Insights from the Plant Visit and Management Interaction

In this edition of LEARNING OF THE WEEK, we’ll discuss some interesting insights that we gained from the plant visit and management meet of GMM Pfaudler Ltd.

Disclaimer: Welcome to our factory tour in words—where hard hats are optional, but your patience is mandatory! We promise a riveting journey through the assembly line of ideas.

The World of Chemicals that we live in Today

The chemical industry is like the hidden magician behind almost everything we use in daily life. From the moment you wake up and brush your teeth to the time you relax on your couch, you’re surrounded by its creations. The toothpaste you use, the plastic in your toothbrush, the fabric of your clothes, the fuel in your car, and even the food packaging in your kitchen – all owe their existence to this industry. It transforms raw materials like oil, air, and water into over 70,000 products that touch nearly every aspect of our lives. Whether it’s fertilizers that grow our food, medicines that heal us, or paints that color our world, the chemical industry is everywhere, quietly making life better, brighter, and more convenient.

A Company that is benefitted as well as impacted by Chemicals

Today we are going to talk about one company whose business is closely tied to the chemical consumption. GMM Pfaudler – a company that manufactures machines for 90% of the top chemical companies globally. Besides chemicals (including agro and specialty), this company has been serving clients from industries like pharmaceuticals, oil and gas, petroleum refineries, power, renewable energy, mineral mining, etc.

GMM Pfaudler – Business Brief

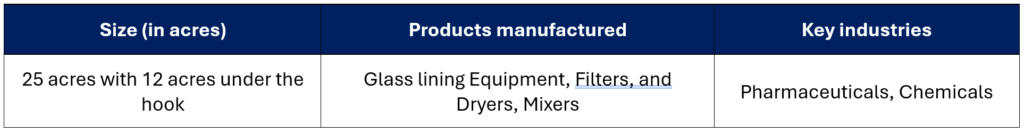

The company offers everything from a single piece of equipment to complete end-to-end process solutions, along with after-sales services. GMM’s business is divided into three segments: Glass Lined Equipment (GLE), Proprietary Products, and Heavy Engineering. Details about each segment, including product portfolio, industries served, and manufacturing locations, are provided in the table below.

Insights – Vatva Plant (Heavy Engineering)

Negotiation and Conversion of Clients: GMM Pfaudler bags orders for its heavy engineering segment based on three criterias, a) cost competitiveness, b) product quality, and c) ability to make timely delivery. Dhaval Rajput, General Manager of Finance and Accounts shared that the Company also offers minor price cut down to remain cost competitive. He also added that from his personal experience, that uncompetitive pricing can also lead to order loss. Besides price competitiveness, clients seek top quality products which are a result of robust manufacturing process. In fact, clients audit the product at every stage. On-time delivery is ascertained with efficient project management skills, a credential that GMM has built from its past track record. YTD FY25, the company has reduced its TAT and delivered all its projects before time.

Receiving Specifications: Machine specifications like pressure, temperature, etc., are provided by the client. The building materials and thickness of the vessel will depend upon the amount of temperature and pressure the vessel would have to undergo. The building material progression begins with carbon steel, followed by stainless steel, nickel alloys, and the toughest, titanium. The usage mix of these material varies monthly based on incoming orders.

Design Development and Receiving Advance: Post-approval of designs and drawings, the company receives an advance of up to 40%, followed by an additional 15%. This funding supports raw material procurement imported from Europe (delivery period of ~2 months). GMM procures raw materials only after securing orders and maintains a six-month inventory, given an average lead time of 6-9 months (can go upto 12 month for complex processes). The production process with exotic alloys requires a clean room for activities like welding so that no contamination or dust is encountered with the alloy. GMM possesses India’s biggest clean rooms.

Manufacturing & Dispatch: Approximately 95% of fabrication is done in-house, while simpler processes are outsourced. The Company holds over 1,800 procedure qualifications, including radiography qualifications. Depending on the type of alloy, the complexity of metallurgy becomes crucial. This is GMM’s area of expertise and value add where the company uses its art of handling alloys before and after heating, relieving stress, efficient welding, etc. Inappropriate or incorrect handling may lead to the alloy cracking up. The reactor, once assembled, is cleaned and painted.

