The Next Growth Sector

In this newsletter, we will talk about the Indian shipping sector.

Shipbuilding is one of the world’s oldest trades, serving as the sole means of connecting distant regions for centuries. From cities to empires, ships were essential for expanding horizons.The use of ships followed a pattern: In ancient times, as nations and empires grew, they dispatched explorer ships to discover new lands, a journey that could take months or even years. Upon finding a promising land, trade routes were established, linking empires through maritime connections. However, if the newfound territory was hostile or highly valuable, it often attracted the attention of other nations.

In India, even before Vasco da Gama’s arrival, the region was renowned for luxury goods like spices and textiles and had extensive trade networks with the Middle East, Southeast Asia, and Europe. The Indian peninsula boasted strong shipbuilding capabilities with multiple empires and ports. When the British arrived, they brought their ships and technology, building them in India to export goods.

However, today, India’s shipbuilding industry is less than 1% of the global shipbuilding market and we are heavily depended on foreign vessels for our needs. This decline is disheartening, prompting an examination of why India has struggled in this sector and how things are beginning to change.

Indian Shipbuilding Struggle

We have struggled to create a functioning shipping industry in the country.

Some of the reasons for it are:

- Financial Constraints: Shipbuilding requires significant capital, with high interest rates in India making it hard for shipbuilders to compete globally.

- Inadequate Policy Support: Historically, there has been a lack of consistent and supportive government policies to foster the growth of the shipbuilding sector. Although there have been initiatives like the Financial Assistance Policy, their utilization has been limited, and challenges such as high material imports and low automation persist.

- Technological and Infrastructure Gaps: Indian shipyards lack modern capabilities and rely on imported components, affecting competitiveness.

- Skilled Workforce Issues: Despite lower labor costs, productivity is hampered by a lack of skills in modern shipbuilding techniques, necessitating workforce upskilling.

- Defence: India’s focus on defence shipbuilding has limited the development of its commercial fleet, as most shipbuilding capacity is used for defense contracts, leaving little room for merchant shipping.

Southeast Asia’s Domination

In ancient times, nations that experienced rapid economic growth often saw their shipbuilding industries flourish. This pattern repeated in Japan, South Korea, and China, where economic expansion was driven by globalization and increased exports. As these countries’ economies boomed, their shipbuilding sectors grew significantly, leveraging their newfound wealth and global trade connections to become dominant players in the industry.

Incentives: Recognizing the need for a strong shipping industry to boost economic growth, governments offered substantial subsidies. China and South Korea currently provide shipbuilders with 20-30% subsidies.

Private Participation: The involvement of private companies has been crucial in developing a successful shipbuilding industry.

Their market share in the global shipping industry is as follows:

China: Dominates the global shipbuilding market with a 58.1% share, thanks to large-scale production and technological advances.

Major Players – China Shipbuilding Industry Corporation (CSIC), China State Shipbuilding Corporation (CSSC), and China Ocean Shipping Company (COSCO).

South Korea: Holds 20% of the market, remaining a key competitor despite a slight decline in share.

Major Players – Hyundai Heavy Industries, DSME, and Samsung Heavy Industries

Japan: Has a 7% market share, leveraging advanced technology and expertise in specialized vessels.

Major Players – Mitsubishi Heavy Industries, Imabari Shipbuilding, and Oshima Shipbuilding

As a result, these three Southeast Asian nations together hold 85% of the global shipbuilding market.

Now, before we move ahead, let’s briefly understand the importance of having an independent shipbuilding capacity.

Modern Shipping Industry: A Strategic Asset

Owning a national fleet offers key advantages beyond trade. It ensures ships are available during crises, protects against embargoes, and saves foreign exchange spent on chartering and freight charges to other countries. This strategic asset strengthens national security and economic resilience, highlighting the importance of developing a robust domestic shipping industry.

India’s Ambitious Shipbuilding Plans: Setting Sail for Global Dominance

India is gearing up to expand its shipbuilding capacity to match its growing stature in global trade. By 2030, the country aims to establish two mega shipbuilding parks, one on each coast, targeting a share of the $100 Bn global market. These parks will be pivotal in enhancing India’s ability to construct larger ships, boosting current capabilities from handling 1.25 million tons to 3 million tons of cargo.

Maritime Development Fund

To support this ambitious plan, the Indian government is set to launch a ₹25,000 crore Maritime Development Fund (MDF). This fund aims to provide long-term, low-cost financial support for indigenous shipbuilding and blue water infrastructure projects. Structured as a corporate entity, the MDF will involve participation from multilateral financial institutions and global funds.

Key Objectives of the MDF

– Reduce India’s reliance on foreign ships by promoting domestic shipbuilding.

– Increase India’s share in the global shipbuilding market from less than 1% to 5%.

– Support cruise tourism, port capacity expansion, coastal shipping, and inland waterways development through public-private partnerships.

Strategic Initiatives

Tax incentives similar to those in Norway, Korea, and Japan will be considered to attract both domestic and global players into India’s ship leasing and management sector. With these initiatives, India is poised to transform its maritime industry and secure a significant position in the global shipbuilding arena.

