A close look at Garvita India’s strategy

We feel privileged that part of our job includes interacting with industry veterans and gaining insights from them about their businesses. Last week, we had the opportunity to meet Mr. Yogesh Malhotra and gain valuable insights into the recycling industry.

In this blog, we delve into insights about the recycling business that we learned from the management of Gravita India.

But before getting into our insight from the meeting, let’s sync up. Shall we?

What is recycling & its importance?

Recycling is a crucial process that involves converting waste materials into new, usable products. It helps reduce the consumption of fresh raw materials, minimize energy usage, decrease air and water pollution, and lower greenhouse gas emissions. The importance of recycling in India cannot be overstated, given the country’s rapid urbanization and industrialization, which have led to an exponential increase in waste generation.

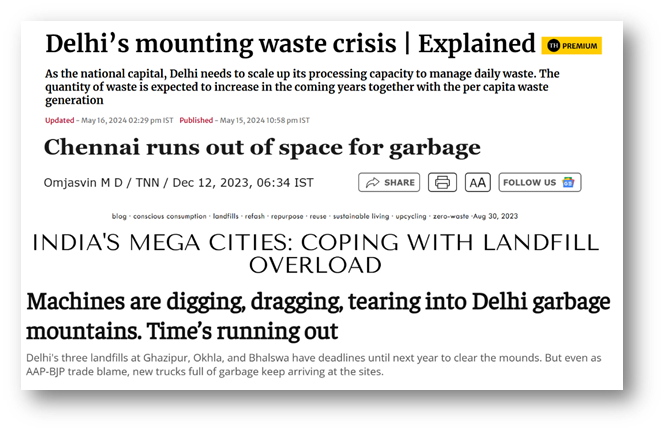

Indian cities are facing severe problems with saturated landfills and a lack of proper places to discard waste. Metro cities like Delhi, Mumbai, Chennai, etc., struggle with overflowing landfills, which cause significant environmental and health hazards. Overflowing landfills emit harmful gases like methane, contributing to air pollution and posing severe health risks to nearby residents.

Now the problem is we cannot burn, bury or throw away this waste in the ocean as it will have negative implications on the environment.

So naturally, the only option we have is recycling.

To tackle these problems, the government is promoting recycling and has introduced various measures, such as the Swachh Bharat Mission, Plastic Waste Management Rules, E-waste management rules, and Extended Producer Policy Responsibility (EPR).

Companies involved in various stages of the recycling value chain are undergoing structural demand.

So, with this background, let’s understand a bit about Gravita.

About Gravita India:

Gravita India Ltd. operates recycling units across various locations, including India, Ghana, Mozambique, Togo, Senegal, Tanzania, and Sri Lanka. The company recycles lead, aluminum, plastic, and rubber.

Further, the company also helps other companies set up lead and aluminum recycling plants. The entire process is done in-house, from design and development to manufacturing. So far, the company has delivered 70+ such turnkey projects.

Manufacturing Base

The company currently has 11 plants, 5 in India and 6 outside India

Until 2015, Gravita mainly focused on lead recycling. Then, they decided to branch out into aluminum, plastic, and rubber. Talk about diversifying your portfolio!

Currently, company in under a transition phase where share of non-lead business is at 30%.

Did you Know? Today, almost 60-70% of global lead production is derived from recycling lead acid batteries. 🤔

Where do they get battery scrap from?

Okay, now let’s get to the juicy part – how does Gravita get its hands on all this battery scrap? It’s actually quite interesting, and a bit surprising too!

In India, there are two primary sources of battery scrap:

- Retail outlets (you know, where you and I buy our batteries)

- Institutions like call centres and banks that need battery backups

Here’s the kicker—retail outlets account for a whopping 75% of the total battery scrap volume. But guess what? Gravita and other organized players can’t touch this source! Shocking, right?

You’re probably thinking, “Wait, why can’t they access 75% of the market?” Well, it’s all about the money, honey! Let me break it down for you:

Imagine you’re running a retail outlet selling batteries. A customer comes in to buy a new battery and they give you their old battery. Now, you’ve got two options:

- Sell it to organized players like Gravita for 1,000 rupees

- Sell it to a third-party dealer who offers 1,050 rupees

Which would you choose? The higher price, right? That’s precisely what these retail outlets do.

But here’s where it gets a bit shady. These third-party dealers sell the batteries to small-scale recyclers for 1,156 rupees (980 + 18% GST). The twist? They pocket the GST instead of paying it to the government. It’s like a recycling black market!

So, Gravita and other organized players are left relying on the institutional side for their battery scrap in India. But don’t worry, things are changing!