Workforce and Challenges

The workforce is a critical component of the production process, as most of the work is handled by skilled laborers. GMM employs skilled laborers with decades of experience and trains ~90 engineers annually. However, labor-intensive operations pose scalability challenges with annual attrition rates going as high as 15-20%. When asked about automation, the management highlighted that automation could reduce lead times but increase costs by 30%.

Competitive Landscape

Tier-1 competition: L&T and Godrej dominate with larger capacities and the ability to execute larger orders. It is noteworthy to learn that ~80% of the employees at Godrej are from ISGEC Heavy Engineering Ltd.

Tier-2 competition: Players like Anup Engineering are present with a strong focus on export (40-45%) with higher margins (20-25%).

Global competition: Italian companies like Walter Tosto and Tab Italy are key players.

Future Outlook for the Vatva Facility

Exotic Alloys: GMM aims to move up the pyramid by increasing its use of higher-grade and higher-value materials like titanium for higher margins.

Industry Diversification: The management expressed the company’s interest in venturing into aerospace, nuclear, etc. by building components like TSLV, GSLV, missiles, combustion chambers, etc.

Capacity Utilization: By FY25, GMM targets achieving a ~50% utilization. The management is not witnessing any demand slowdown and is planning to ramp up utilization.

Hyderabad Consolidation: Plans are underway to consolidate operations from Hyderabad into Gujarat.

Capital Expenditure: An incremental investment of Rs. 40-50 cr is planned to enhance capabilities for manufacturing higher-tonnage products.

Business Expansion and Exports: The company is leveraging Pfaudler’s network to increase exports, which currently account for ~20% of revenue but are expected to double within 2-3 years. This will lead to margin expansion going forward.

Insights – Karamsad Plant (Glass Lined Equipments)

Raw Material Procurement: Due to the standardization of a large portion of the production, GMM procures materials in bulk and operates a batch production process for standard parts, achieving lead times of 6-12 weeks.

Standardized Barrel and Customized Heads: While the reactor body is standardized, the head is custom-made. The body of the vessel is welded after rolling the plate as shown below.

(Source: Pfaudler, YouTube Video)

Making and Welding Nozzels: Nozzles are marked manually as per client specifications to ensure precise integration with existing manufacturing infrastructure at client’s facility. Image shown below.

(Source: Pfaudler, YouTube Video)

Material handling difficulty increases with the increase in diameter. To reduce such difficulty, a rotating solution is used, which turns the head in a clockwise direction, bringing every nozzle to the welder. After welding the nozzle, the head and barrels are welded together.

(Source: Pfaudler, YouTube Video)

Surface Cleaning: The vessel undergoes surface cleaning in a blast furnace. This removes dust and contamination that may have settled on the surface during production. GMM possesses six blasting chambers to remove dust and contamination. It is important to note that cleaning is inevitable before applying glass spray.

Glass Formulation, Spraying and Testing: Though the process of glass spraying was not shown to us during the visit, it was communicated that this critical process is known only to a couple of head employees at the floor. However, to complete the process, we have taken the images of this missing part of the process shared by Pfaudler. This reaffirms the fact that GMM got the glasslining technology from Pfaudler.

Glass spray preparation involves mixing ingredients like quartz sand and soda, smelting them into molten glass, cooling them into frits, and preparing them for spraying. GMM offers four glass variants: a) PPG (pharmaceutical), b) Anti-Static Glass, c) Abrasion Resistant Glass, and d) World Wide Glass (used in 70% of vessels).

Melting the Spray: For melting the spray, the reactor is heated in furnaces at 800–1,000°C. The Company possesses seven natural gas furnaces and four electric furnaces. After the heating process, the reactor is cooled which takes around 4-5 hours. This process is repeated 7 times on average but can also go up to 10 in certain cases.

