More Spending, Less Savings

Welcome to this week’s edition of TOPICAL WEDNESDAY! Today, we will talk about the government’s focus on stimulating the Indian economy.

Dear readers, before we dive into today’s topic, let me ask you this: how are you really doing? I ask this sincerely because, wow, what a rollercoaster this February has been so far. Before the budget, we were all feeling some anxiety, hoping the government wouldn’t make things worse. Then came the Budget on February 1st—on a Saturday, no less—but overall, we were pleasantly surprised. Finance Minister Nirmala Sitharaman presented a decent budget, and one of the highlights was an increase in the income tax bracket, making income up to Rs. 12 lakh effectively tax-free. This is great news for the middle class, India’s consumption engine, as it means they won’t have to pay exorbitant taxes and will have more disposable income to spend. The FMCG and Consumer Durable indices, in particular, reacted positively, rising by 2.9% and 2.5%, respectively. We all went into the weekend looking forward to a promising week ahead.

But little did we know, while we were unwinding, the Western world had its own plans. Newly elected President Trump made it clear that he was not bluffing: he announced a tariff on Canada, Mexico, and China, effective immediately. Shortly thereafter, Canada’s Prime Minister and Mexico’s President retaliated with their own tariffs on U.S. imports. To make matters worse, China’s Ministry of Commerce issued a statement expressing “strong dissatisfaction” and vowed to take “necessary countermeasures” to protect its interests. Our hopes for a calm week quickly crumbled as global markets braced for Monday’s opening—Asian markets, which open first, were expected to take a hit. Indeed, most global markets saw a drop of 1.4–2.4%, though India was less affected, with the Sensex dropping just 0.41%. It was certainly a tumultuous few days. But by Monday itslef, Canada and Mexico decided to work together with the USA and tariff implementation was postponed for 30 days, closing this supposed trade war in 24 hours. Phew!! what a crazy couple of days it’s been.

While we can’t do much about the ongoing trade war—it is, after all, still unfolding—let’s turn our attention to our own Budget. This isn’t meant to be a deep dive into Budget 2025 (every household in India is already doing that), but rather, we’ll focus on the intent behind the government’s recent budgets and the strategic measures being taken to stimulate GDP growth.

To understand that, let’s first look at how GDP works.

Four factors that drive GDP:

GDP is driven by four main factors:

GDP = Consumption + Investment + Government Spending + Net Exports (Exports – Imports)

Consumption: Private consumer spending on goods and services like food, clothing, and healthcare.

Investment: Business investments in capital goods, infrastructure, residential construction, and inventory changes.

Government Spending: Public service expenditures on infrastructure, defense, education, and healthcare.

Net Exports: The difference between exports and imports.

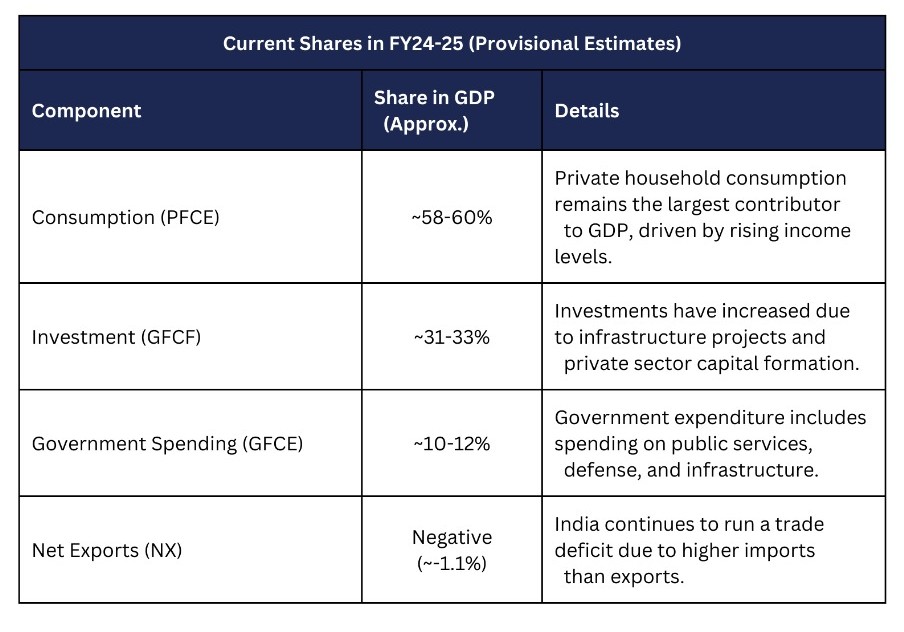

India’s GDP in a Snapshot:

(Source: India Briefing, PIB, MOSPI)

As you can see, consumption is the dominant driver of India’s GDP. Over the past five years, government spending has increased, followed by private investments, but India still remains a trade-deficit country. However, these macro factors don’t directly impact us on a personal level. What really affects each of us is consumption, which makes up the largest share of India’s GDP.

