Welcome to this week’s edition of TOPICAL WEDNESDAY! Today, we will talk about the changing focus of the Indian electronics sector.

Electronics manufacturing has historically been a catalyst for economic transformation in nations aspiring to achieve high-income status. After World War II, the United States pioneered this journey with innovations like the transistor and the rise of Silicon Valley. Japan followed in the 1970s-90s, becoming a global leader in consumer electronics, while South Korea and Taiwan emerged as powerhouses in semiconductors and display technologies during the 1990s. Finally, China’s meteoric rise in the 2000s established it as the “world’s factory” for electronics. Even today, electronics manufacturing remains a critical driver of GDP growth, exports, and technological innovation for these nations.

(Source: Statista, UNIDO, S&P Global)

India is now positioning itself as a key player in global electronics manufacturing. Initiatives like “Make in India“, the Production Linked Incentive (PLI) schemes, and geopolitical shifts such as the China Plus One strategy are propelling this growth.

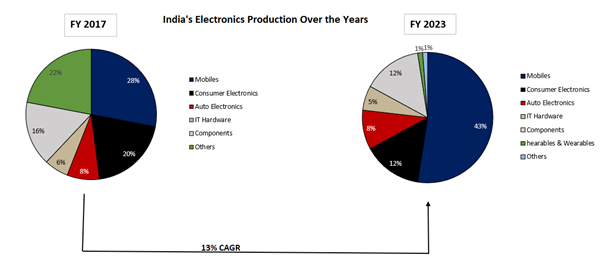

The sector’s production value more than doubled from $48 Bn in FY17 to $115 Bn in FY24, reflecting an impressive CAGR of ~13%. However, India’s share in global electronics exports still remains under 1%, with much of its production focused on low-margin, high-volume products like mobile phones. In contrast, other nations dominate high-value segments, requiring advanced skills and innovation.

This raises a crucial question: Can India ascend the global value chain to lead in high-value electronics manufacturing?

To answer this, we must examine India’s current position and what it will take to achieve this transformation.

Indian Electronics Sector: High Volume, Low Margin (HVLM)

Currently, India’s electronics sector is characterized mostly by high-volume, low-margin (HVLM) manufacturing. Most components—such as processors, cameras, microphones, displays—are imported (primarily from China) and assembled domestically for OEMs. We have previously covered the Indian ESDM sector in our newsletter. To read more about it, click here. Supported by policies like the PLI scheme offering financial incentives, this model has been profitable for India. The total electronics manufacturing output grew from $48 Bn in FY17 to $115 Bn in FY24 (13% CAGR), while exports surged from $5 Bn to $29 Bn during the same period.

Mobile phone assembly has been the biggest driver of this growth.

Mobile Phones

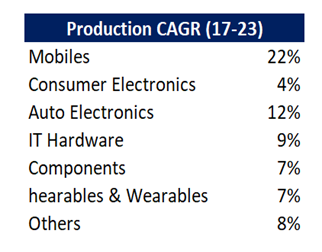

A Growth Driver Mobile phone manufacturing has been the fastest-growing segment within India’s electronics sector, expanding at a CAGR of 22% between FY17-23.

(Source: MeitY)

Today, it accounts for 43% of total sector output and over 50% of total electronics exports. Apple Inc., is leading this export growth with $13.3 Bn worth of exports (65% of total smartphone exports), followed by Samsung at 20%. Companies like Foxconn and Tata Electronics manufacture iPhones locally, while Samsung operates its own facilities. Chinese brands such as Xiaomi, Oppo, Vivo, and OnePlus also dominate local production through contract manufacturers like Dixon Technologies, which operate on very low margins to serve both domestic and export markets.

Other segments like IT hardware and consumer electronics have shown moderate growth but have lagged behind mobile phones in scale.

Value Addition: A Work in Progress

India currently achieves only 18-20% local value addition across products, mostly limited to low-value components like battery packs, chargers, and cables. High-value components such as semiconductors, integrated circuits (ICs), PCBs, display assemblies, and camera modules are still imported from countries like China, Japan, Taiwan, and South Korea.

However, there is growing momentum among stakeholders toward increasing domestic value addition to 40% by focusing on high-value components.