India’s New Shipbuilding Policy

India is set to unveil a new shipbuilding policy designed to boost its presence in the global market. The policy includes a recycling credit note scheme and a fixed subsidy rate for the next decade, with plans to establish three maritime clusters in Andhra Pradesh, Gujarat, and Odisha.

Key Features of the Policy

Subsidy Structure: The policy offers tiered subsidies—20% for standard vessels, 25% for specialized ships like tankers, and 30% for eco-friendly vessels—fixed until 2034, with a potential extension to 2047.

Recycling Credit Note: Fleet owners will receive a credit note worth 40% of the scrap value for ships dismantled in India, which can be used to offset the cost of building new ships locally.

Investment and Collaboration

India is seeking investments from South Korean and Japanese shipbuilders to establish itself as a major shipbuilding hub. Companies like Hanwha Ocean, Samsung Heavy Industries, Mitsubishi Shipbuilding, and Mitsui Engineering are exploring opportunities for investment and technology transfer.

India’s Potential Edge in the Shipbuilding Industry

India is positioning itself as a promising alternative in the global shipbuilding market, capitalizing on the overbooked capacities of leading nations like China, Japan, and South Korea. These countries have shipyards contracted out until the end of the decade, creating an opportunity for India to step in.

Focus on Green Shipping

India is emphasizing green shipping by using eco-friendly methods to reduce ships’ environmental impact through cleaner fuels and improved energy efficiency. This focus aligns with global trends towards sustainable shipping practices.

Major Indian Shipping Companies

Key players in India’s shipbuilding industry include Mazagon Dock Ltd., Cochin Shipyard Ltd., Hindustan Shipyard Ltd., and L&T Shipbuilding. Additionally, the Adani Group has announced a major shipbuilding initiative at Mundra Port in Gujarat.

Future Goal

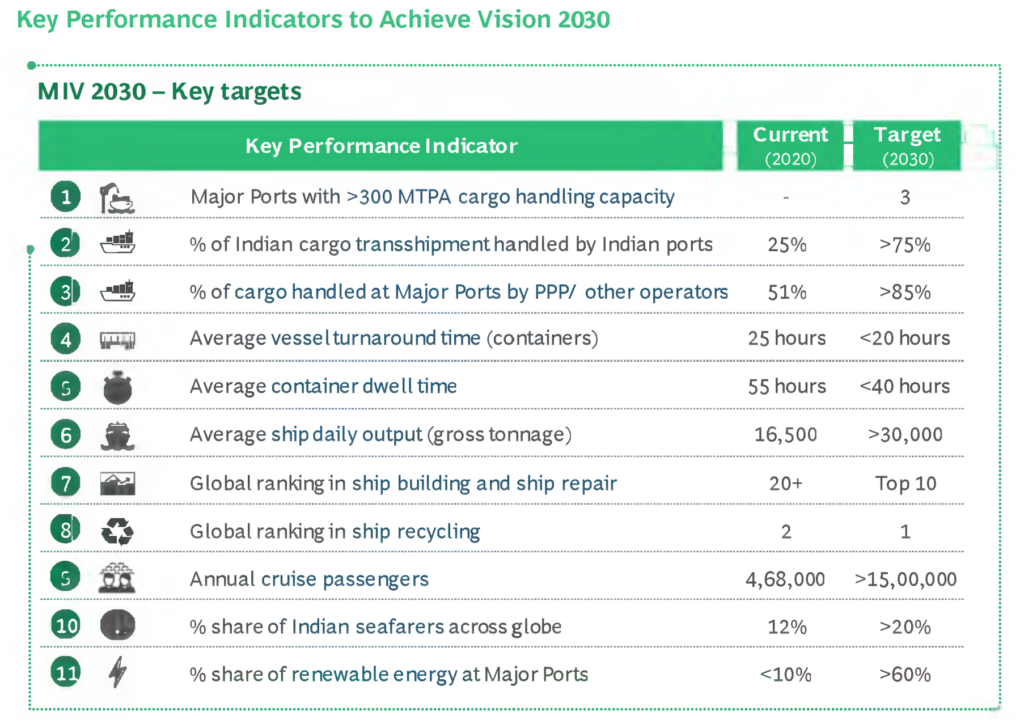

The government aims to increase India’s share in the global shipbuilding market by fostering innovation and efficiency through these initiatives. With these efforts, India hopes to rise from its current global rank of 22nd in shipbuilding to the top 10 by 2030 under Maritime India Vision 2030 and top 5 by 2047 under Amrit Kaal 2047. Here is the summary of goals under Maritime India Vision (MIV) 2030.

Closing Remarks

With the central government pushing reforms, foreign interest rising, and domestic players stepping up, India’s shipping industry is poised for significant changes. The key to success lies in execution. As India’s export share grows, a robust domestic shipping fleet will be essential. The pieces are falling into place, and this sector could be the next big growth story. So, keep an eye on developments in the coming months to see if India can truly make its mark on the global stage.

Fin Meme of the Week

Follow us

If you are a diligent investor, you would not want to miss checking out our research platform, where we share insightful research on companies regularly. Gain access to our sample research by clicking on the button below.