Consumption Stimulates the Economy:

Private Final Consumption Expenditure (PFCE) refers to household spending on goods and services. It typically accounts for around 60% of GDP in India. Consumption can be broken down into two categories:

- Non-discretionary/Essential Spending: This includes food, rent or mortgage, and healthcare. These are basic necessities, and people tend to spend just enough to meet their needs.

- Discretionary Spending: This includes spending on items like electronics, travel, entertainment, and luxury goods—expenses that rise with an increase in disposable income.

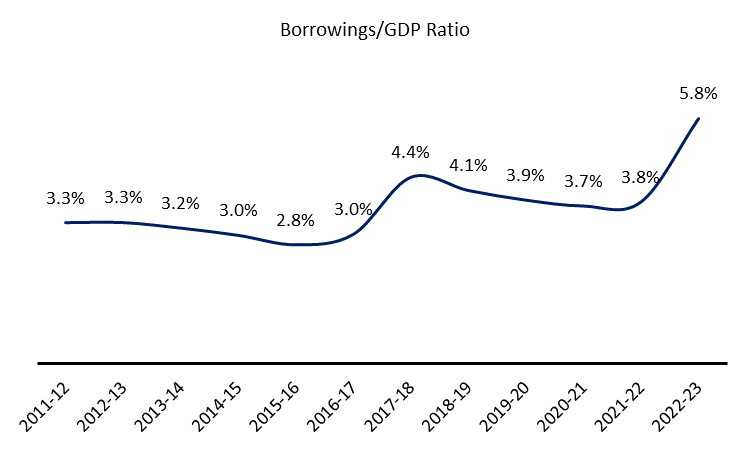

Post-COVID, we witnessed a surge in discretionary spending, with Indians splurging on everything from cars and clothes to dining out and holidays. In fact, premium products saw faster growth compared to entry-level ones, often fueled by credit, leading to household debt reaching a 15-year high. This reliance on loans for consumption saw India’s household debt-to-GDP ratio rise from 3.3% in 2012 to 5.8% in 2023.

(Source: MOSPI)

This boom in spending on non-essential goods was great news for the government, as it translated into higher GST revenue—Rs. 2.10 lakh crore in April 2024 alone. But, by the second half of 2024, urban consumption began to slow down, coinciding with a tightening of credit. Many banks reported increased loan defaults, leading to a reduction in unsecured loans and credit card offerings.

The slowdown in economic activity has impacted India’s GDP growth, with projections for FY25 revised down to 6.4-6.8%, compared to the 8.2% growth recorded in FY24. However, the recent budget aims to put more money into the hands of Indians, and it does so in an interesting way.

Govt. Strategy – Consume More or Pay More:

This year, the government raised the tax bracket, making income up to Rs. 12 lakh effectively tax-free. This increase is part of a broader trend in recent budgets where income tax slabs have been progressively adjusted higher.

(ET, TOI, HT)

But having extra disposable income doesn’t automatically translate into more spending. Increased savings can actually hinder GDP growth, which is why the government has cleverly designed policies to encourage spending.

Taxes on Investments:

Savings, especially in investments like stocks, real estate, and gold, do not directly contribute to GDP growth. When you buy shares or property, no new goods or services are created. To offset this, the government taxes such investments, including long-term capital gains (LTCG), short-term capital gains (STCG), stamp duties, and dividend taxes. Over the past decade, India has steadily increased taxes on these assets to ensure that money isn’t sitting idle and instead circulates in the economy.

Key Tax Changes:

(PIB, Bajaj Finserve, Cleartax)

In the recent budget, the government also shifted the tax treatment of long-term capital gains on Unit Linked Insurance Plans (ULIPs), taxing them at 12.5% rather than treating them as regular income. This is part of a broader strategy to encourage spending on goods and services rather than simply holding investments.

Through these measures, the government makes it clear: either spend your extra income, boosting consumption and generating GST revenue, or pay higher taxes on your investments.

Closing Thoughts:

This strategy of directing money into the economy—whether through spending or higher taxes on investments—allows the government to utilize these funds for national growth. Ultimately, the aim is to stimulate the economy in ways that benefit the country’s long-term prosperity.

If you found this newsletter insightful, please share it with others using this link. Also, feel free to share your thoughts on X.

Disclaimer: This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

😂Meme of the Week🤣

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.