.1%, and mid cap dropped by 9.2%.

This weakening momentum, coupled with peak valuations, raises serious questions about sustainability. (Don’t just take our word for it—check out the chart below to see how stretched these valuations really are.) It might just be time to tread carefully in this overheated space!

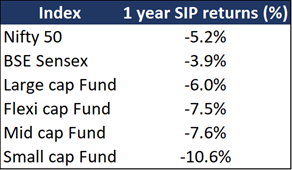

SIPs: Patience is the Name of the Game

Mr. Naren didn’t sugarcoat it — mid-term SIP performances might leave investors disappointed, especially for funds started after 2023 in today’s high-valuation market. While SIPs held for the long haul (think 20 years) are unlikely to deliver negative returns, let’s be real—how many investors actually stick around that long? For those expecting quick gains, the next 3-4 years could be a tough ride, with returns likely to be flat or even negative. So, if your SIPs aren’t delivering right now, don’t be surprised—it’s the nature of starting investments in an overheated market.

(Source: Economic Times)

India’s Macros: A Solid Foundation

Mr. Naren highlighted India’s solid macro economic foundation, with stable government finances, resilient GDP growth, and robust bank and corporate balance sheets. He believes this strong growth story makes large-cap stocks the ideal bet, as they are well-positioned to capitalize on India’s economic momentum while offering lower risk compared to the overheated small- and mid-cap segments.

Mr. Naren’s Picks for This Market

In a market full of overvalued pockets, Mr. Naren made it clear where the real opportunities lie. Large-cap and flexi-cap funds are his top picks right now, offering both stability and growth potential. He’s also bullish on banking stocks, which are commanding reasonable valuations and have rock-solid balance sheets. With their strong fundamentals, banks are well-positioned to ride the next wave of growth. If you’re looking to play it smart in this market, these are the areas to focus on!

Focus on the Now: Secure Gains and Stay Cautious

While long-term investing is great, Mr. Naren emphasized the need to tackle immediate challenges in today’s market. With small-cap and mid-cap stocks looking overvalued and excessive leverage creeping in, he suggested now might be the perfect time to lock in the gains you’ve made over the past 4-5 years. He also didn’t shy away from addressing the ongoing IPO frenzy, particularly in the SME segment, drawing parallels to the ’90s OTC exchange era when numerous low-quality IPOs eventually collapsed. A striking example of the current market exuberance is the Resourceful Automobile IPO, an SME offering that aimed to raise Rs. 12 Cr but received bids worth an astonishing Rs. 4,800 Cr.

His advice? Be cautious—speculative excesses in IPOs and derivatives could lead to big losses. Add to that hedge funds shorting stocks in derivatives, and you’ve got a recipe for heightened market volatility. The message is clear: play it safe, secure your wins, and don’t get caught up in the hype!

Large Caps: Ready to Shine When the Tide Turns

Mr. Naren is highly optimistic about large-cap stocks, and for good reason. With FIIs showing aggressive selling activity recently—offloading nearly Rs. 1 lakh Cr YTD (compared to Rs. 3 lakh Cr in the entire 2024) — large caps are perfectly positioned to benefit when this money flows back into the market. These stocks tend to be the first choice for FIIs due to their liquidity, stability, and ability to absorb large investments. He believes that as FII sentiment improves, large caps are set to reap the rewards, making them a smart bet in today’s market environment.

Closing remarks

In one of our previous newsletters, we highlighted how the majority of returns in 2024 came from small-cap and mid-cap stocks, which surged by 29.3% and 26.1%, respectively, while the Sensex lagged behind with an increase of just 8%. We also pointed out that the mid-cap and small-cap indices, relative to the Sensex, were approaching or had already surpassed their all-time high levels. This raised concerns about potential corrections in these market segments, something many investors have already started experiencing in their portfolios. At such elevated levels, caution is essential. While a company might be an excellent business, it doesn’t necessarily make it a great investment at every valuation. Valuation matters!

Disclaimer: This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

😂Meme of the Week🤣

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.