The Next Growth Phase

India’s initial success has been driven by government incentives, manufacturing investments, and cost advantages like cheap manpower. However, moving forward requires a shift toward high-value products through strategic policies and investments

Key Government Policies:

Semiconductor Mission (Launched December 2021): This initiative is crucial for advancing India’s electronics sector. Semiconductor chips power all electronic devices we use, but currently, India does not produce these chips and relies entirely on imports from East Asian countries. The goal of this policy is to set up semiconductor manufacturing facilities (fabs) in India and reduce dependency on imports.

Financial outlay: Rs. 76,000 crore ($10 billion).

Focus: Establish semiconductor fabs and reduce import dependency

PLI Scheme for IT Hardware (Second Round) (Launched May 2023): After the success of mobile phone manufacturing under similar incentives, this scheme aims to position India as a major global player in IT hardware production and exports.

Financial outlay: Rs. 17,000 crore

Focus: Boost local production of laptops and servers.

Modified Electronics Manufacturing Clusters (EMC 2.0): The scheme aims to address challenges faced by industries by improving supply chain responsiveness, reducing logistics costs, and decreasing time-to-market.

Focus: Expanded clusters in cities like Noida and Bengaluru for high-value manufacturing.

New PLI Scheme for Electronic Components (Expected January 2025): Expected to be announced in the Union Budget 2025, it is a significant initiative by the Indian government to strengthen the domestic electronics manufacturing ecosystem.

Financial outlay: Rs. 25,000 crore ($3 billion).

Focus: Generate $50–60 Bn worth of electronic components domestically.

These are just some of the schemes that are launched or are expected to be launched by the government. All of this has led to following major investments by Indian companies.

Semiconductors and Advanced Electronics

Tata Electronics: It is investing Rs. 91,000 crore ($11 Bn) in Gujarat to build a semiconductor manufacturing plant in partnership with Taiwan’s Powerchip Semiconductor Manufacturing Corporation (PSMC). This facility will produce advanced silicon carbide chips for AI, automotive, and high-performance computing.

It has committed another Rs, 40,000 crore ($4.8 Bn) for semiconductor assembly and packaging facilities in Assam.

Micron Technology: The company is investing $2.75 Bn in Gujarat to set up a facility for assembling, testing, marking, and packaging (ATMP) memory chips, with 70% of the funding supported by the Indian government.

AMD & Applied Materials: Each investing Rs. 3,300 crore to enhance R&D capabilities and semiconductor manufacturing equipment in India.

Electronics Components

Kaynes Technology: Has allocated Rs. 4,000 crore for semiconductor assembly projects in Telangana.

Dixon Technologies: Planning Rs.1,800 crore in investments over three years for projects like inverter controller boards (in partnership with Ericsson) and display modules.

Opened an R&D center in Noida focused on display devices.

Amber Enterprises: Investing Rs. 350–375 crore in FY25 to manufacture PCBs (Printed Circuit Boards) and other components.

IT Hardware

Under the PLI scheme for IT hardware, companies like Acer, Asus, Dell, HP, and Lenovo are investing Rs. 3,000 crore to locally manufacture laptops, tablets, and servers.

Consumer Electronics & Components

Motherson Group & BIEL Crystal Manufactory (Hong Kong): Formed a joint venture to produce high-quality glass covers for smartphones, with Apple as a key customer.

Quectel & Syrma SGS Technology: Partnering to manufacture IoT modules in India as part of the “Make in India” initiative.

Intel Collaboration

Intel is working with eight Indian manufacturers, including Dixon Technologies and Syrma SGS, to develop a strong laptop manufacturing ecosystem using advanced Surface Mount Technology (SMT).

While these are just initial steps and there is still a long way to go, it shows that we are strategically positioned for the next phase of growth in India’s electronics sector.

Closing Thoughts

India’s electronics sector is gearing up for a shift towards higher value addition and higher value manufacturing with significant investments by companies like Tata Electronics, Micron Technology, and Vedanta; strategic partnerships with global players like Intel and PSMC; and government-backed initiatives like the Semiconductor Mission and PLI schemes. While we are still far from becoming a major global player and face many constraints like finance, skilled manpower, and fundamental infrastructure, the focus of the industry and all stakeholders seems to be in the right direction.

Disclaimer: This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

😂Meme of the Week🤣

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.