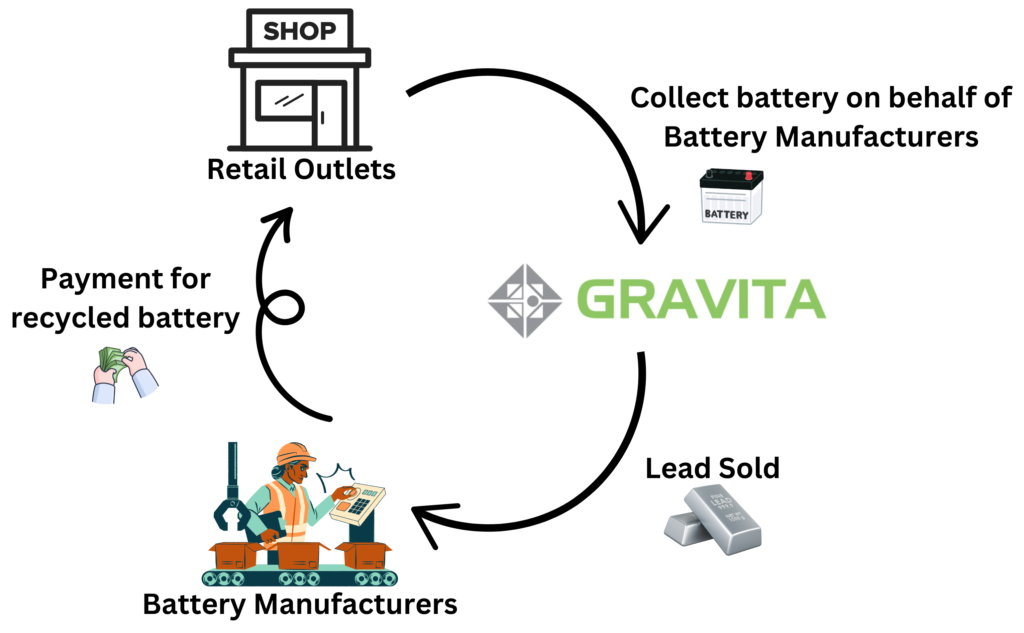

In August 2022, the government introduced something called Extended Producer Responsibility (EPR). Sounds fancy, right? Basically, it means battery manufacturers like Exide and Amara Raja Batteries now have to take responsibility for collecting, recycling, and refurbishing waste batteries. They need to collect 50% of old batteries by FY25 and 90% by FY27. Talk about a game-changer!

This is where players like Gravita come in like knights in shining armour. They’ve partnered with battery manufacturing companies to collect battery scrap from retail outlets on their behalf. It’s like they’ve found a secret passage into that 75% of the market that was closed off before!

Below is the modus operandi of the tie-up with battery manufacturers

Business Model

Now, let’s discuss business models. Gravita has four different business models, depending on where it sources its raw materials, processes them, and sells them.

Sourcing, processing and selling outside India is most beneficial for the company.

In the tolling model, which sources from retail outlets on behalf of battery manufacturers, generates least EBITDA per kg and also contributes the least to the topline.

One question which might pop up reading this could be why is Gravita increasing focus towards this tolling model which has the least profitability?

The answer to this lies in looking at ROCE, which is more than 30-35% for tolling business. Isn’t that amazing? Here how:

This business has the potential to brings massive volume, doesn’t require working capital, and there’s no price volatility risk. No need for complicated hedging strategies here!

Now, you might be wondering, “Won’t battery manufacturers just start doing this themselves?” Good question! While they do have recycling plants, there’s a big problem – logistics. Imagine trying to bring battery scrap from all over India to one location. It would be a nightmare and super expensive!

This is where Gravita shines. They have plants all over India, so they can process the scrap close to where it’s sourced and sell the lead to customers near that plant. It’s like a recycling relay race, but way more efficient! Gravita charges only Rs. 6-7 rupees per kg for processing, while it would cost battery manufacturers Rs. 11-12 rupees per kg for logistics alone. It’s a win-win situation!

Diversifying product-wise & Geographically

When we say ‘Don’t put all your eggs in one basket’, Gravita seems to have taken this very seriously.

Since 1992, the company has entered into multiple countries like Sri Lanka, Ghana, Senegal, Mozambique, Tanzania, Togo, Dominican Republic and Oman.

Further, the company is in the process of diversifying away from Lead recycling into other recycled products.

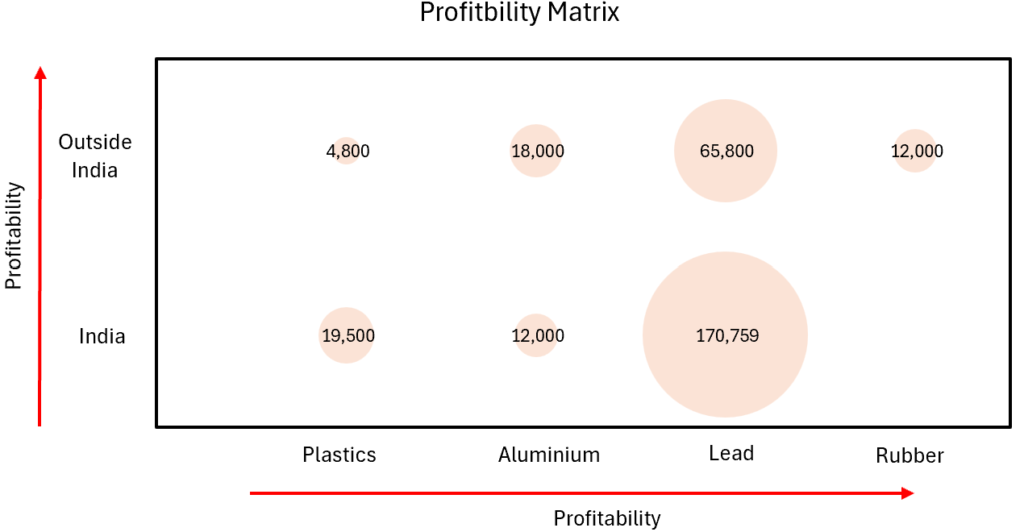

Profitability changes based on product and region. Below is the map highlighting highest profitable to lowest profitable products.

Essentially, the company is diversifying itself to mitigate the impact of disruptions in any country or any recycled product.

Please note, blog is only for informational purpose. This is not an investment recommendation. We at Bastion Research do not hold any investment in Gravita India. Kindly do you due diligence while investing.

✍🏻Author of this newsletter – Parth Agrawal (LINKEDIN)

Fin Meme of the Week

NIFTY to 12,000 Gang