(Source: Pfaudler, YouTube Video)

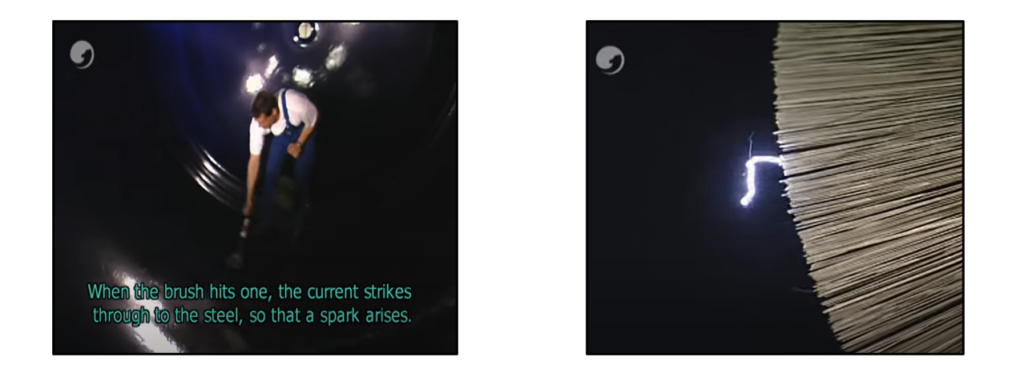

Testing: After cooling, non-uniformities are identified using an electric brush. In extreme cases, the entire glass lining may need reapplication. After passing these tests, the reactor is ready for dispatch.

(Source: Pfaudler, YouTube Video)

Other Important Points:

The average life of the glass depends on the corrosive and harmful characteristics of the chemical, but it is estimated to have an average lifespan of 15-20 years with scope for reglassification – a high-margin service that allows clients to extend asset life before purchasing new equipment. As per the management, the quality provided by GMM is much superior and lasts longer compared to peers. Generally, reglassification is preferred by overseas clients in order to sweat assets better before purchasing a new one. Also, the manufacturing lead time is longer overseas than in India.

Out of the total cost, non-glass materials contribute ~50%, glass contributes ~20%, while labour and others amount to the remaining 30% of the cost. GMM’s biggest clients include – Sun Pharma, Dr. Reddy, UPL (once the biggest client), PI Industries, Deccan, Hikal (GMM’s sole supplier).

Insights – Karamsad Plant (Proprietary Products)

Mixers

Mixer = Reactor + Agitator (installed inside a reactor). Agitators play a crucial role in improving batch times and reducing power costs. These mixers play a critical role in industries like chemicals, paints, and pharmaceuticals. GMM is a leading agitator supplier with notable deliveries, including 250 units to Birla Opus Paints and 500 units to Asian Paints.

Filters & Dryers:

Faster drying times are important for making better-quality products and improving efficiency. While no standard catalogue exists, GMM provides customized solutions for filters and dryers based on specific problems faced by its client. Around 80% of Filter & Dryer (F&D) sales occur in India, with assembly done in Switzerland to ensure quality. Innovations like the Vertical Nutsche Filter-Cum-Dryer (VNFCD) combine filtration and drying into one unit for enhanced efficiency. New products are first tested on a smaller scale for lab trials before full-scale production. Filters are important for separating liquids from slurries.

R&D & Services:

The facility has a dedicated R&D team of 20 employees and a service team of 70 employees that supports reglassification services.

Future Outlook for Karamsad Facility

As per the management, despite challenges in market dynamics, GMM’s innovations in glass lining technology, filters/dryers, and mixers position it well for future growth. With anticipated sales growth in GLE and potential expansion in mixing technologies, Karamsad remains a cornerstone of GMM’s operations.

Observations

Southern Market Presence: A southern player in GLE had indicated that GMM may shut down its Hyderabad plant due to challenges in booking sales in Southern India (unverified but noted during the visit). Eventually in Dec’24, the company announced shutting down its plant.

Market Dynamics: The overseas demand redirection strategy remains unclear; managers indicated it would depend on excess demand abroad.

Disclaimer: These insights are based on our observations and interpretations, which might not be complete or accurate. Bastion Research and its associates do not have any stake in GMM Pfaudler Ltd. This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.

MEME OF THE WEEK